As filed with the Securities and Exchange Commission

on November 18, 2024

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

TRILOGY METALS INC.

(Exact name of registrant as specified in its

charter)

British

Columbia

(State or other jurisdiction of incorporation or organization) |

|

98-1006991

(I.R.S. Employer Identification No.) |

Suite 901, 510 Burrard Street

Vancouver, British Columbia

Canada V6C 3A8

(Address of Principal Executive Offices) (Zip Code) |

Trilogy Metals Inc. Equity Incentive Plan

Trilogy Metals Inc. 2012 Restricted Share Unit

Plan

Trilogy Metals Inc. 2012 Deferred Share Unit

Plan |

| (Full

title of the plan) |

DL Services, Inc.

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104

(Name and address of agent for service)

(206) 903-8800

(Telephone number, including area code, of

agent for service)

With a copy to

Kimberley R. Anderson

Dorsey & Whitney LLP

701 Fifth Avenue, Suite 6100

Seattle, WA 98104

(206) 903-8800 |

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ¨ |

|

Accelerated

filer ¨ |

| |

|

|

| Non-accelerated

filer x |

|

Smaller

reporting company x |

| |

|

|

| |

|

Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for the complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Explanatory Note

This Registration Statement on Form S-8

is filed for the purpose of registering 5,450,427 common shares of Trilogy Metals Inc. (the “Company”), which may be issued

pursuant to awards under the Company’s Equity Incentive Plan, Restricted Share Unit Plan, and Deferred Share Unit Plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information specified in Item 1 and Item 2 of Part I of Form S-8 will be sent or given to participants

as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). In accordance

with the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and the instructions to Form S-8,

such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus

supplements pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation

of Documents by Reference. |

The following documents that have been filed by us with the SEC are

incorporated in this registration statement by reference:

| 2. | All

other reports filed by our company under Section 13(a) or 15(d) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) since November 30,

2023. |

Except to the extent that information is deemed

furnished and not filed pursuant to securities laws and regulations, all documents subsequently filed by the Company pursuant to Sections

13(a), 13(c), 14, and 15(d) of the Exchange Act prior to the filing of a post-effective amendment that indicates that all securities

offered have been sold or that deregisters all securities then remaining unsold shall also be deemed to be incorporated by reference

herein and to be a part hereof from the dates of filing of such documents. Any statement contained in a document incorporated or deemed

to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the

extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by

reference herein modifies or supersedes such statement. Any statements so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this Registration Statement.

| Item 4. | Description

of Securities. |

Not Applicable.

| Item 5. | Interests

of Named Experts and Counsel. |

None.

| Item 6. | Indemnification

of Directors and Officers. |

The Business Corporations Act (British Columbia)

(“BCBCA”) provides that a company may:

| |

· |

indemnify

an eligible party against all judgments, penalties or fines awarded or imposed in, or amounts paid in settlement of, an eligible

proceeding, to which the eligible party is or may be liable; and |

| |

· |

after

the final disposition of an eligible proceeding, pay the “expenses” (which includes costs, charges and expenses (including

legal fees) but excludes judgments, penalties, fines or amounts paid in settlement of a proceeding) actually and reasonably incurred

by an eligible party in respect of that proceeding. |

However, after the final disposition of an eligible

proceeding, a company must pay expenses actually and reasonably incurred by an eligible party in respect of that proceeding if the eligible

party (i) has not been reimbursed for those expenses, and (ii) is wholly successful, on the merits or otherwise, or is substantially

successful on the merits, in the outcome of the proceeding. The BCBCA also provides that a company may pay the expenses as they are incurred

in advance of the final disposition of an eligible proceeding if the company first receives from the eligible party a written undertaking

that, if it is ultimately determined that the payment of expenses is prohibited under the BCBCA, the eligible party will repay the amounts

advanced.

For the purpose of the BCBCA, an “eligible

party”, in relation to a company, means an individual who:

| (a) | is

or was a director or officer of the company, |

| (b) | is

or was a director or officer of another corporation |

| (i) | at

a time when the corporation is or was an affiliate of the company, or |

| (ii) | at

the request of the company, or |

| (c) | at

the request of the company, is or was, or holds or held a positive equivalent to that of,

a director or officer of a partnership, trust, joint venture or other unincorporated entity, |

and includes, with some exceptions, the heirs

and personal or other legal representatives of that individual.

An “eligible proceeding” under the

BCBCA is a proceeding in which an eligible party or any of the heirs and personal or other legal representatives of the eligible party,

by reason of the eligible party being or having been a director or officer of, or holding or having held a position equivalent to that

of a director or officer of, the company or an associated corporation (i) is or may be joined as a party, or (ii) is or may

be liable for or in respect of a judgment, penalty or fine in, or expenses related to, the proceeding. A “proceeding” includes

any legal proceeding or investigative action, whether current, threatened, pending or completed.

Notwithstanding the foregoing, the BCBCA prohibits

indemnifying an eligible party or paying the expenses of an eligible party if any of the following conditions apply:

| |

· |

if the

indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that such agreement was made,

the company was prohibited from giving the indemnity or paying the expenses by its memorandum or articles; |

| |

· |

if the

indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that the indemnity

or payment is made, the company is prohibited from giving the indemnity or paying the expenses by its memorandum or articles; |

| |

· |

if, in

relation to the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view

to the best interests of the company or the associated corporation, or as the case may be; or |

| |

· |

in the

case of an eligible proceeding other than a civil proceeding, if the eligible party did not have reasonable grounds for believing

that the eligible party’s conduct in respect of which the proceeding was brought was lawful. |

Additionally, if an eligible proceeding is brought

against an eligible party by or on behalf of the company or by or on behalf of an associated corporation, the company must not (i) indemnify

the eligible party in respect of the proceeding; or (ii) pay the expenses of the eligible party in respect of the proceeding.

Whether or not payment of expenses or indemnification

has been sought, authorized or declined under the BCBCA, on the application of a company or an eligible party, the Supreme Court of British

Columbia may do one or more of the following:

| |

· |

order

a company to indemnify an eligible party against any liability incurred by the eligible party in respect of an eligible proceeding; |

| |

· |

order

a company to pay some or all of the expenses incurred by an eligible party in respect of an eligible proceeding; |

| |

· |

order

the enforcement of, or any payment under, an agreement of indemnification entered into by a company; |

| |

· |

order

a company to pay some or all of the expenses actually and reasonably incurred by any person in obtaining an order under this section;

or |

| |

· |

make any

other order the court considers appropriate. |

The BCBCA provides that a company may purchase

and maintain insurance for the benefit of an eligible party or the heirs and personal or other legal representatives of the eligible

party against any liability that may be incurred by reason of the eligible party being or having been a director or officer of, or holding

or having held a position equivalent to that of a director or officer of, the company or an associated corporation.

Articles of the Registrant

The

Registrant’s articles provide that, subject to the BCBCA, the Registrant must indemnify a director or former director and his or

her heirs and legal personal representatives against all eligible penalties to which such person is or may be liable, and the

Registrant must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by such person

in respect of that proceeding. Pursuant to the Registrant’s articles, each director is deemed to have contracted with the Registrant

on the aforementioned terms.

The Registrant’s articles further provide

that the Registrant may indemnify any person, subject to any restrictions in the BCBCA, and that the failure of a director or officer

of the Registrant to comply with the BCBCA or the Registrant’s articles does not invalidate any indemnity to which he or she is

entitled under the Registrant’s articles.

The Registrant is authorized by its articles

to purchase and maintain insurance for the benefit of any eligible person.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions,

the Registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities

Act, and is therefore unenforceable.

The Registrant maintains directors’ and

officers’ liability insurance for its directors. This insurance provides coverage for indemnity payments made by the Registrant

to its directors and officers as required or permitted by law for losses, including legal costs, incurred by officers and directors in

their capacity as such. This policy also provides coverage directly to individual directors and officers if they are not indemnified

by the Registrant. The insurance coverage for directors and officers has customary exclusions, including libel and slander, and those

acts determined to be uninsurable under law, or deliberately fraudulent or dishonest or to have resulted in personal profit or advantage.

| Item 7. | Exemption

from Registration Claimed. |

Not Applicable.

* Filed herewith

| (a) | The Registrant hereby undertakes: |

| (1) | To file, during any

period in which offers or sales are being made, a post-effective amendment to this Registration

Statement: |

| (i) | To include any prospectus

required by section 10(a)(3) of the Securities Act; |

(ii) To

reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective

amendment hereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) (§ 230.424(b) of this

chapter) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price

set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable,

in the effective registration statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or

any material change to such information in this Registration Statement;

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13

or Section 15(d) of the Exchange Act that are incorporated by reference into this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The undersigned registrant

hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report

pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in this Registration

Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against

public policy as expressed in such Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

Signatures

The

Registrant. Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds

to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed

on its behalf by the undersigned, thereunto duly authorized, in the City of Vancouver, Province of British Columbia, Canada, on this

19 of November, 2024.

| |

TRILOGY METALS INC. |

| |

|

|

| |

By: |

/s/

Elaine Sanders |

| |

Name: |

Elaine Sanders |

| |

Title: |

Chief Financial Officer |

SIGNATURES

OF OFFICERS AND DIRECTORS

AND Power of Attorney

Each person whose signature

appears below constitutes and appoints each of Tony Giardini and Elaine Sanders as the undersigned’s true and lawful attorney-in-fact

and agents, with the full power of substitution and resubstitution, for them in any and all capacities, to sign any and all amendments

(including post-effective amendments, exhibits thereto, and other documents in connection therewith) to this registration statement and

any related registration statements necessary to register additional securities and to file the same with exhibits thereto and other

documents in connection therewith with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power

and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes

as such person might or could do in person, hereby ratifying and confirming all that each of said attorney-in-fact and agent, or their

substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and

on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Tony Giardini |

|

Director, President and Chief Executive Officer of the Company |

|

November 19, 2024 |

| Tony Giardini |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Elaine Sanders |

|

Vice President, Chief Financial Officer and Corporate Secretary of the Company |

|

November 19, 2024 |

| Elaine Sanders |

|

(Principal Financial Officer and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ James Gowans |

|

Director |

|

November 19, 2024 |

| James Gowans |

|

|

|

|

| |

|

|

|

|

| /s/ William Hayden |

|

Director |

|

November 19, 2024 |

| William Hayden |

|

|

|

|

| |

|

|

|

|

| /s/ William Hensley |

|

Director |

|

November 19, 2024 |

| William Hensley |

|

|

|

|

| |

|

|

|

|

| /s/ Gregory Lang |

|

Director |

|

November 19, 2024 |

| Gregory Lang |

|

|

|

|

| |

|

|

|

|

| /s/ Janice Stairs |

|

Director |

|

November 19, 2024 |

| Janice Stairs |

|

|

|

|

| |

|

|

|

|

| /s/ Diana Walters |

|

Director |

|

November 19, 2024 |

| Diana Walters |

|

|

|

|

Signature

of AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of Trilogy Metals

Inc. has signed this Registration Statement on November 19, 2024.

| |

TRILOGY METALS

INC. |

| |

|

|

| |

By: |

/s/

Gregory Lang |

| |

Name: |

Gregory Lang |

| |

Title: |

Director |

Exhibit 5.1

| |

Blake,

Cassels & Graydon LLP

Barristers & Solicitors

Patent & Trade-mark Agents

1133 Melville Street

Suite 3500, The Stack

Vancouver, BC V6E 4E5 Canada

Tel: 604-631-3300 Fax: 604-631-3309 |

| |

|

|

| November 19, 2024 | | Reference: 99166/1 |

| | | |

| Trilogy Metals Inc. | | |

| 609 Granville Street, Suite 1150 | | |

| Vancouver BC V7Y 1G5 | | |

| RE: |

Trilogy Metals Inc. – Registration Statement on Form S-8 |

Dear Sirs/Mesdames:

We have acted as Canadian counsel to Trilogy Metals

Inc., a company formed under the laws of the Province of British Columbia (the “Company”), in connection with the preparation

and filing with the United States Securities and Exchange Commission of a Registration Statement (the “Registration Statement”)

on Form S-8 under the United States Securities Act of 1933, as amended (the “Act”).

The purpose of the Registration Statement is to

register the offer and sale of up to 5,450,427 common shares of the Company (the “Shares”) issuable pursuant to the

following:

| (1) | the exercise of Options (“Options”) to be granted pursuant to the pursuant to the Trilogy

Metals Inc. Equity Incentive Plan (the “Trilogy Incentive Plan”); |

| (2) | the redemption of share units (the “RSUs”) issued under the Trilogy Metals Inc. 2012

Restricted Share Unit Plan (the “RSU Plan”); and |

| (3) | the redemption of deferred share units (the “DSUs”) governed by the Trilogy Metals

Inc. 2012 Non-Employee Directors Deferred Share Unit Plan (the “DSU Plan”). |

We have examined originals or copies, certified

or otherwise identified to our satisfaction, of the Notice of Articles and Articles of the Company and resolutions of the directors of

the Company and the shareholders of the Company with respect to the matters referred to herein. We have also examined such certificates

of public officials, officers of the Company, corporate records and other documents as we have deemed necessary as a basis for the opinion

expressed below. In our examination of such documents, we have assumed the authenticity of all documents submitted to us as certified

copies or facsimiles thereof.

Our opinions herein are limited to the laws of

British Columbia and the federal laws of Canada applicable therein.

Based upon the foregoing, and provided that all

necessary corporate action has been taken by the Company to authorize the issuance of the Options, RSUs and DSUs: (1) upon the due

exercise of the Options granted pursuant to and in accordance with the Trilogy Incentive Plan; (2) upon the redemption of RSUs in

accordance with their terms and the RSU Plan; and (3) upon the redemption of DSUs in accordance with their terms and the DSU Plan,

the Shares underlying the Options, RSUs and DSUs will be validly issued as fully paid and non-assessable.

Consent is hereby given to the use of our name

in the Registration Statement and to the filing, as an exhibit to the Registration Statement, of this opinion. In giving such consent,

we do not admit that we come within the category of persons whose consent is required under Section 7 of the Act.

Yours truly,

“Blake, Cassels & Graydon LLP”

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in this

Registration Statement on Form S-8 of Trilogy Metals Inc. of our report dated February 8, 2024 relating to the

consolidated financial statements of Trilogy Metals Inc., which appears in Trilogy Metals Inc. Annual Report on Form 10-K for

the year ended November 30, 2023.

/s/PricewaterhouseCoopers LLP

Chartered Professional Accountants

Vancouver, Canada

November 19, 2024

PricewaterhouseCoopers LLP

PricewaterhouseCoopers Place, 250 Howe Street, Suite 1400, Vancouver,

British Columbia, Canada V6C 3S7

T: +1 604 806 7000, F: +1 604 806 7806, ca_vancouver_main_fax@pwc.com,

www.pwc.com/ca

“PwC” refers to PricewaterhouseCoopers LLP, an Ontario

limited liability partnership.

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in this

Registration Statement on Form S-8 of Trilogy Metals Inc. of our report dated February 8, 2024 relating to the financial

statements of Ambler Metals LLC, which appears in Trilogy Metals Inc.’s Annual Report on Form 10-K for the year ended

November 30, 2023.

/s/PricewaterhouseCoopers LLP

Chartered Professional Accountants

Vancouver, Canada

November 19, 2024

PricewaterhouseCoopers LLP

PricewaterhouseCoopers Place, 250 Howe Street, Suite 1400, Vancouver,

British Columbia, Canada V6C 3S7

T: +1 604 806 7000, F: +1 604 806 7806, ca_vancouver_main_fax@pwc.com,

www.pwc.com/ca

“PwC” refers to PricewaterhouseCoopers LLP, an Ontario

limited liability partnership.

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Trilogy Metals Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type |

Security Class

Title |

Fee

Calculation Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee Rate |

Amount of

Registration

Fee |

| Equity |

Common Shares, no par value |

Rule 457(c) and 457(h) |

521,765 |

$1.1376(2)(3) |

$593,559.86 |

0.0001531 |

$90.88 |

| Equity |

Common Shares, no par value |

Rule 457(c) and 457(h) |

4,828,309 |

$1.1376 (2)(4) |

$5,492,684.32 |

0.0001531 |

$840.93 |

| Equity |

Common Shares, no par value |

Rule 457(c) and 457(h) |

100,353 |

$1.1376 (2)(5) |

$114,161.58 |

0.0001531 |

$17.48 |

| Total Offering Amounts |

|

$6,200,405.76 |

|

$949.29 |

| Total Fee Offsets |

|

-- |

|

-- |

| Net Fee Due |

|

|

|

$949.29 |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration

Statement also covers any additional shares of Trilogy Metals Inc.’s (the “Registrant”) common shares that become issuable

under the Trilogy Metals Inc. Equity Incentive Plan, Trilogy Metals Inc. 2012 Restricted Share Unit Plan, and the Trilogy Metals Inc.

2012 Deferred Share Unit Plan, by reason of any stock dividend, stock split, recapitalization or similar transaction effected without

the Registrant’s receipt of consideration which would increase the number of outstanding shares of common stock. |

| (2) | Pursuant to Rule 457(c) and 457(h) under the Securities Act, the Proposed Maximum Aggregate Offering Price with respect

to the common shares is calculated based upon the average of high and low prices of the Registrant’s common stock as reported on

NYSE American on November 15, 2024. |

| (3) | Represents common shares, without par value, that may be issued pursuant to future grants under the Trilogy Metals Inc. Equity Incentive

Plan. |

| (4) | Represents common shares, without par value, that may be issued pursuant to the Trilogy Metals Inc. 2012 Restricted Share Unit Plan. |

| (5) | Represents common shares, without par value, that may be issued pursuant to the Trilogy Metals Inc. 2012 Deferred Share Unit Plan. |

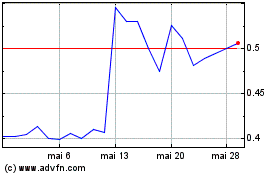

Trilogy Metals (AMEX:TMQ)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Trilogy Metals (AMEX:TMQ)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025