ENDEAVOUR LAUNCHES CONSTRUCTION OF ITY CIL

PROJECT BASED ON OPTIMIZATION STUDY

View News Release in PDF Format

View Presentation in PDF Format

HIGHLIGHTS

- Optimization Study significantly improves the previous

Feasibility Study results (published in November 2016) and

positions the Ity CIL Project as Endeavour's next long-life

low-cost flagship asset

- Long 14-year mine life based on current reserves which

increased by 1.0Moz to 2.9Moz

- Average annual production over the first 5 years increased by

42% to 235koz and AISC decreased by 3% to $494/oz

- Average annual production over the first 10 years increased by

51% to 204koz and AISC decreased by 2% to $549/oz

- Robust economics with after-tax NPV5% of $710m, a 73% increase,

based on a gold price of $1,250/oz

- Ity CIL Project has entered the construction phase following

Board approval

- Endeavour's in-house construction team has begun to transition

from Houndé to Ity and has commenced mobilisation to site

- $412 million initial capex, fully funded from existing sources

of capital with the recent Revolving Credit Facility upsize

- 20-month construction duration with the first gold pour

expected for mid-2019

Abidjan, September 20, 2017 - Endeavour

Mining Corporation ("Endeavour") (the "Company) (TSX:EDV)

(OTCQX:EDVMF) is pleased to announce that its Board of Directors

has approved the construction decision for its Ity CIL project at

its mine in Cote d'Ivoire following the robust results obtained

from its Optimization Study.

The Ity CIL Project Feasibility and Optimization

studies have been conducted to analyze the economic viability of

constructing a straight forward gravity circuit/Carbon-In-Leach

("CIL") plant as an alternate processing route to the current heap

leach process. Following the publication of the November 2016

Feasibility Study ("FS"), an Optimization Study ("OS") was prepared

to better capture the value created from the recent exploration

success which has led to increasing the plant name-plate design

from 3.0Mtpa to 4.0Mtpa. In addition, several changes have been

made to leverage construction and operating synergies between Ity,

Agbaou and Houndé.

The production profile and economics have

significantly improved, as summarized in Table 1 below:

Table 1: Summary of 2016 CIL

Feasibility Study vs. 2017 Optimization Study

|

(On a 100% basis) |

2017 OPTIMIZATION STUDY |

2016 FEASIBILITY STUDY |

VARIANCE (OS VS. FS) |

| M&I Resources

(inclusive of Reserves) |

3.8Moz |

2.3Moz |

+65% |

| P&P Reserves |

2.9Moz |

1.9Moz |

+53% |

| Average production

(first 5 years) |

235koz |

165koz |

+42% |

| Average AISC (first 5

years) |

$494/oz |

$507/oz |

(3%) |

| After-tax NPV5%

based on $1,250/oz |

$710m |

$411m |

+73% |

| After-tax IRR based on

$1,250/oz |

40.3% |

35.9% |

+12% |

| After-tax

IRR based on $1,000/oz |

23.2% |

19.5% |

+19% |

Sébastien de Montessus, President & CEO,

stated: "Today's study clearly positions Ity as our next

flagship asset with robust project economics, a strong long-life

production profile, and significant exploration upside. Its average

annual production in the first five years of 235koz with AISC below

$500/oz and an after-tax IRR of +20% even at a low gold price

of $1,000 per ounce are proof of the compelling economics of the

project.

With the upcoming first gold pour at Houndé and

Ity CIL construction expected to be completed within 20-months, we

remain on track to achieve our strategic milestones of becoming a

+800,000 ounce per year gold producer with group AISC below $800

per ounce and mine lives above 10 years by 2019."

Jeremy Langford, COO, added: "We have optimized

the Ity CIL project by maximizing the construction and operational

synergies between Agbaou, Houndé and Ity, and by leveraging the

same designs, components, equipment and spare parts where possible

from one project to the other, along with incorporating our

extensive construction expertise. The construction team is excited

to transition from Houndé to Ity and to continue to build on its

construction track-record."

SUMMARY OF KEY CHANGES FROM PREVIOUS

FEASIBILITY STUDYThe Ity CIL Project Optimization Study has

been managed by Endeavour's in house development team and

independently prepared by Lycopodium Minerals Pty Ltd

("Lycopodium") with the support of six globally recognized

engineering firms, with the key operational and financial results

summarized in the table below:

Table 2: Detailed Summary of

2016 CIL Feasibility Study vs. 2017 Optimization Study

|

|

2017 OPTIMIZATION STUDY |

2016 FEASIBILITY STUDY |

VARIANCE (OS VS. FS) |

| LIFE OF MINE

PRODUCTION |

|

|

|

| Strip

ratio, w:o |

1.9 |

2.1 |

(10%) |

| Tonnes

of ore processed, Mt |

57.0Mt |

41.0Mt |

+39% |

| Grade

processed, Au g/t |

1.57 g/t |

1.42 g/t |

+10% |

| Gold

content processed, Moz |

2.87 Moz |

1.88 Moz |

+53% |

| LOM

Average Gold recovery, % |

86% |

83% |

+3% |

| Gold

production, Moz |

2.47 Moz |

1.56 Moz |

+58% |

| Mine

life, years |

14.3 years |

13.7 years |

+4% |

|

Average annual gold production, koz |

173 Koz |

114 Koz |

+52% |

| Cash

costs, $/oz |

$554 |

$528 |

+5% |

| AISC,

$/oz |

$580 |

$603 |

(4%) |

| AVERAGE FOR YEARS 1 TO

5: |

|

|

|

| Gold

production, kozpa |

235 koz |

165 koz |

+42% |

| Cash

costs, $/oz |

$472/oz |

$446/oz |

+6% |

| AISC,

$/oz |

$494/oz |

$507/oz |

(3%) |

| AVERAGE FOR YEARS 1 TO

10: |

|

|

|

| Gold

production, kozpa |

204 koz |

135 koz |

+51% |

| Cash

costs, $/oz |

$523/oz |

$488/oz |

+7% |

| AISC,

$/oz |

$549/oz |

$559/oz |

(2%) |

|

CAPITAL COST |

|

|

|

|

Initial capital cost, $m |

$412m |

$307m |

+34% |

|

- of which equipment lease, $m |

$61m |

$25m |

+160% |

|

Upfront capital cost, $m |

$351m |

$282m |

+24% |

|

ECONOMICS (BASED ON $1,250/OZ) |

|

|

|

|

After-tax IRR |

40% |

36% |

+12% |

|

After-tax NPV ( 0% discount rate) |

$990m |

$607m |

+63% |

|

After-tax NPV ( 5% discount rate) |

$710m |

$411m |

+73% |

|

Payback period |

1.8 years |

2.1 years |

(17%) |

The key changes made in the Optimization Study

include:

- CIL process plant increased from 3Mtpa to 4Mtpa to better

capture the value created from the recent exploration success which

has discovered the Bakatouo deposit and increased resources at

notably Daapleu and Mont/Ity Flat.

- Simplified and optimized the process plant design to maximize

the replication of the Houndé design, where applicable, to capture

working capital inventory synergies.

- Improved recoveries based on additional metallurgical testwork,

namely on the Daapleau primary material.

- Addition of a diverter/flop-gate system which allows the Ball

Mill to run independently during periods when the SAG mill is shut

down. This operability allows the plant to maximize utilization and

effectively ensure process milling all year round.

- Addition of a 26MW full back up power station, identical to

that installed at the Houndé project.

- Optimized upfront capital cost and sequenced overall build time

with a higher percentage of "Self-Perform" works.

- Optimized the site layout, which allows the current heap leach

operation to run independently of the CIL project. As such, the

construction of the CIL project is not expected to impact the heap

leach operation.

RESERVES INCREASED BY 1.0Moz, UP 53%

The updated Mineral Reserve estimates were

undertaken by Snowden Mining industry Consultants (Snowden).

Changes from the previously reported Mineral Reserves are largely

due to revised and updated Mineral Resource estimates on the

Daapleu, Ity and Bakatouo deposits and revised operating costs

largely associated with revised processing capabilities from a 3

Mtpa facility to a 4 Mtpa treatment facility.

Compared to the 2016 Feasibility Study

reserves, a total of 1.0Moz were added, with the main increases

coming from the discovery of Bakatouo (+532koz), and additional

resource to reserve conversion at Mont Ity/Ity Flat (+211koz),

Teckraie/Verse Ouest (+187koz), and at Daapleu (+79koz) following

additional drilling, as shown in the table below. The Colline Sud

deposit is expected to be mined during the heap leach phase and

therefore has been excluded from CIL Mineral

Reserves.

Table 3: CIL Project Reserves

Comparison

| Deposits on a 100% basis |

Optimization Study Reserves, as at September 1,

2017 |

|

Feasibility Study Reserves, as at October 1,

2016 |

|

Variance (koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

| Open Pits |

|

|

|

|

|

|

|

|

|

|

Bakatouo |

6.9 |

2.40 |

532 |

|

- |

- |

- |

|

+532 |

|

Colline Sud |

- |

- |

- |

|

- |

- |

- |

|

- |

|

Daapleu |

18.4 |

1.72 |

1,015 |

|

19.3 |

1.51 |

936 |

|

+79 |

|

Mont Ity / Ity Flat |

7.4 |

2.03 |

479 |

|

3.8 |

2.19 |

268 |

|

+211 |

|

Gbeitouo |

2.5 |

1.37 |

111 |

|

2.6 |

1.35 |

112 |

|

(1) |

|

Walter |

1.2 |

1.07 |

41 |

|

1.9 |

1.22 |

73 |

|

(32) |

|

Zia NE |

6.2 |

1.06 |

210 |

|

4.8 |

1.24 |

192 |

|

+18 |

|

Sub-total |

42.5 |

1.75 |

2,390 |

|

32.4 |

1.52 |

1,580 |

|

+810 |

| Existing

Stockpiles |

|

|

|

|

|

|

|

|

|

|

Aires |

5.8 |

1.09 |

202 |

|

5.8 |

1.09 |

202 |

|

- |

|

Teckraie/ Verse Ouest |

8.7 |

1.02 |

284 |

|

2.8 |

1.07 |

97 |

|

+187 |

|

Sub-total |

14.5 |

1.05 |

486 |

|

8.6 |

1.08 |

300 |

|

+186 |

|

Total |

57.0 |

1.57 |

2,876 |

|

41.0 |

1.42 |

1,880 |

|

+996 |

Mineral Reserve estimates follow the Canadian

Institute of Mining, Metallurgy and Petroleum ("CIM") definitions

standards for mineral resources and reserves and have been

completed in accordance with the Standards of Disclosure for

Mineral Projects as defined by National Instrument 43-101. Notes

are provided in Section "About the Mineral Reserve and Resources"

of this Press Release, with effective date September 1, 2017. Full

details on the 2016 Feasibility Study Reserves are available in the

Company's published press release dated November 10, 2016.

INDICATED RESOURCE INCREASED BY

1.5Moz

The updated Indicated and Inferred Mineral

Resource estimates were undertaken by Cube Consulting (Cube), and

incorporate all validated RC, DC and AC drilling completed at the

Ity CIL Project up to May 1, 2017.

There is a total of 10 deposit areas included

in the updated Mineral Resource for the Ity CIL Project including

four in situ gold deposits that have been or are currently in

production, comprising Mont Ity, Ity Flat, ZiaNE and Walter, plus

three near-mine in situ deposits comprising Gbeitouo, Daapleu,

Colline Sud and Bakatouo, and two rock waste dumps at Teckraie and

Verse Ouest and a discontinued heap leach pad Aires.

Compared to the resource inventory used to

build the 2016 Feasibility Study, a total of 1.5Moz of Indicated

Resources were added, with the main increases coming from the

discovery of Bakatouo (+704koz), and additional Indicated resources

outlined at Daapleu (+384koz), Mont Ity / Ity Flat (+189koz), and

Verse Ouest (+187koz), as shown in the table below.

Table 4: Resource

Comparison

| |

2017 OPTIMIZATION STUDY INVENTORY |

|

2016 FEASIBILITY STUDY INVENTORY |

| Deposits on a 100% basis |

Indicated Resources |

|

Inferred Resources |

|

Indicated Resources |

|

Inferred Resources |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

| Open Pits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Daapleu |

28.1 |

1.50 |

1,349 |

|

0.7 |

0.92 |

22 |

|

19.9 |

1.51 |

965 |

|

4.3 |

1.15 |

160 |

| Mont Ity /

Flat |

10.1 |

2.20 |

716 |

|

9.7 |

1.40 |

436 |

|

7.5 |

2.19 |

527 |

|

11.1 |

1.92 |

684 |

| Gbeitouo |

2.9 |

1.35 |

124 |

|

0.3 |

1.48 |

13 |

|

2.9 |

1.35 |

124 |

|

0.3 |

1.48 |

13 |

| Walter |

1.6 |

1.23 |

65 |

|

0.6 |

1.35 |

26 |

|

2.1 |

1.21 |

81 |

|

0.7 |

1.32 |

28 |

| Zia NE |

6.7 |

1.28 |

274 |

|

4.0 |

1.40 |

178 |

|

7.7 |

1.31 |

325 |

|

4.0 |

1.39 |

179 |

| Bakatouo |

10.2 |

2.14 |

704 |

|

0.6 |

2.27 |

44 |

|

- |

- |

- |

|

- |

- |

- |

|

Colline Sud |

1.0 |

2.14 |

66 |

|

0.4 |

2.11 |

28 |

|

- |

- |

- |

|

- |

- |

- |

|

Sub-total |

60.6 |

1.69 |

3,298 |

|

16.3 |

1.43 |

747 |

|

40.1 |

1.57 |

2,022 |

|

20.4 |

1.62 |

1,064 |

| Existing

Stockpiles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aires |

5.8 |

1.09 |

202 |

|

0.2 |

0.78 |

6 |

|

5.8 |

1.09 |

202 |

|

0.2 |

0.78 |

6 |

| Teckraie |

2.8 |

1.07 |

97 |

|

0.1 |

0.55 |

2 |

|

2.8 |

1.07 |

97 |

|

0.1 |

0.55 |

2 |

|

Verse Ouest |

5.9 |

0.99 |

187 |

|

2.3 |

0.50 |

37 |

|

- |

- |

- |

|

8.4 |

0.85 |

230 |

|

Sub-total |

14.5 |

1.04 |

486 |

|

2.6 |

0.54 |

45 |

|

8.6 |

1.08 |

300 |

|

8.7 |

0.85 |

238 |

|

Total |

75.1 |

1.57 |

3,784 |

|

18.9 |

1.30 |

792 |

|

48.7 |

1.48 |

2,322 |

|

29.1 |

1.39 |

1,302 |

Resource estimated to the Indicated status,

as such no Measured Resources available. Mineral Resource

estimates follow the Canadian Institute of Mining, Metallurgy and

Petroleum ("CIM") definitions standards for mineral resources and

reserves and have been completed in accordance with the Standards

of Disclosure for Mineral Projects as defined by National

Instrument 43-101. Notes are provided in Section "About the Mineral

Reserve and Resources" of this Press Release, with effective date

September 1, 2017. Full details on the 2016 Feasibility Study

Inventory are available in the Company's published press release

dated November 10, 2016.

MINING OPERATIONS, PROCESSING, AND

METALLURGYMINING AND PROCESSING STRATEGY

A number of schedules were completed to test

the impact of limiting stockpile size and it was found that there

was limited benefit to allowing for large stockpiles. As such, the

mining sequence and stockpile management has improved in the

Optimized Study compared to the Feasibility Study. Whereas

previously the mining period was 9 years followed by the processing

of stockpiled low-grade ore for another 5 years, the current mine

plan is based on 12 years of mining followed by the processing of

stockpiled low-grade ore for another 2 years.

A combination of strategic pit staging and

stockpiling allows gold production to be brought forward, with

about 1.2 Moz mined in the first 5 years from commissioning and 1.5

Moz in the last 10 years. The overall grade profile declines

gradually over the life of mine as higher grade deposits such as

Bakatouo, Daapleu and Mont Ity / Flat are mined upfront.

Mining OperationsThe mine planning,

resource and cost estimation for the Feasibility Study is based on

an owner-operated mining operation using 90-tonne haul trucks and a

maximum mining movement of 16Mt per year with a vertical advance of

approximately 40 metres per year. The Company sees these figures as

conservative in nature due to the annual rainfall at the Ity

project. Mining is scheduled to commence three months before

the start of the processing plant to pre-strip the pits and

stockpile ore. The mining fleet contract has been awarded to

Komatsu to benefit from synergies relating to minimizing spare

parts inventory and maintenance costs, as both Houndé and Karma

have a similar fleet.

Table 5: Mine Plan

|

|

Total |

Y-1 |

Y-2 |

Y-3 |

Y-4 |

Y-5 |

Y-6 |

Y-7 |

Y-8 |

Y-9 |

Y-10 |

Y-11 |

Y-12 |

| Total material moved,

Mt |

167 |

15.6 |

16.0 |

16.0 |

16.0 |

16.0 |

16.0 |

13.8 |

12.7 |

15.9 |

13.6 |

10.1 |

5.1 |

| Total ore mined,

Mt |

57 |

4.6 |

5.8 |

5.9 |

4.7 |

4.8 |

5.1 |

4.3 |

3.8 |

5.4 |

5.9 |

4.9 |

1.9 |

| Stripping ratio,

w:o |

1.9 |

2.4 |

1.8 |

1.7 |

2.4 |

2.3 |

2.1 |

2.2 |

2.3 |

1.9 |

1.3 |

1.1 |

1.7 |

| Grade mined, g/t

Au |

1.57 |

1.70 |

2.05 |

1.78 |

1.87 |

1.65 |

1.88 |

1.20 |

1.37 |

1.38 |

1.30 |

1.12 |

1.08 |

|

Contained gold mined, koz |

2,883 |

250 |

380 |

340 |

284 |

256 |

310 |

166 |

168 |

241 |

246 |

176 |

66 |

Processing Operations

Following updated resource and reserve

estimates, the key change to the design basis is an increase in

throughput from 3 Mtpa feed to 4 Mtpa feed based on a blend of

primary and oxide ore with a conventional primary crushing followed

by SAG and Ball milling circuit (SABC) with recycle pebble

crusher, gravity circuit and conventional CIL

(Carbon-In-Leach) plant. Soluble copper from the Bakatouo asset is

blended with the low copper Daapleu ore into the plant process

schedule until depletion of Bakatouo. A maximum process plant feed

limit of 200ppm cyanide soluble copper constraint has been set, to

manage cyanide consumption within the CIL plant and detoxification

circuit.

The process plant will notably be composed of

a single stage primary crushing to produce a crushed product size

of 80% passing (P80 of 166 mm) and a two stage SAG (with pebble

crusher recycle)/ Ball milling in closed circuit with hydrocyclones

to produce a P80 grind size of 75 micrometers. A gravity

concentrator and Intensive Leach Reactor (ILR) have been included

in the design as per the FS. The CIL circuit comprises eight CIL

tanks (up from six in the FS) containing carbon for gold and silver

adsorption with oxygen sparged from two 25 tonne PSA Oxygen

plants and a 18 tonne split Anglo (AARL) elution circuit.

Electrowinning and induction furnace smelting completes the gold

doré production process. A cyanide detoxification and arsenic

removal circuit is included in the process facility design, for

treatment of process residue before discharge to the fully lined

57Mt Tailings Storage Facility (TSF), located adjacent to the

processing facility. Feed water for the processing facility will

come from various sources such as pit dewatering bores, the Cavally

River for (make-up) and decant return from the TSF.

Table 6: Processing

Schedule

|

|

Total |

Y-1 |

Y-2 |

Y-3 |

Y-4 |

Y-5 |

Y-6 |

Y-7 |

Y-8 |

Y-9 |

Y-10 |

Y-11 |

Y-12 |

Y-13 |

Y-14 |

| Ore processed, Mt |

57.2 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

| Grade processed, g/t

Au |

1.57 |

2.26 |

2.32 |

2.21 |

1.87 |

1.99 |

1.80 |

1.37 |

1.57 |

1.84 |

1.32 |

1.45 |

0.98 |

0.72 |

0.53 |

| Recovery rate, % |

86% |

86% |

84% |

84% |

88% |

87% |

87% |

85% |

80% |

80% |

93% |

90% |

90% |

84% |

86% |

|

Recovered gold, koz |

2,467 |

250 |

250 |

238 |

212 |

223 |

201 |

151 |

161 |

189 |

159 |

167 |

113 |

77 |

59 |

Metallurgy

The overall life of mine recovery rate

increased from 83% in the Feasibility Study to 86% in the Optimized

Study due to the addition of high-recovery Bakatouo oxide and fresh

ore, Mont Ity ore and better recovery on Daapleu Sulphides

following additional testwork.

Table 7: Gold Recovery Rate by

Deposit

|

|

Bakatouo Oxides/Fresh |

Bakatouo Transition |

Daapleu Sulphides |

Daapleu Oxides |

Gbeitouo |

Mont Ity/Flat |

Walter |

Zia NE |

Stockpiles |

Total |

| LOM Tonnage, Mt |

6.07 |

0.8 |

7.8 |

10.6 |

2.5 |

7.4 |

1.2 |

6.2 |

14.5 |

57.0 |

| % of LOM Tonnage |

11% |

1% |

14% |

19% |

4% |

13% |

2% |

11% |

25% |

100% |

| Gold Grade, g/t Au |

2.28 |

3.29 |

2.41 |

1.21 |

1.37 |

2.03 |

1.08 |

1.06 |

1.04 |

1.57 |

| Gold

Recovery rate, % |

95/97% |

84% |

66% |

85% |

88% |

89% |

96% |

97% |

92% |

86% |

For the economic model, payable silver in the

doré ingots has been estimated on a conservative ratio of 2 to 1. A

detailed investigation of the metallurgical response of the

Bakatouo deposit was undertaken. Most samples showed high gold

extractions but soluble copper levels were also high, particularly

in the transition ore. As such, Endeavour has elected to blend in

the soluble copper ore constraining it to 200ppm per feed blend.

The Daapleu Primary ore can be considered refractory, with elevated

Arsenic levels in the fresh ore, however it has negligible copper.

Further detailed testwork has shown improvements, allowing the

reported recovery for the higher Arsenic fresh material to increase

to from 60% in the Feasibility Study to 66% in the Optimization

Study.

Low Operating Costs

The operating cost estimates have been re-scoped

based on most recent available cost information and based on a

4mtpa processing operation.

Table 8: Life of Mine Operating

Costs in US$, estimated at ± 15% accuracy

|

|

2017 OPTIMIZATION STUDY |

2016FEASIBILITY STUDY |

VARIANCE (OS VS. FS) |

| Open

Pit Mining and Rehandling, $/tonne moved |

$2.89/t |

$2.45/t |

+18% |

| Processing, $/t

milled |

$11.96/t |

$10.56/t |

+13% |

| G&A

costs, $/t milled |

$2.23/t |

$2.79/t |

(20%) |

|

Operating Cost, $/t milled |

$22.90/t |

$20.56/t |

+11% |

Operating costs have been based on a delivered

diesel price of $1.00/L and are in line with current local pricing.

Following the connection to the grid, electricity costs have been

estimated based on $0.1243/kWh.

PROJECT CAPEX SUMMARYThe optimized and

fully scoped upfront capital cost has been re-estimated to reflect

the upgrade project scope at $412 million, inclusive of $49 million

for the owner-mining fleet and $34 million for contingencies, as

summarised in the table below. The upfront capital is expected to

be $351 million as a $61 million lease financing is expected to be

put in place for the mining fleet and power station.

Table 9: Initial Capital Cost

Estimate Summary (US$, ±15%)

|

|

2017 OPTIMIZATION STUDY |

2016FEASIBILITY STUDY |

| Treatment Plant |

94 |

63 |

| Reagents and

Services |

14 |

9 |

| Infrastructure and

Tailings |

71 |

46 |

| Mining (includes

pre-striping and $49m for equipment) |

84 |

59 |

| Construction

Distributables |

26 |

24 |

| Management Costs |

17 |

16 |

| Owners Project

Costs |

66 |

59 |

| Owners

Operations Costs |

5 |

4 |

| Sub-Total |

378 |

282 |

| Contingency |

34 |

26 |

|

Total |

412 |

307 |

Capital costs include the construction of a 58

km, 91kv overhead power line, which connects to the national grid

at Danane and terminates with a substation at Ity which will be

owned by Côte d'Ivoire Energie ("CIE"). A full 26MW full high speed

diesel back-up power station provides 100% redundancy. The

infrastructure in place will be improved with roads upgraded to an

all-weather and free draining carriageway to provide access for the

delivery of equipment, materials and services to the site. A new

camp will be built approximately 1 kilometer north-west of the

process plant and will provide accommodation for 200 employees, and

provisions have been made to construct a suitable airstrip.

A Cavally River diversion will be installed to

allow development of the Daapleu pit, with a second diversion

upstream of the Walter pit. Pit protection bunds will also be

installed and a bridge/culvert road structure from Daapleu over the

Cavally River will also be built.

The proposed approach to project implementation

is similar in nature to the current execution methodology of the

Endeavour Project Services In-House team in that Endeavour will

engage a suitably qualified Engineering, Procurement and

Construction Management (EPCM) Engineer for design and construction

management of the process plant and infrastructure, which will then

be handed over to an Owner's operating team. Endeavour will

self-perform the development of the mine infrastructure and

provision of ongoing drill and blast and mine operating services

under an Owner's mine technical team.

The schedule anticipates the project being

completed within 20 months from EPCM award.

PROJECT ECONOMICSThe results of the

financial model show robust results. Applying a long term gold

price of $1,250/oz on a flat line basis from the commencement of

production, the after-tax NPV5% is $710 million, IRR is 40.3% and

project payback period is 1.8 years.

Table 10: Gold Price

Sensitivity

| Gold Price ($US/oz) |

After-tax NPV ($m) |

After-tax IRR |

|

0% |

5% |

10% |

|

$1,000/oz |

520 |

343 |

221 |

23.2% |

|

$1,050/oz |

613 |

416 |

280 |

26.7% |

|

$1,100/oz |

707 |

489 |

339 |

30.2% |

|

$1,150/oz |

801 |

563 |

399 |

33.6% |

|

$1,200/oz |

896 |

636 |

458 |

36.9% |

|

$1,250/oz |

990 |

710 |

518 |

40.3% |

|

$1,300/oz |

1,072 |

773 |

569 |

43.1% |

|

$1,350/oz |

1,166 |

847 |

629 |

46.4% |

|

$1,400/oz |

1,260 |

920 |

688 |

49.6% |

PROJECT IS FULLY FUNDED

As shown in Figure 1 below, the Ity CIL Project

is fully funded with significant headroom available based on

liquidity and funding sources available which include cash and

undrawn upsized Revolving Credit Facility ("RCF"), the future cash

generation from existing operating mines the upcoming proceeds from

the sale of the Nzema mine, potential Ity power station and

equipment financing, and the upcoming La Mancha anti-dilution

equity placement.

Figure 1: Funding Sources

As was successfully implemented during the

Houndé construction period, Endeavour will study the opportunity to

put in place a short-term Gold Revenue Protection Strategy,

consisting of Gold Option Contracts on only a portion of its

production, to mitigating risk and increase the certainty of its

upcoming free cash flow during its peak investment phase.

HEAP LEACH OPERATION

It is envisaged that the heap leach operation

will run during the construction period and that heap leach

activities will cease once the CIL plant is commissioned. Endeavour

will reassess the risk and opportunity of running both operations

in parallel once the CIL project has been developed.

COMMUNITY AND SOCIAL RESPONSIBILITY

ACTIONS

Endeavour recognizes that an active CSR program

is the foundation of long-term success and its social license to

operate. Baseline studies for the ESIA from 2013 to 2016 have been

completed and an ESIA report was published in March 2016 and a

Resettlement Action Plan ("RAP") has been completed.

Three environmental permits have been granted

covering the mining and process plant, Daapleu and Gbeitouo

exploitation and mining and surface infrastructure.

Full CSR team complement is now in place and

working on establishing CSR best practices and reporting.

EXPLORATION POTENTIAL

The Ity area has significant exploration

potential with several deposits located within 5 kilometers of one

another in addition to several exploration targets identified as

per the blue dashed area in the Figure below. This area represents

a small portion of the 80km corridor controlled by Endeavour.

Figure 2: Ity Mine Area and Surrounding

Exploration Targets

ABOUT THE MINERAL RESERVES AND

RESOURCES

The in situ Mineral Resources, which include

Daapleu, Mont Ity / Ity Flat, Bakatouo, Gbeitouo, Walter, Zia NE

and Colline Sud, have been reported inside optimised pit shells and

above a 0.5 g/t Au cut-off. Reporting within an optimised pit shell

satisfies the requirement for the Mineral Resource to have

reasonable prospects for future economic extraction. The pit

optimisation assumes a US$1,500/oz Au price.

The Mineral Resource for the rock dumps, which

include the Teckraie and Verse Ouest Mineral Resources and also the

Aires heap leach pad, have not been reported inside an optimised

pit shell. These deposits have been built up above the existing

topography and the associated shallow laterite located directly

below, therefore satisfying the requirement for the Mineral

Resource to have reasonable prospects for future economic

extraction. The Teckraie and Verse Ouest rock dump Mineral

Resources and Aires leach pad Mineral Resources have been reported

above 0.0 g/t Au because there is unlikely to be any grade

selectivity during mining. The underlying laterite Mineral

Resources for each of the deposits has been reported above 0.5 g/t

Au given the possibility for some mining selectivity. The Colline

Sud deposit is expected to be mined during the heap leach phase and

therefore has been excluded from CIL Mineral Reserves. All Mineral

Resources are current as at April 30, 2017. Mineral resources which

are not mineral reserves do not have demonstrated economic

viability.

Reported tonnage and grade figures have been

rounded from raw estimates to reflect the relative accuracy of the

estimate. Minor variations may occur during the addition of rounded

numbers.

The statistical analysis, geological modelling

and resource estimation for Colline Sud were prepared by Kevin

Harris, CPG. Mr. Harris is Endeavour Mining's Group Resource

Manager and is a "Qualified Person" as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101").

The statistical analysis, geological modelling

and resource estimation for Bakatouo, Mt Ity/Ity flat, Daapleu and

Verse Ouest were prepared by Mark Zammit, CPG. Mr. Zammit is a

principal consultant geologist with Cube Consulting Pty Ltd and is

a "Qualified Person" as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101").

The statistical analysis, geological modelling

and resource estimation for Bakatouo, Mt Ity/Ity flat, Daapleu,

Gbeitouo, Walter, Zia NE. Aires and Verse Ouest were prepared by

Mark Zammit, CPG. Mr. Zammit is a principal consultant geologist

with Cube Consulting Pty Ltd and is a "Qualified Person" as defined

by National Instrument 43-101 - Standards of Disclosure for Mineral

Projects ("NI 43-101").

The Qualified person for the Ity Mineral Reserve

estimation is Mr Allan Earl AWASM FAusIMM. Mr. Earl is an executive

consultant with Snowden Mining industry Consultants Pty Ltd and is

a "Qualified Person" as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101").

A gold price of US$1,250/oz was used in the pit

optimizations for Mineral Reserves. The estimation of break-even

cut-off grades are based on net revenue (gold price x process

recovery) and the throughput (ore related) costs.

QUALIFIED PERSONS

Jeremy Langford, Endeavour's Chief Operating

Officer - Fellow of the Australasian Institute of Mining and

Metallurgy - FAusIMM, is a Qualified Person under NI 43-101, and

has reviewed and approved the operational analysis, operating and

capital estimates, and other technical information in this news

release.

CONFERENCE CALL AND LIVE WEBCAST FOR ITY CIL

PROJECT

Management will host a conference call and live

webcast today at 9:30am Toronto time (EST) to discuss the results

of the Ity CIL Project Optimization Study.

The conference call and live webcast are scheduled

at:9:30am Toronto time 6:30am in Vancouver 9:30am in Toronto

and New York 2:30pm in London 9:30pm in Hong Kong and Perth

The live webcast can be accessed through the following

link: https://edge.media-server.com/m6/p/44r6ckra

Analysts and interested investors are also invited to

participate and ask questions using the dial-in numbers below:

International: +1646 254 3360North American toll-free: 1877 280

2342UK toll-free: 0800 279 4992

Confirmation code: 5815693

The conference call and webcast will be available for

playback on Endeavour's website.

Click here to add Webcast reminder to

Outlook Calendar

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

Endeavour is ideally positioned as the major

pure West-African multi-operation gold mining company, operating 5

mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Karma),

Mali (Tabakoto), and Ghana (Nzema). In 2017, it expects to produce

between 500koz and 530koz at an AISC of US$855 to US$900/oz,

following the full-year deconsolidation of the discontinued Nzema

mine. Endeavour is currently building its Houndé project in Burkina

Faso, which is expected to commence production in Q4-2017 and to

become its flagship low-cost mine with an average annual production

of 190koz at an AISC of US$709/oz over an initial 10-year mine

life, based on reserves. The development of the Houndé and Ity CIL

projects are expected to lift Endeavour's group production to

+900kozpa and decrease its average AISC to circa $800/oz by 2019,

while exploration aims to extend all mine lives to +10 years.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

MINE PLAN

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/0c0ed29a-8b66-421c-b03b-c2fd52ee3f53

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/f9d8eac9-b368-4b0b-9053-9854d5c60557

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/a7f62c74-3438-48c6-a236-7e814f97c283

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/6a159db6-5088-4fb1-a1df-d79121ef5aa7

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/69188139-a721-4cab-85b4-e09f3d04e8b1

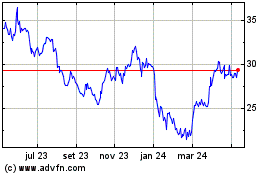

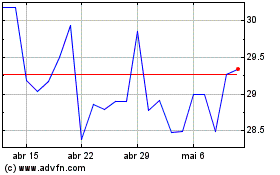

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025