Endeavour Mining Announces Closing of the Private Placement of Convertible Senior Notes

06 Fevereiro 2018 - 8:25PM

ENDEAVOUR MINING ANNOUNCES CLOSING OF THE

PRIVATE PLACEMENT OF CONVERTIBLE SENIOR NOTES

View News Release in PDF Format

George Town, February 6, 2018

- Endeavour Mining Corporation (TSX: EDV) announces that

it has closed the previously announced private placement of

convertible senior notes due 2023 (the "Notes") for an aggregate

principal amount of USD 300 million. In addition, the initial

purchasers exercised today the over-allotment option, for an

aggregate principal amount of USD 30 million, which is

expected to close on or about February 8, 2018.

IMPORTANT NOTE

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the Notes or any

shares issuable upon conversion of the Notes. The offer and sale of

the Notes and the shares, if any, due upon conversion have not

been, and will not be, registered under the U.S. Securities Act of

1933, as amended (the "U.S. Securities Act"), or the securities

laws of any other jurisdiction, and the Notes and the shares, if

any, due upon conversion may not be offered or sold in the United

States absent registration or an exemption from registration. There

will be no public offering of the Notes, or the shares, if any, due

upon conversion in the United States.

Solely for the purposes of the product

governance requirements contained within: (a) EU Directive

2014/65/EU on markets in financial instruments, as amended ("MiFID

II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU)

2017/593 supplementing MiFID II; and (c) local implementing

measures (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the MIFID II Product Governance Requirements)

may otherwise have with respect thereto, the Notes have been

subject to a product approval process, which has determined that:

(i) the target market for the Notes is eligible counterparties and

professional clients only, each as defined in MiFID II; and (ii)

all channels for distribution of the Notes to eligible

counterparties and professional clients are appropriate. Any person

subsequently offering, selling or recommending the Notes (a

"distributor") should take into consideration the manufacturers'

target market assessment; however, a distributor subject to MiFID

II is responsible for undertaking its own target market assessment

in respect of the Notes (by either adopting or refining the

manufacturers' target market assessment) and determining

appropriate distribution channels.

The target market assessment is without

prejudice to the requirements of any contractual or legal selling

restrictions in relation to any offering of the Notes

For the avoidance of doubt, the target market

assessment does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of MiFID II; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

the Notes.

The Notes are not intended to be offered or sold

and should not be offered or sold to any retail investor in the

European Economic Area ("EEA"). For these purposes, a retail

investor means a person who is one (or more) of: (i) a retail

client as defined in point (11) of Article 4(1) of MiFID II; or

(ii) a customer within the meaning of Directive 2002/92/EC (as

amended, the "Insurance Mediation Directive"), where that customer

would not qualify as a professional client as defined in point (10)

of Article 4(1) of MiFID II; or (iii) not a qualified investor as

defined in Directive 2003/71/EC (as amended, the "Prospectus

Directive"). Consequently, no key information document required by

Regulation (EU) No 1286/2014 (as amended, the "PRIIPS Regulation")

for offering or selling the Notes or otherwise making them

available to retail investors in the EEA has been prepared and

therefore offering or selling the Notes or otherwise making them

available to any retail investor in the EEA may be unlawful under

the PRIIPS Regulation.

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

DFH

Public Affairs in Toronto John Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in London Carole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/fae11d76-f77a-4122-9243-d737db6453ac

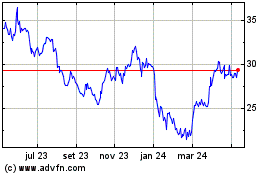

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

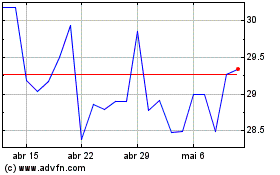

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025