ENDEAVOUR UPSIZES AND EXTENDS ITS RCF UNTIL

2021, PROVIDING SIGNIFICANT HEADROOM TO FUND GROWTH

PROJECTS

View News Release in PDF Format

George Town, September 19, 2017 -

Endeavour Mining (TSX:EDV)(OTCQX:EDVMF) is pleased to announce that

it has refinanced its previous Revolving Credit Facility ("RCF") on

improved terms and upsized it to $500 million from $350 million,

thereby providing significant headroom to fund its growth

projects.

Sébastien de Montessus, President & CEO,

stated: "We are delighted to increase and extend the RCF on

significantly improved terms with strong endorsements from our

existing bank group, and the addition of 3 new lenders to our

syndicate who are global leaders in mining finance.

Our ability to fund our growth projects is

further strengthened with this upsized RCF which complements our

existing cash position, future cash flow generation from our

operating mines as well as the expected proceeds from the Nzema

mine sale. With project payback periods of less than two years at

both Hounde and Ity, we expect to quickly repay any drawn portion

of the RCF while preserving our flexibility to fund future

projects."

On September 19, Endeavour entered into an

Amended and Restated Facility Agreement with a syndicate of

international banks for an upsized and extended RCF with improved

terms compared to its previous RCF, which was established in March

2015.

The key terms of the upsized RCF include:

- Principal amount of $500 million, representing a $150 million

increase from the principal amount of $350 million under the 2015

RCF.

- The new RCF will bear interest on a sliding scale of between

LIBOR plus 2.95% to 3.95% based on the Company's leverage ratio, a

decrease compared to its previous RCF interest rate of LIBOR plus

3.75% to 5.75%.

- Commitment fees for the undrawn portion of the facility of

1.03%, compared to 1.31% to 2.01% (depending on the applicable

margin) with its previous RCF.

- Lower maintenance costs, which are expected to represent

savings of approximately $5 million per year compared to the

previous RCF.

- The term of the new RCF is four years, maturing in September

2021, representing an extension of the previous RCF which matures

in March 2020.

- The principal outstanding on the upsized RCF is repayable as a

single bullet payment on the maturity date, compared to semi-annual

reductions/repayments starting September 2018 for the 2015

RCF.

- The new RCF can be repaid at any time without penalty, and

offers Endeavour a corporate style covenant package, which enhances

the flexibility to run its business from day-to-day.

Proceeds from the loan will be utilized to fund

Endeavour's project pipeline, repay the existing RCF, and may be

used for general corporate purposes. The enlarged bank syndicate

includes Citibank, ING Bank, Investec and Société Générale as

continuing lenders, and Barclays, HSBC and Macquarie as new

lenders.

CONFERENCE CALL AND LIVE WEBCAST FOR ITY CIL

PROJECT

Endeavour Mining intends to publish the

Optimization Study for its Ity CIL Project before TSX market open

tomorrow (September 20th, 2017) and host a conference call and live

webcast on the same day at 9:30am Toronto time (EST).

The conference call and live webcast are scheduled on

Wednesday September 20th at:9:30am Toronto time 6:30am in

Vancouver 9:30am in Toronto and New York 2:30pm in London 9:30pm in

Hong Kong and Perth

The live webcast can be accessed through the following

link: https://edge.media-server.com/m6/p/44r6ckra

Analysts and interested investors are also invited to

participate and ask questions using the dial-in numbers below:

International: +1646 254 3360North American toll-free: 1877 280

2342UK toll-free: 0800 279 4992

Confirmation code: 5815693

The conference call and webcast will be available for

playback on Endeavour's website.

Click here to add Webcast reminder to

Outlook Calendar

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 011 2706 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

Endeavour is ideally positioned as the major

pure West-African multi-operation gold mining company, operating 5

mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Karma),

Mali (Tabakoto), and Ghana (Nzema). In 2017, it expects to produce

between 500koz and 530koz at an AISC of US$855 to US$900/oz,

following the full-year deconsolidation of the discontinued Nzema

mine. Endeavour is currently building its Houndé project in Burkina

Faso, which is expected to commence production in Q4-2017 and to

become its flagship low-cost mine with an average annual production

of 190koz at an AISC of US$709/oz over an initial 10-year mine

life, based on reserves. The development of the Houndé and Ity CIL

projects are expected to lift Endeavour's group production to

+900kozpa and decrease its average AISC to circa $800/oz by 2019,

while exploration aims to extend all mine lives to +10 years.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/22758474-f753-4660-9e23-c61538ad71fe

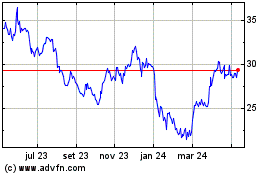

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

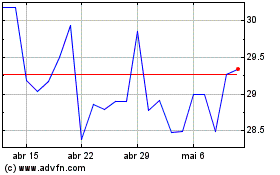

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025