Touchstone Exploration Inc. (“Touchstone” or the “Company”)

(TSX:TXP) (LSE:TXP) announces the results of its independent

year-end 2017 reserves evaluation. Reserve numbers provided herein

were derived from an independent reserves report (the “Reserves

Report”) prepared by GLJ Petroleum Consultants Ltd. (“GLJ”)

effective December 31, 2017.

All currency amounts are in Canadian dollars

unless otherwise stated. The financial information contained herein

is based on the Company’s unaudited expected results for the year

ended December 31, 2017 and is subject to change.

The Company expects to release an operational

update next week and 2017 year-end results on March 27, 2018.

2017 Year-end Reserve Report

Highlights

- The Company increased proved reserves (“1P”) by 20% or 1,756

Mbbl after production and increased proved plus probable reserves

(“2P”) by 18% or 2,837 Mbbl after production.

- The increase in reserves replaced production by 450% on a 1P

basis and 665% on a 2P basis.

- The Company’s December 31, 2017 net present value of future net

revenues before tax (discounted at 10 percent) was $407.9 million

($210.5 million on a 1P basis).

- December 31, 2017 net present value of future net revenues

after tax (discounted at 10 percent) was $156.7 million ($83.5

million on a 1P basis).

- Future development costs (“FDC”) associated with a portion of

the Company’s internally identified drilling location inventory and

portfolio of low risk recompletion projects totaled $57.8 million

for 1P and $85.3 million for both 2P.

- Finding and development costs (including changes in FDC) were

$7.66 for 1P and $6.33 for 2P. Using the Company’s estimated 2017

operating netback of $24.23 per barrel, the 1P recycle ratio was

3.2 times, and the 2P recycle ratio was 3.8 times.

- The Company’s asset base remains conservatively booked, with 1P

assigned 62 drilling locations (30% of the Company’s identified

drilling inventory) and 2P assigned 90 drilling locations (43% of

the Company’s identified drilling inventory).

2017 Year-end Reserves

Summary

Touchstone’s year-end crude reserves in Trinidad

were evaluated by independent reserves evaluator GLJ in accordance

with definitions, standards and procedures contained in the

Canadian Oil and Gas Evaluation Handbook and National Instrument

51-101 Standards of Disclosure for Oil and Gas Activities (“NI

51-101”). Additional reserves information as required under NI

51-101 will be included in the Company’s Annual Information Form,

which will be filed on SEDAR on or before March 31, 2018. The

reserves estimates set forth below are based upon GLJ’s Reserve

Report dated March 7, 2018. All values in this press release are

based on GLJ’s forecast prices and estimates of future operating

and capital costs as at December 31, 2017.

In certain tables set forth below, the columns

may not add due to rounding. Possible reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10 percent probability that the quantities

actually recovered will equal or exceed the sum of proved plus

probable plus possible reserves.

Summary of Gross Oil Reserves as of

December 31, 2017 by Product Type(1),(2)

|

Reserves Category |

|

|

Light and Medium Oil(Mbbl) |

Heavy Oil(Mbbl) |

Total

OilEquivalent(Mbbl) |

| |

|

|

|

|

|

|

Proved |

|

|

|

|

|

|

Developed Producing |

|

|

4,017 |

571 |

4,588 |

|

Developed Non-Producing |

|

|

781 |

213 |

994 |

|

Undeveloped |

|

|

4,594 |

558 |

5,152 |

|

Total Proved |

|

|

9,391 |

1,342 |

10,733 |

|

|

|

|

|

|

|

|

Probable |

|

|

7,058 |

744 |

7,802 |

|

Total Proved plus Probable |

|

|

16,450 |

2,086 |

18,535 |

|

|

|

|

|

|

|

|

Possible |

|

|

5,297 |

624 |

5,921 |

| Total Proved plus Probable plus

Possible |

|

21,747 |

2,710 |

24,456 |

|

Notes: |

|

| (1) |

Gross

Reserves are the Company's working interest share of the remaining

reserves before deduction of any royalties. |

| (2) |

See

“Advisories: Oil and Natural Gas Reserves”. |

Summary of Net Present Values of Future Net Revenue as

of December 31, 2017(1),(2)

| Reserves Category |

Net Present Values of Future Net Revenues

Before Income Taxes Discounted at (% per year)

($000’s) |

| 0% |

5% |

10% |

15% |

20% |

| |

|

|

|

|

|

|

Proved |

|

|

|

|

|

|

Developed Producing |

114,771 |

79,682 |

62,994 |

53,032 |

46,294 |

|

Developed Non-Producing |

53,820 |

44,682 |

37,912 |

32,742 |

28,692 |

|

Undeveloped |

195,543 |

140,798 |

109,612 |

88,523 |

73,281 |

|

Total Proved |

364,134 |

265,163 |

210,518 |

174,297 |

148,268 |

|

|

|

|

|

|

|

|

Probable |

393,087 |

265,708 |

197,411 |

154,840 |

125,856 |

|

Total Proved plus Probable |

757,221 |

530,871 |

407,929 |

329,136 |

274,124 |

|

|

|

|

|

|

|

|

Possible |

323,132 |

188,257 |

132,408 |

102,272 |

83,287 |

|

Total Proved plus Probable plus Possible |

1,080,353 |

719,128 |

540,337 |

431,408 |

357,411 |

| Reserves Category |

Net Present Values of Future Net Revenues

After Income Taxes(3) Discounted at (% per year)

($000’s) |

| 0% |

5% |

10% |

15% |

20% |

| |

|

|

|

|

|

|

Proved |

|

|

|

|

|

|

Developed Producing |

48,259 |

37,339 |

31,670 |

28,047 |

25,452 |

|

Developed Non-Producing |

19,282 |

16,114 |

13,779 |

12,002 |

10,614 |

|

Undeveloped |

69,483 |

49,554 |

38,035 |

30,218 |

24,574 |

|

Total Proved |

137,024 |

103,007 |

83,484 |

70,267 |

60,640 |

|

|

|

|

|

|

|

|

Probable |

141,383 |

97,435 |

73,214 |

57,881 |

47,356 |

|

Total Proved plus Probable |

278,406 |

200,442 |

156,698 |

128,148 |

107,996 |

|

|

|

|

|

|

|

|

Possible |

113,175 |

69,477 |

50,329 |

39,691 |

32,888 |

|

Total Proved plus Probable plus Possible |

391,581 |

269,919 |

207,027 |

167,839 |

140,884 |

| Notes: |

|

| (1) |

Based on GLJ’s December

31, 2017 escalated price forecast. See “Summary of Pricing,

Inflation and Foreign Exchange Assumptions”. |

| (2) |

See “Advisories: Oil

and Natural Gas Reserves”. |

| (3) |

Income taxes include

all resource income, appropriate income tax calculations per

current Republic of Trinidad and Tobago tax regulations and

estimated December 31, 2017 consolidated tax pools and non-capital

losses. |

Summary of Pricing, Inflation and

Foreign Exchange Assumptions

The following table sets forth the benchmark

reference prices, inflation and foreign exchange rates reflected in

the Reserves Report.

|

Forecast Year |

NYMEX WTI at Cushing, Oklahoma

(US$/bbl)(1) |

Brent Blend FOB North Sea

(US$/bbl)(1) |

Inflation Rate (%/year)(2) |

US$/C$ Exchange Rate(3) |

|

|

|

|

|

|

| 2018 |

59.00 |

65.50 |

2.0 |

0.79 |

| 2019 |

59.00 |

63.50 |

2.0 |

0.79 |

| 2020 |

60.00 |

63.00 |

2.0 |

0.80 |

| 2021 |

63.00 |

66.00 |

2.0 |

0.81 |

| 2022 |

66.00 |

69.00 |

2.0 |

0.82 |

| 2023 |

69.00 |

72.00 |

2.0 |

0.83 |

| 2024 |

72.00 |

75.00 |

2.0 |

0.83 |

| 2025 |

75.00 |

78.00 |

2.0 |

0.83 |

| 2026 |

77.33 |

80.33 |

2.0 |

0.83 |

| 2027 |

78.88 |

81.88 |

2.0 |

0.83 |

| Thereafter % change per

year |

2.0% |

2.0% |

Nil |

Nil |

|

|

|

|

|

|

| Notes: |

|

| (1) |

This summary table

identifies benchmark reference pricing schedules that might apply

to a reporting issuer. Product sales prices will reflect these

reference prices with further adjustments for quality differentials

and transportation to point of sale. |

| (2) |

Inflation rates for

forecasting pricing and costs. |

| (3) |

Exchange rates used to

generate the benchmark reference prices in this table. |

Reconciliation of Changes in Gross

Reserves(1),(2)

|

Factors |

|

Total Proved Reserves (Mbbl) |

Total Proved plus Probable Reserves

(Mbbl) |

|

|

|

|

|

|

December 31, 2016 |

|

8,977 |

15,698 |

|

Extensions and improved recovery |

|

1,880 |

3,256 |

|

Technical revisions |

|

386 |

110 |

|

Economic factors |

|

(8) |

(26) |

|

Production |

|

(502) |

(502) |

|

December 31, 2017 |

|

10,733 |

18,535 |

|

Reserves replacement ratio (%)(3) |

|

450 |

665 |

| Notes: |

|

| (1) |

Gross Reserves are the

Company's working interest share of the remaining reserves before

deduction of any royalties. |

| (2) |

See “Advisories: Oil

and Natural Gas Reserves”. |

| (3) |

Reserves replacement

ratio is calculated as net increase to reserves divided by 2017

average production of 502 Mbbl. See “Advisories: Oil and Gas

Metrics”. |

Future Development Costs

The following table provides information

regarding the development costs deducted in the estimation of the

Company’s future net revenue using forecast prices and costs as

included in the Reserves Report.

|

Year |

|

Total Proved Reserves ($000’s) |

Total Proved plus Probable Reserves ($000’s) |

| |

|

|

|

| 2018 |

|

10,400 |

13,170 |

| 2019 |

|

18,039 |

23,633 |

| 2020 |

|

18,020 |

25,703 |

| 2021 |

|

11,384 |

22,780 |

|

Thereafter |

|

- |

- |

| Total

undiscounted |

|

57,842 |

85,287 |

|

Total discounted at 10% per year |

|

47,906 |

69,615 |

Reserve Life Index by Reserves

Category(1),(2)

The Company reduced its December 31, 2017 2P

reserve life index by 19% from year-end 2016 from 24.0 years to

20.2 years. The following table provides the reserve life index by

reserves category as included in the Reserves Report.

|

Reserves Category |

|

|

Gross Reserves Volume (Mbbl) |

Reserve Life(years) |

Reserve Life Index (years) |

| |

|

|

|

|

|

| Total

Proved |

|

|

10,733 |

50.0 |

14.2 |

|

Total Probable |

|

|

7,802 |

50.0 |

48.7 |

|

Total Proved plus Probable |

|

|

18,535 |

50.0 |

20.2 |

|

Notes: |

|

| (1) |

Gross

Reserves are the Company's working interest share of the remaining

reserves before deduction of any royalties. |

| (2) |

See

“Advisories: Oil and Gas Metrics”. |

Estimated Company Gross Reserve Metrics(1)

|

|

Total Proved Reserves |

Total Proved plus Probable

Reserves |

|

|

|

|

| Exploration capital

expenditures ($000’s)(2),(3) |

1,183 |

1,183 |

| Development capital

expenditures ($000’s)(2),(3) |

6,960 |

6,960 |

| Change in

future development costs ($000’s) |

9,142 |

12,986 |

|

Estimated finding and development costs(4) |

17,285 |

21,129 |

|

Net reserve additions (Mbbl)(4) |

2,258 |

3,339 |

|

Estimated finding and development costs per barrel

($/bbl)(4) |

7.66 |

6.33 |

|

Estimated 2017 operating netback

($/bbl)(2),(5) |

24.23 |

24.23 |

|

Estimated recycle ratio(4) |

3.2x |

3.8x |

|

Notes: |

|

| (1) |

Gross

Reserves are the Company's working interest share of the remaining

reserves before deduction of any royalties. |

| (2) |

Financial

information is based on the Company’s preliminary 2017 unaudited

financial statements and is therefore subject to audit.

Accordingly, unaudited capital expenditure amounts and operating

netbacks used in the calculation of finding and development costs

and recycle ratios are Management’s estimate and are subject to

change. |

| (3) |

Exploration

and development capital excludes capitalized general and

administration costs and corporate asset expenditures. See

“Advisories: Oil and Gas Metrics”. |

| (4) |

See

“Advisories: Oil and Natural Gas Reserves” and “Advisories: Oil and

Gas Metrics”. |

| (5) |

See

“Non-GAAP Measures”. |

Advisories

Forward-Looking Statements

Certain information provided in this press

release may constitute forward-looking statements within the

meaning of applicable securities laws. Forward-looking information

in this press release may include, but is not limited to,

statements relating to estimated crude oil reserves, current field

estimated production, the potential undertaking, timing, locations

and costs of future well drilling, the quality and quantity of

prospective hydrocarbon accumulations as indicated by wireline

logs, drilling location inventory, future development costs

associated with crude oil reserves, and sufficiency of resources to

fund operations. Although the Company believes that the

expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Because

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company’s Annual

Information Form dated March 21, 2017 which has been filed on SEDAR

and can be accessed at www.sedar.com. The forward-looking

statements contained in this press release are made as of the date

hereof; and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

Statements relating to reserves are by their

nature forward-looking statements, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves and resources described exist in the quantities predicted

or estimated, and can be profitably produced in the future. The

recovery and reserve estimates of Touchstone’s reserves provided

herein are estimates only, and there is no guarantee that the

estimated reserves will be recovered. Consequently, actual results

may differ materially from those anticipated in the forward-looking

statements.

Oil and Natural Gas

Reserves

The disclosure in this press release summarizes

certain information contained in the Reserves Report but represents

only a portion of the disclosure required under NI 51-101. Full

disclosure with respect to the Company’s reserves as at December

31, 2017 will be contained in the Company’s Annual Information Form

for the year ended December 31, 2017 which will be filed on SEDAR

on or before March 31, 2018. All evaluations and reviews of future

net revenues are stated prior to any provision for finance expenses

or general and administrative costs and after the deduction of

estimated future capital expenditures and estimated future well

abandonment costs. It should not be assumed that the present worth

of estimated future net revenues presented in the tables above

represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be

attained, and variances could be material. The recovery and

reserves estimates of crude oil provided herein are estimates only,

and there is no guarantee that the estimated reserves will be

recovered. Actual crude oil reserves may be greater than or less

than the estimates provided herein.

GLJ has forecast reserve volumes and future cash

flows based upon current and historical well performance through to

the economic production limit of individual wells. Notwithstanding

established precedence and contractual options for the continuation

and renewal of the Company’s existing operating agreements, in many

cases the forecast economic limit of individual wells is beyond the

current term of the relevant operating agreements.

Oil and Gas Metrics

This press release contains certain oil and gas

metrics that are commonly used in the oil and gas industry such as

reserves additions, reserves replacement ratio, reserve life index,

finding and development costs, and recycle ratio. These metrics do

not have standardized meanings or standardized methods of

calculation and therefore such measures may not be comparable to

similar measures presented by other companies. Such metrics have

been included herein to provide readers with additional metrics to

evaluate the Company’s performance; however, such measures are not

reliable indicators of the future performance of the Company, and

future performance may not compare to the performance in prior

periods and therefore such metrics should not be unduly relied

upon. The Company uses these oil and gas metrics for its own

performance measurements and to provide shareholders with measures

to compare the Company’s operations over time. Readers are

cautioned that the information provided by these metrics, or that

can be derived from the metrics presented in this press release,

should not be relied upon for investment purposes.

Net reserve additions are calculated as the

change in reserves from the beginning to the end of the applicable

period excluding period production. Reserves replacement ratio is

calculated as period net reserve additions divided by period

production. Reserve life index is calculated as total Company gross

reserves divided by annual production.

Finding and development costs are the sum of

capital expenditures excluding capitalized general and

administrative costs and corporate capital expenditures incurred in

the period and the change in future development costs required to

develop those reserves. The Company’s annual audit of its December

31, 2017 consolidated financial statements is not complete.

Accordingly, unaudited capital expenditure amounts used in the

calculation of finding and development costs are Management’s

estimate and are subject to change. Finding and development costs

per barrel is determined by dividing current period net reserve

additions to the corresponding period’s finding and development

cost. The aggregate of the exploration and development costs

incurred in the most recent financial year and the change during

that year in estimated future development costs generally will not

reflect total finding and development costs related to reserves

additions for that year.

Recycle ratios are calculated by dividing the

current period finding and development costs per barrel to

operating netbacks prior to realized gains or losses on commodity

derivative contracts in the corresponding period (see “Non-GAAP

Measures”). The Company’s annual audit of its December 31, 2017

consolidated financial statements is not complete. Accordingly,

unaudited operating netbacks used in the calculation of recycle

ratio are Management’s estimate and are subject to change. The

recycle ratio compares netbacks from existing reserves to the cost

of finding new reserves and may not accurately indicate the

investment success unless the replacement of reserves are of

equivalent quality as the produced reserves.

Drilling Locations

This press release discloses drilling locations

in three categories: (i)1P locations; (ii) 2P locations; and (iii)

unbooked locations.1P locations and 2P locations are derived from

the Reserves Report and account for locations that have associated

proved and/or probable reserves, as applicable. Unbooked locations

are internal estimates based on the prospective acreage associated

with the Company’s assets and an assumption as to the number of

wells that can be drilled based on industry practice and internal

review. Unbooked locations do not have attributed reserves. Of the

approximately 208 (net) drilling locations identified herein, 62

(net) are 1P locations; 28 (net) are 2P locations; and the

remaining are unbooked locations. Unbooked locations have been

identified by Management as an estimation of the Company’s

multi-year drilling activities based on evaluation of applicable

geologic, seismic, engineering, production and reserves

information. There is no certainty that the Company will drill all

unbooked locations, and if drilled there is no certainty that such

locations will result in additional oil and gas reserves or

production. The locations on which the Company will actually drill

wells will ultimately depend upon the availability of capital,

regulatory approvals, crude oil prices, costs, actual drilling

results, additional reservoir information that can be obtained and

other factors. While certain of the unbooked drilling locations

have been de-risked by drilling existing wells in relative close

proximity to such unbooked drilling locations, other unbooked

drilling locations are farther away from existing wells where

Management has less information about the characteristics of the

reservoir and therefore there is more uncertainty whether wells

will be drilled in such locations, and if drilled there is more

uncertainty that such wells will result in additional oil and gas

reserves or production.

Non-GAAP Measures

The Company uses operating netback as a key

performance indicator of field results. Operating netback does not

have a standardized meaning under IFRS and therefore may not be

comparable with the calculation of similar measures by other

companies. Operating netback is presented on a per barrel basis and

is calculated by deducting royalties and operating expenses from

petroleum revenue. Operating netback is presented herein prior to

realized gains or losses on commodity derivative contracts. The

Company’s annual audit of its December 31, 2017 consolidated

financial statements is not complete. Accordingly, unaudited

figures used in the calculation of operating netback and recycle

ratios are Management’s estimate and are subject to change. The

Company considers operating netbacks to be a key measure as they

demonstrate Touchstone’s profitability relative to current

commodity prices. This measurement assists Management and investors

in evaluating operating results on a per barrel basis to analyze

performance on a historical basis.

Crude Oil Abbreviations

| bbl(s) |

|

barrel(s) |

| bbls/d |

|

barrels per day |

| Mbbl |

|

one thousand

barrels |

About Touchstone

Touchstone Exploration Inc. is a Calgary based

company engaged in the business of acquiring interests in petroleum

and natural gas rights, and the exploration, development,

production and sale of petroleum and natural gas. Touchstone is

currently active in onshore properties located in the Republic of

Trinidad and Tobago. The Company's common shares are traded on the

Toronto Stock Exchange and the AIM market of the London Stock

Exchange under the symbol “TXP”.

Contact

Mr. Paul Baay, President and Chief Executive

Officer; orMr. James Shipka, Chief Operating OfficerTelephone:

403.750.4487www.touchstoneexploration.com

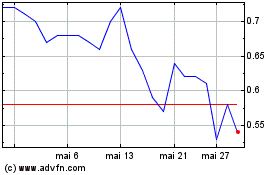

Touchstone Exploration (TSX:TXP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Touchstone Exploration (TSX:TXP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025