Valeura Announces Increase to Previously Announced Bought Deal Financing to $60 Million

08 Fevereiro 2018 - 2:42PM

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE

SERVICES OR FOR DISSEMINATION IN THE U.S.

Valeura Energy Inc. ("Valeura" or the "Corporation") (TSX:VLE) is

pleased to announce that, in connection with its previously

announced bought deal financing, Valeura and the syndicate of

underwriters led by GMP FirstEnergy and including Cormark

Securities Inc. (collectively, the "Underwriters"), have agreed to

increase the size of the financing (the "Offering"). Valeura will

now issue 10,527,000 common shares at $5.70 per common share for

aggregate gross proceeds of approximately $60 million.

The Corporation expects to use the net proceeds

of the Offering to fund the continued appraisal of its

basin-centered gas play in Turkey and for general corporate

purposes.

The Offering will be made in each of the

provinces of Canada, except Quebec, by way of short form

prospectus. The Offering is scheduled to close on or about March 1,

2018.

ABOUT THE CORPORATION

Valeura Energy Inc. is a Canada-based public

company currently engaged in the exploration, development and

production of petroleum and natural gas in Turkey.

Forward Looking Statements and

Cautionary Statements

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any state in the United

States in which such offer, solicitation or sale would be unlawful.

The securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements. This press release may contain statements within the

meaning of safe harbour provisions as defined under securities laws

and regulations.

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur. Forward-looking information in this press release may

include, but is not limited to, information with respect to: the

timing and completion of the Offering, the use of proceeds of the

Offering; and continued operations in Turkey. Forward-looking

statements are based on the current expectations and opinions of

management at the date the statements are made and are subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements. The Corporation cannot

assure that actual results will be consistent with these

forward-looking statements. They are made as of the date hereof and

are subject to change and the Corporation assumes no obligation to

revise or update them to reflect new circumstances, except as

required by law. Prospective investors should not place undue

reliance on forward looking statements. The statements herein are

made on the basis of certain assumptions, including the performance

of the Underwriters’ obligations in relation to the Offering and

the timely receipt of any required approvals. A number of risk

factors could cause actual results to differ materially from those

anticipated by the Corporation, including but not limited to the

Underwriters’ failure to perform their obligations under the

Offering, the inability delays in closing the Offering, the

determination by the board of directors to use the proceeds of the

Offering for purposes other than as noted in this press release,

risks associated with the oil and natural gas industry, risks

associated with negotiating with foreign governments as well as

country risk associated with conducting international activities,

and other factors, many of which are beyond the control of the

Corporation. The material risk factors affecting the Corporation

and its business are contained in the Corporation’s Annual

Information Form which is available under Valeura’s issuer profile

on SEDAR at www.sedar.com.

Additional information relating to Valeura is

also available on SEDAR at www.sedar.com.

Sean Guest, President & CEOValeura Energy Inc.(403)

930-1172sguest@valeuraenergy.com

Steve Bjornson, CFOValeura Energy Inc.(403)

930-1151sbjornson@valeuraenergy.com

www.valeuraenergy.com

Neither the Toronto Stock Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

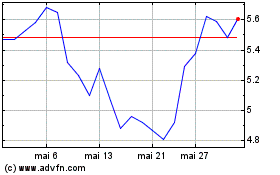

Valeura Energy (TSX:VLE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Valeura Energy (TSX:VLE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025