0001517302false00015173022024-10-292024-10-2900015173022024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

Artisan Partners Asset Management Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35826 | 45-0969585 |

(State or other jurisdiction of

incorporation or organization) | (Commission file number) | (I.R.S. Employer

Identification No.) |

| | |

| 875 E. Wisconsin Avenue, Suite 800 Milwaukee, WI 53202 | |

| (Address of principal executive offices and zip code) | |

(414) 390-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

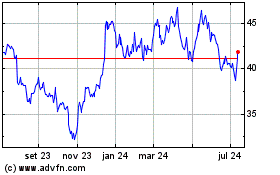

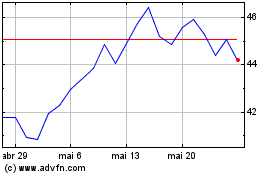

| Class A common stock, par value $0.01 per share | APAM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 29, 2024, Artisan Partners Asset Management Inc. (the “Company”) issued a press release announcing the availability of certain consolidated financial and operating results for the three and nine months ended September 30, 2024. Copies of the press release and the full earnings release are attached hereto as Exhibit 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished in this Item 2.02, including the exhibits incorporated herein by reference, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Artisan Partners Asset Management Inc.

Date: October 29, 2024

| | | | | | | | |

| By: | | /s/ Charles J. Daley, Jr. |

| Name: | | Charles J. Daley, Jr. |

| Title: | | Executive Vice President, Chief Financial Officer and Treasurer |

Artisan Partners Asset Management Inc. Reports 3Q24 Results

Milwaukee, WI - October 29, 2024 - Artisan Partners Asset Management Inc. (NYSE: APAM) (the “Company” or “Artisan Partners”) today reported its results for the three and nine months ended September 30, 2024, and declared a quarterly dividend.The full September 2024 quarter earnings release and investor presentation can be viewed at www.apam.com.

Conference Call

The Company will host a conference call on October 30, 2024, at 1:00 p.m. (Eastern Time) to discuss its results for the three and nine months ended September 30, 2024. Hosting the call will be Eric Colson, Chief Executive Officer, Jason Gottlieb, President, and C.J. Daley, Chief Financial Officer. Supplemental materials that will be reviewed during the call are available on the Company’s website at www.apam.com. The call will be webcast and can be accessed via the Company’s website. Listeners may also access the call by dialing 877.328.5507 or 412.317.5423 for international callers; the conference ID is 10192111. A replay of the call will be available until November 6, 2024, at 9:00 a.m. (Eastern Time), by dialing 877.344.7529 or 412.317.0088 for international callers; the replay conference ID is 5832848. An audio recording will also be available on the Company’s website.

About Artisan Partners

Artisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Artisan Partners’ autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates.

Source: Artisan Partners Asset Management Inc.

Investor Relations Inquiries

866.632.1770

ir@artisanpartners.com

Artisan Partners Asset Management Inc. Reports 3Q24 Results

Milwaukee, WI - October 29, 2024 - Artisan Partners Asset Management Inc. (NYSE: APAM) (the “Company” or “Artisan Partners”) today reported its results for the three and nine months ended September 30, 2024, and declared a quarterly dividend.

Chief Executive Officer Eric Colson said, "Artisan Partners brings together differentiated investment talent, broad opportunity sets, and long-term asset allocation demand. This combination has tremendous power to compound client wealth and business value—over time periods that we believe matter to our clients and shareholders. Those time periods vary but we believe are measured in market cycles and multi-year periods. Since our IPO in 2013, we have returned $36.47 per share in cumulative dividends (relative to our IPO price of $30.00 per share) and delivered an annual total shareholder return, with dividends reinvested, of 12.38% versus 12.05% for the S&P 500 and 7.80% for the Russell 2000.

"Our earliest strategies, launched between 1995 and 2002, are style, market cap, or geographically oriented. They have been and remain powerful compounders, representing nearly $79 billion of our AUM and delivering average annual absolute returns of 10.66% and average annual alpha of 289 basis points, since inception and after fees.

"In the early 2000s, recognizing that our teams’ investment research covered a broad universe of global equities, we expanded degrees of freedom to include global equities, providing our talent with more ways to differentiate and aligning us with institutional demand, especially outside of the United States. The investment and business outcome has validated our approach. Today, the strategies we launched between 2005 and 2011 represent nearly $59 billion of AUM and have delivered average annual absolute returns of 8.63% and average annual alpha of 142 basis points, since inception and after fees.

“Our latest phase of growth has focused on fixed income, alternatives, and private assets. The public equity opportunity set has been shrinking, especially in the developed world. The number of U.S. public companies peaked in 1996 at over 8,000 and has declined by over 40% since. The number of developed market public companies peaked in 2007 at over 26,000 and has declined 20% since. As the opportunity set shrinks, allocators are increasingly accessing public equity returns via low cost exposure and thematic ETFs. There are now more than twice as many ETFs as there are publicly traded U.S. stocks.

"In response, we have added degrees of freedom across our existing investment strategies and focused new launches on areas where we believe there is more dispersion and greater opportunity for talent to generate differentiated results.

"Credit markets remain ripe for alpha given the number of issuers and variety of instruments and opportunities to differentiate. Unlike many high-yield strategies, the Artisan High Income strategy invests significantly in floating rate leveraged loans—which has contributed to Artisan High Income Fund being ranked #4 of 302 funds in its Lipper category over the ten years since its inception. Similarly, the Artisan Credit team has invested in less liquid, distressed, and other special situations in the Artisan Credit Opportunities strategy to generate an average annual return of 10.29%, after fees, since inception in 2017.

"Another example of expanding the opportunity set is the Artisan EMsights Capital Group. Across the team’s three strategies, they are invested in 66 countries. They own local currency positions in 32 countries, including Peru, Serbia, and Indonesia. They use derivatives extensively to isolate the risks they want to take and to take those risks efficiently. Artisan Global Unconstrained Fund includes 155 unique issuers, including hard and local currency sovereign and corporate bonds, treasury bills, loans, equities, currency forwards, futures, credit default and interest rate swaps, and options.

"Lastly, we continue to believe that private securities offer an additional dimension for talent to add value for clients. We currently have private investments in multiple strategies and both our China Post-Venture and Dislocation Opportunities funds are designed specifically to take advantage of private market opportunities. We remain committed to adding more private capabilities across our platform.

"Building durable investment strategies takes time. We have launched eight new strategies over the last five years, five of which are credit-oriented or alternative. They are compounding capital and generating differentiated results. Demand for these strategies exists, and we continue to develop our ability to access that demand. We have executed on this latest phase of thoughtful growth while continuing to deliver long-term results for shareholders. Over the last five years, we have returned $16.94 per share in cumulative dividends and delivered an annual total shareholder return of 18.56% versus 14.11% for the S&P 500 and 7.91% for the Russell 2000. We remain true to Who We Are as a high value-added investment firm and we continue to execute on our business model and philosophy. Compelling long-term outcomes for clients, talent, and shareholders follow."

The table below presents AUM and a comparison of certain GAAP and non-GAAP (“adjusted”) financial measures. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| (unaudited, in millions except per share amounts or as otherwise noted) |

| Assets Under Management (amounts in billions) |

| Ending | $ | 167.8 | | | $ | 158.9 | | | $ | 136.5 | | | $ | 167.8 | | | $ | 136.5 | |

| Average | 162.8 | | | 158.6 | | | 142.2 | | | 158.5 | | | 139.0 | |

| | | | | | | | | |

| Consolidated Financial Results (GAAP) |

| Revenues | $ | 279.6 | | | $ | 270.8 | | | $ | 248.7 | | | $ | 814.8 | | | $ | 726.1 | |

| Operating income | 93.2 | | | 86.6 | | | 82.2 | | | 257.5 | | | 227.2 | |

| Operating margin | 33.3 | % | | 32.0 | % | | 33.0 | % | | 31.6 | % | | 31.3 | % |

Net income attributable to Artisan Partners Asset Management Inc. | $ | 72.9 | | | $ | 57.6 | | | $ | 53.1 | | | $ | 190.0 | | | $ | 157.5 | |

| Basic earnings per share | 1.03 | | | 0.80 | | | 0.76 | | | 2.68 | | | 2.27 | |

| Diluted earnings per share | 1.03 | | | 0.80 | | | 0.76 | | | 2.68 | | | 2.27 | |

| | | | | | | | | |

Adjusted1 Financial Results |

| Adjusted operating income | $ | 97.8 | | | $ | 87.3 | | | $ | 80.9 | | | $ | 266.7 | | | $ | 228.4 | |

| Adjusted operating margin | 35.0 | % | | 32.2 | % | | 32.5 | % | | 32.7 | % | | 31.5 | % |

Adjusted EBITDA2 | $ | 103.6 | | | $ | 92.3 | | | $ | 85.5 | | | $ | 282.2 | | | $ | 239.6 | |

| Adjusted net income | 74.5 | | | 66.0 | | | 60.8 | | | 202.1 | | | 170.3 | |

| Adjusted net income per adjusted share | 0.92 | | | 0.82 | | | 0.75 | | | 2.50 | | | 2.11 | |

______________________________________

1 Adjusted measures are non-GAAP measures and are explained and reconciled to the comparable GAAP measures in Exhibit 2.

2 Adjusted EBITDA represents adjusted net income before interest expense, income taxes, depreciation and amortization expense.

2

September 2024 Quarter Compared to June 2024 Quarter

AUM increased to $167.8 billion at September 30, 2024, an increase of $8.9 billion, or 6%, compared to $158.9 billion at June 30, 2024, primarily due to $9.9 billion of market appreciation, partially offset by $0.8 billion of net client cash outflows and $0.2 billion of Artisan Funds' distributions not reinvested. For the quarter, average AUM increased 3% to $162.8 billion from $158.6 billion in the June 2024 quarter.

Revenues of $279.6 million in the September 2024 quarter increased $8.8 million, or 3%, from $270.8 million in the June 2024 quarter, primarily due to higher average AUM in the September 2024 quarter and one more calendar day in the September 2024 quarter.

Operating expenses of $186.4 million in the September 2024 quarter increased $2.2 million, or 1%, from $184.2 million in the June 2024 quarter, primarily due to a $3.0 million increase in long-term incentive compensation which was mainly driven by market valuation changes.

GAAP operating margin was 33.3% in the September 2024 quarter, compared to 32.0% in the June 2024 quarter. Adjusted operating margin was 35.0% in the September 2024 quarter, compared to 32.2% in the June 2024 quarter.

Within non-operating income (expense), investment gains (losses) are comprised of net investment gains (losses) of consolidated and nonconsolidated investment products, including investments held to economically hedge compensation plans (collectively referred to as "investments in sponsored products"). Total investment gains, which include gains attributable to third party shareholders of consolidated investment products, were $35.5 million in the September 2024 quarter, compared to gains of $3.5 million in the June 2024 quarter. Artisan Partners' portion of the gains from investments in sponsored products was $18.2 million in the September 2024 quarter, compared to gains of $0.8 million in the June 2024 quarter. The $18.2 million of gains for the September 2024 quarter was comprised of $9.5 million of gains on investments to hedge compensation plans and $8.7 million of gains on seed investments.

GAAP net income was $72.9 million, or $1.03 per basic and diluted share, in the September 2024 quarter, compared to GAAP net income of $57.6 million, or $0.80 per basic and diluted share, in the June 2024 quarter. Adjusted net income was $74.5 million, or $0.92 per adjusted share, in the September 2024 quarter, compared to adjusted net income of $66.0 million, or $0.82 per adjusted share, in the June 2024 quarter.

September 2024 Quarter Compared to September 2023 Quarter

AUM at September 30, 2024 was $167.8 billion, up 23% from $136.5 billion at September 30, 2023. The change in AUM from the prior year quarter was primarily due to $35.5 billion of investment returns, partially offset by $3.3 billion of net client cash outflows and $0.9 billion of Artisan Funds' distributions not reinvested. Average AUM for the September 2024 quarter was $162.8 billion, 14% higher than average AUM for the September 2023 quarter.

Revenues of $279.6 million in the September 2024 quarter increased $30.9 million, or 12%, from $248.7 million in the September 2023 quarter, primarily due to higher average AUM.

Operating expenses of $186.4 million in the September 2024 quarter increased $19.9 million, or 12%, from $166.5 million in the September 2023 quarter, primarily due to an $8.4 million increase in incentive compensation driven by higher revenues, and an $8.0 million increase in long-term incentive compensation costs; these costs included $5.8 million of additional expense from the market valuation changes and $1.2 million of additional expense from the retirement acceleration feature on 2024 grants.

GAAP operating margin was 33.3% in the September 2024 quarter, compared to 33.0% in the September 2023 quarter. Adjusted operating margin was 35.0% in the September 2024 quarter, compared to 32.5% in the September 2023 quarter.

Total investment gains, which include gains attributable to third party shareholders of consolidated investment products, were $35.5 million in the September 2024 quarter, compared to gains of $5.5 million in the September 2023 quarter. Artisan Partners' portion of the gains from investments in sponsored products was $18.2 million in the September 2024 quarter, compared to losses of $3.6 million in the September 2023 quarter.

GAAP net income was $72.9 million, or $1.03 per basic and diluted share, in the September 2024 quarter, compared to GAAP net income of $53.1 million, or $0.76 per basic and diluted share, in the September 2023 quarter. Adjusted net income was $74.5 million, or $0.92 per adjusted share, in the September 2024 quarter, compared to adjusted net income of $60.8 million, or $0.75 per adjusted share, in the September 2023 quarter.

Nine Months Ended September 2024 Compared to Nine Months Ended September 2023

AUM increased to $167.8 billion at September 30, 2024, an increase of 23% compared to $136.5 billion at September 30, 2023. Average AUM for the September 2024 nine-month period was $158.5 billion, 14% higher than average AUM of $139.0 billion for the September 2023 nine-month period.

Revenues of $814.8 million for the nine months ended September 2024 increased $88.7 million, or 12%, from $726.1 million for the nine months ended September 2023, primarily due to higher average AUM.

Operating expenses of $557.3 million for the nine months ended September 2024 increased $58.4 million, or 12%, from $498.9 million for the nine months ended September 2023, primarily due to a $53.1 million increase in compensation and benefits. The increase in compensation and benefits was comprised of a $29.9 million increase in incentive compensation due to increased revenues, a $16.1 million increase in long-term incentive compensation which included an $8.0 million increase from market valuation changes and $5.2 million of additional expense from the retirement acceleration provision on 2024 grants, and a $7.0 million increase in salaries and benefits as a result of increases in the number of full-time associates and salary increases.

GAAP operating margin was 31.6% for the nine months ended September 2024, compared to 31.3% for the nine months ended September 2023. Adjusted operating margin was 32.7% for the nine months ended September 2024, compared to 31.5% for the nine months ended September 2023.

Total investment gains, which include gains attributable to third party shareholders of consolidated investment products, were $70.3 million in the nine months ended September 2024, compared to gains of $45.7 million for the nine months ended September 2023. Artisan Partners' portion of the gains from investments in sponsored products was $35.5 million for the nine months ended September 2024, compared to gains of $19.2 million for the nine months ended September 2023. The $35.5 million for the nine months ended September 30, 2024 was comprised of $19.8 million of gains on investments to hedge compensation plans and $15.7 million of gains on seed investments.

GAAP net income was $190.0 million, or $2.68 per basic and diluted share, for the nine months ended September 2024, compared to GAAP net income of $157.5 million, or $2.27 per basic and diluted share, for the nine months ended September 2023. Adjusted net income was $202.1 million, or $2.50 per adjusted share, for the nine months ended September 2024, compared to adjusted net income of $170.3 million, or $2.11 per adjusted share, for the nine months ended September 2023.

Capital Management & Balance Sheet

Cash and cash equivalents were $253.9 million at September 30, 2024, compared to $141.0 million at December 31, 2023. During the September 30, 2024 quarter, the Company paid a variable quarterly dividend of $0.71 per share of Class A common stock with respect to the June 2024 quarter. The Company had total borrowings of $200.0 million at September 30, 2024 and December 31, 2023.

During the September 2024 quarter, limited partners of Artisan Partners Holdings exchanged 176,213 common units for 176,213 Class A common shares. The exchanges increased the Company's public float of Class A common stock by 176,213 or 0.3%.

Total stockholders’ equity was $405.0 million at September 30, 2024, compared to $351.4 million at December 31, 2023. The Company had 70.1 million Class A common shares outstanding at September 30, 2024. The Company’s debt leverage ratio, calculated in accordance with its loan agreements, was 0.5x at September 30, 2024.

Dividend

The Company’s board of directors declared a variable quarterly dividend of $0.82 per share of Class A common stock with respect to the September 2024 quarter. The variable quarterly dividend represents approximately 80% of the cash generated in the September 2024 quarter and will be paid on November 29, 2024, to shareholders of record as of the close of business on November 15, 2024. Based on our projections and subject to change, we expect some portion of the 2024 dividend payments to constitute a return of capital for tax purposes.

Subject to board approval each quarter, we currently expect to pay a quarterly dividend of approximately 80% of the cash the Company generates each quarter. We expect cash generation will generally equal adjusted net income plus long-term incentive compensation expense, less cash reserved for future franchise capital awards (which we expect will generally approximate 4% of investment management revenues each quarter), with additional adjustments made for certain other sources and uses of cash, including capital expenditures. After the end of the year, our board will consider payment of a special dividend.

*********

Conference Call

The Company will host a conference call on October 30, 2024, at 1:00 p.m. (Eastern Time) to discuss these results. Hosting the call will be Eric Colson, Chief Executive Officer, Jason Gottlieb, President, and C.J. Daley, Chief Financial Officer. Supplemental materials that will be reviewed during the call are available on the Company’s website at www.apam.com. The call will be webcast and can be accessed via the Company’s website. Listeners may also access the call by dialing 877.328.5507 or 412.317.5423 for international callers; the conference ID is 10192111. A replay of the call will be available until November 6, 2024, at 9:00 a.m. (Eastern Time), by dialing 877.344.7529 or 412.317.0088 for international callers; the replay conference ID is 5832848. An audio recording will also be available on the Company’s website.

Forward-Looking Statements and Other Disclosures

Certain statements in this release, and other written or oral statements made by or on behalf of the Company, are “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and our future performance, as well as management’s current expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. These forward-looking statements are only predictions based on current expectations and projections about future events. These forward-looking statements are subject to a number of risks and uncertainties, and there are important factors that could cause actual results, level of activity, performance, actions or achievements to differ materially from the results, level of activity, performance, actions or achievements expressed or implied by the forward-looking statements. These factors include: the loss of key investment professionals or senior management, adverse market or economic conditions for whatever reason, poor performance of our investment strategies, change in the legislative and regulatory environment in which we operate, operational or technical errors or other matters that cause damage to our reputation, and other factors disclosed in the Company’s filings with the Securities and Exchange Commission, including those factors listed under the caption entitled “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 22, 2024, as such factors may be updated from time to time. Our periodic and current reports are accessible on the SEC's website at www.sec.gov. The Company undertakes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release.

Assets Under Management (AUM) refers to the assets of pooled vehicles and separate accounts to which Artisan Partners provides services. Artisan Partners’ AUM as reported here includes assets for certain strategies for which Artisan Partners provides non-discretionary model portfolios to managed account sponsors, for which we earn only investment-related service fees. Such non-discretionary assets are reported on a lag not exceeding one quarter and represented $98 million, $65 million and $55 million in aggregate as of September 30, 2024, June 30, 2024 and September 30, 2023, respectively. Artisan's definition of AUM is not based on any definition of Assets Under Management contained in the ADV or in any of Artisan's fund management agreements.

Results for any investment strategy described herein, and for different investment products within a strategy, are affected by numerous factors, including different material market or economic conditions; different investment management fee rates, brokerage commissions and other expenses; and the reinvestment of dividends or other earnings. The returns for any strategy may be positive or negative, and past performance does not guarantee future results.

Unless otherwise noted, composite returns have been presented gross of investment advisory fees applied to client accounts, but include applicable trade commissions and transaction costs. Management fees, when reflected, would reduce the results presented for an investor in an account managed within a composite. Net-of-fees composite returns presented in these materials were calculated using the highest model investment advisory fees applicable to portfolios within the composite. Fees may be higher for certain pooled vehicles, and the composite may include accounts with performance-based fees. Index returns do not reflect the payment of fees and expenses. Certain Artisan composite returns may be represented by a single account.

In these materials, we present Value Added, which is the difference between an Artisan strategy's average annual return and the return of its respective benchmark. We may also present Excess Returns (alpha), which are an estimate of the amount in dollars by which Artisan's investment strategies have outperformed or underperformed their respective benchmark. Excess Returns are calculated by (i) multiplying a strategy's beginning-of-year AUM by the difference between the returns (in basis points) of the strategy (gross of fees, unless otherwise indicated) and the benchmark for the ensuing year and (ii) summing all strategies' Excess Returns for each year calculated. Market Returns include all changes in AUM not included in Excess Returns, client cash flows and Artisan Funds distributions not reinvested. The benchmark used for purposes of presenting a strategy’s performance and calculating Value Added and Excess Returns is generally the market index most commonly used by our clients to compare the performance of the relevant strategy. For certain strategies that are managed for absolute return, the benchmark used for purposes of presenting a strategy’s performance and calculating Value Added and Excess Returns is the index used by the Company’s management to evaluate the performance of the strategy.

Composites / Indexes used for the comparison calculations described are: Non-U.S. Growth Strategy / International Value Strategy-MSCI EAFE Index; Global Equity Strategy / Global Opportunities Strategy / Global Value Strategy-MSCI ACWI Index; Global Discovery Strategy: MSCI ACWI Small Mid Index; Non-U.S. Small-Mid Growth Strategy-MSCI ACWI ex-USA Small Mid Index; U.S. Mid-Cap Growth Strategy-Russell Midcap Growth® Index; U.S. Mid-Cap Value Strategy-Russell Midcap Value® Index; U.S. Small-Cap Growth Strategy-Russell 2000 Growth® Index; Value Equity Strategy-Russell 1000 Value® Index; Developing World Strategy / Sustainable Emerging Markets Strategy-MSCI Emerging Markets Index; High Income Strategy-ICE BofA US High Yield Index; Credit Opportunities Strategy-ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index; Antero Peak Strategy / Antero Peak Hedge Strategy / Select Equity Strategy / Value Income Strategy-S&P 500® Index; International Explorer Strategy-MSCI All Country World Ex USA Small Cap Index; China Post-Venture Strategy-MSCI China SMID Cap Index; Floating Rate Strategy-Credit Suisse Leveraged Loan Total Return Index; Global Unconstrained Strategy-ICE BofA 3-Month U.S. Treasury Bill Index; Emerging Markets Debt Opportunities Strategy-J.P. Morgan EMB Hard Currency/Local Currency 50-50 Index; Emerging Markets Local Opportunities Strategy - J.P. Morgan GBI-EM Global Diversified Index. Where applicable, composite returns have been included for the following discontinued strategies and their indexes: Global Small-Cap Growth Strategy (Jul 1, 2013-Dec 31, 2016)-MSCI ACWI Small Cap Index; U.S. Small-Cap Value Strategy (Jun 1, 1997-Apr 30, 2016)-Russell 2000® Index; Non-U.S. Small-Cap Growth Strategy (Jan 1, 2002-Nov 30, 2018)-MSCI EAFE Small Cap Index. Index returns do not reflect the payment of fees and expenses. An investment cannot be made directly in an Artisan Partners composite or a market index and the aggregated results are hypothetical.

None of the information in these materials constitutes either an offer or a solicitation to buy or sell any fund securities, nor is any such information a recommendation for any fund security or investment service. The funds and strategies may not be available to all investors in all jurisdictions.

Any discrepancies included in this release between totals and the sums of the amounts listed are due to rounding.

Artisan High Income Fund - Investor Class was ranked as follows by Lipper, Inc. within the High Yield category as of September 30, 2024 (Fund/Category): 1yr (187/431); 3yr (28/406); (5yr (20/391); and 10yr (4/301). The number of funds in the category may include several share classes of the same mutual fund which may have a material impact on the fund's ranking within the category. Lipper rankings are based on total return of a fund’s stated share class, are historical and do not represent future results.

About Artisan Partners

Artisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Artisan Partners’ autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates.

Source: Artisan Partners Asset Management Inc.

Investor Relations Inquiries

866.632.1770

ir@artisanpartners.com

Exhibit 1

Artisan Partners Asset Management Inc.

Consolidated Statements of Operations

(unaudited; in millions, except per share amounts or as noted)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | | | |

| Management fees | | | | | | | | | |

| Artisan Funds & Artisan Global Funds | $ | 174.7 | | | $ | 170.2 | | | $ | 156.4 | | | $ | 510.4 | | | $ | 452.6 | |

| Separate accounts and other | 104.9 | | | 100.5 | | | 92.2 | | | 304.3 | | | 273.3 | |

| Performance fees | — | | | 0.1 | | | 0.1 | | | 0.1 | | | 0.2 | |

| Total revenues | 279.6 | | | 270.8 | | | 248.7 | | | 814.8 | | | 726.1 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | | |

| Compensation and benefits | 149.0 | | | 146.8 | | | 130.7 | | | 445.7 | | | 392.6 | |

| Distribution, servicing and marketing | 6.3 | | | 6.4 | | | 6.2 | | | 19.1 | | | 17.8 | |

| Occupancy | 8.2 | | | 7.5 | | | 7.2 | | | 23.0 | | | 21.5 | |

| Communication and technology | 13.1 | | | 13.1 | | | 13.0 | | | 39.7 | | | 38.4 | |

| General and administrative | 9.8 | | | 10.4 | | | 9.4 | | | 29.8 | | | 28.6 | |

| Total operating expenses | 186.4 | | | 184.2 | | | 166.5 | | | 557.3 | | | 498.9 | |

| Operating income | 93.2 | | | 86.6 | | | 82.2 | | | 257.5 | | | 227.2 | |

| Interest expense | (2.2) | | | (2.2) | | | (2.3) | | | (6.5) | | | (6.5) | |

| Interest income on cash and cash equivalents and other | 2.7 | | | 2.1 | | | 2.1 | | | 6.6 | | | 3.8 | |

| Net gain (loss) on the tax receivable agreements | (0.5) | | | — | | | 0.5 | | | (0.5) | | | 0.5 | |

| Net investment gain (loss) of consolidated investment products | 23.1 | | | 3.3 | | | 9.8 | | | 45.6 | | | 38.2 | |

| Net investment gain (loss) of nonconsolidated investment products | 12.4 | | | 0.2 | | | (4.3) | | | 24.7 | | | 7.5 | |

| Total non-operating income (expense) | 35.5 | | | 3.4 | | | 5.8 | | | 69.9 | | | 43.5 | |

| Income before income taxes | 128.7 | | | 90.0 | | | 88.0 | | | 327.4 | | | 270.7 | |

| Provision for income taxes | 24.6 | | | 18.7 | | | 14.6 | | | 65.3 | | | 51.7 | |

| Net income before noncontrolling interests | 104.1 | | | 71.3 | | | 73.4 | | | 262.1 | | | 219.0 | |

Less: Net income attributable to noncontrolling interests - Artisan Partners Holdings LP | 14.5 | | | 11.5 | | | 11.3 | | | 38.9 | | | 35.5 | |

Less: Net income (loss) attributable to noncontrolling interests - consolidated investment products | 16.7 | | | 2.2 | | | 9.0 | | | 33.2 | | | 26.0 | |

Net income attributable to Artisan Partners Asset Management Inc. | $ | 72.9 | | | $ | 57.6 | | | $ | 53.1 | | | $ | 190.0 | | | $ | 157.5 | |

| | | | | | | | | |

Basic earnings per share - Class A common shares | $ | 1.03 | | | $ | 0.80 | | | $ | 0.76 | | | $ | 2.68 | | | $ | 2.27 | |

Diluted earnings per share - Class A common shares | $ | 1.03 | | | $ | 0.80 | | | $ | 0.76 | | | $ | 2.68 | | | $ | 2.27 | |

| | | | | | | | | |

| Average shares outstanding | | | | | | | | | |

| Class A common shares | 65.1 | | | 65.0 | | | 63.5 | | | 64.8 | | | 63.4 | |

| Participating unvested restricted share-based awards | 5.5 | | | 5.5 | | | 5.6 | | | 5.5 | | | 5.6 | |

| Total average shares outstanding | 70.6 | | | 70.5 | | | 69.1 | | | 70.3 | | | 69.0 | |

Exhibit 2

Artisan Partners Asset Management Inc.

Reconciliation of GAAP to Non-GAAP (“Adjusted”) Measures

(unaudited; in millions, except per share amounts or as noted)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Net income attributable to Artisan Partners Asset Management Inc. (GAAP) | $ | 72.9 | | | $ | 57.6 | | | $ | 53.1 | | | $ | 190.0 | | | $ | 157.5 | |

Add back: Net income attributable to noncontrolling interests - Artisan Partners Holdings LP | 14.5 | | | 11.5 | | | 11.3 | | | 38.9 | | | 35.5 | |

| Add back: Provision for income taxes | 24.6 | | | 18.7 | | | 14.6 | | | 65.3 | | | 51.7 | |

Add back: Compensation expense (reversal) related to market valuation changes in compensation plans | 4.6 | | | 0.7 | | | (1.3) | | | 9.2 | | | 1.2 | |

| Add back: Net (gain) loss on the tax receivable agreements | 0.5 | | | — | | | (0.5) | | | 0.5 | | | (0.5) | |

| Add back: Net investment (gain) loss of investment products attributable to APAM | (18.2) | | | (0.8) | | | 3.6 | | | (35.5) | | | (19.2) | |

| Less: Adjusted provision for income taxes | 24.4 | | | 21.7 | | | 20.0 | | | 66.3 | | | 55.9 | |

| Adjusted net income (Non-GAAP) | $ | 74.5 | | | $ | 66.0 | | | $ | 60.8 | | | $ | 202.1 | | | $ | 170.3 | |

| | | | | | | | | |

| Average shares outstanding | | | | | | | | | |

| Class A common shares | 65.1 | | | 65.0 | | | 63.5 | | | 64.8 | | | 63.4 | |

| | | | | | | | | |

| Assumed vesting or exchange of: | | | | | | | | | |

| Unvested restricted share-based awards | 5.5 | | | 5.6 | | | 5.7 | | | 5.5 | | | 5.7 | |

Artisan Partners Holdings LP units outstanding (noncontrolling interest) | 10.4 | | | 10.4 | | | 11.5 | | | 10.6 | | | 11.5 | |

| Adjusted shares | 81.0 | | | 81.0 | | | 80.7 | | | 80.9 | | | 80.6 | |

| | | | | | | | | |

| Basic earnings per share (GAAP) | $ | 1.03 | | | $ | 0.80 | | | $ | 0.76 | | | $ | 2.68 | | | $ | 2.27 | |

| Diluted earnings per share (GAAP) | $ | 1.03 | | | $ | 0.80 | | | $ | 0.76 | | | $ | 2.68 | | | $ | 2.27 | |

| Adjusted net income per adjusted share (Non-GAAP) | $ | 0.92 | | | $ | 0.82 | | | $ | 0.75 | | | $ | 2.50 | | | $ | 2.11 | |

| | | | | | | | | |

| Operating income (GAAP) | $ | 93.2 | | | $ | 86.6 | | | $ | 82.2 | | | $ | 257.5 | | | $ | 227.2 | |

Add back: Compensation expense (reversal) related to market valuation changes in compensation plans | 4.6 | | | 0.7 | | | (1.3) | | | 9.2 | | | 1.2 | |

| Adjusted operating income (Non-GAAP) | $ | 97.8 | | | $ | 87.3 | | | $ | 80.9 | | | $ | 266.7 | | | $ | 228.4 | |

| | | | | | | | | |

| Operating margin (GAAP) | 33.3 | % | | 32.0 | % | | 33.0 | % | | 31.6 | % | | 31.3 | % |

| Adjusted operating margin (Non-GAAP) | 35.0 | % | | 32.2 | % | | 32.5 | % | | 32.7 | % | | 31.5 | % |

| | | | | | | | | |

Net income attributable to Artisan Partners Asset Management Inc. (GAAP) | $ | 72.9 | | | $ | 57.6 | | | $ | 53.1 | | | $ | 190.0 | | | $ | 157.5 | |

Add back: Net income attributable to noncontrolling interests - Artisan Partners Holdings LP | 14.5 | | | 11.5 | | | 11.3 | | | 38.9 | | | 35.5 | |

Add back: Compensation expense (reversal) related to market valuation changes in compensation plans | 4.6 | | | 0.7 | | | (1.3) | | | 9.2 | | | 1.2 | |

| Add back: Net (gain) loss on the tax receivable agreements | 0.5 | | | — | | | (0.5) | | | 0.5 | | | (0.5) | |

| Add back: Net investment (gain) loss of investment products attributable to APAM | (18.2) | | | (0.8) | | | 3.6 | | | (35.5) | | | (19.2) | |

| Add back: Interest expense | 2.2 | | | 2.2 | | | 2.3 | | | 6.5 | | | 6.5 | |

| Add back: Provision for income taxes | 24.6 | | | 18.7 | | | 14.6 | | | 65.3 | | | 51.7 | |

| Add back: Depreciation and amortization | 2.5 | | | 2.4 | | | 2.4 | | | 7.3 | | | 6.9 | |

| Adjusted EBITDA (Non-GAAP) | $ | 103.6 | | | $ | 92.3 | | | $ | 85.5 | | | $ | 282.2 | | | $ | 239.6 | |

Supplemental Non-GAAP Financial Information

The Company’s management uses non-GAAP measures (referred to as “adjusted” measures) of net income to evaluate the profitability and efficiency of the underlying operations of the business and as a factor when considering net income available for distributions and dividends. These adjusted measures remove the impact of (1) net gain (loss) on the tax receivable agreements (if any), (2) compensation expense (reversal) related to market valuation changes in compensation plans, and (3) net investment gain (loss) of investment products. These adjustments also remove the non-operational complexities of the Company’s structure by adding back noncontrolling interests and assuming all income of Artisan Partners Holdings is allocated to APAM. Management believes these non-GAAP measures provide meaningful information to analyze the Company’s profitability and efficiency between periods and over time. The Company has included these non-GAAP measures to provide investors with the same financial metrics used by management to manage the Company.

Non-GAAP measures should be considered in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP. The Company’s non-GAAP measures may differ from similar measures used by other companies, even if similar terms are used to identify such measures. The Company’s non-GAAP measures are as follows:

•Adjusted net income represents net income excluding the impact of (1) net gain (loss) on the tax receivable agreements (if any), (2) compensation expense (reversal) related to market valuation changes in compensation plans, and (3) net investment gain (loss) of investment products. Adjusted net income also reflects income taxes assuming the vesting of all unvested Class A share-based awards and as if all outstanding limited partnership units of Artisan Partners Holdings had been exchanged for Class A common stock of APAM on a one-for-one basis. Assuming full vesting and exchange, all income of Artisan Partners Holdings is treated as if it were allocated to APAM, and the adjusted provision for income taxes represents an estimate of income tax expense at an effective rate reflecting APAM's current federal, state and local income statutory tax rates. The adjusted tax rate was 24.7% for all periods presented.

•Adjusted net income per adjusted share is calculated by dividing adjusted net income by adjusted shares. The number of adjusted shares is derived by assuming the vesting of all unvested Class A share-based awards and the exchange of all outstanding limited partnership units of Artisan Partners Holdings for Class A common stock of APAM on a one-for-one basis.

•Adjusted operating income represents the operating income of the consolidated company excluding compensation expense related to market valuation changes in compensation plans.

•Adjusted operating margin is calculated by dividing adjusted operating income by total revenues.

•Adjusted EBITDA represents adjusted net income before interest expense, income taxes, depreciation and amortization expense.

Net gain (loss) on the tax receivable agreements represents the income (expense) associated with the change in estimate of amounts payable under the tax receivable agreements entered into in connection with APAM’s initial public offering and related reorganization.

Compensation expense (reversal) related to market valuation changes in compensation plans represents the expense (income) associated with the change in the long-term incentive award liability resulting from investment returns of the underlying investment products. Because the compensation expense impact of the investment market exposure is economically hedged, management believes it is useful to reflect the expected net income offset in the calculation of adjusted operating income, adjusted net income, and adjusted EBITDA. The related investment gain (loss) on the underlying investments is included in the adjustment for net investment gain (loss) of investment products.

Net investment gain (loss) of investment products represents the non-operating income (expense) related to the Company’s investments, in both consolidated sponsored investment products and nonconsolidated sponsored investment products, including investments in sponsored investment products held to economically hedge compensation plans. Excluding these non-operating market gains or losses on investments provides greater transparency to evaluate the profitability and efficiency of the underlying operations of the business. Interest income generated on cash and cash equivalents is considered part of normal operations, and therefore, is not excluded from adjusted net income.

Exhibit 3

Artisan Partners Asset Management Inc.

Condensed Consolidated Statements of Financial Condition

(unaudited; in millions)

| | | | | | | | | | | |

| As of |

| September 30, | | December 31, |

| 2024 | | 2023 |

| Assets |

| Cash and cash equivalents | $ | 253.9 | | | $ | 141.0 | |

| Accounts receivable | 110.0 | | | 101.2 | |

| Investment securities | 211.9 | | | 150.5 | |

Deferred tax assets | 419.5 | | | 436.5 | |

Assets of consolidated investment products | 465.5 | | | 414.9 | |

| Operating lease assets | 87.2 | | | 94.7 | |

| Other | 62.6 | | | 67.1 | |

| Total assets | $ | 1,610.6 | | | $ | 1,405.9 | |

| | | |

| Liabilities and equity |

| Accounts payable, accrued expenses, and other | $ | 193.2 | | | $ | 77.7 | |

| Borrowings | 199.4 | | | 199.3 | |

| Operating lease liabilities | 105.7 | | | 113.4 | |

| Amounts payable under tax receivable agreements | 341.4 | | | 364.0 | |

| Liabilities of consolidated investment products | 66.9 | | | 47.7 | |

| Total liabilities | 906.6 | | | 802.1 | |

| | | |

| Redeemable noncontrolling interests | 299.0 | | | 252.4 | |

| Total stockholders’ equity | 405.0 | | | 351.4 | |

| Total liabilities, redeemable noncontrolling interests and stockholders’ equity | $ | 1,610.6 | | | $ | 1,405.9 | |

Exhibit 4

Artisan Partners Asset Management Inc.

Assets Under Management

(unaudited; in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | % Change from2 | |

| September 30, | | June 30, | | September 30, | | June 30, | | September 30, | |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 | |

| | | | | | | | | | |

| Beginning assets under management | $ | 158,887 | | | $ | 160,384 | | | $ | 142,989 | | | (0.9) | % | | 11.1 | % | |

| Gross client cash inflows | 6,210 | | | 5,604 | | | 5,601 | | | 10.8 | % | | 10.9 | % | |

| Gross client cash outflows | (6,953) | | | (7,214) | | | (6,940) | | | 3.6 | % | | (0.2) | % | |

| Net client cash flows | (743) | | | (1,610) | | | (1,339) | | | 53.9 | % | | 44.5 | % | |

Artisan Funds' distributions not reinvested1 | (222) | | | (91) | | | (75) | | | (144.0) | % | | (196.0) | % | |

| Investment returns and other | 9,918 | | | 204 | | | (5,080) | | | NM | | 295.2 | % | |

| | | | | | | | | | |

| Ending assets under management | $ | 167,840 | | | $ | 158,887 | | | $ | 136,495 | | | 5.6 | % | | 23.0 | % | |

| Average assets under management | $ | 162,783 | | | $ | 158,579 | | | $ | 142,199 | | | 2.7 | % | | 14.5 | % | |

| | | | | | | | | | |

| For the Nine Months Ended | | | | % Change from | | |

| September 30, | | September 30, | | | | September 30, | | | |

| 2024 | | 2023 | | | | 2023 | | | |

| | | | | | | | | | |

| Beginning assets under management | $ | 150,167 | | | $ | 127,892 | | | | | 17.4 | % | | | |

| Gross client cash inflows | 18,001 | | | 15,889 | | | | | 13.3 | % | | | |

| Gross client cash outflows | (20,876) | | | (19,567) | | | | | (6.7) | % | | | |

| Net client cash flows | (2,875) | | | (3,678) | | | | | 21.8 | % | | | |

Artisan Funds' distributions not reinvested1 | (398) | | | (190) | | | | | (109.5) | % | | | |

| Investment returns and other | 20,946 | | | 12,471 | | | | | 68.0 | % | | | |

| | | | | | | | | | |

| Ending assets under management | $ | 167,840 | | | $ | 136,495 | | | | | 23.0 | % | | | |

| Average assets under management | $ | 158,514 | | | $ | 138,982 | | | | | 14.1 | % | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

______________________________________

1 Artisan Funds' distributions not reinvested represents the amount of income and capital gain distributions that were not reinvested in the Artisan Funds.

2 "NM" stands for Not Meaningful.

11

Exhibit 5

Artisan Partners Asset Management Inc.

Assets Under Management by Investment Team and Vehicle

(unaudited; in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | By Investment Team2 |

| | Growth | Global Equity | U.S. Value | International Value | Global Value | Sustainable Emerging Markets | Credit | Developing World | Antero Peak Group | International Small-Mid | EMsights Capital Group | Total |

| September 30, 2024 | | |

| Beginning assets under management | | $ | 38,917 | | $ | 13,495 | | $ | 7,266 | | $ | 43,745 | | $ | 27,793 | | $ | 1,857 | | $ | 11,165 | | $ | 3,997 | | $ | 2,236 | | $ | 7,042 | | $ | 1,374 | | $ | 158,887 | |

| Gross client cash inflows | | 1,192 | | 79 | | 131 | | 1,284 | | 974 | | 41 | | 1,120 | | 106 | | 124 | | 268 | | 891 | | 6,210 | |

| Gross client cash outflows | | (2,057) | | (600) | | (123) | | (1,428) | | (699) | | (37) | | (1,115) | | (259) | | (106) | | (517) | | (12) | | (6,953) | |

| Net client cash flows | | (865) | | (521) | | 8 | | (144) | | 275 | | 4 | | 5 | | (153) | | 18 | | (249) | | 879 | | (743) | |

Artisan Funds' distributions not reinvested1 | | — | | — | | — | | (128) | | — | | — | | (94) | | — | | — | | — | | — | | (222) | |

| Investment returns and other | | 1,610 | | 791 | | 537 | | 3,475 | | 1,660 | | 145 | | 546 | | 381 | | 149 | | 518 | | 106 | | 9,918 | |

| | | | | | | | | | | | | |

| Ending assets under management | | $ | 39,662 | | $ | 13,765 | | $ | 7,811 | | $ | 46,948 | | $ | 29,728 | | $ | 2,006 | | $ | 11,622 | | $ | 4,225 | | $ | 2,403 | | $ | 7,311 | | $ | 2,359 | | $ | 167,840 | |

| Average assets under management | | $ | 38,736 | | $ | 13,703 | | $ | 7,538 | | $ | 45,371 | | $ | 28,598 | | $ | 1,900 | | $ | 11,361 | | $ | 3,925 | | $ | 2,273 | | $ | 7,177 | | $ | 2,201 | | $ | 162,783 | |

| | | | | | | | | | | | | |

| June 30, 2024 | | |

| Beginning assets under management | | $ | 41,311 | | $ | 14,259 | | $ | 7,519 | | $ | 43,262 | | $ | 27,645 | | $ | 1,042 | | $ | 10,640 | | $ | 3,837 | | $ | 2,245 | | $ | 7,390 | | $ | 1,234 | | $ | 160,384 | |

| Gross client cash inflows | | 706 | | 216 | | 129 | | 1,446 | | 588 | | 846 | | 1,047 | | 157 | | 127 | | 194 | | 148 | | 5,604 | |

| Gross client cash outflows | | (2,470) | | (808) | | (137) | | (1,661) | | (852) | | (43) | | (560) | | (180) | | (225) | | (274) | | (4) | | (7,214) | |

| Net client cash flows | | (1,764) | | (592) | | (8) | | (215) | | (264) | | 803 | | 487 | | (23) | | (98) | | (80) | | 144 | | (1,610) | |

Artisan Funds' distributions not reinvested1 | | — | | — | | — | | — | | — | | — | | (91) | | — | | — | | — | | — | | (91) | |

| Investment returns and other | | (630) | | (172) | | (245) | | 698 | | 412 | | 12 | | 129 | | 183 | | 89 | | (268) | | (4) | | 204 | |

| | | | | | | | | | | | | |

| Ending assets under management | | $ | 38,917 | | $ | 13,495 | | $ | 7,266 | | $ | 43,745 | | $ | 27,793 | | $ | 1,857 | | $ | 11,165 | | $ | 3,997 | | $ | 2,236 | | $ | 7,042 | | $ | 1,374 | | $ | 158,887 | |

| Average assets under management | | $ | 39,539 | | $ | 13,727 | | $ | 7,273 | | $ | 43,749 | | $ | 27,794 | | $ | 1,088 | | $ | 10,850 | | $ | 3,890 | | $ | 2,245 | | $ | 7,095 | | $ | 1,329 | | $ | 158,579 | |

| | | | | | | | | | | | | |

| September 30, 2023 | | |

| Beginning assets under management | | $ | 38,586 | | $ | 13,917 | | $ | 6,648 | | $ | 36,786 | | $ | 23,974 | | $ | 873 | | $ | 8,198 | | $ | 3,572 | | $ | 3,129 | | $ | 7,192 | | $ | 114 | | $ | 142,989 | |

| Gross client cash inflows | | 1,181 | | 141 | | 84 | | 1,957 | | 376 | | 17 | | 799 | | 131 | | 43 | | 170 | | 702 | | 5,601 | |

| Gross client cash outflows | | (2,755) | | (486) | | (212) | | (1,123) | | (952) | | (58) | | (422) | | (228) | | (527) | | (176) | | (1) | | (6,940) | |

| Net client cash flows | | (1,574) | | (345) | | (128) | | 834 | | (576) | | (41) | | 377 | | (97) | | (484) | | (6) | | 701 | | (1,339) | |

Artisan Funds' distributions not reinvested1 | | — | | — | | — | | — | | — | | — | | (75) | | — | | — | | — | | — | | (75) | |

| Investment returns and other | | (1,731) | | (575) | | (145) | | (1,018) | | (692) | | (36) | | 138 | | (252) | | (190) | | (557) | | (22) | | (5,080) | |

| | | | | | | | | | | | | |

| Ending assets under management | | $ | 35,281 | | $ | 12,997 | | $ | 6,375 | | $ | 36,602 | | $ | 22,706 | | $ | 796 | | $ | 8,638 | | $ | 3,223 | | $ | 2,455 | | $ | 6,629 | | $ | 793 | | $ | 136,495 | |

| Average assets under management | | $ | 37,406 | | $ | 13,712 | | $ | 6,655 | | $ | 37,286 | | $ | 23,780 | | $ | 874 | | $ | 8,474 | | $ | 3,488 | | $ | 2,917 | | $ | 7,050 | | $ | 557 | | $ | 142,199 | |

______________________________________

1 Artisan Funds' distributions not reinvested represents the amount of income and capital gain distributions that were not reinvested in the Artisan Funds.

2 Effective March 31, 2024, the International Small-Mid team, managing the Non-U.S. Small-Mid Growth strategy, became its own autonomous investment franchise. For comparability purposes, historical assets under management for both the Global Equity team and the International Small-Mid team are presented as though they were distinct teams prior to March 31, 2024.

12

Exhibit 5

Artisan Partners Asset Management Inc.

Assets Under Management by Investment Team and Vehicle

(unaudited; in millions)

| | | | | | | | | | | | | | |

| Three Months Ended | | By Vehicle |

| | Artisan Funds & Artisan Global Funds | Separate Accounts and Other 1 | Total |

| September 30, 2024 | |

| Beginning assets under management | | $ | 76,985 | | $ | 81,902 | | $ | 158,887 | |

| Gross client cash inflows | | 3,635 | | 2,575 | | 6,210 | |

| Gross client cash outflows | | (4,477) | | (2,476) | | (6,953) | |

| Net client cash flows | | (842) | | 99 | | (743) | |

Artisan Funds' distributions not reinvested2 | | (222) | | — | | (222) | |

| Investment returns and other | | 5,179 | | 4,739 | | 9,918 | |

Net transfers3 | | (46) | | 46 | | — | |

| Ending assets under management | | $ | 81,054 | | $ | 86,786 | | $ | 167,840 | |

| Average assets under management | | $ | 78,511 | | $ | 84,272 | | $ | 162,783 | |

| | | | |

| June 30, 2024 | |

| Beginning assets under management | | $ | 77,414 | | $ | 82,970 | | $ | 160,384 | |

| Gross client cash inflows | | 3,377 | | 2,227 | | 5,604 | |

| Gross client cash outflows | | (4,007) | | (3,207) | | (7,214) | |

| Net client cash flows | | (630) | | (980) | | (1,610) | |

Artisan Funds' distributions not reinvested2 | | (91) | | — | | (91) | |

| Investment returns and other | | 292 | | (88) | | 204 | |

Net transfers3 | | — | | — | | — | |

| Ending assets under management | | $ | 76,985 | | $ | 81,902 | | $ | 158,887 | |

| Average assets under management | | $ | 77,008 | | $ | 81,571 | | $ | 158,579 | |

| | | | |

| September 30, 2023 | |

| Beginning assets under management | | $ | 69,144 | | $ | 73,845 | | $ | 142,989 | |

| Gross client cash inflows | | 3,313 | | 2,288 | | 5,601 | |

| Gross client cash outflows | | (3,440) | | (3,500) | | (6,940) | |

| Net client cash flows | | (127) | | (1,212) | | (1,339) | |

Artisan Funds' distributions not reinvested2 | | (75) | | — | | (75) | |

| Investment returns and other | | (2,297) | | (2,783) | | (5,080) | |

Net transfers3 | | (15) | | 15 | | — | |

| Ending assets under management | | $ | 66,630 | | $ | 69,865 | | $ | 136,495 | |

| Average assets under management | | $ | 69,042 | | $ | 73,157 | | $ | 142,199 | |

______________________________________

1 Separate accounts and other consists of AUM we manage in or through vehicles other than Artisan Funds and Artisan Global Funds. This AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts and in our own private funds.

2 Artisan Funds' distributions not reinvested represents the amount of income and capital gain distributions that were not reinvested in the Artisan Funds.

3 Net transfers represent certain amounts that we have identified as having been transferred out of one investment strategy, investment vehicle, or account and into another strategy, vehicle, or account.

13

Exhibit 6

Artisan Partners Asset Management Inc.

Assets Under Management by Investment Team and Vehicle

(unaudited; in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | By Investment Team2 |

| | Growth | Global Equity | U.S. Value | International Value | Global Value | Sustainable Emerging Markets | Credit | Developing World | Antero Peak Group | International Small-Mid | EMsights Capital Group | Total |

| September 30, 2024 | | |

| Beginning assets under management | | $ | 38,546 | | $ | 13,725 | | $ | 7,057 | | $ | 41,009 | | $ | 25,670 | | $ | 917 | | $ | 9,683 | | $ | 3,453 | | $ | 2,101 | | $ | 7,151 | | $ | 855 | | $ | 150,167 | |

| Gross client cash inflows | | 2,794 | | 427 | | 398 | | 4,640 | | 2,355 | | 1,010 | | 3,519 | | 451 | | 343 | | 665 | | 1,399 | | 18,001 | |

| Gross client cash outflows | | (6,641) | | (2,314) | | (466) | | (4,634) | | (2,274) | | (124) | | (2,143) | | (629) | | (598) | | (1,034) | | (19) | | (20,876) | |

| Net client cash flows | | (3,847) | | (1,887) | | (68) | | 6 | | 81 | | 886 | | 1,376 | | (178) | | (255) | | (369) | | 1,380 | | (2,875) | |

Artisan Funds' distributions not reinvested1 | | — | | — | | — | | (128) | | — | | — | | (270) | | — | | — | | — | | — | | (398) | |

| Investment returns and other | | 4,963 | | 1,927 | | 822 | | 6,061 | | 3,977 | | 203 | | 833 | | 950 | | 557 | | 529 | | 124 | | 20,946 | |

| | | | | | | | | | | | | |

| Ending assets under management | | $ | 39,662 | | $ | 13,765 | | $ | 7,811 | | $ | 46,948 | | $ | 29,728 | | $ | 2,006 | | $ | 11,622 | | $ | 4,225 | | $ | 2,403 | | $ | 7,311 | | $ | 2,359 | | $ | 167,840 | |

| Average assets under management | | $ | 39,326 | | $ | 13,772 | | $ | 7,329 | | $ | 43,662 | | $ | 27,617 | | $ | 1,318 | | $ | 10,784 | | $ | 3,814 | | $ | 2,248 | | $ | 7,145 | | $ | 1,499 | | $ | 158,514 | |

| | | | | | | | | | | | | |

| September 30, 2023 | | |

| Beginning assets under management | | $ | 33,977 | | $ | 13,871 | | $ | 6,088 | | $ | 30,210 | | $ | 21,767 | | $ | 873 | | $ | 7,140 | | $ | 3,466 | | $ | 3,676 | | $ | 6,752 | | $ | 72 | | $ | 127,892 | |

| Gross client cash inflows | | 2,905 | | 667 | | 195 | | 6,149 | | 1,304 | | 63 | | 2,542 | | 488 | | 311 | | 529 | | 736 | | $ | 15,889 | |

| Gross client cash outflows | | (5,093) | | (2,205) | | (556) | | (3,222) | | (3,130) | | (217) | | (1,506) | | (1,277) | | (1,695) | | (665) | | (1) | | (19,567) | |

| Net client cash flows | | (2,188) | | (1,538) | | (361) | | 2,927 | | (1,826) | | (154) | | 1,036 | | (789) | | (1,384) | | (136) | | 735 | | $ | (3,678) | |

Artisan Funds' distributions not reinvested1 | | — | | — | | — | | — | | — | | — | | (190) | | — | | — | | — | | — | | $ | (190) | |

| Investment returns and other | | 3,492 | | 664 | | 648 | | 3,465 | | 2,765 | | 77 | | 652 | | 546 | | 163 | | 13 | | (14) | | $ | 12,471 | |

| | | | | | | | | | | | | |

| Ending assets under management | | $ | 35,281 | | $ | 12,997 | | $ | 6,375 | | $ | 36,602 | | $ | 22,706 | | $ | 796 | | $ | 8,638 | | $ | 3,223 | | $ | 2,455 | | $ | 6,629 | | $ | 793 | | $ | 136,495 | |

| Average assets under management | | $ | 36,812 | | $ | 14,087 | | $ | 6,489 | | $ | 35,210 | | $ | 23,203 | | $ | 882 | | $ | 8,118 | | $ | 3,593 | | $ | 3,260 | | $ | 7,080 | | $ | 248 | | $ | 138,982 | |

______________________________________

1 Artisan Funds' distributions not reinvested represents the amount of income and capital gain distributions that were not reinvested in the Artisan Funds.

2 Effective March 31, 2024, the International Small-Mid team, managing the Non-U.S. Small-Mid Growth strategy, became its own autonomous investment franchise. For comparability purposes, historical assets under management for both the Global Equity team and the International Small-Mid team are presented as though they were distinct teams prior to March 31, 2024.

14

Exhibit 6

Artisan Partners Asset Management Inc.

Assets Under Management by Investment Team and Vehicle

(unaudited; in millions)

| | | | | | | | | | | | | | |

| Nine Months Ended | By Vehicle |

| | Artisan Funds & Artisan Global Funds | Separate Accounts and other 1 | Total |

| September 30, 2024 | | |

| Beginning assets under management | | $ | 72,763 | | $ | 77,404 | | $ | 150,167 | |

| Gross client cash inflows | | 11,643 | | 6,358 | | 18,001 | |

| Gross client cash outflows | | (12,866) | | (8,010) | | (20,876) | |

| Net client cash flows | | (1,223) | | (1,652) | | (2,875) | |

Artisan Funds' distributions not reinvested2 | | (398) | | — | | (398) | |

| Investment returns and other | | 9,958 | | 10,988 | | 20,946 | |

Net transfers3 | | (46) | | 46 | | — | |

| Ending assets under management | | $ | 81,054 | | $ | 86,786 | | $ | 167,840 | |

| Average assets under management | | $ | 76,706 | | $ | 81,808 | | $ | 158,514 | |

| | | | |

| September 30, 2023 | | |

| Beginning assets under management | | $ | 60,811 | | $ | 67,081 | | $ | 127,892 | |

| Gross client cash inflows | | 11,294 | | 4,595 | | 15,889 | |

| Gross client cash outflows | | (11,074) | | (8,493) | | (19,567) | |

| Net client cash flows | | 220 | | (3,898) | | (3,678) | |

Artisan Funds' distributions not reinvested2 | | (190) | | — | | (190) | |

| Investment returns and other | | 5,804 | | 6,667 | | 12,471 | |

Net transfers3 | | (15) | | 15 | | — | |

| Ending assets under management | | $ | 66,630 | | $ | 69,865 | | $ | 136,495 | |

| Average assets under management | | $ | 67,110 | | $ | 71,872 | | $ | 138,982 | |

______________________________________

1 Separate accounts and other consists of AUM we manage in or through vehicles other than Artisan Funds and Artisan Global Funds. This AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts and in our own private funds.

2 Artisan Funds' distributions not reinvested represents the amount of income and capital gain distributions that were not reinvested in the Artisan Funds.

3 Net transfers represent certain amounts that we have identified as having been transferred out of one investment strategy, investment vehicle, or account and into another strategy, vehicle, or account.

15

Artisan Partners Asset Management Inc.

Investment Strategy AUM and Gross Composite Performance 1

As of September 30, 2024

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Composite Inception Date | | | | | | | | | | Average Annual Value-Added 2 Since Inception (bps) |

| | Strategy AUM (in $MM)3 | | Average Annual Total Returns (%) | |

| Investment Team and Strategy | | | 1 YR | 3 YR | 5 YR | 10 YR | Inception | |

| Growth Team | | | | | | | | | | | |

| Global Opportunities Strategy | 2/1/2007 | | $ | 22,005 | | | 33.31% | 2.69% | 13.02% | 12.42% | 11.30% | | 439 |

| MSCI All Country World Index | | | | | 31.76% | 8.08% | 12.18% | 9.38% | 6.91% | | |

| Global Discovery Strategy | 9/1/2017 | | $ | 1,688 | | | 26.24% | 0.10% | 12.71% | --- | 13.59% | | 604 |

| MSCI All Country World Small Mid Index | | | | | 25.55% | 3.08% | 9.19% | --- | 7.55% | | |

| U.S. Mid-Cap Growth Strategy | 4/1/1997 | | $ | 12,792 | | | 17.31% | (4.94)% | 10.57% | 10.84% | 14.19% | | 443 |

Russell Midcap® Index | | | | | 29.33% | 5.75% | 11.28% | 10.18% | 10.38% | | |

Russell Midcap® Growth Index | | | | | 29.33% | 2.31% | 11.47% | 11.29% | 9.76% | | |

| U.S. Small-Cap Growth Strategy | 4/1/1995 | | $ | 3,177 | | | 26.30% | (5.22)% | 8.64% | 11.95% | 10.64% | | 285 |

Russell 2000® Index | | | | | 26.76% | 1.84% | 9.38% | 8.78% | 9.00% | | |

Russell 2000® Growth Index | | | | | 27.66% | (0.35)% | 8.81% | 8.94% | 7.79% | | |

| Global Equity Team | | | | | | | | | | | |

| Global Equity Strategy | 4/1/2010 | | $ | 360 | | | 33.07% | 3.04% | 10.28% | 10.78% | 11.94% | | 256 |

| MSCI All Country World Index | | | | | 31.76% | 8.08% | 12.18% | 9.38% | 9.38% | | |

| Non-U.S. Growth Strategy | 1/1/1996 | | $ | 13,217 | | | 26.72% | 3.81% | 7.01% | 6.17% | 9.58% | | 435 |

| MSCI EAFE Index | | | | | 24.77% | 5.48% | 8.19% | 5.70% | 5.23% | | |

| China Post-Venture Strategy | 4/1/2021 | | $ | 188 | | | 24.23% | (6.86)% | --- | --- | (6.90)% | | 492 |

| MSCI China SMID Cap Index | | | | | 13.70% | (11.17)% | --- | --- | (11.82)% | | |

| U.S. Value Team | | | | | | | | | | | |

| Value Equity Strategy | 7/1/2005 | | $ | 4,931 | | | 25.22% | 11.25% | 14.56% | 11.10% | 9.78% | | 156 |

Russell 1000® Index | | | | | 35.68% | 10.82% | 15.62% | 13.09% | 10.64% | | |

Russell 1000® Value Index | | | | | 27.76% | 9.02% | 10.68% | 9.22% | 8.22% | | |

| U.S. Mid-Cap Value Strategy | 4/1/1999 | | $ | 2,863 | | | 21.84% | 7.05% | 10.65% | 8.38% | 12.10% | | 241 |

Russell Midcap® Index | | | | | 29.33% | 5.75% | 11.28% | 10.18% | 9.71% | | |

Russell Midcap® Value Index | | | | | 29.01% | 7.38% | 10.32% | 8.93% | 9.69% | | |

| Value Income Strategy | 3/1/2022 | | $ | 17 | | | 27.43% | --- | --- | --- | 6.98% | | (603) |

| S&P 500 Index | | | | | 36.35% | --- | --- | --- | 13.01% | | |

| International Value Team | | | | | | | | | | | |

| International Value Strategy | 7/1/2002 | | $ | 46,605 | | | 27.80% | 12.03% | 13.84% | 9.58% | 12.01% | | 562 |

| MSCI EAFE Index | | | | | 24.77% | 5.48% | 8.19% | 5.70% | 6.39% | | |

| International Explorer Strategy | 11/1/2020 | | $ | 343 | | | 24.35% | 5.54% | --- | --- | 15.47% | | 601 |

| MSCI All Country World Index Ex USA Small Cap (Net) | | | | | 23.25% | 1.39% | --- | --- | 9.46% | | |

| Global Value Team | | | | | | | | | | | |

| Global Value Strategy | 7/1/2007 | | $ | 29,390 | | | 30.55% | 10.48% | 12.07% | 9.63% | 9.30% | | 274 |

| MSCI All Country World Index | | | | | 31.76% | 8.08% | 12.18% | 9.38% | 6.56% | | |

| Select Equity Strategy | 3/1/2020 | | $ | 338 | | | 33.99% | 9.58% | --- | --- | 13.96% | | (355) |

| S&P 500 Index | | | | | 36.35% | 11.90% | --- | --- | 17.51% | | |

| Sustainable Emerging Markets Team | | | | | | | | | | | |

| Sustainable Emerging Markets Strategy | 7/1/2006 | | $ | 2,006 | | | 25.90% | 0.36% | 6.41% | 6.23% | 5.73% | | 75 |

| MSCI Emerging Markets Index | | | | | 26.05% | 0.40% | 5.74% | 4.02% | 4.98% | | |

| Credit Team | | | | | | | | | | | |

| High Income Strategy | 4/1/2014 | | $ | 11,295 | | | 15.87% | 5.04% | 7.14% | 7.34% | 7.21% | | 244 |

| ICE BofA US High Yield Index | | | | | 15.66% | 3.08% | 4.54% | 4.95% | 4.77% | | |

| Credit Opportunities Strategy | 7/1/2017 | | $ | 254 | | | 21.20% | 12.21% | 16.86% | --- | 13.82% | | 1,148 |

| ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index | | | | | 5.64% | 3.50% | 2.45% | --- | 2.34% | | |

| Floating Rate Strategy | 1/1/2022 | | $ | 73 | | | 9.34% | --- | --- | --- | 7.28% | | 67 |

| Credit Suisse Leveraged Loan Total Return Index | | | | | 9.65% | --- | --- | --- | 6.61% | | |

| Developing World Team | | | | | | | | | | | |

| Developing World Strategy | 7/1/2015 | | $ | 4,225 | | | 44.55% | (2.18)% | 13.81% | --- | 11.82% | | 728 |

| MSCI Emerging Markets Index | | | | | 26.05% | 0.40% | 5.74% | --- | 4.54% | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Antero Peak Group | | | | | | | | | | | |

| Antero Peak Strategy | 5/1/2017 | | $ | 2,175 | | | 44.33% | 8.58% | 14.92% | --- | 18.89% | | 429 |

| S&P 500 Index | | | | | 36.35% | 11.90% | 15.96% | --- | 14.60% | | |

| Antero Peak Hedge Strategy | 11/1/2017 | | $ | 228 | | | 38.42% | 6.72% | 11.67% | --- | 13.22% | | (107) |

| S&P 500 Index | | | | | 36.35% | 11.90% | 15.96% | --- | 14.29% | | |

| International Small-Mid Team | | | | | | | | | | | |

| Non-U.S. Small-Mid Growth Strategy | 1/1/2019 | | $ | 7,311 | | | 20.80% | (2.29)% | 8.66% | --- | 11.25% | | 303 |

| MSCI All Country World Index Ex USA Small Mid Cap | | | | | 23.01% | 1.63% | 7.25% | --- | 8.22% | | |

| EMsights Capital Group | | | | | | | | | | | |

| Global Unconstrained Strategy | 4/1/2022 | | $ | 655 | | | 10.31% | --- | --- | --- | 10.38% | | 619 |

| ICE BofA 3-Month Treasury Bill Index | | | | | 5.46% | --- | --- | --- | 4.19% | | |

| Emerging Markets Debt Opportunities Strategy | 5/1/2022 | | $ | 1,024 | | | 16.07% | --- | --- | --- | 13.64% | | 663 |

| J.P. Morgan EMB Hard Currency/Local Currency 50-50 Index | | | | | 14.99% | --- | --- | --- | 7.01% | | |

| Emerging Markets Local Opportunities Strategy | 8/1/2022 | | $ | 680 | | | 15.74% | --- | --- | --- | 12.42% | | 287 |

| J.P. Morgan GBI-EM Global Diversified Index | | | | | 13.42% | --- | --- | --- | 9.55% | | |

| | | | | | | | | | | |

| Total Assets Under Management | | | $ | 167,840 | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

______________________________________

1 We measure the results of our “composites”, which represent the aggregate performance of all discretionary client accounts, including pooled investment vehicles, invested in the same strategy except those accounts with respect to which we believe client-imposed restrictions may have a material impact on portfolio construction and those accounts managed in a currency other than U.S. dollars (the results of these accounts, which represented approximately 16% of our assets under management at September 30, 2024, are maintained in separate composites, which are not presented in these materials). Returns for periods less than one year are not annualized.

2 Value-added is the amount, in basis points, by which the average annual gross composite return of each of our strategies has outperformed or underperformed its

respective benchmark. See Forward-Looking Statements and Other Disclosures for further information on the benchmark indexes used. Value-added for periods less than

one year is not annualized.

3 AUM for Artisan Sustainable Emerging Markets and U.S. Mid-Cap Growth strategies includes $97.7 million in aggregate for which Artisan Partners provides investment models to managed account sponsors (reported on a lag not exceeding one quarter).

v3.24.3

Cover

|

Oct. 29, 2024 |

Jul. 23, 2024 |

| Document Information [Line Items] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Oct. 29, 2024

|

|

| Entity Registrant Name |

Artisan Partners Asset Management Inc.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-35826

|

|

| Entity Tax Identification Number |

45-0969585

|

|

| Entity Address, Address Line One |

875 E. Wisconsin Avenue, Suite 800

|

|

| Entity Address, City or Town |

Milwaukee

|

|

| Entity Address, State or Province |

WI

|

|

| Entity Address, Postal Zip Code |

53202

|

|

| City Area Code |

414

|

|

| Local Phone Number |

390-6100

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

|

Class A common stock, par value $0.01 per share

|

| Trading Symbol |

|

APAM

|

| Security Exchange Name |

|

NYSE

|

| Entity Emerging Growth Company |

false

|

|

| Amendment Flag |

false

|

|

| Entity Central Index Key |

0001517302

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |