Atlas Engineered Products Released Q3 Results – Organic Year Over Year Sales Growth of 26% and Accretive Acquisitions of Cl...

02 Maio 2018 - 9:48AM

ATLAS ENGINEERED PRODUCTS LTD. (the

“Company”) (TSX-V:AEP), a leading supplier of trusses and

engineered wood products

, released its financial

results for the third quarter ended February 28, 2018.

Accretive Acquisitions

The Company’s Clinton and Truebeam acquisitions

were completed during the final week of the third quarter. The key

benefits of these acquisitions are:

- Immediately accretive revenues and EBITDA for each of Clinton

and Truebeam which will be reflected in the fourth fiscal quarter

2018.

- Servicing growing Southwestern Ontario communities of

Mississauga, Hamilton and London, as well as Northern Alberta

communities of Fort McMurray and Peace River.

- Operational in three major provinces in Canada, which will

allow for future expansion in these key provinces on an accelerated

basis.

Financial highlights for the Third

Quarter 2018:

The third quarter financial results include the

impact of costs associated with adding to the Company’s management

team and infrastructure to support growth, and expenses related to

the Company’s accretive acquisition and expansion program.

- Revenue growth to $2,079,046 for the 2018 quarter as compared

to revenue of $1,757,921 for the 2017 quarter, which represents a

18% increase for the quarter.

- Year over year revenue growth for the nine months ended

February 28, 2018 was 26%.

- Q3 Gross Margins of 24% for the Quarter, and 27%

year-to-date.

- Adjusted EBITDA* of $83,830 for the quarter is lower as

compared to $222,722 for the three months ended February 28, 2017

due to increased costs to support the Company’s expansion. In

future quarters these will be offset by the results of the

Company’s accretive acquisitions.

- Net loss of $295,757 for the third quarter 2018 compared to net

income of $140,215. Increase in net loss mostly a result of

share based payment expense of $285,412 and acquisition costs

relating to Clinton and Truebeam.

Guy Champagne, President of Atlas, commented,

“We are very pleased that our Atlas Nanaimo operation has been able

to support the significant investments we have made in launching

our growth strategy. This is a testament to how strong our core

business is and provides a very stable foundation for rapid

growth. Next quarter’s will affirm the positive financial

impacts of our Clinton and Truebeam operations.”

Stock Option Grants

The Company has also granted a total of 470,000

stock options to employees and officers of the Company. The

stock options are exercisable at $0.65 per share, in respect of

232,500, and $0.55 per share, in respect of 237,500 options.

All options are exercisable for a period of five years from the

date of grant.

About Atlas Engineered Products

Ltd.

Atlas Engineered Products is one of British

Columbia’s leading suppliers of trusses and engineered wood

products. The Company was formed over 18 years ago and operates

manufacturing and distribution facilities in British Columbia,

Ontario and Alberta to meet the needs of residential and commercial

builders. Atlas has expert design and engineering teams,

multiple-shift state-of-the-art truss manufacturing operations, and

large inventories of engineered beam and flooring components. The

Company aims to grow its base of business across Canada by pursuing

an aggressive acquisition and consolidation strategy. The Company

will bring its construction industry partners across Canada

unparalleled excellence in service, product, and support.

For further information please contact:Atlas

Engineered Products Ltd. Guy Champagne, PresidentPhone:

1-250-754-1400Email: info@atlasep.ca2005 Boxwood Rd. Nanaimo, BC

V9S 5X9www.atlasengineeredproducts.com

For investor relations please contact:Rob

GamleyPhone: 1-604-689-7422 Email: rob@contactfinancial.comContact

Financial Corp.810 – 609 Granville St. Vancouver, BC V7Y 1G5

*Non-IFRS Measures

Adjusted EBITDA is a measure not recognized

under IFRS. However, management of the Company believes that most

shareholders, creditors, other stakeholders and investment analysts

prefer to have these measures included as reported measures of

operating performance, a proxy for cash flow, and to facilitate

valuation analysis. Adjusted EBITDA is defined as earnings before

interest income, taxes, depreciation and amortization, stock based

compensation, restructuring costs, impairment charges and other

non-recurring gains or losses. Management believes Adjusted EBITDA

is a useful measure that facilitates period-to-period operating

comparisons.

Adjusted EBITDA does not have any standardized

meanings prescribed by IFRS and therefore may not be comparable to

similar measures presented by other issuers. Readers are cautioned

that Adjusted EBITDA is not an alternative to measures determined

in accordance with IFRS and should not, on its own, be construed as

indicators of performance, cash flow or profitability. References

to the Atlas' Adjusted EBITDA should be read in conjunction with

the financial statements and management's discussion and analysis

of Atlas posted on SEDAR (www.sedar.com).

Forward Looking Information

Information set forth in this news release

contains forward-looking statements. These statements reflect

management’s current estimates, beliefs, intentions and

expectations; they are not guarantees of future performance. The

Company cautions that all forward looking statements are inherently

uncertain and that actual performance may be affected by a number

of material factors, many of which are beyond the Company’s

control. Such factors include, among other things: risks and

uncertainties relating to the Company including those to be

described in the Company’s management discussion and analysis for

the quarter ended February 28, 2018 filed by the Company on

www.sedar.com. Accordingly, actual and future events,

conditions and results may differ materially from the estimates,

beliefs, intentions and expectations expressed or implied in the

forward looking information. Except as required under applicable

securities legislation, the Company undertakes no obligation to

publicly update or revise forward-looking information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

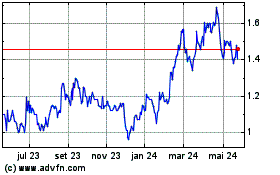

Atlas Engineered Products (TSXV:AEP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

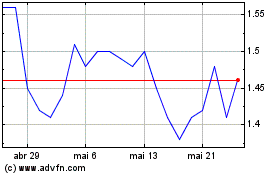

Atlas Engineered Products (TSXV:AEP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025