ENDEAVOUR AND RANDGOLD FORM AN EXPLORATION

JOINT VENTURE IN COTE D'IVOIRE

View News Release in PDF Format

View Map of JV Property

Abidjan, November 2, 2017 - Endeavour

Mining (TSX:EDV) (OTCQX:EDVMF) and Randgold Resources Ltd (LSE:RRS)

are pleased to announce that they have established a joint venture

covering their adjacent Sissedougou and Mankono exploration

properties located in the northern region of Côte d'Ivoire.

Sébastien de Montessus, President & CEO,

stated: "As the two largest producers in Côte d'Ivoire, with a

strong presence in West Africa, both companies welcome the

opportunity to increase their cooperation. This JV will allow us to

accelerate exploration on our Sissedougou property while we

continue to focus our efforts on our 100%-controlled 80km corridor

along our Ity mine, which our exploration strategic review

identified as our highest priority."

Under the terms of the agreement, Randgold and

Endeavour will hold respectively a 70% and 30% interest in the

newly formed joint venture. Randgold will be the joint venture

operator and both parties will contribute to the annual exploration

budget in accordance with their shareholdings. A $3.8 million

exploration campaign has been approved for the remainder of 2017

and 2018.

ABOUT THE EXPLORATION JV PROPERTIES The

adjacent Sissedougou and Mankono exploration properties are located

in the northern region of Côte d'Ivoire, at the contact of the

shear zone hosting the Tongon mine and the shear zone hosting the

Sissingue project and Syama mine.

The Sissedougou property was transferred from La

Mancha to Endeavour in late 2015. After nearly 4 years of

exploration inactivity, Endeavour re-initiated exploration in 2017

as part of its greenfield program. Sissedougou's potential was

initially confirmed with a first 3,378-metre drilling program

carried out by La Mancha in 2011, as drill results suggested the

presence of an 800-metre mineralized structure.

Selected best drill results at Sissedougou, as

published by La Mancha in 2012 (click here to view the press

release), were[1]:

- 34.6 m @ 2.08 g/t Au at 74.6 m, including 1.0 m @ 31.52 g/t

Au

- 18.8 m @ 2.30 g/t Au at 26.1 m

- 23.0 m @ 2.14 g/t Au at 112.6 m, including 2.0 m @ 10.70 g/t

Au

Randgold confirmed the exploration potential of

the Mankono property as its trenching program intercepted a

mineralised system over a 300m wide corridor and 1km strike.[2]

QUALIFIED PERSONS

The scientific and technical content of this

news release has been reviewed, verified and compiled by Gérard de

Hert, EurGeol, Senior Vice President Exploration West Africa for

Endeavour Mining. Gérard de Hert has more than 19 years of mineral

exploration and mining experience, and is a "Qualified Person" as

defined by National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101").

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

endeavour@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.

Endeavour operates 5 mines across Côte d'Ivoire

(Agbaou and Ity), Burkina Faso (Karma), Mali (Tabakoto), and Ghana

(Nzema) which are expected to produce 600-640koz of gold at an AISC

of US$860-905/oz in 2017. Endeavour's high quality development

projects (Hounde, Ity CIL and Kalana) have the combined potential

to deliver an additional 600koz per year at an AISC well below

$700/oz between 2018 and 2020. In addition, its exploration program

aims to discover 10-15Moz of gold by 2021 which represents more

than twice the reserve depletion during the period.

For more information, please

visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

[1] As published in La Mancha Resources (TSX:LMA) press release

dated January 31, 2012, available on SEDAR and by clicking

here.

[2] As published in Randgold's Q3 Report, dated November 2,

2017, available on their website.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/5251a697-c585-4230-a7ad-9cdbcc701a4d

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/f5099c41-1e51-4ba3-80b5-e05e21e2213d

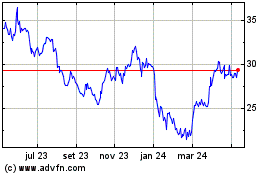

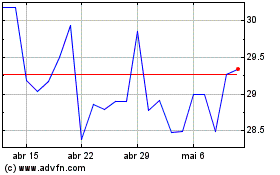

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025