UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 6-K

________________________

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-41921

_________________________

Joint Stock Company Kaspi.kz

(Translation of registrant’s name into English)

______________________

|

154A Nauryzbai Batyr Street |

Almaty, Kazakhstan |

050013 |

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

EXPLANATORY NOTE

On October 18, 2024, Joint Stock Company Kaspi.kz (the “Company”) issued a press release titled “Kaspi.kz 3Q and 9M 2024 Financial Results” and furnished as Exhibit 99.1 hereto.

The IFRS financial statement tables in Exhibit 99.1 are incorporated by reference into the Company’s registration statement on Form S-8 (File No. 333-276609).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Joint Stock Company Kaspi.kz |

|

|

|

October 18, 2024 |

By: |

/s/ Tengiz Mosidze |

|

|

Name: Tengiz Mosidze Title: Chief Financial Officer |

|

|

|

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

Exhibit 99.1

Kaspi.kz 3Q and 9M 2024 Financial Results

Almaty, Kazakhstan, 18 October 2024 – Joint Stock Company Kaspi.kz (“Kaspi.kz”, “we”) (Nasdaq:KSPI) which operates the Kaspi.kz Super App for consumers and Kaspi Pay Super App for merchants, today publishes its unaudited consolidated IFRS financial results for the quarter and nine months ended 30 September 2024 (“3Q & 9M 2024”).

9M 2024 Highlights

•Timing of marketing campaigns has distorted GMV growth between 2Q and 3Q. 9M 2024 is more representative of business performance with revenue and net income up 34% and 23% respectively. On track for FY24 net income growth of around 25%.

•Our faster growing and more profitable Payments and Marketplace Platforms together accounted for 68% of consolidated net income, up from 63% in 9M 2023.

•All Platforms continued to deliver strong top-line growth for the first 9 months of 2024:

oMarketplace remains our fastest growing platform with GMV and revenue up 46% and 76% YoY respectively.

oMarketplace net income up 45% YoY. New service Kaspi Gift Cards launched. An innovative way to drive Super App engagement and Marketplace transactions.

•Within Marketplace, e-Commerce keeps delivering the stand-out performance:

oe-Commerce GMV up 95% YoY.

oe-Commerce Take Rate up 40 bps YoY to 11.1%.

•e-Grocery top-line keeps growing fast:

oGMV up 88% YoY in 3Q 2024 & active consumers up to 725k.

•Kaspi Travel is still growing rapidly:

oLast year we launched Kaspi Tours, a vacation package marketplace and in the seasonally important third quarter of 2024 tours GMV increased 302% YoY.

oTours are growth enhancing and had an 8.1% Take Rate in 3Q 2024.

•In Payments, strong top-line continues to drop-through to bottom-line:

oPayment’s transactions up 42% YoY.

oB2B Payments remains the fastest-growing component of TPV. We expect B2B to keep growing significantly faster than Payments TPV.

oPayment’s revenue and net income both up 24% YoY respectively.

•Fintech Platform TFV growth up 34% YoY:

oMerchant & Micro Business Finance and BNPL is our fastest growing lending product and at 17% of TFV in 9M 2024 is increasingly meaningful in size.

oDedicated Business Deposit for merchants launched. Another reason for merchants to transact with Kaspi.kz and an additional source of funding for us.

oModerating interest rates and loans growing faster than deposits led to accelerating Fintech net income growth in the third quarter of 2024.

•For a long time, we have said investing in our growth including international expansion is our top priority. With the acquisition of a controlling stake in Hepsiburada, we:

oExpand our market to 100 million people.

oGain one of the leading e-Commerce franchises in Türkiye ’s underpenetrated and fast-growing e-Commerce market.

oHepsiburada is a strong cultural fit with Kaspi.kz given its innovative culture, focus on high quality services and sustainable growth.

•Formal letter of interest to participate in the privatisation of the Humo payments system in Uzbekistan submitted. We are awaiting information on the next steps.

•Based on 3Q 2024 Kaspi.kz consolidated financials our Board of Directors has proposed a dividend of KZT850/ADS, subject to shareholder approval.

•We remain on track to deliver on our expectation of around 25% year-over-year full-year 2024 Kaspi.kz consolidated net income growth. With the return of Juma, the fourth quarter of 2024, should see accelerating growth and higher profitability, compared with 3Q 2024.

To the shareholders of Kaspi.kz:

Expanding our addressable market to 100 million people has been an important strategic priority for Kaspi.kz. On October 17th, we signed a definite agreement to acquire a controlling stake in Hepsiburada, one of Türkiye’s leading e-Commerce platforms.

Serving 12 million consumers and 101 thousand merchants, we believe Hepsiburada is a strong cultural fit with Kaspi.kz given its innovative culture, focus on providing high quality services to consumers and merchants and commitment to long-term sustainable growth. Like Kaspi.kz, Hepsiburada is a highly entrepreneurial company and home-grown e-Commerce champion, built by a visionary founder. Both companies are driven by a similar purpose, namely to improve consumers’ and merchants’ lives. Hepsiburada is EBITDA positive, which is a strong testament to its founder and management team who have focused on profitable growth rather than growth at all costs. The transaction is expected to close in the first quarter of 2025.

Turning to Kaspi.kz’s third quarter, where we continued to execute in line with our plans.

User engagement remains at record levels, with our consumers transacting 72 times per month, Payments transaction up 38% year-over-year and Marketplace purchases up 45%. We always aim to do more for our customers and strong transaction activity in turn is resulting in rapid momentum across our businesses.

Marketplace Platform GMV was up 46% year-over-year for the first nine months of the year. With the return of Juma in November, growth is expected to accelerate again compared to growth in the third quarter. Within Marketplace, our more recent initiatives continue to scale at a rapid rate. e-Grocery GMV increased 88% in the third quarter and in Kaspi Travel, GMV from Kaspi Tours increased 302%. Product innovation also continues at pace, with digital Kaspi Gift Cards added to Marketplace recently.

The fourth quarter of the year has started well and the consumer and merchant environment remains healthy. As discussed before, our Fintech Platform is now seeing its Net Income growth accelerate, with a further step up in growth expected in the fourth quarter and our newly launched deposit account for merchants has gotten off to a great start. Payments Platform remains as healthy as ever.

Looking through the timing of marketing campaigns, we’re very much on track to deliver another year of strong top and bottom-line growth.

For the third quarter of 2024, our Board of Directors has recommended a dividend of KZT850/ADS, subject to shareholder approval.

Mikheil Lomtadze

Kaspi.kz CEO and co-founder

Kaspi.kz 3Q & 9M 2024 Product Highlights

Update on e-Grocery, Kaspi Tours, Gift Cards & Kaspi Deposit for merchants

From starting in Almaty just over two years ago, Kaspi e-Grocery continues growing at a

rapid rate. With an innovative, high-quality digital offering, we believe we are transforming the food shopping experience in Kazakhstan. During 3Q 2024, e-Grocery GMV increased 88% year-over-year and active consumers reached around 725 thousand.

For the remainder of this year, we will continue scaling volumes, expand capacity of existing dark stores and have just opened another large dark store in Almaty to meet rapidly growing consumer demand.

When we launched Kaspi Travel we initially offered flight bookings before subsequently adding rail ticketing. Last year, we launched Kaspi Tours, our vacation package marketplace.

Tours are additive to Travel’s growth and take-rate. During 3Q 2024, Tours GMV increased 302% year-over-year and for 9M 2024 accounted for 9% of Travel GMV.

We recently launched digital Kaspi Gift Cards. Consumers design a personalised greeting and chose the amount of money they want to send. The recipient spends the proceeds on our Marketplace Platform. Kaspi Gift Cards are innovative way of driving Super App engagement and Marketplace transaction volumes.

We have long been the market leader in local currency consumer deposits but have never had a dedicated savings account for merchants. We launched Deposit for merchants in mid-August and by the end of the third quarter of 2024, already had 41K accounts and KZT69 billion in deposits. Our merchants earn a competitive rate of interest which is accrued daily, have immediate access to their money and have yet another reason to use more of our services. Merchant deposits give us an additional source of funding.

As always, we expect to continue launching new services, and our product pipeline for the remainder of 2024 and beyond is as exciting as ever.

Kaspi.kz 3Q and 9M 2024 Financial Highlights

Revenue up 34% and net income up 23% YoY in 9M 2024

On-track for 2024 consolidated net income up around 25% YoY

During 3Q 2024, consolidated revenue increased 28% year-over-year to KZT650 billion. For 9M 2024, revenue increased 34% year-over-year to KZT1.8 trillion.

Our Payments Platform delivered fast and consistent top-line growth, due to the ongoing success of Kaspi Pay and B2B Payments. In Marketplace, strong momentum is led by e-Commerce including e-Grocery. However, as we previously flagged, with Juma happening in June this led to more moderate GMV growth in the third quarter. Marketplace revenue continues to benefit from VAS growth. TFV growth in the third quarter was also impacted by the timing of Juma and so is expected to be stronger in the fourth quarter. Healthy origination over the last 12 months means Fintech revenue growth remains strong.

During 3Q 2024, our consolidated net income increased 18% year-over-year to KZT274

billion. For 9M 2024, net income increased 23% year-over-year to KZT740 billion.

Payments Platform continues to deliver strong bottom-line growth and high profitability.

Marketplace’s profit growth is lower than revenue growth due to rapid growth in 1P e-

Grocery and e-Car’s revenue. In Fintech, growth in funding costs is moderating and in the third quarter profit growth started to accelerate. In the fourth quarter of 2024, Fintech profitability should step up again.

Our faster growing and more profitable Payments and Marketplace Platforms continue to deliver strong bottom-line growth, accounting for 68% of consolidated net income, up from 63% in 9M 2023.

Based on our 3Q 2024 financial results our Board of Directors has proposed a dividend per ADS equivalent to KZT850, subject to shareholder approval.

Payments Platform

Transactions up 38% and 42% YoY in 3Q & 9M 2024

Consistently strong top & bottom-line growth

Revenue up 24% YoY 9M 2024 & net income up 24%

Payments Platform facilitates transactions between merchants and consumers. Payments Platform is also fundamental to high levels of Super App engagement, while proprietary payments data informs decision making across multiple areas of our business.

In 9M 2024, Payments Platform had 732,000 merchants and 13.4 million consumers.

During 3Q and 9M 2024, transaction volumes increased 38% and 42% year-over-year respectively. Volumes keep growing fast due to growth in Kaspi Pay transactions, rapid adoption of B2B Payments and the ongoing popularity of Bill Payments.

During 3Q 2024, TPV increased 28% year-over-year to KZT9.8 trillion. TPV growth below

transactions growth reflects lower average ticket size year-over-year, as householders use Payments Platform more frequently for more of their day-to-day transactions. For 9M 2024, TPV increased 32% year-over-year to KZT26.6 trillion.

Kaspi B2B Payments is the fastest-growing component of our TPV and during 9M 2024,

accounted for 5% of TPV. We expect B2B Payments to continue growing significantly faster than Payments TPV.

Payments Take Rate during 3Q 2024 was 1.18%, compared with 1.20% in 3Q 2023. Take Rate remains broadly stable year-over-year, albeit rapid growth in Kaspi Pay QR payments is a slight drag. For 9M 2024, Take Rate was 1.19% compared with 1.23% in the same period in 2023.

Payments Platform revenue increased 25% year-over-year to reach KZT156 billion during 3Q 2024. As interest rates decline, growth in interest revenue on current account balances is below fee revenue growth. For 9M 2024, Payments Platform revenue increased 24% year-over-year to reach KZT421 billion.

Payments Platform net income increased 25% year-over-year to KZT103 billion, during 3Q 2024. High Payments Platform profitability continues to reflect tight cost control. For 9M 2024, Payments Platform net income increased 24% year-over-year to KZT272 billion.

For full-year 2024 we continue to expect Payments Platform revenue to increase around

20% year-over-year, reflecting robust consumer and merchant transaction trends. Stable Payments Take Rate should be supportive for revenue growth but needs to be balanced against slower growth in interest revenue on account balances. Considering Payments Platform’s operational gearing, we expect bottom-line growth to once again grow ahead of revenue growth, at around 25% year-over-year.

Marketplace Platform

Purchases up 45% and 39% in 3Q & 9M 2024

Revenue growth ahead of GMV due to valued-added services

Revenue up 76% YoY in 9M 2024 & net income up 45% even with 1P

Our Marketplace Platform connects both online and offline merchants with consumers.

m-Commerce is our mobile solution for shopping in person, while consumers can use e-Commerce to shop anywhere, any time with free delivery. Kaspi Travel allows consumers to book flights, rail tickets and package holidays. e-Grocery helps households with their day-to-day shopping needs. Kolesa.kz gives Marketplace leadership in auto and real estate classifieds and is integrated with e-Cars which includes the sale of 1P & 3P cars and their parts.

In 9M 2024, Marketplace Platform had 7.8 million consumers.

During 3Q and 9M 2024, Marketplace purchases increased 45% and 39% year-over-year respectively. All Marketplace services are contributing to growth, led by e-Commerce including e-Grocery.

In 3Q 2024, Marketplace GMV increased 24% year-over-year to reach KZT1.5 trillion. As we flagged at our first half 2024 financial results, we held Kaspi Juma in June, compared with July last year, leading to lower year-over-year growth in the third quarter of this year. The timing of marketing events can shift from quarter to quarter and so trends over longer periods of time and our full year guidance are more indicative of our performance. For 9M 2024, GMV was up 46% year-over-year to reach KZT4.1 trillion and Juma will once again take place in the fourth quarter.

Valued-added services revenue including Kaspi Delivery, advertising and Classifieds, resulted in Marketplace Take Rate increasing significantly to 9.5% in both 3Q and 9M 2024. During the same periods in 2023, Take Rate was 9.1% and 8.8% respectively.

In 3Q 2024, e-Commerce demand was extremely strong with orders up 132% year-over-

year. GMV increased 71% year-over-year to KZT712 billion. For 9M 2024, orders and GMV increased 121% and 95% year-over-year respectively, with GMV reaching KZT1.9 trillion.

e-Grocery GMV accounted for 5% of e-Commerce GMV in 9M 2024. e-Cars, which is an important focus area for us, accounted for 29% of e-Commerce GMV over the same period.

During 3Q and 9M 2024, m-Commerce purchases increased 12% and 10% year-over-year respectively. However, m-Commerce ticket size is highly sensitive to promotional campaigns. GMV declined 5% year-over-year to reach KZT652 billion in 3Q 2024 but increased 18% to KZT1.9 trillion in 9M 2024. M-Commerce’s Take Rate increased to 9.0% in both 3Q and 9M 2024 from 8.8% and 8.4% in the same periods in 2023.

Kaspi Travel’s GMV increased 30% year-over-year to KZT129 billion during 3Q 2024. Take Rate increased by 20 bps year-over-year to 4.5%, due to fast growth in Kaspi Tours. For 9M 2024, Travel’s GMV increased 35% year-over-year to KZT354 billion, with Take Rate up to 4.5% from 4.2% during the same period in 2023. Travel’s GMV growth should remain strong with tours, which accounted for 9% of Travel’s GMV in the first nine months of 2024, becoming more meaningful.

With Marketplace Take Rate up year-over-year, 3Q 2024 Marketplace revenue grew

significantly faster than GMV and was up 43% year-over-year to KZT179 billion. For 9M 2024, Marketplace revenue increased 76% year-over-year to KZT498 billion.

During 3Q 2024, Marketplace Platform net income reached KZT84 billion, representing a

14% increase year-over-year. Net income growth below revenue growth, reflects rapid e-

Grocery revenue growth. For 9M 2024, Marketplace net income increased 45% year-over-year to KZT233 billion.

For full-year 2024, we expect Marketplace revenue to increase around 65% year-over-year vs. our previous expectation of around 70%. Asset light 3P e-Car’s is growing faster than expected and cannibalising 1P car sales. Elsewhere momentum remains strong, and we expect revenue to be boosted by the rapid growth of VAS. We continue to anticipate net income growth of around 40% year-over-year, with the changing 1P/3P mix in cars having almost no impact on profit growth.

Fintech Platform

TFV up 34% & deposits up 28% YoY in 9M 2024

TFV origination growing fast YoY & net income growth accelerating again

Revenue up 24% YoY in 9M 2024 & net income up 7%

Our Fintech Platform provides consumers with BNPL, finance and savings products, and merchants with merchant lending and deposits.

We finished 9M 2024 with 6.4 million loan consumers and 5.5 million deposit consumers.

During 3Q 2024, TFV increased 18% year-over-year, to reach KZT2.6 trillion. More moderate TFV growth reflects the time of Juma, with growth expected to accelerate again in the fourth quarter. For 9M 2024, TFV increased 34% year-over-year, to reach KZT7.4 trillion.

Low risk, small ticket Buy-Now-Pay-Later (BNPL) loans accounted for 42% of TFV in 9M 2024, making them our most important Fintech Platform product. Merchant and Micro Business Finance is our fastest growing lending product, accounting for 17% of TFV during first nine months of 2024. Car financing integrated with Kolesa.kz is also an important opportunity

and along with BNPL, we expect that Fintech products integrated with Marketplace should continue to see their share of TFV increase.

Our average net loan portfolio increased by 39% year-over-year, to KZT5.0 trillion in 3Q 2024 and 39% to KZT4.7 trillion in 9M 2024. Our deposit base is now growing at a slower rate than our loan portfolio. In 3Q 2024, average savings increased by 25% year-over-year to KZT5.8 trillion. For 9M 2024, average savings increased by 28% year-over-year to KZT5.5 trillion. Our loan to deposit ratio increased to 88% at the end of the first nine months of 2024 up from 79% in 9M 2023.

Fintech yield was stable at 6% during 3Q 2024 and 18% for 9M 2024.

During 3Q 2024, our cost of risk was 0.5%, with credit quality strong and consistent with previous quarters. Our NPL ratio of 5.6% is broadly stable compared with the end of FY

2023.

Fintech Platform revenue increased by 24% year-over-year to reach KZT332 billion during 3Q 2024. Fintech revenue growth is benefitting from healthy levels of origination over the previous year and stable yield trends. For 9M 2024, Fintech Platform revenue increased by 24% year-over-year to reach KZT930 billion.

In 3Q 2024, Fintech Platform’s net income increased by 15% year-over-year to KZT88 billion. We reduced our deposit rate for the first time in February 2024 and as our loan to deposit ratio moves up, Fintech profitability growth is accelerating. For 9M 2024, Fintech Platform net income increased 7% year-over-year to KZT235 billion.

For full-year 2024, we continue to expect Fintech Platform revenue to increase around 20% year-over-year, reflecting strong underlying customer demand especially linked to Marketplace growth, a stable economic backdrop and only slightly lower yield. As the effects of our lower deposit rate become more meaningful, we expect Fintech net income growth to accelerate again in the fourth quarter of 2024. For full-year 2024, we continue to expect Fintech net income growth around 15% year-over-year.

2024 Full Year Guidance

The current quarter has started well and we observe a healthy and predictable consumer and merchant environment. The fourth quarter of 2024, should see accelerating growth and higher profitability, compared with 3Q 2024.

For full-year 2024, we remain on track to deliver on our expectation of around 25% year-over-year Kaspi.kz consolidated net income growth.

Third Quarter and Nine Months 2024 Financial Results Conference Call

Monday, 21st October 2024 at 8.00am EST (1pm GMT, 5.00pm Astana time).

To pre-register for this call, please go to the following link:

https://www.netroadshow.com/events/login?show=ac66cfee&confId=71533

You will receive access details via email.

Kaspi.kz consolidated financial statements

About Kaspi.kz

Kaspi.kz’s mission is to improve people’s lives by developing innovative mobile products and services. To deliver upon this we operate a unique two-sided Super App model – Kaspi.kz Super App for consumers and Kaspi Pay Super App for merchants.

Through these Super Apps consumers and merchants can access our leading Payments, Marketplace, and Fintech Platforms. All our services are designed to be highly relevant to users’ everyday needs and enable consumers and merchants to connect and transact, using our proprietary payments network.

The combination of a large, highly engaged consumer and merchant base, best-in-class, highly relevant digital products and a capex lite approach, results in strong top-line growth, a profitable business model and enables us to continue innovating, delighting our users and fulfilling our mission.

Harvard Business School has written two case studies on Kaspi.kz which it continues to teach to its MBA students.

Kaspi.kz has been listed on Nasdaq since January 2024.

Use of Key Financial and Operating Metrics

Certain parts of this press release contain our key financial and operating metrics, which we do not consider to be non-IFRS financial measures. We use these metrics to evaluate our

business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions. Our key operating metrics may be calculated in a manner different than similar key financial and operating metrics used by other companies.

(1)Average Monthly Active Users (MAU) is the monthly average number of users with at least one discrete session (visit) in excess of 10 seconds on the Kaspi.kz Super App in the last three months of each relevant period.

(2)Average Daily Active Users (DAU) is the monthly average of the daily number of users with at least one discrete session (visit) in excess of 10 seconds on the Kaspi.kz Super App in the last three months of each relevant period.

(3)Average DAU to Average MAU ratio is the ratio of Average DAU to Average MAU for the same period.

(4)Monthly Transactions per Active Consumer is the ratio of the total number of transactions for the prior 12 months to the total number of active consumers (the total number of consumers which have used any of our products or services at least once during the prior 12 months), divided by 12.

(5)Active Merchants is the total number of merchant stores that completed at least one sale of goods or services, or a transaction to or with a consumer, during the prior 12 months.

(6)Total Payment Value (TPV) is the total value of B2B and payment transactions made by Active Consumers within our Payments Platform, excluding free P2P and QR payments.

(7)Payments Take-Rate is the ratio of fees generated from B2B transactions, consumer card and QR transactions and membership fees included in Payments fee revenue to TPV for the same period.

(8)Payments Active Consumers is the total number of consumers that completed at least one transaction within Payments during the prior 12 months.

(9)Payments Transactions is the total number of TPV transactions.

(10)Gross Merchandise Value (GMV) is the total transaction value of goods and services sold within Marketplace (on an aggregate, “third-party” or “first-party” basis, as applicable).

(11)Marketplace Active Consumers is the total number of consumers that completed at least one purchase of goods and services within Marketplace during the prior 12 months.

(12)Marketplace Purchases is the total number of goods or services purchase transactions made by consumers within Marketplace.

(13)Marketplace Take-Rate is the ratio of Marketplace fee revenue to Marketplace 3P GMV.

(14)e-Commerce Gross Merchandise Value (GMV) is the total transaction value of goods and services sold within the e-Commerce business of Marketplace (on an aggregate, “third-party” or “first-party” basis, as applicable). Our “first-party” e-Commerce GMV reflects e-Grocery’s GMV starting from February 2023; prior to that, e-Grocery’s GMV was part of our “third-party” e-Commerce GMV.

(15)e-Commerce Take-Rate is the ratio of fee revenue generated in the e-Commerce business of Marketplace to e-Commerce 3P GMV.

(16)e-Grocery Gross Merchandise Value (GMV) is the total transaction value of goods and services sold within the e-Grocery business of Marketplace.

(17)e-Grocery Active Consumers is the total number of consumers that completed at least one purchase within the e-Grocery business of Marketplace during the prior 12 months.

(18)e-Grocery Purchases is the total number of goods or services purchase transactions made by consumers within the e-Grocery business of Marketplace.

(19)e-Cars Gross Merchandise Value (GMV) is the total transaction value of goods and services sold within the e-Cars business of Marketplace.

(20)e-Cars Take-Rate is the ratio of fee revenue generated in the e-Cars business of Marketplace to e-Cars 3P GMV.

(21)m-Commerce Gross Merchandise Value (GMV) is the total transaction value of goods and services sold within the m-Commerce business of Marketplace.

(22)m-Commerce Active Consumers is the total number of consumers that completed at least one purchase within the m-Commerce business of Marketplace during the prior 12 months.

(23)m-Commerce Purchases is the total number of goods or services purchase transactions made by consumers within the m-Commerce business of Marketplace.

(24)m-Commerce Take-Rate is the ratio of fee revenue generated in the m-Commerce business of Marketplace to m-Commerce GMV.

(25)Kaspi Travel Gross Merchandise Value (GMV) is the total transaction value of services sold within the Kaspi Travel business of Marketplace.

(26)Kaspi Travel Active Consumers is the total number of consumers that completed at least one purchase within the Kaspi Travel business of Marketplace during the prior 12 months.

(27)Kaspi Travel Purchases is the total number of services purchase transactions made by consumers within the Kaspi Travel business of Marketplace.

(28)Kaspi Travel Take-Rate is the ratio of fee revenue generated in the Kaspi Travel business of Marketplace to Kaspi Travel GMV.

(29)Total Finance Value (TFV) is the total value of loans to customers issued and originated within Fintech for the period indicated.

(30)Fintech Active Consumers (loans) is the total number of consumers that received at least one financing product within Fintech during the prior 12 months.

(31)Fintech Active Consumers (deposits) is the total number of consumers that had a deposit for at least one day within Fintech during the prior 12 months.

(32)Average Net Loan Portfolio is the average monthly balance of the Fintech net loan portfolio for the respective period.

(33)Fintech Yield is the sum of Fintech interest income on loans to customers and Fintech fee revenue divided by Average Net Loan Portfolio.

(34)TFV to Average Net Loan Portfolio Conversion Rate is TFV for the prior 12 months divided by Average Net Loan Portfolio for the same period.

(35)Average Savings is the monthly average of customer accounts, which consists of total deposits of individuals and legal entities, for the respective period.

(36)Cost of Risk is the total provision expense for loans divided by the average balance of gross loans to customers for the same period.

Exchange Rate Calculations

The Kazakhstani tenge (KZT) to US dollar ($) exchange rate used by us for the presentation of certain financial, operating and other data denominated in tenge and included in this presentation is KZT481.19 per $1, as of 30 September 2024.

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the U.S. federal securities laws, which statements relate to our current expectations and views of future events. In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “may,” “might,” “will,” “expect,” “estimate,” “could,” “should,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “prospective,”

“continue,” “is/are likely to” or other similar expressions. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. Therefore, you should not place undue reliance on these forward-looking statements. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, risks related to the following: our ability to consummate the Agreement and the transactions contemplated thereby; our ability to realize the benefits of the transactions contemplated by the Agreement; our ability to attract sufficient new customers, engage and retain our existing customers or sell additional functionality, products and services to them on our platforms; our ability to maintain and improve the network effects of our Super App business model; our ability to improve or maintain technology infrastructure; our ability to successfully execute the new business model and reach profitability of the e-Grocery operations; our ability to partner with sufficient new merchants or maintain relationships with our existing merchant partners; our ability to effectively manage the growth of our business and operations; developments affecting the financial services industry; our brand or trusted status of our platforms and Super Apps; our ability to retain and motivate our personnel and attract new talent, or to maintain our corporate culture; our ability to keep pace with rapid technological developments to provide innovative services; our ability to implement changes to our systems and operations necessary to capitalize on our future growth opportunities; changes in relationships with third-party providers, including software and hardware suppliers, delivery services, credit bureaus and debt collection agencies; our ability to compete successfully against existing or new competitors; our ability to integrate acquisitions, strategic alliances and investments; our ability to adequately obtain, maintain, enforce and protect our intellectual property and similar proprietary rights; evolving nature of Kazakhstan’s legislative and regulatory framework; our ability to obtain or retain certain licenses, permits and approvals in a timely manner; our ability to successfully remediate the existing material weaknesses in our internal control over financial reporting and our ability to establish and maintain an effective system of internal control over financial reporting; dependence on our subsidiaries for cash to fund our operations and expenses, including future dividend payments, if any; and risks related to other factors discussed under Item 3.D. “Risk Factors” in our Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on April 29, 2024 and our other SEC filings we make from time to

time.

We operate in an evolving environment. New risks emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the effect of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The forward-looking statements made in this press release relate only to events or information as of the date on which the statements are made in this press release. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

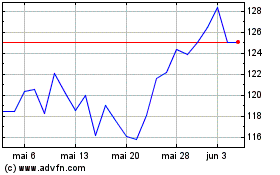

Joint Stock Company Kasp... (NASDAQ:KSPI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Joint Stock Company Kasp... (NASDAQ:KSPI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024