ENDEAVOUR MINING

CORPORATION PRICES PRIVATE OFFERING OF USD 300 MILLION OF

CONVERTIBLE SENIOR NOTES DUE 2023

View News Release in PDF Format

George Town, January 30, 2018 -

Endeavour Mining Corporation (TSX: EDV) (the "Company") announced

today that it has priced the private placement of convertible

senior notes due 2023 (the "Notes") for an aggregate principal

amount of USD 300 million. The Company has also granted to the

initial purchasers a 30-day option, post pricing date, to purchase

additional Notes in an aggregate principal amount of up to USD 30

million.

The Notes, with a minimum principal amount

denomination of USD 200,000 each, will be issued at par with a

coupon of 3.00 per cent per annum. The initial conversion rate is

41.8363 of the Company's ordinary shares ("Shares") per USD 1,000

principal amount of Notes, or an initial conversion price of

approximately USD 23.90 per Share, representing a conversion

premium of approximately 32.5 per cent to today's VWAP on the

Toronto Stock Exchange, converted at the fixed exchange rate of USD

1.00 = CAD 1.23280 determined at 4 p.m. on the date of this press

release.

The Notes will bear interest semi-annually and

will mature on February 15, 2023, unless earlier redeemed,

repurchased or converted in accordance with their terms. The

Company may, subject to certain conditions, elect to satisfy the

principal amount due at maturity or upon redemption through the

payment or delivery of a combination of Shares and, if applicable,

cash.

Settlement is expected on or around February 5,

2018. The Company has applied for the Notes to list and trade on

The International Stock Exchange (formerly the Channel Islands

Securities Exchange) and undertakes to have the Notes listed on

such exchange, or another internationally recognized, regularly

operating, regulated or non-regulated stock exchange or securities

market, as soon as reasonably practicable but no later than April

30, 2018.

The Company estimates that the net proceeds from

this Offering will be approximately $296.3 million (or

approximately $325.9 million if the Initial Purchasers fully

exercise their option to purchase additional Notes), after

deducting the Initial Purchasers' transaction fees but before the

Company's other expenses from the Offering. The Company expects to

use the net proceeds for refinancing of indebtedness and other

general corporate purposes. Lenders in respect of the indebtedness

being refinanced may include the Bookrunners.

In the context of the Offering, the Company has

agreed to a lock-up undertaking for a period of 90 calendar days

from the date of this press release, subject to customary

exceptions.

Endeavour Mining Corporation

27 Hospital Road, George Town, Grand Cayman

KY1-9008

ISIN: KYG3040R1589

Toronto Stock Exchange

IMPORTANT NOTE

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the Notes or any

Shares issuable upon conversion of the Notes, nor shall there be

any offer or sale of the Notes or any such Shares in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction. Any offers

of the Notes will be made only by means of a private offering

memorandum. The Notes being offered have not been approved or

disapproved by any regulatory authority, nor has any such authority

passed upon the accuracy or adequacy of the applicable private

offering memorandum.

The offer and sale of the Notes and the Shares,

if any, due upon conversion have not been, and will not be,

registered under the U.S. Securities Act of 1933, as amended (the

"U.S. Securities Act"), or the securities laws of any other

jurisdiction, and the Notes will be offered and sold:

(i) outside the United States in reliance

on Regulation S under the U.S. Securities Act ("Regulation S");

or

(ii) to qualified institutional buyers

("QIBs") in reliance on the exemption from registration provided by

Rule 144A under the U.S. Securities Act ("Rule 144A").

In member states of the European Economic Area,

this press release is for distribution only to and directed only at

persons who are "qualified investors" within the meaning of

Directive 2003/71/EC (and amendments thereto, including Directive

2010/73/EU) (the "Prospectus Directive"). In relation to each

member state of the European Economic Area that has implemented the

Prospectus Directive (each, a "Relevant Member State"), the

investment contemplated by this press release is not being made,

and will not be made, to the public in that Relevant Member State,

other than to any legal entity that is a "qualified investor" as

defined in Article 2(1)(e) of the Prospectus Directive. Each

potential investor located within a Relevant Member State of the

European Economic Area will be deemed to have represented,

acknowledged and agreed that it is a "qualified investor" within

the meaning of Article 2(1)(e) of the Prospectus Directive.

Within the United Kingdom, this press release is

for distribution only to and directed only at persons who (a) have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the "Financial

Promotion Order"), (b) are persons falling within Article 49(2)(a)

to (d) ("high net worth companies, unincorporated associations,

etc") of the Financial Promotion Order and (c) are persons to whom

an invitation or inducement to engage in investment activity

(within the meaning of section 21 of the Financial Services and

Markets Act 2000) in connection with the investment may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to as "relevant persons"). The

investment is not being offered to the public in the United

Kingdom. This press release is directed only at relevant

persons and must not be acted on or relied on by persons who are

not relevant persons. The investment or investment activity

to which this press release relates is only available to, and will

only be engaged in with, relevant persons and any person who

receive this press release who is not a relevant person should not

rely or act upon it.

Solely for the purposes of the product

governance requirements contained within: (a) EU Directive

2014/65/EU on markets in financial instruments, as amended ("MiFID

II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU)

2017/593 supplementing MiFID II; and (c) local implementing

measures (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the MIFID II Product Governance Requirements)

may otherwise have with respect thereto, the Notes have been

subject to a product approval process, which has determined that:

(i) the target market for the Notes is eligible counterparties and

professional clients only, each as defined in MiFID II; and (ii)

all channels for distribution of the Notes to eligible

counterparties and professional clients are appropriate. Any person

subsequently offering, selling or recommending the Notes (a

"distributor") should take into consideration the manufacturers'

target market assessment; however, a distributor subject to MiFID

II is responsible for undertaking its own target market assessment

in respect of the Notes (by either adopting or refining the

manufacturers' target market assessment) and determining

appropriate distribution channels.

The target market assessment is without

prejudice to the requirements of any contractual or legal selling

restrictions in relation to any offering of the Notes

For the avoidance of doubt, the target market

assessment does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of MiFID II; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

the Notes.

The Notes are not intended to be offered or sold

and should not be offered or sold to any retail investor in the

European Economic Area ("EEA"). For these purposes, a retail

investor means a person who is one (or more) of: (i) a retail

client as defined in point (11) of Article 4(1) of MiFID II; or

(ii) a customer within the meaning of Directive 2002/92/EC (as

amended, the "Insurance Mediation Directive"), where that customer

would not qualify as a professional client as defined in point (10)

of Article 4(1) of MiFID II; or (iii) not a qualified investor as

defined in Directive 2003/71/EC (as amended, the "Prospectus

Directive"). Consequently, no key information document required by

Regulation (EU) No 1286/2014 (as amended, the "PRIIPS Regulation")

for offering or selling the Notes or otherwise making them

available to retail investors in the EEA has been prepared and

therefore offering or selling the Notes or otherwise making them

available to any retail investor in the EEA may be unlawful under

the PRIIPS Regulation.

Notes sold in the Canadian provinces of British

Columbia, Alberta, Ontario and Quebec will be subject to further

restrictions as described in the Canadian Offering

Memorandum. Please refer to the Offering Memorandum for

additional information regarding resale restrictions applicable to

the Notes.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking

statements including, among other things, statements relating to

the timing of the proposed offering and expected use of proceeds

from the offering. These forward-looking statements are made

pursuant to the safe harbour provisions of the Private Securities

Litigation Reform Act of 1995. These statements involve risks and

uncertainties that could cause actual results to differ materially,

including, but not limited to, whether or not the Company will

offer the Notes or consummate the offering, the final terms of the

offering, prevailing market conditions, the anticipated principal

amount of the Notes, which could differ based upon market

conditions, the anticipated use of the proceeds of the offering,

which could change as a result of market conditions or for other

reasons, and the impact of general economic, industry or political

conditions in the United States or internationally. Readers should

carefully review this release and should not place undue reliance

on the Company's forward-looking statements. These forward-looking

statements were based on information, plans and estimates as of the

date of this release.

The Company assumes no obligation to, and does

not currently intend to, update any such forward-looking statements

after the date of this release.

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/897b1d15-8712-4ddd-ab25-d0c35b56cc52

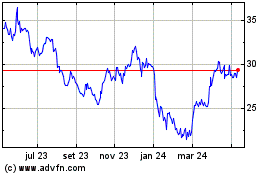

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

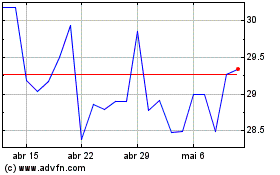

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025