ATLAS ENGINEERED PRODUCTS LTD. (“Atlas” or

the “Company”) (TSX-V: AEP) today reports its record

financial results for the year ended May 31, 2018. The financial

statements and related management’s discussion and analysis

(MD&A) can be viewed on SEDAR at www.sedar.com.

Revenue for the year ended May 31, 2018 was

$11,597,176, up from $8,076,027 for the previous year, representing

an overall growth in revenue from the prior year of 43.6%.

Revenue for the year ended May 31, 2018 from the Company’s business

in Nanaimo, BC was $10,340,571, representing year-over-year organic

growth of 28% from the year ended May 31, 2017. Revenue from

acquisitions for the year ended May 31, 2018 was $1,256,605 (2017 –

nil), representing 10.8% the Company’s revenues for the year.

Revenue for the quarter ended May 31, 2018 was

$3,987,449, which is 93.3% higher than for the same quarter in the

previous fiscal year. Revenue achieved during the quarter ended May

31, 2018 recognizes the full impact of the Clinton acquisition.

Based on these quarterly results, management anticipates annualized

revenues of approximately $18.1 million combined for the Atlas and

Clinton operations.

Adjusted EBITDA for the year ended May 31, 2018

was $1,413,140, representing a 12% Adjusted EBITDA Margin, compared

with $1,790,954 Adjusted EBITDA and 22% Adjusted EBITA Margin for

the prior year. (See “Non-IFRS Financial Measures”).

During the year ended May 31, 2018, the Company

absorbed $966,886 in new costs for filing and transfer agent fees,

management and professional fees, shareholder communication, and

travel. Most of these expenditures were incurred in connection with

the Company’s acquisition and integration activities and for

corporate costs.

The cost of sales for the twelve months ended

May 31, 2018 was $8,725,350 compared to $5,987,828 for the twelve

months ended May 31, 2017 due to increased sales and an increase in

raw material costs. Gross margins slipped slightly from

25.9% to 24.8%, notwithstanding a significant increase in lumber

costs. The Company was successful in passing on most of these

increased costs through price increases.

The Company recorded a net loss of $4,954,765

($0.16 per share) for the twelve months ended May 31, 2018 compared

to a net loss of $793,043 ($731.73 per share) for the twelve months

ended May 31, 2017. The increase in net loss is mainly the result

of listing expenses of $4,864,786 recognized as a result of the

Reverse Takeover (“RTO”) with Archer Petroleum, which is a one-time

accounting entry and is not reflective of the Company’s ongoing

operations.

Mr. Guy Champagne, President of Atlas explains

that “We are very pleased that our growth and financial results to

date have met or exceeded our 2018 stated objectives, which are

right on plan. The Annualized Revenue and Adjusted EBITDA margin

targets we have been communicating to the investment community are

$50 million and 15%, respectively. We consider these very

achievable and expect to enter 2019 at that annualized revenue

threshold as we continue to make accretive acquisitions of good

companies whose revenues we can grow organically as well.”

About Atlas Engineered Products

Ltd.

Atlas Engineered Products is a leading supplier

of trusses and engineered wood products. Atlas was formed over 18

years ago and operates manufacturing and distribution facilities in

British Columbia and Ontario to meet the needs of residential and

commercial builders. Atlas has expert design and engineering teams,

multiple-shift state-of-the-art truss manufacturing operations, and

large inventories of engineered beam and flooring components. Atlas

aims to grow its base of business across Canada by pursuing an

aggressive acquisition and consolidation and product

diversification strategy. Atlas will bring its construction

industry partners across Canada unparalleled excellence in service,

product, and support and is committed to supplying them with the

full array of components and assemblies they might require for

their projects – from design to lockup.

For further information please contact:Atlas

Engineered Products Ltd. Guy Champagne, PresidentPhone:

1-250-754-1400Email: info@atlasep.caUnit 102, 6551 Aulds Road

Nanaimo, BC V9S 5X9 www.atlasengineeredproducts.com

For investor relations please contact:Rob

GamleyPhone: 1-604-689-7422 Email: rob@contactfinancial.comContact

Financial Corp.810 – 609 Granville St. Vancouver, BC V7Y 1G5

Forward Looking Information

Information set forth in this news release

contains forward-looking statements. These statements reflect

management’s current estimates, beliefs, intentions and

expectations; they are not guarantees of future performance. The

Company cautions that all forward looking statements are inherently

uncertain and that actual performance may be affected by a number

of material factors, many of which are beyond the Company’s

control. Such factors include, among other things: risks and

uncertainties relating to the Company including those to be

described in the Annual Information Form filed by the Company on

June 1, 2018 and the Management’s Discussion and Analysis

(“MD&A”) for the Company’s fiscal year ended May 31, 2018 filed

by the Company on September 20, 2018, both on www.sedar.com.

Accordingly, actual and future events, conditions and results may

differ materially from the estimates, beliefs, intentions and

expectations expressed or implied in the forward looking

information. Except as required under applicable securities

legislation, the Company undertakes no obligation to publicly

update or revise forward-looking information.

Forward-looking statements in this news release

also include future-oriented financial information and financial

outlook information (“FOFI”) regarding the Company and its

prospective results of operations, cash flows and components

thereof. The FOFI contained in this news release is subject

to the same assumptions, risk factors, limitations and

qualifications set forth in the Company’s MD&A for the year

ended May 31, 2018 relating to other forward-looking

statements. The FOFI contained in this news release is

provided for the purpose of providing information regarding

management’s assessment of the Company’s anticipated business

operations, and may not be appropriate for other purposes

Forward-looking statements, including FOFI,

contained herein are made as of the date of this news release and

the Company disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events

or results or otherwise except as required by securities law. There

can be no assurance that forward-looking statements will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

*NON-GAAP / NON-IFRS FINANCIAL

MEASURES

Certain measures in this news release do not

have any standardized meaning under IFRS and, therefore are

considered non-IFRS or non-GAAP measures. These non-IFRS

measures are used by management to facilitate the analysis and

comparison of period-to-period operating results for the Company

and to assess whether the Company’s operations are generating

sufficient operating cash flow to fund working capital needs and to

fund capital expenditures. As these non-IFRS measures do not

have any standardized meaning under IFRS, these measures may not be

comparable to similar measures presented by other issuers.

The non-IFRS measures used in this news release include “EBITDA”,

“EBITDA Margin”, “adjusted EBITDA”, and “adjusted EBITDA

Margin”. “EBITDA” is calculated as revenue less operating

expenses before interest expense, interest income, amortization and

depletion, impairment charges, and income taxes. “EBITDA

Margin” is EBITDA expressed as a percentage of revenues.

“Adjusted EBITDA” is EBITDA after adjusting for share-based

payments, foreign exchange gains or losses and non-recurring

items. “Adjusted EBITDA Margin” is Adjusted

EBITDA expressed as a percentage of revenues.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

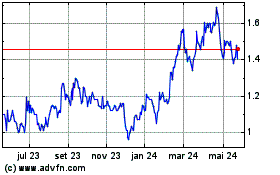

Atlas Engineered Products (TSXV:AEP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

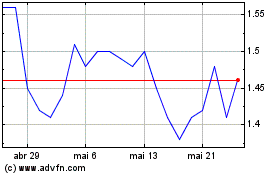

Atlas Engineered Products (TSXV:AEP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025