E-L Financial Corporation Limited Announces June 30, 2017 Financial Results

03 Agosto 2017 - 5:27PM

E-L Financial Corporation Limited (“E-L Financial”) (TSX:ELF)

(TSX:ELF.PR.F) (TSX:ELF.PR.G) (TSX:ELF.PR.H) today reported for the

quarter ended June 30, 2017, consolidated shareholders' net

income of $97.5 million or $23.84 per share compared with $103.2

million or $25.28 per share in 2016. For the six months ended

June 30, 2017, E-L Financial earned consolidated shareholders'

net income of $361.6 million or $90.10 per share compared with

$41.8 million or $8.67 per share in 2016.

E-L Financial’s net equity value per Common

Share was $1,241.48 at June 30, 2017, an increase of 7% from

$1,159.26 as at December 31, 2016.

E-L Corporate

For the quarter ended June 30, E-L Corporate

earned net income of $64.4 million in 2017 compared to $78.6

million in 2016. The decrease in net income is primarily due to E-L

Corporate’s net gain on investments of $42.4 million compared to

$66.3 million in 2016. E-L Corporate’s investments for the second

quarter of 2017 yielded a pre-tax total return of 2% mainly due to

positive investment returns compared to 3% in the prior period.

For the six months ended June 30, E-L Corporate

earned net income of $278.7 million in 2017 compared to a net loss

of $19.8 million in 2016. The increase in net income is due to E-L

Corporate’s net gain on investments of $312.1 million compared to a

net loss of $87.5 million in 2016. E-L Corporate’s global

investment portfolio was positively impacted by the performance of

foreign equity markets. The net loss on investments in 2016 is

primarily attributable to the impact of the strengthening of the

Canadian dollar on the global investment portfolio. At

June 30, 2017, 84% (December 31, 2016 - 85%) of E-L

Corporate’s investments were denominated in foreign currencies with

44% (December 31, 2016 - 48%) and 12% (December 31, 2016

- 14%) exposed to U.S. and European equities respectively.

Empire Life

The Empire Life Insurance Company ("Empire

Life") reported net income attributable to E-L Financial of $33.1

million in the second quarter of 2017 compared to $24.6 million for

the comparable period in 2016. The increase in earnings for the

second quarter of 2017 compared to 2016 is primarily as a result of

lower hedge cost in 2017 and improved operating performance in the

Employee Benefits product line, partially offset by lower gains in

the Individual Insurance product lines.

For the six months ended June 30, 2017,

Empire Life's net income attributable to E-L Financial was $82.9

million compared to $61.6 million for the comparable period in

2016. The increase in net income was primarily due to the above

mentioned items and improved operating performance in the Wealth

Management product line.

Empire Life's assets under management (including

segregated fund and mutual fund assets) increased 9% over

June 30, 2016 levels to reach $16.7 billion.

Empire Life’s Minimum Continuing Capital and

Surplus Requirements ratio increased to 249% at June 30, 2017

compared to 248% at December 31, 2016.

CONSOLIDATED SUMMARY OF NET INCOME

(UNAUDITED)

| E-L Financial

Consolidated |

|

Second quarter |

|

Year to date |

|

(thousands of dollars) |

|

2017 |

2016 |

|

2017 |

2016 |

| |

|

|

|

|

|

|

| Contribution to net

income (loss) |

|

|

|

|

|

|

| E-L Corporate1 |

|

$ |

64,353 |

|

$ |

78,556 |

|

|

$ |

278,697 |

|

$ |

(19,750 |

) |

| Empire

Life2 |

|

33,137 |

|

24,622 |

|

|

82,889 |

|

61,555 |

|

| Net

income |

|

$ |

97,490 |

|

$ |

103,178 |

|

|

$ |

361,586 |

|

$ |

41,805 |

|

| E-L

Corporate |

|

Second quarter |

|

Year to date |

|

(thousands of dollars) |

|

2017 |

2016 |

|

2017 |

2016 |

| |

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

| Net gain (loss) on

investments3 |

|

$ |

42,411 |

|

$ |

66,324 |

|

|

$ |

312,113 |

|

$ |

(87,535 |

) |

| Investment and other

income |

|

41,790 |

|

37,109 |

|

|

66,059 |

|

62,575 |

|

| Share of

associates income |

|

12,064 |

|

8,608 |

|

|

12,800 |

|

2,280 |

|

| |

|

96,265 |

|

112,041 |

|

|

390,972 |

|

(22,680 |

) |

|

Expenses |

|

|

|

|

|

|

| Operating |

|

6,726 |

|

6,052 |

|

|

13,369 |

|

12,160 |

|

| Income taxes |

|

14,788 |

|

10,846 |

|

|

53,546 |

|

(4,382 |

) |

|

Non-controlling interests |

|

10,398 |

|

16,587 |

|

|

45,360 |

|

(10,708 |

) |

|

|

|

31,912 |

|

33,485 |

|

|

112,275 |

|

(2,930 |

) |

|

Net income (loss) |

|

$ |

64,353 |

|

$ |

78,556 |

|

|

$ |

278,697 |

|

$ |

(19,750 |

) |

| Empire

Life |

|

Second quarter |

|

Year to date |

|

(thousands of dollars) |

|

2017 |

2016 |

|

2017 |

2016 |

| |

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

| Net premiums |

|

$ |

204,461 |

|

$ |

210,581 |

|

|

$ |

406,855 |

|

$ |

440,356 |

|

| Net gain on

investments3 |

|

166,220 |

|

232,336 |

|

|

247,794 |

|

302,999 |

|

| Investment and other

income |

|

69,648 |

|

65,343 |

|

|

134,205 |

|

126,128 |

|

| Fee

income |

|

63,191 |

|

56,330 |

|

|

124,467 |

|

111,093 |

|

| |

|

503,520 |

|

564,590 |

|

|

913,321 |

|

980,576 |

|

|

Expenses |

|

|

|

|

|

|

| Benefits and

expenses |

|

458,750 |

|

526,919 |

|

|

797,591 |

|

888,604 |

|

| Income and other

taxes |

|

12,980 |

|

12,332 |

|

|

33,073 |

|

28,900 |

|

|

Non-controlling and participating policyholders' interests |

|

(1,347 |

) |

717 |

|

|

(232 |

) |

1,517 |

|

|

|

|

470,383 |

|

539,968 |

|

|

830,432 |

|

919,021 |

|

|

Net income |

|

$ |

33,137 |

|

$ |

24,622 |

|

|

$ |

82,889 |

|

$ |

61,555 |

|

1 Net of non-controlling interests2 Net of

non-controlling interests and participating policyholders' income

(loss)3 Includes fair value change on FVTPL investments and

realized gains on AFS investments

Non-GAAP Measures

The Company uses non-GAAP measures including net

equity value per Common share to provide investors with

supplemental measures of its operating performance that may not

otherwise be apparent when relying solely on International

Financial Reporting Standards ("IFRS") financial measures. Net

equity value per Common share provides an indication of the

accumulated shareholder value, adjusting shareholders’ equity to

reflect investments in associates at fair value, net of tax, as

opposed to their carrying value.

The Company also uses assets under management to

provide investors with a supplemental measure of Empire Life's

performance and to highlight trends in its core business that may

not otherwise be apparent when relying solely on IFRS financial

measures. The Company also believes that securities analysts,

investors and other interested parties frequently use non-GAAP

measures in the evaluation of issuers.

About E-L Financial

E-L Financial operates as an investment and

insurance holding company. In managing its operations, E-L

Financial distinguishes between two operating segments, E-L

Corporate and Empire Life.

E-L Corporate represents investments in stocks

and fixed income securities held directly and indirectly through

pooled funds, closed-end investment companies and other investment

companies. The investment strategy is to accumulate shareholder

value through long-term capital appreciation and dividend income

from its investments.

Empire Life is a subsidiary of E-L Financial

Corporation Limited. Since 1923, Empire Life has provided

competitive individual and group life and health insurance,

investment and retirement products to Canadians. Empire Life’s

mission is to make it simple, fast and easy for Canadians to get

the investment, insurance and group benefits coverage they need to

build wealth, generate income, and achieve financial security.

For further information please contact:

Scott F. Ewert

Vice President and Chief Financial Officer

E-L Financial Corporation Limited

Telephone: (416) 947-2578

Fax: (416) 362-0792

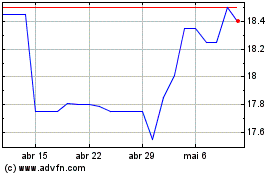

E L Financial (TSX:ELF.PR.G)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

E L Financial (TSX:ELF.PR.G)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024