Endeavour Closes the Sale of its Non-Core Nzema Mine

03 Janeiro 2018 - 11:49AM

ENDEAVOUR CLOSES THE SALE OF ITS NON-CORE

NZEMA MINE

View News Release in PDF Format

George Town, January 3, 2018 - Endeavour

Mining Corporation (TSX:EDV OTCQX: EDVMF) ("Endeavour") is pleased

to announce that on December 29, 2017, it completed the sale of its

90% interest in the non-core Nzema Mine in Ghana to BCM

International Ltd ("BCM"), as previously announced on August 9,

2017.

Endeavour received a payment of US$38.5 million

upon closing, corresponding to the first two payments less

adjustments. Additional deferred payments of up to US$25 million

are expected to be received over the course of 2018 and 2019, based

upon reaching certain agreed upon milestones related to mine free

cash flow generation.

ABOUT BCM INTERNATIONAL

BCM International is one of Africa's largest

mining and civil contractors, with offices across eight countries

and a long history in Ghana, where it is headquartered.

BCM International has deep mining expertise,

with in house technical staff capable of taking a mine from

start-up through commissioning and set-up of the technical

disciplines of the mine through to ongoing production.

Their experience gained in Ghana over more than

20 years working with local cultural and business practices,

workforce management, local business relationships, tax and

corporate compliance matters, banking relationships and many other

logistical issues is core to the company's business.

ENDEAVOUR CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 011 2719 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.

Endeavour operates 5 mines across Côte d'Ivoire

(Agbaou and Ity), Burkina Faso (Houndé, Karma), and Mali

(Tabakoto). Endeavour's high-quality development projects (recently

commissioned Houndé, Ity CIL and Kalana) have the combined

potential to deliver an additional 600koz per year at an AISC well

below $700/oz between 2018 and 2020. In addition, its exploration

program aims to discover 10-15Moz of gold by 2021 which represents

more than twice the reserve depletion during the period.

For more information, please visit

www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London

W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/810dccda-1869-4255-a56e-f73b429ea247

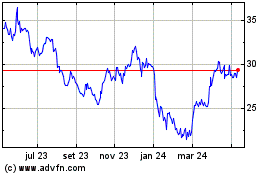

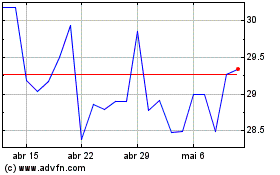

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025