Newcrest Mining Limited Announces Equity Investment in Almadex Minerals Limited

12 Abril 2018 - 9:30AM

On February 26, 2018, Newcrest International Pty Ltd. (“NIPL”), a

wholly-owned subsidiary of Newcrest Mining Limited (“Newcrest”),

entered into a subscription agreement with Almadex Minerals Limited

(the “Company”) to purchase 14,025,312 common shares in the capital

of the Company, representing 19.9% of the issued and outstanding

common shares (the “Common Shares”) at a price of C$1.36 per Common

Share for an aggregate subscription price of $19,074,425 (the

“Subscription Price”) by way of private placement (the “Private

Placement”).

Closing of the Private Placement is subject to

certain customary conditions and the completion of a reorganization

transaction (the “Spin-out Transaction”) in which certain assets of

the Company will be transferred to a newly formed corporation, the

shares of which will be distributed to the Company’s shareholders.

Under the terms of the Subscription Agreement, the number of

Common Shares to be acquired by Newcrest and the price per Common

Share may be adjusted in certain instances so that Newcrest

acquires 19.9% of the issued and outstanding Common Shares

following closing of the Spin-out Transaction and the Private

Placement for the Subscription Price.

Following the satisfaction of certain

conditions, on April 11, 2018, NIPL placed the Subscription Price

into escrow. As of April 11, 2018, it is expected that the issued

and outstanding common shares of the Company, after giving effect

to the Spin-out Transaction and the Private Placement, will be

72,070,998 and NIPL will acquire 14,342,129 common shares pursuant

to the Private Placement. It is expected that the closing of the

Private Placement will be on or about May 28, 2018.

Newcrest does not currently own or control any

securities of the Company. Following the completion of the Spin-out

Transaction and the Private Placement, Newcrest will have ownership

or control over 14,342,129 Common Shares representing approximately

19.9% of the issued and outstanding Common Shares.

The Common Shares will be acquired by Newcrest

for investment purposes, and in the future it may, from time to

time, increase or decrease its investment in the Company through

market transactions, private agreements, treasury issuances or

otherwise at any time subject to applicable restrictions and

depending on market conditions and any other relevant factors.

This news release is being issued under the

early warning reporting provisions of applicable securities laws.

An early warning report with additional information in respect of

the foregoing matters will be filed and made available under the

SEDAR profile of the Company at www.sedar.com. To obtain a copy of

the early warning report, you may also contact Christopher Maitland

on + 61 3 9522 5717. Newcrest’s address is Level 8, 600 St. Kilda’s

Road, Melbourne, Victoria, Australia, 3004.

Forward-Looking Information

Certain statements in the press release are

forward-looking statements and are prospective in nature, including

statements with respect to Newcrest’s future intentions regarding

the securities of the Company. Forward-looking statements are not

based on historical facts, but rather on current expectations and

projections about future events, and are therefore subject to risks

and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Such forward-looking statements should therefore be

construed in light of such factors, and Newcrest is not under any

obligation, and expressly disclaims any intention or obligation, to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

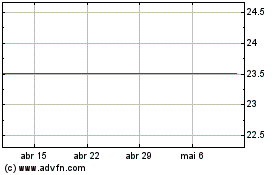

Newcrest Mining (ASX:NCM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Newcrest Mining (ASX:NCM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025