Innergex Announces $150 Million Convertible Debenture Offering

23 Maio 2018 - 5:36PM

THIS MEDIA RELEASE IS NOT FOR DISTRIBUTION TO

UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED

STATES

Innergex Renewable Energy Inc. (TSX:INE) (“Innergex” or the

“Corporation”) has entered into an agreement with TD Securities

Inc., CIBC Capital Markets, BMO Capital Markets and National Bank

Financial Inc. on behalf of a syndicate of underwriters, pursuant

to which the underwriters have agreed to purchase, on a bought deal

basis, convertible unsecured subordinated debentures of Innergex

(the “Debentures”) in an aggregate principal amount of $150 million

(the “Offering”). The Debentures will be offered at a price of

$1,000 per Debenture by way of short form prospectus in each of the

provinces of Canada, and may also be offered in the United States

under applicable registration statement exemptions.

The Debentures will bear interest at a rate of

4.75% per annum, payable semi-annually on June 30 and

December 31 each year, commencing on December 31, 2018. The

Debentures will be convertible at the holder’s option into Innergex

common shares at a conversion price of $20.00 per share (the

“Conversion Price”), representing a conversion rate of 50.000

common shares per $1,000 principal amount of Debentures. The

Debentures will mature on June 30, 2025. They will not be

redeemable before June 30, 2021. On and after June 30, 2021, and

before June 30, 2023, Innergex may redeem the Debentures at

par plus accrued and unpaid interest, in certain circumstances. On

or after June 30, 2023, Innergex may redeem the Debentures at par

plus accrued and unpaid interest.

Innergex has also granted an over-allotment

option to the underwriters of the Offering, entitling them to

purchase, for a period of 30 days from the closing of the Offering,

up to $22.5 million principal amount of additional Debentures at

the offering price of $1,000 per Debenture, to cover

over-allotments, if any.

The net proceeds of the Offering will be used to

reduce drawings under the Corporation’s revolving term credit

facility, which will then be available to be drawn, as required, to

fund future acquisitions, development projects and for general

corporate purposes.

In connection with the Offering, Innergex will

file a preliminary short form prospectus in all provinces of Canada

by May 29, 2018. The prospectus offering is subject to all standard

regulatory approvals, including that of the Toronto Stock Exchange,

and is expected to close on or about June 12, 2018.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities in

any jurisdiction. The Debentures being offered, and the Innergex

common shares issuable upon the conversion or redemption of the

Debentures, have not been and will not be registered under the U.S.

Securities Act of 1933 or state securities laws. Accordingly, the

Debentures may not be offered or sold in the United States except

pursuant to applicable exemptions from registration.

This press release is not an offer of

securities for sale in the United States. Securities may not be

sold in the United States absent registration or an exemption from

registration.

About Innergex Renewable Energy

Inc.The Corporation develops, acquires, owns and operates

run-of-river hydroelectric facilities, wind farms, solar

photovoltaic farms and geothermal power generation plants. As a

global player in the renewable energy sector, Innergex conducts

operations in Canada, the United States, France and Iceland.

Innergex manages a large portfolio of assets currently consisting

of interests in 64 operating facilities with an aggregate net

installed capacity of 1,642 MW (gross 2,886 MW), including 34

hydroelectric facilities, 25 wind farms, three solar farms and two

geothermal facilities. Innergex also holds interests in two

projects under development with a net installed capacity of 355 MW

(gross 360 MW) one of which is currently under construction

and prospective projects at different stages of development with an

aggregate net capacity totalling 8,180 MW (gross 8,850 MW).

Innergex Renewable Energy Inc. is rated BBB- by S&P. The

Corporation's strategy for building shareholder value is to develop

or acquire high-quality facilities that generate sustainable cash

flows and provide an attractive risk-adjusted return on invested

capital and to distribute a stable dividend.

Forward-Looking Information

Disclaimer In order to inform readers of the Corporation's

future prospects, this press release contains forward-looking

information within the meaning of applicable securities laws

(“Forward-Looking Information”). Forward-Looking Information can

generally be identified by the use of words such as "projected",

"potential", "expect", “will”, "should", "estimate", “forecasts”,

"intends", or other comparable terminology that states that certain

events will or will not occur. It represents the estimates and

expectations of the Corporation relating to future results and

developments as of the date of this press release. It includes

future-oriented financial information or financial outlook within

the meaning of securities laws, such as use of proceeds of the

Offering, to inform readers of the potential financial impact of

the Offering. Such information may not be appropriate for other

purposes.

The material risks and uncertainties that may

cause actual results and developments to be materially different

from current expressed Forward-Looking Information are referred to

in the Corporation’s Annual Information Form in the “Risk Factors”

section and include, without limitation: the ability of the

Corporation to execute its strategy for building shareholder value;

its ability to raise additional capital and the state of capital

markets; liquidity risks related to derivative financial

instruments; variability in hydrology, wind regimes and solar

irradiation; delays and cost overruns in the design and

construction of projects; uncertainty surrounding the development

of new facilities; variability of installation performance and

related penalties; and the ability to secure new power purchase

agreements or to renew existing ones.

Although the Corporation believes that the

expectations and assumptions on which Forward-Looking Information

is based are reasonable, readers of this press release are

cautioned not to rely unduly on this Forward-Looking Information

since no assurance can be given that they will prove to be correct.

The Corporation does not undertake any obligation to update or

revise any Forward-Looking Information, whether as a result of

events or circumstances occurring after the date of this press

release, unless so required by legislation.

For informationKarine

VachonDirector – Communications450 928-2550, ext.

1222kvachon@innergex.cominnergex.com

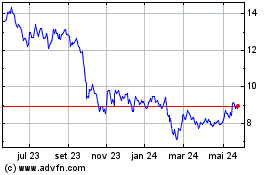

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

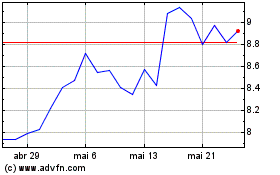

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024