AbraPlata Resource

Corp. (TSX.V:ABRA) (OTC:ABBRF) (Frankfurt:1AH)

("AbraPlata" or the "Company") is pleased to provide an update on

its Diablillos property in Salta Province, Argentina. Having

recently completed a non-brokered private placement of $2 million

(see the Company`s news release dated January 12, 2018), AbraPlata

is in the process of finalizing a Preliminary Economic Assessment

(“PEA”) of its Diablillos silver-gold project, the results of which

are expected to be announced by the end of Q1 2018. In

addition, the Company is preparing plans for 2018 drill testing of

newly identified exploration targets aimed at expanding the mineral

resource base on the property.

“The PEA is expected to demonstrate the

substantial silver and gold production potential of the Diablillos

property as an open pit operation, provide investors with estimates

of the project economics, and provide a road map to the delivery of

a fully permitted project for development by Q3 2019,” commented

Hernan Zaballa, Chairman of AbraPlata. “Moreover, we believe we can

grow the existing mineral resources identified to date, which

currently only includes the main Oculto deposit, by converting

additional near-surface mineralization to resources through the

drilling planned for 2018.”

Preliminary Economic Assessment

The Diablillos PEA is being conducted under the guidance of lead

consultant RPA Inc of Toronto (“RPA”). RPA is being assisted

by GR Engineering Services Ltd of Perth, Western Australia

(“GRES”), and Saxum Engineered Solutions of Argentina (“Saxum”).

The PEA will cover all aspects of the Diablillos

project that would typically be addressed in a scoping study.

RPA is preparing land and permit requirements, geology and

resources (including a new resource estimate for the property), all

mining aspects (including mine design and optimization, mining

methods and equipment, and waste rock disposal procedures), and

Life-of-Mine plan. GRES is providing inputs with respect to

preliminary process design criteria, process flow diagrams, general

arrangement drawings, mechanical equipment lists, material

take-offs, leach pad and tailings storage facility, and supporting

infrastructure (roads, power, water, buildings, etc). Saxum

is responsible for cost estimation and identifying the local

sources of plant and materials. The report will also include

after-tax cash flow forecasts and cash flow sensitivity to key

inputs.

Drilling CampaignA recent

technical review of the Diablillos property together with the

detailed mapping of key outcrop and drill data analysis has defined

three areas on the property that require further drilling with the

objective of converting mineralization into resources. These

areas are:

- The Oculto silver-gold deposit and its immediate environs;

- Satellite deposits surrounding Oculto that are prospective for

silver mineralization; and

- The Northern arc of mineral occurrences located approximately

1,500 metres north of the main Oculto deposit.

The drill campaign is expected to commence in Q2

2018.

Expansion of Oculto Silver and Gold

MineralizationThe Oculto deposit contains all of the

current Indicated Mineral Resources reported on the property to

date. New geological interpretation by the Company indicates

that Oculto has a much stronger structural control element than

previously thought. Most of the structures that control

mineralization trend NE with a steep southeast dip. A secondary set

of control structures strike ESE with steep southerly dips. The

secondary structures have been poorly tested because they are

subparallel to historical drilling. Correlation of the control

structures between surface mapping and drill intersections has

identified numerous areas where high grade silver and gold

mineralization has not been closed off by existing drill

definition. This offers potential for a substantial increase in the

Oculto resource via additional drilling.

Satellite Deposits with Near-Surface

Silver MineralizationDrilling at the satellite deposits of

Fantasma, Alpaca, and Laderas is required to test recently

identified mineralized NE- and ESE-trending mineralized structures

which have been inadequately tested or not been tested at all in

the past. The Company completed approximately 3,000 metres of

drilling at Fantasma in the H2 2017, and this drilling indicted

that mineralization was open to the east and could be linked to the

Oculto deposit. Additional drilling in 2018 is planned to

bring near-surface silver mineralization contained in the satellite

deposits into mineral resources.

Northern Arc TargetsCerro Viejo

Oeste, Cerro del Medio, Pedernales, and Corderos are

geophysical/geochemical targets located in the Northern Arc, which

is located to the north of Oculto on the Diablillos property, and

form part of a structural array dominated by ENE and NW mineralized

structures that dip 70-80 north. The ENE structures are

invariably thicker with better breccia development. Mineralization

in the wider area follows a NW-trending structure and individual

prospects are generally ENE to ESE splays off the main NW trend.

Drilling in 2018 is expected to test the extent of this structure

and the potential for additional satellite deposits in this

area.

Streamlining of Management

StructureIn an effort to reduce costs and conserve

financial resources, the Company has made personnel changes to

eliminate redundancies and streamline its management structure

and wishes to acknowledge, and to express its gratitude

for, the contributions made by the affected individuals.

Deferred compensation and other amounts owing by the Company to

these individuals in connection with the cessation of their

employment in the aggregate amount of $97,500 will be satisfied by

way of the issuance of 414,893 common shares of the Company at a

deemed price of $0.235 per share. The transaction is

subject to approval by the TSX Venture Exchange (the "Exchange").

In compliance with Canadian securities laws and the rules of the

Exchange, the common shares to be issued will be subject to a hold

period of four (4) months.

Qualified PersonWillem Fuchter,

PhD PGeo, President & CEO of AbraPlata Resource Corp. and a

qualified person as defined by National Instrument 43-101 Standards

of Disclosure for Mineral Projects, has reviewed and approved the

scientific and technical information contained in this news

release.

About AbraPlataAbraPlata is a

junior mining exploration company focused on delivering shareholder

returns by unlocking mineral value in Argentina. The

Company's experienced management team has assembled an outstanding

portfolio of gold, silver and copper exploration assets, and is

focused on advancing its flagship Diablillos silver-gold property,

with an Indicated Mineral Resource containing 81.3M oz Ag and 755k

oz Au, through the various stages of feasibility. In

addition, AbraPlata owns the highly prospective Cerro Amarillo

property with its cluster of five mineralized Cu-(Mo-Au) porphyry

intrusions located in a mining camp hosting the behemoth El

Teniente, Los Bronces, and Los Pelambres porphyry Cu-Mo deposits.

Further exploration work is also planned for the Company’s Samenta

porphyry Cu-Mo property south of First Quantum’s TacaTaca project

as well as its Aguas Perdidas Au-Ag epithermal property.

ON BEHALF OF THE BOARD ABRAPLATA RESOURCE

CORP."Willem Fuchter"Willem Fuchter President & Chief

Executive Officer

For further information concerning this news

release, please contact:

| Willem Fuchter |

|

|

Rob Bruggeman |

| President & Chief

Executive Officer |

|

|

Investor

Relations |

| AbraPlata Resource

Corp. |

|

|

AbraPlata Resource

Corp. |

| Tel:

+54.11.5258.0920 |

|

|

Tel:

+1.416.884.3556 |

| E-mail:

willem@abraplata.com |

|

|

Email:

rob@abraplata.com |

| |

|

|

|

This news release includes certain "forward-looking statements"

under applicable Canadian securities legislation. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable, are subject to known

and unknown risks, uncertainties, and other factors which may cause

the actual results and future events to differ materially from

those expressed or implied by such forward-looking statements. All

statements that address future plans, activities, events or

developments that the Company believes, expects or anticipates will

or may occur are forward-looking information. There can be no

assurance that such statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information about AbraPlata and its

projects, please visit the Company’s website at

www.abraplata.com.

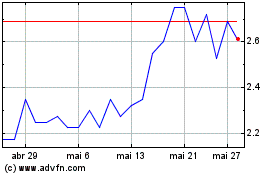

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024