ENDEAVOUR REPORTS Q3-2017

RESULTS; FY-2017 GUIDANCE INCREASED WITH

HOUNDÉ

View News Release in PDF Format

View Presentation in PDF Format

OPERATIONAL AND FINANCIAL

Highlights

- Q3 total production remained fairly flat over Q2 at 148koz

with AISC also flat at $906/oz; year-to-date performance on track

to meet the initial FY-2017 guidance

- Successful early commissioning of the Houndé flagship mine

lifts full year production guidance to

- 630-675koz and decreases AISC guidance to below

$900/oz

- Q3 Free Cash Flow Before Growth Projects flat over

Q2 at $34m, with $100m achieved year-to-date

- Net Debt increased from $183m to $221m since the previous

quarter-end due to Houndé construction spend, with Net Debt to

EBITDA ratio remaining healthy at 0.98 times

- Well positioned to fund growth with $325m in available

sources of financing and liquidity

Project Highlights

- Houndé construction and commissioning completed ahead of

schedule and below budget

- Ity CIL Project construction launched in September after

Optimization Study demonstrated it will be another flagship asset

with a long 14-year mine life, average annual production of 235koz

at AISC of $494/oz over the first 5 years, and an after-tax

NPV5% of $710m and IRR of 40% at $1,250/oz

EXPLORATION Highlights

- Exploration success increases FY-2017 budget from $40m

to $45m, with $37m already spent YTD

- Near-mine exploration success includes 1Moz already added at

Ity this year and new discoveries made at both Karma and

Houndé

- Greenfield exploration activities launched in early 2017

with encouraging results already received

- Exploration JV formed in Q4 2017 with Randgold for adjacent

properties in Ivory Coast

George Town, November 9, 2017 - Endeavour Mining

(TSX:EDV) (OTCQX:EDVMF) is pleased to announce its financial and

operating results for the quarter ended September 30, 2017, with

highlights provided in the table below.

Table 1: Key Operational and Financial

Highlights

| (Held-for-sale Nzema asset included for all

figure, except where indicated as for continuing

operations) |

QUARTER ENDED |

|

NINE MONTHS ENDED |

|

Sep. 30, 2017 |

Jun. 30,2017 |

Sep. 30, 2016 |

|

Sep. 30, 2017 |

Sep. 30, 2016 |

Variance |

| Total

Gold Production, oz |

148 |

152 |

146 |

|

459 |

416 |

+10% |

| Realized Gold Price,

$/oz |

1,235 |

1,219 |

1,328 |

|

1,214 |

1,238 |

(2%) |

| AISC, $/oz |

906 |

897 |

898 |

|

903 |

900 |

0% |

|

All-in Sustaining Margin, $/oz |

330 |

322 |

430 |

|

311 |

338 |

(8%) |

| Free Cash Flow Before

Growth Projects1, $m |

34 |

33 |

44 |

|

100 |

106 |

(6%) |

| Net Free Cash Flow From

Operations, $m |

32 |

(11) |

2 |

|

59 |

12 |

+392% |

|

Net Debt At Period End, $m |

(221) |

(183) |

83 |

|

(221) |

83 |

+166% |

| Earnings from

Continuing Mine Operations, $m |

7 |

35 |

49 |

|

66 |

125 |

(47%) |

| Basic Net Earnings

(Loss) from Cont. $/share |

(0.26) |

0.20 |

0.16 |

|

(0.24) |

(0.01) |

n.a |

| Adj. Net

Earnings (Loss) from Cont. Operations, $/share |

(0.10) |

0.11 |

0.26 |

|

0.10 |

0.91 |

(88%) |

Reference MD&A for more details. 1) Free Cash

Flow before Growth Projects stated before WC, tax & financing

costs.

Sébastien de Montessus, President & CEO,

stated: "While the year is not yet over, clearly 2017 will be

underpinned by the successful construction and commissioning of our

flagship Houndé mine which reached commercial production

under-budget and two months ahead of schedule. Houndé will now have

an immediate positive impact on our operational and financial

performance for the remainder of 2017 and beyond, enabling us to

increase group production, lower group AISC and ultimately increase

group free cash flow generation.

During the third quarter we also set in motion

our next growth phase by launching the construction of the Ity CIL

project which will become our second flagship mine as shown with

the recently published optimization study. In addition, we have

launched the Kalana Project optimization study to maintain a growth

pipeline beyond Houndé and Ity CIL.

On the operational front we have successfully

completed the mill optimization program at Karma, executed a

turn-around at Nzema which enabled us to successfully sell the

asset, and advanced restructuring and cost-cutting initiatives at

Tabakoto which should start to yield positive results in the

upcoming quarters.

Recently, we also upsized our revolving credit

facility from $350 to 500 million, which provides us with

additional financial flexibility to advance our growth

projects.

We are confident the important strategic

milestones already achieved this year, combined with our

exploration success, have us well positioned to meet our 2019

objective of achieving an annual production of more than 800koz

with AISC of below $800/oz and mine lives of more than 10

years."

PRODUCTION & AISC ON TRACK TO MEET FULL

YEAR GUIDANCE

- Group production totaled 148koz in Q3-2017 and 459koz for the

first nine months of the year, on track to meet the initial full

year guidance of 600-640koz.

- The Group's total production in Q3-2017 remained fairly flat

compared to Q2-2017 (down 4koz), as a strong increase at Nzema (due

to higher grades following the cut-back) compensated for the

expected lower production at Tabakoto (open pit mining transitioned

to a lower grade deposit) and the impact of the rainy season.

- As announced on August 9, 2017, Nzema has been classified as an

asset held-for-sale according to IFRS and the transaction is

expected to close upon receiving regulatory approval.

- The Group remains on-track to meet its initial full year

guidance as strong performance at Agbaou and Nzema are expected to

counterbalance Ity's under-performance, while both Tabakoto and

Karma are expected to be within guidance.

Table 2: Group Production,

koz

| (All amounts in koz, on a 100% basis) |

QUARTER ENDED |

|

NINE MONTHS ENDED |

|

INITIAL 2017 FULL-YEAR

GUIDANCE |

|

Sep. 30, 2017 |

Jun. 30,2017 |

Sep. 30, 2016 |

|

Sep. 30, 2017 |

Sep. 30, 2016 |

|

|

Agbaou |

46 |

45 |

49 |

|

134 |

138 |

|

175 |

- |

180 |

|

Tabakoto |

32 |

41 |

37 |

|

116 |

115 |

|

150 |

- |

160 |

| Ity |

12 |

14 |

15 |

|

42 |

58 |

|

75 |

- |

80 |

|

Karma |

21 |

24 |

20 |

|

77 |

33 |

|

100 |

- |

110 |

| PRODUCTION FROM

CONTINUING OPERATIONS |

111 |

124 |

121 |

|

369 |

344 |

|

500 |

- |

530 |

| Nzema (held for

sale) |

37 |

27 |

24 |

|

91 |

64 |

|

100 |

- |

110 |

|

Youga (sold in March 2016) |

- |

- |

- |

|

- |

8 |

|

- |

- |

- |

| TOTAL

PRODUCTION |

148 |

152 |

146 |

|

459 |

416 |

|

600 |

- |

640 |

- Group AISC was $906/oz in Q3 and $903/oz for the first nine

months of the year, on track to meet the higher-end of the initial

FY-2017 guidance.

- Group AISC in Q3-2017 increased slightly compared to Q2-2017,

as the reduction at Nzema was offset by increases across the other

mines due to seasonal and mine sequencing factors. In addition, the

AISC were adversely impacted by the 7% appreciation of the Euro

versus the US dollar in Q3-2017.

- Group AISC for the first nine months of the year remained

fairly flat compared to the same period of 2016 as the increases at

Agbaou, Ity, and Tabakoto were offset by the addition of Karma and

a reduction at Nzema. In addition, G&A costs decreased from

$52/oz to $42/oz while sustaining exploration increased from $18/oz

to $26/oz in line with Endeavour's reinvigorated exploration

strategy.

- The Group remains on track to meet the higher-end of the

initial FY-2017 guidance as the over-performance of Agbaou and

Nzema is expected to offset higher costs at Ity and Tabakoto.

Table 3: Group All-In Sustaining

Costs, US$/oz

| (All amounts in US$/oz) |

QUARTER ENDED |

|

NINE MONTHS ENDED |

|

INITIAL 2017 FULL-YEAR

GUIDANCE |

|

Sep. 30, 2017 |

Jun. 30,2017 |

Sep. 30, 2016 |

|

Sep. 30, 2017 |

Sep. 30, 2016 |

|

|

Agbaou |

638 |

606 |

550 |

|

634 |

534 |

|

660 |

- |

700 |

|

Tabakoto |

1,278 |

1,054 |

1,071 |

|

1,085 |

1,067 |

|

950 |

- |

990 |

| Ity |

1,141 |

780 |

724 |

|

920 |

737 |

|

740 |

- |

780 |

|

Karma |

973 |

755 |

- |

|

811 |

- |

|

750 |

- |

800 |

|

MINE-LEVEL AISC FOR CONTINUING OPERATIONS |

937 |

801 |

763 |

|

846 |

768 |

|

785 |

- |

835 |

|

Corporate G&A |

28 |

51 |

58 |

|

42 |

52 |

|

42 |

- |

40 |

|

Sustaining Exploration |

11 |

28 |

24 |

|

26 |

18 |

|

28 |

- |

25 |

| GROUP AISC FOR

CONTINUING OPERATIONS |

976 |

880 |

844 |

|

914 |

838 |

|

855 |

- |

900 |

| Nzema (held for

sale) |

705 |

985 |

1,136 |

|

859 |

1,184 |

|

895 |

- |

940 |

|

Youga (sold in March 2016) |

- |

- |

- |

|

- |

1,101 |

|

- |

- |

- |

| GROUP

AISC |

906 |

897 |

898 |

|

903 |

900 |

|

860 |

- |

905 |

FULL YEAR GUIDANCE INCREASED WITH SUCCESSFUL

HOUNDE START-UP

Due to its quicker than expected construction

and ramp-up period, commercial production at Houndé was declared

two months ahead of schedule on November 1, 2017. With the Houndé

flagship mine expected to produce between 30,000 and 35,000 ounces

during Q4-2017 at AISC between $550-600/oz, the Group's 2017 full

year total production guidance has been increased from 600,000 -

640,000 ounces to 630,000 - 675,000 ounces while the total AISC

guidance has been decreased to below $900/oz, as shown in Tables 4

and 5 below.

Table 4: Updated Group

Production Guidance, koz

| (All

amounts in koz, on a 100% basis) |

UPDATED 2017 FULL-YEAR GUIDANCE |

| Current Production From

Continuing Operations (Unchanged as per Table 2) |

500 |

- |

530 |

|

Hounde |

30 |

- |

35 |

| PRODUCTION FROM

CONTINUING OPERATIONS |

530 |

- |

565 |

| Nzema

(held for sale) |

100 |

- |

110 |

| TOTAL

PRODUCTION |

630 |

- |

675 |

Table 5: Updated All-In

Sustaining Costs Guidance, US$/oz

|

(All amounts in US$/oz) |

UPDATED 2017 FULL-YEAR GUIDANCE |

| Current Group AISC For

Continuing Operations (Unchanged as per Table 3) |

855 |

- |

900 |

|

Hounde |

550 |

- |

600 |

| GROUP AISC

FOR CONTINUING OPERATIONS |

845 |

- |

890 |

| Nzema

(held for sale) |

895 |

- |

940 |

| GROUP

AISC |

850 |

- |

895 |

Houndé is expected to immediately be cash flow

generative. As such, the Group's 2017 expected Free Cash Flow

before growth projects (and before working capital movement, tax

and financing costs) has been increased from $155 million to $165

million, assuming a gold price of $1,250/oz. In addition to

adding Houndé, the guidance has been updated to incorporate an

increase in the Group's non-sustaining exploration budget by $5

million following significant exploration success at Ity and to

classify Nzema as a non-continuing operation, as presented in Table

6 below.

Table 6: Updated Free Cash Flow Guidance based

on US$1,250/oz, in $m

| In

$m |

INITIAL GUIDANCE |

REVISED GUIDANCE |

| NET REVENUE

(based on production guidance mid-point for continuing

operations) |

755 |

665 |

|

Mine level AISC costs (based on AISC guidance mid-point for

continuing operations) |

(510) |

(440) |

|

Corporate G&A |

(21) |

(21) |

|

Sustaining exploration |

(14) |

(14) |

| GROUP ALL-IN

SUSTAINING MARGIN FOR CONTINUING OPERATIONS |

210 |

190 |

|

Nzema All-in Sustaining Margin (based on guidance mid-points) |

- |

35 |

|

Non-sustaining mine exploration |

(20) |

(25) |

|

Non-sustaining capital |

(35) |

(35) |

| FREE

CASH FLOW BEFORE GROWTH PROJECTS (and before WC, tax and

financing cost) |

155 |

165 |

AGBAOU MINE

Q3 vs Q2-2017 Insights

- Production remained fairly flat as greater tonnes processed

offset the lower head grade.

- Tonnes of ore mined increased due to the continued improvement

in equipment availability. As the rainy season limited access to

the higher grade harder transitional/fresh ore in the South pit,

mining activities shifted to the lower grade softer oxide ore in

the West pit.

- Mill throughput increased as the proportion of fresh ore

processed decreased from 21% to 15%.

- Recovery rates remained fairly constant.

- All-in sustaining costs increased by $32/oz due to planned

higher sustaining capital costs, while increased mining unit costs

were offset by lower processing unit costs.

- The mining unit costs increased from $2.40/t to $2.62/t mainly

due to increased blasting in the South pit and deeper elevations

mined.

- Processing unit costs decreased from $7.67/t to $7.08/t mainly

due to greater throughput volume associated with a lower quantity

of harder fresh material processed.

- As planned, sustaining capital costs increased from $12/oz to

$46/oz due to land compensation and increased waste

capitalisation.

YTD 2017 vs YTD 2016 Insights

- In line with guidance, production decreased slightly and

AISC increased as Agbaou moved from processing mainly soft oxide

ore in 2016 to processing a blend of oxide and harder transitional

and fresh ore in 2017.

- AISC since the beginning of the year stand at $634/oz, well

below the guided $660-700/oz, as less fresh and transitional ore

was processed than planned.

Table 7: Agbaou

Quarterly Performance Indicators

| For

The Quarter Ended |

Q3-2017 |

Q2-2017 |

Q3-2016 |

| Tonnes ore mined,

kt |

824 |

709 |

651 |

| Strip ratio (incl.

waste cap) |

8.19 |

8.81 |

9.56 |

| Tonnes milled, kt |

770 |

693 |

709 |

| Grade, g/t |

1.96 |

2.23 |

2.21 |

| Recovery

rate, % |

93% |

94% |

96% |

| PRODUCTION,

KOZ |

46 |

45 |

49 |

| Cash

Cost/oz |

548 |

528 |

432 |

|

AISC/OZ |

638 |

606 |

550 |

Table 8: Agbaou 9 Months

Performance Indicators

|

For The Nine Months Ended |

Sept 30 2017 |

Sept 30 2016 |

| Tonnes

ore mined, kt |

2,157 |

2,123 |

| Strip

ratio (incl. waste cap) |

8.68 |

7.89 |

| Tonnes

milled, kt |

2,146 |

2,106 |

| Grade,

g/t |

2.09 |

2.20 |

|

Recovery rate, % |

94% |

97% |

|

PRODUCTION, KOZ |

134 |

138 |

| Cash

Cost/oz |

541 |

430 |

|

AISC/OZ |

634 |

534 |

Outlook

- In Q4-2017, production is expected to decrease slightly and

AISC is expected to increase as the mine continues to progress

towards a greater oxide to fresh/transitional ore blend, with an

increased planned sustaining capital spend.

- Agbaou remains on track to meet the FY-2017 production guidance

of 175,000-180,000 ounces and is expected to achieve the lower-end

of the initial AISC guidance of $660-700/oz.

TABAKOTO MINEQ3 vs Q2-2017 Insights

- Production decreased mainly due to lower open pit tonnage

and grade, in addition to the impact of strong rainfall and a

national strike.

- As anticipated, the high grade Kofi C pit was depleted during

the quarter and activities transitioned to mining the Kofi B pit

and to initiating pre-stripping at the Tabakoto North pit, which

resulted in a higher strip ratio.

- Open pit tonnes of ore mined decreased due to the

aforementioned depletion of Kofi C and pit access at Kofi B being

limited because of the wet road conditions.

- Underground tonnes of ore mined slightly decreased due to

increased development activities and the national strike.

- Processing activities continued to perform well, maintaining a

fairly stable throughput as the old Djambaye deposit low grade ore

stockpiles were used to supplement the feed supply to the

plant.

- The recovery rate decreased slightly due to the ore

characteristics of the old Djambaye stockpiles.

- The head grade decreased due to the aforementioned depletion of

Kofi C and the contribution from lower grade

stockpiles.

- AISC increased by $224/oz mainly due to the volume effect

related to the decrease in gold sold, an increased strip ratio and

an increase in mining, processing and G&A unit costs, which

were partially offset by lower sustaining costs.

- Open pit mining unit costs increased from $3.72/t to $3.91/t

due to lower volumes mined and increased pumping because of the

rainy season.

- Underground mining costs increased from $61.18/t to $75.79/t

due to more maintenance on the underground mining fleet.

- Processing unit costs increased from $19.00/t to $20.83/t due

to increased cyanide and lime consumption due to the ore

characteristics of Djambaye stockpiles treated.

- G&A unit costs increased from $9.39/t to $12.13/t due to

the timing of expenditures, remaining flat compared to

Q3-2016.

- Sustaining capital decreased from $252/oz to $174/oz mainly as

a result of less open-pit waste capitalization and underground

development.

YTD 2017 vs YTD 2016 Insights

- Production remained flat as higher open pit feed

compensated for lower underground feed, while the overall head

grade and recovery remained constant.

- AISC increased as higher mining costs and the use of low

grade stockpiles was partially offset by lower processing, G&A

and sustaining costs.

Table 9: Tabakoto Quarterly

Performance Indicators

| For

The Quarter Ended |

Q3-2017 |

Q2-2017 |

Q3-2016 |

| OP tonnes ore mined,

kt |

108 |

157 |

160 |

| OP strip ratio (incl.

waste cap) |

9.13 |

8.87 |

8.81 |

| UG tonnes ore mined,

kt |

179 |

184 |

238 |

| Tonnes milled, kt |

392 |

407 |

381 |

| Grade, g/t |

2.64 |

3.32 |

3.31 |

| Recovery

rate, % |

93% |

94% |

95% |

| PRODUCTION,

KOZ |

32 |

41 |

37 |

| Cash cost/oz |

1,104 |

802 |

894 |

|

AISC/OZ |

1,278 |

1,054 |

1,071 |

Table 10: Tabakoto 9 Months

Performance Indicators

| For

Nine Months Ended |

Sept 30 2017 |

Sept 30 2016 |

| OP tonnes ore mined,

kt |

482 |

454 |

| OP strip ratio (incl.

waste cap) |

8.40 |

11.13 |

| UG tonnes ore mined,

kt |

599 |

691 |

| Tonnes milled, kt |

1,204 |

1,186 |

| Grade, g/t |

3.16 |

3.17 |

| Recovery

rate, % |

94% |

94% |

| PRODUCTION,

KOZ |

116 |

115 |

| Cash

Cost/oz |

872 |

843 |

|

AISC/OZ |

1,085 |

1,067 |

Outlook

- Ongoing cost saving and optimization programs are underway

including overhead reduction, centralizing procurement, fleet

replacement, and improvement of equipment availability and mining

efficiency. A redundancy program totaling approximately 300 people

has already been completed in early Q4-2017.

- Q4 production is expected to remain stable and AISC are

expected to slightly improve following implementation of the

aforementioned cost savings program, as well as the end of the

rainy season.

- Tabakoto is on track to meet the lower-end of the initial

FY-2017 production guidance of 150,000 - 160,000 ounces while AISC

are expected to be above the initial guidance of $950-990/oz.

Baboto North Acquisition

- After quarter-end, Endeavour entered into an agreement with

Randgold Resources Ltd to purchase the Baboto North deposit, which

is adjacent to Endeavour's Kofi C deposit, for $12 million payable

in two tranches. Endeavour expects to initiate mining activities at

Baboto North in late 2018.

ITY MINE

Q3 vs Q2-2017 Insights

- Production decreased due to lower processed grades and recovery

rates, which were partially offset by increased stacked

tonnage.

- Tonnes of ore mined decreased over the previous quarter as

mining activities were slowed due to the rainy season, but

increased over the previous year as a result of improved equipment

availability.

- Mining activities initially focused on the high-grade Bakatouo

deposit early in the quarter. However, due to its low heap leach

recovery rate, a decision was made to preserve Bakatouo for the

upcoming CIL plant (due to better economics from high CIL recovery

rates and lower operating costs). Consequently, mining activities

were shifted to the Zia and Ity Flat pits where only lower grade

areas were accessible on short notice.

- Ore stacked significantly increased despite the rainy season,

due to the softer nature of the Ity Flat laterite ore.

- The stacked grade decreased as a result of the aforementioned

mine plan change, which resulted in lower grade areas being

accessible for mining on short notice.

- Recovery rates decreased as a result of Bakatouo's low heap

leach recovery rate due to its high soluble copper content.

- AISC increased due to higher mining costs and increased

sustaining capital expenditures, which were partially offset by

lower stacking costs.

- Mining unit costs increased from $2.86/t to $5.16/t, following

a similar trend to last year due to increased pumping required

during the rainy season and lower volumes mined.

- Stacking costs decreased from $16.03/t to $14.75/t, despite the

higher cyanide consumption rate associated with the ore processed

from the Bakatouo deposit which was mainly due to greater stacking

volumes.

- Sustaining capital costs increased from $50/oz to $149/oz due

to upgrades in the mining fleet which were allocated over reduced

production.

YTD 2017 vs YTD 2016 Insights

- Production decreased as mining shifted to lower grade deposits,

stacking activities were negatively impacted by wet and sticky ore

from Bakatouo, and the recovery rate returned to normalised

levels.

- While mining and processing costs per tonne decreased, the AISC

increased as fixed costs were allocated over less production.

Table 11: Ity Quarterly

Performance Indicators

| For

The Quarter Ended |

Q3-2017 |

Q2-2017 |

Q3-2016 |

| Tonnes ore mined,

kt |

305 |

374 |

200 |

| Strip ratio (incl.

waste cap) |

2.90 |

4.32 |

3.74 |

| Tonnes stacked, kt |

312 |

243 |

271 |

| Grade, g/t |

1.58 |

2.15 |

1.90 |

| Recovery

rate, % |

74% |

84% |

91% |

| PRODUCTION,

KOZ |

12 |

14 |

15 |

| Cash cost/oz |

933 |

625 |

456 |

|

AISC/OZ |

1,141 |

780 |

724 |

Table 12: Ity YTD

Performance Indicators

| For

The Nine Months Ended |

Sept 30 2017 |

Sept 30 2016 |

| Tonnes ore mined,

kt |

1,008 |

870 |

| Strip ratio (incl.

waste cap) |

3.93 |

4.32 |

| Tonnes stacked, kt |

822 |

878 |

| Grade, g/t |

1.85 |

2.20 |

| Recovery

rate, % |

85% |

94% |

| PRODUCTION,

KOZ |

42 |

58 |

| Cash cost/oz |

762 |

566 |

|

AISC/OZ |

920 |

737 |

Outlook

- In Q4, Ity's production and cost profile is expected to improve

slightly as the grade profile increases.

- The construction of the Ity CIL Project, which commenced in

September, is now the priority on site due to its significant

importance for the Group. This was demonstrated by the published

optimization study which outlined its potential for annual

production of 235koz at AISC below $500/oz over the first 5 years.

As such, if deemed necessary, the current heap leach activities may

be slowed (due to its immaterial production over the construction

period) in favour of quickly advancing the CIL construction.

- Due to the shift away from mining the higher grade Bakatouo

deposit in H2-2017 and greater priority given to the CIL

construction activities, production is expected to fall below the

initial guidance of 75,000 - 80,000 ounces and AISC are expected to

be above the initial guidance of $740-780/oz.

KARMA MINE

Q3 vs Q2-2017 Insights

- Production decreased due to lower grades and tonnage stacked

which was partially offset by higher recovery rates.

- Total tonnes mined remained flat at 3.6Mt, and tonnes of ore

mined decreased as a greater amount of waste was mined at GG2 due

to the mine plan sequencing. As a result, the strip ratio

temporarily increased and is expected to decrease to a normalized

level in Q4-2017.

- Mining activities focused on the GG2 lower-grade deposit as

less tonnes were extracted at the higher-grade Rambo pit where

mining its harder transitional ore has been postponed to Q4-2017

given it is better suited to be stacked with the upgraded crushing

circuit.

- Stacking decreased due to the downtime associated with

commissioning the upgraded crushing circuit, as well as

decommissioning the original circuit.

- Stacked grade decreased as lower quantities of higher-grade

Rambo ore was stacked and low grade stockpiles represented nearly

20% of the total feed (130,000 tonnes at 0.6 grams per tonne).

- Recovery rates increased as less Rambo harder transitional ore

was introduced onto the heap.

- AISC increased as a result of the aforementioned lower grades

and higher strip ratio, in addition to higher unit processing costs

which were partially offset by lower unit mining costs.

- Mining unit costs decreased from $1.96/t to $1.75/t, due to

lower drilling and blasting requirements as a result of mining less

hard ore from the Rambo deposit and less drill grade control due to

mining more waste.

- Stacking costs increased from $9.30/t to $11.25/t, due to lower

volumes stacked and increased cyanide and cement consumption

associated with the GG2 transitional ore.

- Sustaining capital costs increased from $65/oz to $85/oz due to

the aforementioned increased capitalized stripping which were

allocated over fewer ounces sold.

YTD 2017 vs YTD 2016 Insights

- Karma had its first gold pour in Q2-2016. Its year-to-date

financial data is not presented for the pre-commercial production

period up to October 1, 2016.

Table 13: Karma Performance

Indicators*

| For

The Quarter Ended |

Q3-2017 |

Q2-2017 |

Q3-2016 |

| Tonnes ore mined,

kt |

593 |

1,035 |

3,040 |

| Strip ratio (incl.

waste cap) |

5.13 |

2.49 |

3.68 |

| Tonnes stacked, kt |

720 |

852 |

570 |

| Grade, g/t |

0.91 |

1.24 |

1.21 |

| Recovery

rate, % |

87% |

83% |

90% |

| PRODUCTION,

KOZ |

21 |

24 |

20 |

| Cash cost/oz |

786 |

657 |

n.a. |

|

AISC/OZ |

973 |

755 |

n.a. |

Table 14: Karma YTD Performance

Indicators*

| For

The Nine Months Ended |

Sept 30 2017 |

Sept 30 2016 |

| Tonnes ore mined,

kt |

2,678 |

4,730 |

| Strip ratio (incl.

waste cap) |

3.33 |

3.32 |

| Total Tonnes milled,

kt |

2,526 |

927 |

| Grade, g/t |

1.08 |

1.18 |

| Recovery

rate, % |

85% |

90% |

| PRODUCTION,

KOZ |

77 |

33 |

| Cash cost/oz |

694 |

n.a. |

|

AISC/OZ |

811 |

n.a. |

*AISC for the pre-commercial period before

October 1, 2016, not available

Optimization Project Insights

- Plant optimization work has been successfully carried out

during the past year. The newly installed front-end completed its

performance testing and is running at steady-state while the new

ADR plant is expected to be commissioned by mid-November. In

addition, an on-site camp was built.

Outlook

- Q4 profile is expected to slightly improve as the grades are

expected to increase with the higher-grade Rambo ore feed, which is

expected to be however slightly offset by its lower recovery rates

due to its higher transitional and fresh ore content. In addition,

stacking capacity is expected to increase following the upgrades

made to the plant and crushing circuit.

- Karma is on track to meet the initial FY-2017 production

guidance of 100,000 - 110,000 ounces and with AISC expected to be

at the top end of the initial guidance of $750-800/oz.

NZEMA MINE - ASSET HELD FOR SALE

Nzema Sale Insights

- On August 9, Endeavour announced it had agreed to sell its 90%

stake in the non-core Nzema Mine to BCM International Ltd for a

total cash consideration of up to $65m. Under the sale agreement,

BCM will pay Endeavour US$20 million upon closing of the

transaction, with an additional US$45 million in deferred payments

to be made over the remaining current mine life, until 2019, based

upon reaching certain agreed upon milestones related to mine free

cash flow generation.

- The transaction will close following the approval from the

Ghanaian government.

Q3 vs Q2-2017 Insights

- Production increased significantly due to higher processed

grades and increased mill throughput.

- As expected, tonnes of ore mined decreased slightly due to the

rainy season. Following the completion of the Adamus push-back in

H1-2017, mined grades continued to increase.

- Quality control processes for purchased ore established in

H1-2017 led to higher purchased ore grades with a lower

tonnage.

- Mill throughput performed very well, marking a strong increase

as the previous quarter was impacted by an increased proportion of

fresh ore processed.

- The head grade significantly increased as both the mined and

purchased ores contributed to the improvement.

- Recovery rates remained constant.

- AISC decreased by $280/oz mainly due to the aforementioned

higher grades and subsequent increased production.

- The mining costs decreased from $6.45/t to $6.20/t mainly due

to shorter load and haul distances.

- Processing costs increased from $15.88/t to $17.00/t mainly due

to an increase in power and water treatment costs.

- Sustaining capital costs decreased from $36/oz to $34/oz due to

reduced activity on the tailings storage facility lift during the

wet season.

YTD 2017 vs YTD 2016 Insights

- Production significantly increased and AISC significantly

decreased as the mine is benefiting from higher grade ore following

the push-back, and from high-grade purchased ore.

Table 15: Nzema Performance

Indicators

| For

The Quarter Ended |

Q3-2017 |

Q2-2017 |

Q3-2016 |

| Tonnes ore mined,

kt |

310 |

352 |

222 |

| Mined ore grade,

g/t |

2.91 |

2.24 |

2.05 |

| Strip ratio (incl.

waste cap) |

3.30 |

3.01 |

11.83 |

| Purchased ore milled,

kt |

53 |

82 |

141 |

| Purchased ore grade,

g/t |

4.69 |

3.20 |

3.23 |

| Total Tonnes milled,

kt |

368 |

362 |

424 |

| Grade, g/t |

3.39 |

2.46 |

2.40 |

| Recovery

rate, % |

92% |

92% |

82% |

| PRODUCTION,

KOZ |

37 |

27 |

24 |

| Cash cost/oz |

600 |

838 |

1,038 |

|

AISC/OZ |

705 |

985 |

1,136 |

Table 16: Nzema YTD Performance

Indicators

| For

The Nine Months Ended |

Sept 30 2017 |

Sept 30 2016 |

| Tonnes ore mined,

kt |

1,058 |

712 |

| Mined ore grade,

g/t |

2.38 |

1.57 |

| Strip ratio (incl.

waste cap) |

4.14 |

8.00 |

| Purchased ore milled,

kt |

213 |

332 |

| Purchased ore grade,

g/t |

3.51 |

3.11 |

| Total Tonnes milled,

kt |

1,121 |

1,333 |

| Grade, g/t |

2.73 |

1.77 |

| Recovery

rate, % |

93% |

85% |

| PRODUCTION,

KOZ |

91 |

64 |

| Cash cost/oz |

739 |

1,099 |

|

AISC/OZ |

859 |

1,184 |

Outlook

- After a strong Q3, production in Q4 is expected to decrease and

AISC are expected to increase notably due to anticipated lower

grade and recovery rate.

- Nzema is on track to meet the top-end of the initial FY-2017

production guidance of 100,000 - 110,000 ounces and the low-end of

the initial AISC guidance of $895-940/oz.

HOUNDE MINE

- Houndé achieved its first gold pour on October 18, 2017.

- Commercial production was declared on November 1, more than 2

months ahead of schedule following the rapid construction and

ramp-up periods, with nameplate capacity achieved within weeks

following the introduction of ore into the mill on September 25,

2017.

- A successful performance trial over seven days was completed in

late October with all key metrics exceeded: processing rate is

8,600 tonnes per day (105% of nameplate capacity), overall plant

capacity is 96% and the gold recovery rate is 95% - all above

design parameters.

- Construction was completed $15 million below the initial $328

million budget. An additional $21 million has been spent, mainly on

the addition of a 26MW back up power station and fuel farm and to

build a second tailings storage facility.

- No Lost-Time-Injury occurred over the 7-million man hours

worked during the construction period.

- Mining activities are progressing well with nearly 3-months of

feed already stockpiled and positive grade reconciliation against

the resource model being achieved.

- Houndé is expected to produce between 30,000 and 35,000 ounces

at an AISC of $550-600/oz for Q4-2017.

ITY CIL PROJECT UPDATE

- Ity CIL Project Optimization Study was published in September

and demonstrated it will be another flagship asset with a long

14-year mine life, average annual production of 235koz at AISC of

$494/oz over the first 5 years, and an after-tax NPV5% of $710m and

IRR of 40% at $1,250/oz.

- Construction was launched in September as the Houndé

construction team transitioned to Ity.

- Long-lead items have been ordered and $116 million has already

committed.

- The EPCM contracted was award to Lycopodium.

- Construction workforce mobilisation is progressing well.

- Process plant area earthworks progressing well.

- Danane to Ity 90kV OHL corridor compensation estimation in

progress.

KALANA PROJECT UPDATE

- The Avnel transaction was closed on September 18, 2017.

- Following the close of the transaction, Endeavour completed the

integration of Avnel and initiated pre-development activities to

optimize the Kalana Project, which include:

- Ceasing the current small-scale operations and clearing the

underground workings and existing infrastructure to allow for the

development of future open pits, as well as grant access to

exploration.

- Resuming exploration activities on both the Kalana deposit and

nearby targets including Kalanako, with the initial campaign

expected to run until the end of 2018.

- Launching a revised Feasibility Study with the aim to increase

the current plant design capacity to lift the average annual

production and shorten the mine life based on current reserves,

integrate the exploration results from the upcoming drilling

campaign, and leverage Endeavour's construction expertise and

integrate operating synergies.

- Creating dedicated Kalana Project Community Relations and HSE

teams to validate the census and stakeholder mapping, with the aim

of defining a resettlement action plan before relocation activities

commence.

EXPLORATION ACTIVITIES

- In line with Endeavour's strategic exploration focus, the

exploration program increased from $23 million in the first 9

months of 2016 to $37 million in the same period of 2017, with $40

million budgeted for the full year.

Table 17: Exploration

Expenditure (Includes expensed, sustaining and

non-sustaining)

| AREAS

OF FOCUS |

Q3-2017 |

YTDSEPT. 30, 2017 |

FY-2017 INITIAL GUIDANCE |

| Agbaou |

2.0 |

5.1 |

7.0 |

| Tabakoto |

1.4 |

6.6 |

9.0 |

| Ity |

1.8 |

7.7 |

10.0 |

| Karma |

0.5 |

2.2 |

4.0 |

| Houndé |

1.0 |

4.0 |

5.0 |

| Other |

2.4 |

11.6 |

5.0 |

|

Total |

9.2 |

37.2 |

40.0 |

- During the first 9 months, the near-mine exploration

expenditures were focused on Ity, Tabakoto, Agbaou and Karma, in

line with guidance and our Strategic Exploration plan.

- Due to significant exploration success, in particular at Ity,

the FY-2017 budget has been increased to $45 million.

Agbaou

- Exploration activity during the first 9 months amounted to

approximately 31,000 meters drilled out of the 45,000 meters

planned for the year. In addition, several ground geophysics were

acquired.

- The drill program focused on various pit extensions, the Agbaou

south and Niafouta targets, targets on structurally parallel

trends, in addition to exploration targets located within a 20km

range of the processing plant.

- A dedicated deeper drilling program was also initiated in

Q3-2017 targeting Agbaou's at-depth potential.

Karma

- In 2017 a $4 million exploration program totaling approximately

38,500 meters has been planned and approximately 41,000 meters were

effectively drilled during the first nine months.

- During 2017, drilling focused on testing the extensions of the

Rambo, Goulagou and North Kao deposits, as well as the Yabongso

target.

- A maiden Resource is expected to be delineated by year-end,

with the aim of further extending the mine life.

- After quarter-end, Endeavour paid $0.6 million to Golden Rim

Resources Ltd to acquire geological data relating to their

previously owned tenement in proximity to Karma, which Endeavour

recently secured.

Tabakoto

- As Tabakoto operations are characterized by a short-term mine

life, a $9 million exploration program totalling approximately

86,000 meters of drilling on the Tabakoto and Kofi properties has

been planned for 2017, of which 54,000 meters were drilled in the

first nine months of 2017.

- During the first nine months, the Tabakoto open pit program

focused mainly on drilling out the Kreko and Fougala West targets

and on testing exploration targets supported by the ongoing auger

program.

- During the first nine months, underground drilling focused on

testing the eastern side extensions at Segala and the north-east

extensions at Tabakoto, which generated encouraging preliminary

results.

Ity

- In 2017, a $10 million exploration program totalling

approximately 52,500 meters has been planned for the greater Ity

area. Due to the initial success of the program, the 2017

exploration budget was increased to $15 million. During the first

nine months of 2017, some 56,000 meters were drilled, and drilling

is ongoing on the Le Plaque discovery.

- During the first nine months, drilling focused on the Bakatouo,

Mont Ity Flat, Daapleu, and Colline Sud areas. Positive results

were achieved as the Indicated Resource grew by 1.0 million ounces

since the beginning of the year, reaching 3.8 million ounces (as

announced on July 27, 2017).

- The Le Plaque discovery was announced, and a maiden Inferred

Resource is expected by year-end.

- A regional auger campaign is underway and drilling was

initiated at Yacetouo, Vavoua, Daapleu southwest, Bakatouo

northeast targets. On the Toulepleu exploration license, which is

situated to the southwest of the Ity area, a comprehensive gold in

soil program was performed to consolidate and validate the only

existing and very old data available for this area, and a very

preliminary short RC drilling campaign was conducted with results

still being analyzed.

- A large airborne VTEM/Mag/spectro geophysical program totaling

$0.8 million was also acquired in 2017, to better prioritize and

define exploration targets for 2018 and beyond.

Houndé

- Following a two-year period of no exploration drilling,

activities resumed in 2017 with a $5 million program.

- During the first nine months a total of 6,400 meters diamond

drilling, 2,700 meters reverse circulation drilling and 48,300

meters air-core drilling were conducted on:

- Bouere with the aim of increasing the current resource;

- Kari Pump/Sia/Sianikoui (higher grade exploration targets)

which resulted in positive initial results; and

- Grand Espoir, Bombi, Koho and Kari Fault, which resulted in

initial exploration works.

- Work performed also included advanced soil geochemistry, ground

geophysics on selected targets, regolith and geological

mapping.

- After significant effort was concentrated on the Kari area

during H1-2017, our Q4 activity will concentrate on interpreting

all the results and conduct some additional drilling on the

Sia/Sianikoui area.

Greenfields Exploration

- In addition to near-mine activities, greenfield exploration

efforts were initiated on the 80km Greater Ity trend, Houndé, and

other regional exploration properties in Burkina Faso, and pursued

in Côte d'Ivoire.

- Due to exploration success, a total expenditure of $11 million

has been incurred since the beginning of the year compared to an

initial budget of $5 million.

- A detailed review of Endeavour's exploration portfolio was also

conducted, which resulted in some exploration licenses being

dropped, and others applied for or newly awarded, so as to

concentrate our efforts on the most promising areas.

- After the quarter-end, Endeavour and Randgold Resources

established a 30:70 joint venture covering their adjacent

Sissedougou and Mankono exploration properties located in the

northern region of Côte d'Ivoire. A $3.8 million exploration

campaign has been approved for the remainder of 2017 and 2018.

NET FREE CASH FLOW FROM OPERATIONS

DOUBLED

- Year-to-date gold sales from continuing operations totaled

370koz, up from 312koz in the same period in 2016, mainly due to

the addition of the Karma mine.

- The year-to-date realized gold price was $1,214/oz (net of the

impact of the Karma stream) compared to $1,238/oz in the same

period in 2016. Without the stream the year-to-date 2017 realized

gold price would have been $1,251/oz.

- The Group's year-to-date Free Cash Flow (before working

capital, tax, finance cost, and growth projects) decreased by $6

million to $100 million, compared to the same period of 2016, as

increased gold sales were offset by a $12 million increase in

sustaining and non-sustaining exploration expenditures and lower

margins from notably the Tabakoto and Ity mines.

- The working capital variation improved to $18 million in

Q3-2017, from negative $27 million in Q2-2017, with the

year-to-date outflow reduced to $1 million.

- The year-to-date Net Free Cash Flow from Operations increase

from $12 million in 2016 to $59 million in 2017 mainly due a large

negative working capital variation in 2016.

- Growth projects cash outflow was $90 million in Q3-2017

compared to $63 million in Q2-2017 and $221 million for

year-to-date compared to $92 million for year-to-date 2016. The

year-to-date 2017 spend consists of $186 million of Houndé

construction costs, $13 million on the Ity CIL project, and $22

million on Karma optimisation.

- Acquisition of mining interests consists mainly of $54 million

for the purchase of an additional 25% stake in the Ity mine which

was offset by the $8 million inflow of cash acquired upon the Avnel

acquisition.

Table 18: Simplified Cash Flow

Statement

| |

NINE MONTHS ENDED |

| (in US$ million) |

SEPT. 30, 2017 |

|

SEPT. 30, 2016 |

|

GOLD SOLD FROM CONTINUING OPERATIONS, koz |

370 |

|

312 |

|

Gold Price, $/oz |

1,214 |

|

1,238 |

|

REVENUE FROM CONTINUING OPERATIONS |

445 |

|

394 |

|

Total cash costs |

(260) |

|

(190) |

|

Royalties |

(23) |

|

(18) |

|

Corporate costs |

(15) |

|

(15) |

|

Sustaining capex |

(30) |

|

(32) |

|

Sustaining exploration |

(9) |

|

(5) |

|

ALL-IN SUSTAINING COSTS ("AISC") |

(338) |

|

(260) |

| ALL-IN SUSTAINING

MARGIN FROM CONTINUING OPERATIONS |

107 |

|

133 |

|

AISC Margin from asset held for sale |

37 |

|

5 |

|

Less: Non-sustaining capital |

(23) |

|

(20) |

|

Less: Non-sustaining exploration |

(22) |

|

(13) |

|

FREE CASH FLOW BEFORE GROWTH PROJECTS(and before interest,

working capital, tax & financing costs) |

100 |

|

106 |

|

Working capital |

(1) |

|

(49) |

|

Taxes paid |

(16) |

|

(12) |

|

Interest paid |

(19) |

|

(19) |

|

Cash settlements on hedge programs and gold collar premiums |

(4) |

|

(13) |

| NET FREE CASH FLOW

FROM OPERATIONS |

59 |

|

12 |

|

Growth projects |

(221) |

|

(80) |

|

Greenfield exploration expense |

(6) |

|

(4) |

|

Restructuring costs |

(7) |

|

(18) |

|

Acquisition & disposal of mining interests |

(54) |

|

11 |

|

Cash paid on settlement of share appreciation rights, DSUs and

PSUs |

(4) |

|

(2) |

| Net

equity proceeds and dividends to non-controlling interests |

77 |

|

181 |

|

Proceeds (repayment) of long-term debt |

160 |

|

(106) |

|

Proceeds from pre-production gold sales |

- |

|

34 |

|

Other (foreign exchange gains/losses and other) |

(4) |

|

- |

|

CASH INFLOW (OUTFLOW) FOR THE PERIOD |

1 |

|

28 |

Additional notes available in Endeavour's MD&A filed on

Sedar.

BALANCE SHEET AND FINANCING & LIQUIDITY SOURCES

- As expected, the Net Debt position increased from $26 million

as at the end of December 2016, to $221 million as at the end of

September, 2017, mainly due to:

- $221 million spent on growth projects,

- $39 million added from the Houndé financing agreement,

- $54 million for the purchase of an additional 25% stake in the

Ity mine, partially offset by the net equity proceeds of $77

million since the beginning of the year.

- Upon closing of the Avnel acquisition, La Mancha Holding

S.A.R.L. exercised its anti-dilution right via a private placement

of circa $60 million (C$73 million), of which $30 million was

received after quarter-end. The pro-forma Net Debt position, as at

September 2017, inclusive of the private placement received after

quarter-end, stood at $191 million.

- During Q3-2017, Endeavour drew a further $80 million on its

Revolving Credit Facility ("RCF") to fund its growth projects,

increasing the total drawn amount to $300 million.

- During the quarter Endeavour upsized its previous $350 million

RCF to $500 million on improved terms.

- Endeavour is well positioned to fund its growth as its

available sources of financing and liquidity increased from $215

million at the end of June to $325 million at the end of September

comprised of its $125 million cash position and $200 million

undrawn on its upsized RCF. In addition, Endeavour expects to

obtain equipment financing of approximately $60 million for its Ity

CIL Project and expects to receive proceeds from the Nzema

sale.

Table 19: Net Debt Position

| (in US$

million) |

SEPT. 30, 2017 PRO-FORMA2 |

SEPT. 30, 2017 |

JUN. 30, 2017 |

DEC. 30, 2016 |

| Cash1 |

155 |

125 |

85 |

124 |

| Less: Equipment finance

lease |

(46) |

(46) |

(47) |

(10) |

| Less:

Drawn portion of $500 million RCF |

(300) |

(300) |

(220) |

(140) |

| NET

DEBT POSITION |

(191) |

(221) |

(183) |

(26) |

| NET

DEBT / ADJUSTED EBITDA (LTM) RATIO |

0.85 |

0.98 |

0.76 |

0.11 |

Notes: 1September 30, 2017 position includes $28m

of cash held at the Nzema held-for-sale asset.

2Includes La Mancha private placement which closed

after quarter-end.

ADJUSTED NET EARNINGS

- Year-to-date adjusted net earnings of $19 million compare to

$83 million for the same period of 2016.

- Total adjustments of $62 million were made over the 2017

year-to-date period, mainly related to net loss on discontinued

operations, unrealised loss on financial instruments, stock-based

compensation, acquisition and restructuring costs, non-cash

inventory adjustments, and deferred income tax expense.

- Adjusted net earnings attributable to shareholders

amounted to $10 million for the year-to-date, representing an

adjusted net earnings per share of $0.10.

Table 20: Net Earnings and Adjusted

Earnings

| |

Three months ended |

NINE MONTHS ENDED |

| (in US$

million except per share amounts) |

SEPT. 30, 2017 |

JUN. 30, 2017 |

SEPT. 30, 2016 |

|

SEPT. 30, 2017 |

SEPT. 30,2016 |

| TOTAL NET EARNINGS

(LOSS) |

(65) |

22 |

24 |

|

(43) |

17 |

| Less

adjustments (see MD&A non-GAAP section) |

55 |

(8) |

10 |

|

62 |

66 |

| ADJUSTED NET

EARNINGS |

(10) |

14 |

34 |

|

19 |

83 |

| Less

portion attributable to non-controlling interests |

1 |

4 |

10 |

|

8 |

13 |

| ATTRIBUTABLE TO

SHAREHOLDERS |

(11) |

10 |

24 |

|

10 |

69 |

| Divided

by weighted average number of O/S shares |

106 |

96 |

92 |

|

106 |

76 |

|

ADJUSTED NET EARNINGS PER SHARE (BASIC) FROM CONTINUING

OPERATIONS* |

(0.10) |

0.11 |

0.26 |

|

0.10 |

0.91 |

*Net non-cash inventory adjustments per the

adjusted EBITDA have been added in the current and comparative

periods.

CONFERENCE CALL AND LIVE WEBCAST

Management will host a conference call and live

webcast today at 9:00am Toronto time (EST) to discuss the Company's

financial results.

The conference call and live webcast are scheduled today at:

6:00am in Vancouver 9:00am in Toronto and New York 2:00pm in London

10:00pm in Hong Kong and Perth

The live webcast can be accessed through the following

link: https://edge.media-server.com/m6/p/ybkujgsx

Analysts and interested investors are also invited to

participate and ask questions using the dial-in numbers below:

International: +44(0)20 3450 9987North American toll-free: 1877 280

1254UK toll-free: 0800 279 4992

Confirmation code: 5253206

The conference call and webcast will be available for

playback on Endeavour's website.

Click here to add Webcast reminder to Outlook Calendar

Access the live and On-Demand version of the webcast from mobile

devices running iOS and Android:

QUALIFIED PERSONS

Jeremy Langford, Endeavour's Chief Operating

Officer - Fellow of the Australasian Institute of Mining and

Metallurgy - FAusIMM, is a Qualified Person under NI 43-101, and

has reviewed and approved the technical information in this news

release.

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations+44

203 640 8665mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor(416)

206-0118 x.224jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner+44 7974 982

458ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.

Endeavour operates five 6 mines across Côte

d'Ivoire (Agbaou and Ity), Burkina Faso (Houndé, Karma), Mali

(Tabakoto), and Ghana (Nzema) which are expected to produce

630-675koz of gold at an AISC of US$850-895/oz in 2017. Endeavour's

high quality development projects (recently commissioned Houndé,

Ity CIL and Kalana) have the combined potential to deliver an

additional 600koz per year at an AISC well below $700/oz between

2018 and 2020. In addition, its exploration program aims to

discover 10-15Moz of gold by 2021 which represents more than twice

the reserve depletion during the period.

For more information, please

visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Appendix 1: Production and Cost Details by

Mine

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/e2ded7e1-29e5-4878-b6ef-c336b8a07bb4

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/0ab759b3-39c0-46ca-8690-6df0bcb5aba6

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/5e3cc101-8b13-45c7-b05f-9a72fc920fc8

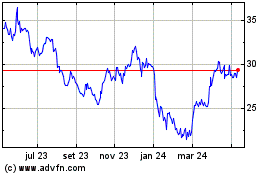

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

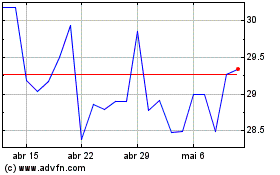

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025