false

--12-31

0000814586

0000814586

2024-11-04

2024-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2024

LIFEWAY FOODS, INC.

(Exact Name of Registrant as Specified in Charter)

| Illinois |

000-17363 |

36-3442829 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

6431 Oakton Street

Morton Grove, Illinois |

60053 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (847) 967-1010

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

LWAY |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

The information set forth in Item 3.03 of this Current Report is incorporated into this Item 1.01 by reference.

Item 3.03. Material Modification to Rights of Security Holders.

On November 4, 2024, the board of directors (the “Board”) of Lifeway Foods, Inc., an Illinois corporation (the “Company”), adopted a shareholder rights agreement and declared a dividend of one right (a “Right”) for each outstanding share of Company common stock, no par value (“Common Stock”), to shareholders of record at the close of business on November 18, 2024 (the “Record Date”). Each Right entitles its holder, subject to the terms of the Rights Agreement (as defined below), to purchase from the Company one one-thousandth of a share of Series A Junior Participating Preferred Stock, no par value (“Preferred Stock”), of the Company at an exercise price of $130.00 per Right, subject to adjustment. The description and terms of the Rights are set forth in a shareholder rights agreement, dated as of November 4, 2024 (the “Rights Agreement”), between the Company and Computershare Trust Company, N.A., as rights agent (and any successor rights agent, the “Rights Agent”).

The Board adopted the Rights Agreement in response to the unsolicited proposal made on September 23, 2024 by Danone North America PBC (“Danone”) to acquire all of the shares of Common Stock that Danone does not already own for $25.00 per share of Common Stock and Danone’s substantial ownership position in the Company. The Board adopted the Rights Agreement to reduce the likelihood that Danone gains control of the Company through open market purchases or otherwise without paying all shareholders an appropriate control premium or without providing the Board sufficient time to make informed judgments and take actions that are in the best interests of all of the Company’s shareholders and other stakeholders.

The Rights Agreement should not interfere with any merger or other business combination approved by the Board.

The Rights. The Rights will attach to any shares of Common Stock that become outstanding after the Record Date and prior to the earlier of the Distribution Time (as defined below) and the Expiration Time (as defined below), and in certain other circumstances described in the Rights Agreement.

Until the Distribution Time, the Rights are associated with Common Stock and evidenced by Common Stock certificates or, in the case of uncertificated shares of Common Stock, the book-entry account that evidences record ownership of such shares, which will contain a notation incorporating the Rights Agreement by reference, and the Rights are transferable with and only with the underlying shares of Common Stock.

Until the Distribution Time, the surrender for transfer of any shares of Common Stock will also constitute the transfer of the Rights associated with those shares. As soon as practicable after the Distribution Time, separate rights certificates will be mailed to holders of record of Common Stock as of the Distribution Time. From and after the Distribution Time, the separate rights certificates alone will represent the Rights.

The Rights are not exercisable until the Distribution Time. Until a Right is exercised, its holder will have no rights as a shareholder of the Company, including the right to vote or to receive dividends.

Separation and Distribution of Rights; Exercisability. Subject to certain exceptions, the Rights become exercisable and trade separately from Common Stock only upon the “Distribution Time,” which occurs upon the earlier of:

|

● |

the close of business on the tenth (10th) day after the “Stock Acquisition Date” (which is defined as (a) the first date of public announcement that any person or group has become an “Acquiring Person,” which is defined as a person or group that, together with its affiliates and associates, beneficially owns 20.0% or more of the outstanding shares of Common Stock (with certain exceptions, including those described below) or (b) such other date, as determined by the Board, on which a person or group has become an Acquiring Person) or |

|

● |

the close of business on the tenth (10th) business day (or such later date as may be determined by the Board prior to such time as any person or group becomes an Acquiring Person) after the commencement of a tender offer or exchange offer that, if consummated, would result in a person or group becoming an Acquiring Person. |

An Acquiring Person does not include:

|

● |

the Company or any subsidiary of the Company; |

|

● |

any officer, director or employee of the Company or any subsidiary of the Company in his or her capacity as such; |

|

● |

any employee benefit plan of the Company or of any subsidiary of the Company or any entity or trustee holding (or acting in a fiduciary capacity in respect of) shares of capital stock of the Company for or pursuant to the terms of any such plan or for the purpose of funding other employee benefits for employees of the Company or any subsidiary of the Company; or |

|

● |

any person or group that, together with its affiliates and associates, as of immediately prior to the first public announcement of the adoption of the Rights Agreement, beneficially owns 20.0% or more of the outstanding shares of Common Stock, so long as such person or group continues to beneficially own at least 20.0% of the outstanding shares of Common Stock and does not acquire shares of Common Stock to beneficially own an amount equal to or greater than the greater of 20.0% and the sum of the lowest beneficial ownership of such person or group since the public announcement of the adoption of the Rights Agreement plus one share of Common Stock. |

In addition, the Rights Agreement provides that no person or group will become an Acquiring Person as a result of security purchases or issuances directly from the Company or through an underwritten offering approved by the Board. Also, a person or group will not be an Acquiring Person if the Board determines that such person or group has become an Acquiring Person inadvertently and such person or group has already divested or divests as promptly as practicable a sufficient number of shares of Common Stock so that such person or group would no longer be an Acquiring Person.

Certain synthetic interests in securities created by derivative positions, whether or not such interests are considered to be ownership of the underlying Common Stock or are reportable for purposes of Regulation 13D of the Securities Exchange Act of 1934, as amended, are treated as beneficial ownership of the number of shares of Common Stock equivalent to the economic exposure created by the derivative position, to the extent actual shares of Common Stock are directly or indirectly held by counterparties to the derivatives contracts.

Expiration Time. The Rights will expire on the earliest to occur of (a) the close of business on November 4, 2025 (the “Final Expiration Time”), (b) the time at which the Rights are redeemed or exchanged by the Company (as described below) or (c) upon the closing of any merger or other acquisition transaction involving the Company pursuant to a merger or other acquisition agreement that has been approved by the Board before any person or group becomes an Acquiring Person (the earliest of (a), (b) and (c) being herein referred to as the “Expiration Time”).

Flip-in Event. In the event that any person or group (other than certain exempt persons) becomes an Acquiring Person (a “Flip-in Event”), each holder of a Right (other than such Acquiring Person, any of its affiliates or associates or certain transferees of such Acquiring Person or of any such affiliate or associate, whose Rights automatically become null and void) will have the right to receive, upon exercise, Common Stock having a value equal to two times the exercise price of the Right.

For example, at an exercise price of $130.00 per Right, each Right not owned by an Acquiring Person (or by certain related parties) following a Flip-in Event would entitle its holder to purchase $260.00 worth of Common Stock for $130.00. Assuming that Common Stock had a per share value of $32.50 at that time, the holder of each valid Right would be entitled to purchase eight shares of Common Stock for $130.00.

To the extent that the Company cannot issue such shares of Common Stock as described above, each holder of a Right (other than such Acquiring Person, any of its affiliates or associates or certain transferees of such Acquiring Person or of any such affiliate or associate, whose Rights automatically become null and void) will have the right to receive, upon exercise, cash, a reduction in the exercise price, other equity securities of the Company, debt securities of the Company, other assets or any combination thereof having an aggregate value equivalent to the value of the shares of Common Stock that would have been issuable (as described above) less the exercise price of the Right.

Flip-over Event. In the event that, at any time following the Stock Acquisition Date, any of the following occurs (each, a “Flip-over Event”):

|

● |

the Company consolidates with, or merges with and into, any other entity, and the Company is not the continuing or surviving entity; |

|

● |

any entity engages in a share exchange with or consolidates with, or merges with or into, the Company, and the Company is the continuing or surviving entity and, in connection with such share exchange, consolidation or merger, all or part of the outstanding shares of Common Stock are changed into or exchanged for stock or other securities of any other entity or cash or any other property; or |

|

● |

the Company sells or otherwise transfers, in one transaction or a series of related transactions, fifty percent (50%) or more of the Company’s assets, cash flow or earning power, |

each holder of a Right (except Rights which previously have been voided as described above) will have the right to receive, upon exercise, common stock of the acquiring company having a value equal to two times the exercise price of the Right.

Preferred Stock Provisions. Each share of Preferred Stock, if issued: will not be redeemable, will entitle the holder thereof, when, as and if declared, to quarterly dividend payments equal to the greater of $1,000 per share and 1,000 times the amount of all cash dividends plus 1,000 times the amount of non-cash dividends or other distributions paid on one share of Common Stock, will entitle the holder thereof to receive $1,000 plus accrued and unpaid dividends per share upon liquidation, will have the same voting power as 1,000 shares of Common Stock and, if shares of Common Stock are exchanged via merger, consolidation or a similar transaction, will entitle the holder thereof to a per share payment equal to the payment made on 1,000 shares of Common Stock.

Anti-dilution Adjustments. The exercise price payable, and the number of shares of Preferred Stock or other securities or property issuable, upon exercise of the Rights are subject to adjustment from time to time to prevent dilution:

|

● |

in the event of a stock dividend on, or a subdivision, combination or reclassification of, the Preferred Stock; |

|

● |

if holders of the Preferred Stock are granted certain rights, options or warrants to subscribe for Preferred Stock or convertible securities at less than the current market price of the Preferred Stock; or |

|

● |

upon the distribution to holders of the Preferred Stock of evidences of indebtedness or assets (excluding regular quarterly cash dividends) or of subscription rights or warrants (other than those referred to above). |

With certain exceptions, no adjustment in the exercise price will be required until cumulative adjustments amount to at least one percent (1%) of the exercise price. No fractional shares of Preferred Stock will be issued and, in lieu thereof, an adjustment in cash will be made based on the market price of the Preferred Stock on the last trading day prior to the date of exercise.

Redemption; Exchange. At any time prior to the earlier of (i) such time as any person or group becomes an Acquiring Person or (ii) the Final Expiration Time, the Company may redeem the Rights in whole, but not in part, at a price of $0.001 per Right (subject to adjustment and payable in cash, Common Stock or other consideration deemed appropriate by the Board). Immediately upon the action of the Board authorizing any redemption or at a later time as the Board may establish for the effectiveness of the redemption, the Rights will terminate and the only right of the holders of Rights will be to receive the redemption price.

At any time after any person or group becomes an Acquiring Person but before any Acquiring Person, together with all of its affiliates and associates, becomes the beneficial owner of fifty percent (50%) or more of the outstanding shares of Common Stock, the Company may exchange the Rights (other than Rights owned by the Acquiring Person, any of its affiliates or associates or certain transferees of Acquiring Person or of any such affiliate or associate, whose Rights will have become null and void), in whole or in part, at an exchange ratio of one share of Common Stock, or one one-thousandth of a share of Preferred Stock (or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges), per Right (subject to adjustment).

Amendment of the Rights Agreement. The Company and the Rights Agent may from time to time amend or supplement the Rights Agreement without the consent of the holders of the Rights. However, at or after such time as any person or group becomes an Acquiring Person, no amendment can materially adversely affect the interests of the holders of the Rights (other than such Acquiring Person, any of its affiliates or associates or certain transferees of such Acquiring Person or of any such affiliate or associate).

Miscellaneous. While the distribution of the Rights will not be taxable to shareholders or to the Company, shareholders may, depending upon the circumstances, recognize taxable income in the event that the Rights become exercisable for Common Stock (or other consideration) or for common stock of the acquiring company or in the event of the redemption of the Rights as described above.

* * * * *

The foregoing description of the Rights Agreement and the Rights does not purport to be complete and is qualified in its entirety by reference to the Rights Agreement, which is filed as Exhibit 4.1 to this Current Report and is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in Item 3.03 of this Current Report is incorporated into this Item 5.03 by reference. In connection with the adoption of the Rights Agreement described in Item 3.03 of this Current Report, the Board designated the rights, preferences and privileges of 40,000 shares of a series of the Company’s preferred stock, no par value, designated as Series A Junior Participating Preferred Stock.

The Certificate of Designations with respect to the Series A Junior Participating Preferred Stock will become effective upon filing with the Illinois Secretary of State. The Company plans to make such filing as soon as practicable. A copy of the form of the Certificate of Designations to be filed with the Illinois Secretary of State has been filed as Exhibit 3.1 to this Current Report and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 5, 2024, the Company issued a press release announcing the adoption of the Rights Agreement. A copy of that press release is furnished as Exhibit 99.1 to this Current Report and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit No. |

|

Description |

| 3.1 |

|

Form of Certificate of Designations of Series A Junior Participating Preferred Stock of the Company (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form 8-A, filed with the Securities and Exchange Commission on November 5, 2024) |

| |

|

|

| 4.1 |

|

Shareholder Rights Agreement, dated as of November 4, 2024, by and between the Company and Computershare Trust Company, N.A., as rights agent (which includes the Form of Rights Certificate as Exhibit B thereto) (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form 8-A, filed with the Securities and Exchange Commission on November 5, 2024) |

| |

|

|

| 99.1 |

|

Press Release issued by the Company on November 5, 2024 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LIFEWAY FOODS, INC. |

| |

|

| Date: November 5, 2024 |

By: |

/s/ Julie Smolyansky |

| |

|

Name: |

Julie Smolyansky |

| |

|

Title: |

Chief Executive Officer and Secretary |

LIFEWAY FOODS, INC. 8-K

Exhibit 99.1

Lifeway

Foods Rejects Proposal from Danone and adopts limited duration shareholder rights plan

MORTON GROVE, Ill., November 5, 2024 — Lifeway Foods, Inc. (NASDAQ:

LWAY) (“Lifeway” or the “Company”), a leading U.S. supplier of kefir and fermented probiotic products to support

the microbiome, today announced that its Board of Directors (the “Board”) has rejected the unsolicited proposal made on September

23, 2024 by Danone North America PBC (“Danone”) to acquire all the shares of Lifeway that it does not already own for $25.00

per share.

After careful and thorough consideration, conducted in consultation

with its independent financial and legal advisors, the Board determined that Danone’s opportunistic proposal substantially undervalues

Lifeway and is not in the best interests of the Company and its shareholders or other stakeholders. In addition, in response to Danone’s

proposal and its substantial ownership position in the Company, the Board adopted a limited duration shareholder rights plan, effective

immediately (the “Rights Plan”).

The Rights Plan is intended to enable all shareholders to realize the

full value of their investment in Lifeway. The Rights Plan will reduce the likelihood that Danone gains control of Lifeway through open

market accumulation or otherwise without paying all shareholders an appropriate control premium or without providing the Board sufficient

time to make informed judgments and take actions that are in the best interests of all of the Company’s shareholders and other stakeholders.

The Rights Plan has similar provisions to those of other plans adopted

by publicly-held companies in comparable circumstances. Under the Rights Plan, Lifeway will distribute to its shareholders one preferred

share purchase right for each outstanding share of Lifeway common stock to shareholders of record at the close of business on November

18, 2024. Initially, these rights will not be exercisable and will trade with, and be represented by, the shares of Lifeway common stock.

Under the Rights Plan, the rights will become exercisable if an entity,

person or group acquires beneficial ownership of 20% or more of the outstanding shares of Lifeway common stock in a transaction not approved

by the Board or if an entity, person or group that currently beneficially owns 20% or more of the outstanding shares of Lifeway common

stock acquires any additional shares. If the rights become exercisable, each right will entitle its holder (other than the person, entity

or group triggering the Rights Plan, whose rights will become void and will not be exercisable) to purchase, at the then-current exercise

price, additional shares of common stock having a then-current market value of twice the exercise price of the right. Certain synthetic

interests in securities created by derivative positions are considered to be ownership of the underlying shares of common stock for purposes

of the Rights Plan.

The Rights Plan does not deter any offer to acquire the Company from

any party, nor does it preclude Lifeway’s Board from considering an offer that is fair and otherwise in the best interests of the

Company’s shareholders.

Unless earlier redeemed, terminated or exchanged pursuant to the Rights

Plan, the rights will expire on November 4, 2025.

Lifeway remains focused on its strategic plan to bring kefir to more

households while also expanding into adjacent categories. The Company plans to continue to build on its strong momentum, as evidenced

by recent financial results, and creating shareholder value. The Board and management are committed to acting in the best interests of

all shareholders and ensuring that they are able to realize the full potential value of their investment.

Further details about the Rights Plan will be contained in a Current

Report on Form 8-K to be filed by the Company with the Securities and Exchange Commission.

Evercore is serving as a financial advisor to Lifeway and Sidley Austin

LLP is serving as legal counsel to Lifeway.

About Lifeway Foods, Inc.

Lifeway Foods, Inc., which has been recognized as one of Forbes’ Best

Small Companies, is America’s leading supplier of the probiotic, fermented beverage known as kefir. In addition to its line of drinkable

kefir, the company also produces a variety of cheeses and a ProBugs line for kids. Lifeway’s tart and tangy fermented dairy products are

now sold across the United States, Mexico, Ireland, South Africa and France. Learn how Lifeway is good for more than just you at lifewayfoods.com.

Forward-Looking Statements

This release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief or

expectations for our business, operations, financial performance or condition. These statements use words such as “continue,”

“believe,” “expect,” “anticipate,” “plan,” “project,” “estimate,” “outlook,”

and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may”

and “could.” You are cautioned not to rely on these forward-looking statements. These forward-looking statements are made

as of the date of this press release, are based on current expectations of future events and thus are inherently subject to a number of

risks and uncertainties, many of which involve factors or circumstances beyond Lifeway’s control. If underlying assumptions prove

inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from Lifeway’s expectations and

projections. These risks, uncertainties and other factors include: price competition; the decisions of customers or consumers; the actions

of competitors; changes in the pricing of commodities; the effects of government regulation; possible delays in the introduction of new

products; customer acceptance of products and services; and other factors discussed in Part I, Item 1A “Risk Factors” of Lifeway’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Lifeway expressly disclaims any obligation to update any forward-looking

statements (including, without limitation, to reflect changed assumptions, the occurrence of anticipated or unanticipated events or new

information), except as required by law.

Contacts:

Perceptual Advisors

Dan Tarman

Email: dtarman@perceptualadvisors.com

OR

Longacre Square Partners

Joe Germani / Miller Winston

Email: LWAY@longacresquare.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

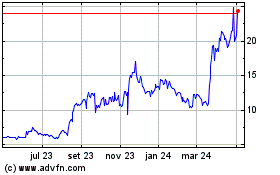

Lifeway Foods (NASDAQ:LWAY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

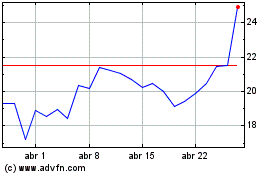

Lifeway Foods (NASDAQ:LWAY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024