Endeavour Completes the Avnel Acquisition and Launches Kalana Project Optimization Activities

18 Setembro 2017 - 8:59AM

ENDEAVOUR COMPLETES THE AVNEL ACQUISITION AND

LAUNCHES KALANA PROJECT OPTIMIZATION ACTIVITIES

View News Release in PDF Format

George Town, September 18, 2017 -

Endeavour Mining (TSX:EDV)(OTCQX:EDVMF) is pleased to announce the

successful completion of its previously announced acquisition of

Avnel Gold Mining Limited (TSX: AVK) ("Avnel"), which owns 80% of

the Kalana Gold project in Mali.

Effective today, the entire issued ordinary

share capital of Avnel is owned by Endeavour. Following a

court-approved scheme of arrangement, Avnel shareholders received

0.0187 of an Endeavour share for each Avnel share held. Avnel will

be delisted from the Toronto Stock Exchange at close of trading on

September 18, 2017.

Pursuant to the acquisition of Avnel, La Mancha

Holding S.àr.l. ("La Mancha") has exercised its anti-dilution right

to maintain its 30% stake and will invest $60 million (C$73

million) via a private placement of approximately 3.2 million

Endeavour ordinary shares. The placement is subject to the approval

by the Toronto Stock Exchange and is expected to close on or before

October 5, 2017.

Following the completion of the transaction and

private placement, Endeavour will have approximately 107 million

ordinary shares issued, with former Avnel shareholders holding

approximately 6.6% of Endeavour's pro forma share capital.

KALANA PROJECT NEXT STEPS

Following the close of the transaction,

Endeavour expects to quickly integrate Avnel and initiate

pre-development activities to optimize the Kalana Project,

including:

- Ceasing the current small-scale operations and clearing the

underground workings and existing infrastructure to allow for the

development of future open pits, as well as grant access to

exploration

- Resuming exploration activities on both the Kalana deposit and

nearby targets including Kalanako, with the initial campaign

expected to run until the end of 2018

- Launching a revised Feasibility Study with the aim to:

- Increase the current plant design capacity to lift the average

annual production and shorten the mine life based on current

reserves

- Integrate the exploration results from the upcoming drilling

campaign

- Leverage Endeavour's construction expertise and integrate

operating synergies

- Update the Environmental Impact Assessment to incorporate the

revised Feasibility Study results

- Creating dedicated Kalana Project Community Relations and HSE

teams to validate the census and stakeholder mapping, with the aim

of defining a resettlement action plan ahead of commencing

relocation activities

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 011 2706 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

Endeavour is ideally positioned as the major

pure West-African multi-operation gold mining company, operating 5

mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Karma),

Mali (Tabakoto), and Ghana (Nzema). In 2017, it expects to produce

between 500koz and 530koz at an AISC of US$855 to US$900/oz,

following the full-year deconsolidation of the discontinued Nzema

mine. Endeavour is currently building its Houndé project in Burkina

Faso, which is expected to commence production in Q4-2017 and to

become its flagship low-cost mine with an average annual production

of 190koz at an AISC of US$709/oz over an initial 10-year mine

life, based on reserves. The development of the Houndé and Ity CIL

projects are expected to lift Endeavour's group production to

+900kozpa and decrease its average AISC to circa $800/oz by 2019,

while exploration aims to extend all mine lives to +10 years.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/f79b7c2d-4f1f-4207-b7b6-a60f3a18bd3e

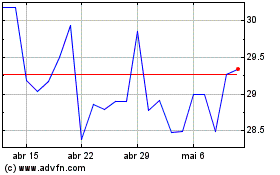

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

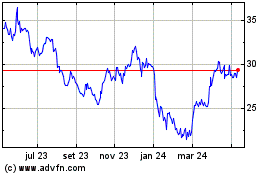

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025