ENDEAVOUR SIGNIFICANTLY EXTENDS HIGH

GRADE MINERALIZATION AT FETEKRO

View News Release in PDF

FETEKRO EXPLORATION HIGHLIGHTS:

- In line with Endeavour's objective of discovering a

standalone greenfield project, exploration resumed on Fetekro in

2017

- With nearly 32,000 meters drilled on the property during

2017-2018, focused primarily on the highly prospective Lafigué

target, Fetekro is to date Endeavour's most advanced greenfield

exploration property

- Lafigué target highlights:

- A large mineralized vein system was defined over an area

2.5km long by 0.6km wide, remaining open at depth and towards the

southeast

- Notable selected intercepts include: 7.97g/t Au over 26.9m,

25.90g/t Au over 10.9m, and 13.21g/t Au over 7.6m

- A maiden resource is expected to be published in Q4-2018 and

a follow-up drill program is scheduled to start in

Q4-2018

- The preliminary assessment of the recently completed

gold-in-soil geochemical campaign indicates the occurrence of

additional targets located in proximity to Lafigué, where a drill

program has been scheduled for 2019

Abidjan, September 24, 2018 - Endeavour

Mining (TSX:EDV)(OTCQX:EDVMF) is pleased announce positive drill

results for the Fetekro greenfield exploration property, located in

north-central Côte d'Ivoire approximately 500km from Abidjan.

Endeavour began exploration on the Fetekro

property in March 2017, following a strategic assessment of its

exploration tenements which ranked the property as a top priority

target. Since then, a total of 312 Reverse Circulation ("RC") and

Diamond Drilling ("DD") holes have been drilled, amounting to

nearly 32,000 meters. Drilling mainly focused on the highly

prospective Lafigué target where a large mineralized vein system

was defined over an area 2.5km long by 0.6km wide, remaining open

at depth and towards the east. All available data is being

interpreted and a maiden resource estimate is expected to be

published in Q4-2018 and a follow-up drilling program is scheduled

to start in Q4-2018.

In addition, a gold-in-soil geochemical campaign

was recently completed. Its preliminary assessment indicates the

occurrence of additionnal targets located in proximity to Lafigué,

where a drill program has been scheduled for 2019.

Patrick Bouisset, Executive Vice-President

Exploration and Growth stated: "We are pleased to continue to

deliver against our two key objectives from our 5-year exploration

strategy outlined in 2016. Following the significant near-mine

exploration success already achieved, in line with our first

objective of extending mine lives, we are now excited to report the

results from Fetekro, which is our most advanced greenfield

exploration property.

The Lafigué target, located within the Fetekro

property, has been the primary focus of our recent greenfield

exploration program. The discovery of extensive mineralization over

such a large area, coupled with the identification of nearby

prospects, is very encouraging. We are eager to publish a maiden

resource later this year, which may bring us one step closer to

achieving our second key objective within our 5-year exploration

program - that of discovering of a standalone greenfield project in

West Africa."

ABOUT THE FETEKRO PROPERTY

The Fetekro property corresponds to the PR 329

exploration license which covers approximately 247 square

kilometers located in north-central Côte d'Ivoire, nearly 500km

from Abidjan, as shown in Figure 1 below. Fetekro is located in the

northern end of the Oumé-Fetekro greenstone belt which extends over

300km in a north/northeast direction within the Proterozoic

Birimian series of central Côte d'Ivoire. This greenstone belt is

composed primarily of volcano-sediments, consisting mainly of mafic

to intermediate metavolcanics, felsic metavolcanics and clastic

meta-sediments, that are bound and intruded by granitoid complexes.

Known gold deposits such as Bonikro and Agbaou are hosted within

the same belt.

Endeavour is the operator of the licence in

joint-venture with Société pour le Développement Minier de la Côte

d'Ivoire ("SODEMI").

Historical drilling between 1998 and 2014 was

sporadic, comprised of 1,803 meters of Reverse Air Blast ("RAB")

drilled over 94 holes, 8,577 meters of Reverse Circulation ("RC")

drilled over 134 shallow holes and 4,165 meters of Diamond Drilling

("DD") drilled over 52 holes.

Exploration was aggressively relaunched in March

2017, following the full reinterpretation of the historical data.

Drilling mainly focused on the highly prospective Lafigué target,

as shown in Figure 1 below, where a large mineralized vein system

was defined over an area 2.5km long by 0.6km wide, while

additionnal targets were identified through the preliminary

assessment of the recently completed gold-in-soil geochemical

campaign.

Figure 1: Simplified map of the Fetekro

property showing the Lafigué prospect

ABOUT THE LAFIGUÉ TARGET - MAIN DISCOVERY

TO-DATE AT FETEKRO

As shown in Figure 2, three main mineralized

zones have been identified at the Lafigué target (Lafigué South,

Center, and North), with Lafigué Center and North remaining open at

depth and towards the southeast.

Figure 2: Lafigué discovery and selected

intercepts per area (True width uncapped)

Some selected best intersects from historical

and Endeavour drilled holes include (true width

uncapped):

- D1297: 13.59m @ 7.33 g/t Au

- R0897 : 26.85 @ 7.97 g/t Au, (including 0.86m @ 17.55 g/t

Au; 0.86m @ 33.20 g/t Au, 0.86m @ 25.60 g/t Au, 0.86m @ 13.25 g/t

Au, 0.86m @ 83.65 g/t Au, 0.86m @ 10.98 g/t Au)

- R0797 : 16.45m @ 5.32 g/t Au, (including 0.86m @ 33.50 g/t

Au, 0.86m @ 11.45 g/t Au, 0.86m @ 10.16 g/t Au)

- D0597B : 19.66m @ 3.71 g/t Au, (including 0.49m @ 26.20

g/t Au)

- LFDH02-15: 4.20m @ 15.60 g/t Au, and 7.00m @ 6.35 g/t Au,

(including 1.15m @ 32.00 g/t Au)

- LFRC02-40 : 5.00m @ 7.88 g/t Au, (including 1.00m @ 19.30

g/t Au) and 12.00m @ 2.90 g/t Au, (including 1.00m @ 16.86 g/t

Au)

- LFDD10-27 : 7.62m @ 13 .21 g/t Au, (including 0.60m @

117.50 g/t Au)

- LF17-112 : 6.34m @ 5.48 g/t Au, (including 0.91m @ 17.50

g/t Au) and 15.41m @ 2.95 g/t Au, (including 0.91m @ 10.73 g/t

Au)

- LF17-131 : 7.25m @ 4.15 g/t Au, (including 0.91m @ 10.41

g/t Au)

- LFDD17-243 : 5.38m @ 2.16 g/t Au and 5.70m @ 4.56 g/t Au,

(including 0.65m @ 27.02 g/t Au)

- LFDD17-244 : 21.70m @ 5.13 g/t Au, (including 1.05m @

20.39 g/t Au, 1.45m @ 35.13 g/t Au)

- LFDD18-402: 8.36m @ 2.91 g/t Au

- LFRC18-365 : 5.98m @ 5.19 g/t Au, (including 1.00m @ 26.78

g/t Au)

- LFRC18-373 : 12.95m @ 2.29 g/t Au, (including 1.00m @

12.59 g/t Au) and 2.99m @ 2.63 g/t Au

- LFDD18-410 : 7.17 m @ 39.69 g/t Au (including 0.8 @ 12.73

g/t Au, 1.2m @ 70.77 g/t Au, 1.25m @ 15.49 g/t Au, 0.80m @ 186.50

g/t Au) and 10.86m @ 25.90 g/t Au, (including 1.30m @ 71.40 g/t Au,

1.34m @ 94.30 g/t Au, 1.39m @ 35.30 g/tAu)

- LFRC18-385: 22.91m @ 2.86 g/t Au and 2.99m @ 3.34 g/t Au

Drill hole intercepts are calculated using a

minimum down-hole length of 2 meters, a cutoff grade of 0.5 g/t Au,

an internal dilution length of 1m and a missing interval grade of 0

g/t Au.

The Lafigué prospect is hosted by an

east-northeast trending reverse faulting zone, which is locally

bounded by two northeast-trending steep oblique-reverse shear

corridors subparallel to the main Birimian structural grain. The

lens-shaped mineralization of Lafigué appears to be hosted within a

network of stacked and mineralized brittle-ductile reverse shear

zones, dipping 20°-30° to the south-southeast. They developed

mostly within the hanging-wall of a possible "basal thrust" which

is either located at the contact between a mafic volcanics sequence

and a mafic intrusive (as shown in the Lafigué Center cross-section

in Figure 3 below) or between a mafic intrusive and a felsic

intrusive (as shown in the Lafigué North cross-section in Figure 3

below).

This "basal thrust" strikes northeast to

north-northeast and dips gently to the south (about 30°S). Regional

schistosity varies in strike from north-south to North 070° with

gentle to intermediate/steep dips to the east and south

(25°-65°).

Figure 3: Lafigué Center Cross-Section

Figure 4: Lafigué North Cross-Section

The shear zones appear to be better developed

at, or near, lithological contact zones, where competency contrasts

do favor the occurrence of brittle-ductile shearing, permeability

increases and enhanced hydrothermal fluids flow. The typical

high-grade mineralization is associated with Qz-Cb-To veins and

related Bt-To-Ser alteration zones (tourmalinization of the host

rock when alteration is intense) hosted by the gently south-dipping

brittle-ductile shear zones. Visible gold can be observed in such

veins.

To date all preliminary test work results

indicate a high gravity recoverable gold content and easy gravity

tails leach with low final residues. In this preliminary test work,

total gold recovery has been higher than 95%.

Preliminary assessments of the recently

performed gold in soil geochemistry indicates the occurrence of

other nearby anomalies close by Lafigué. Once finalized, this

analysis will help provide additional targets to be tested on PR

329 during 2019.

OTHER NEARBY TARGETS OUTLINED

As shown in the figure 5 below, the preliminary

assessment of the recently performed gold in soil geochemistry

indicates the occurrence of other nearby anomalies close by

Lafigué. Some of these targets are expected to be drilled in 2019.

Figure 5: Gold in soil geochemistry

NEXT STEPS

- All available data on the Lafigué target is being interpreted

and a maiden resource estimate is expected to be published during

Q4 2018.

- A follow-up drill program is scheduled to start in Q4-2018 and

to be pursued in 2019 on Lafigué prospect and nearby identified

targets.

QUALIFIED PERSONS

The scientific and technical content of this

news release has been reviewed, verified and compiled by Gérard de

Hert, EurGeol, Senior VP West Africa Exploration for Endeavour

Mining. Gérard de Hert has more than 20 years of mineral

exploration and mining experience and is a "Qualified Person" as

defined by National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101"). The 2017-2018 program is

operated under the field direction of Silvia Bottero, Professional

Natural Scientist and "Qualified Person" as defined by National

Instrument 43-101.

ASSAYS AND QUALITY ASSURANCE/QUALITY CONTROL

/ DRILLING AND ASSAY PROCEDURES

The Reverse Circulation drill program samples

were collected on a 1-meter interval using dual tube, a percussion

hammer and drop centre bit. The material passes through a cyclone

which is thoroughly cleaned after every sample by flushing the

hole. Samples were split at the drill site using a 3-tier riffle

splitter with both bulk and laboratory sample weights and moisture

recorded. Representative samples for each interval were collected

with a spear, sieved into chip trays and retained for

reference.

Drill core (PQ, HQ and NQ size) samples are

selected by LMCI geologists and sawn in half with a diamond blade

at the project site. Half of the core is retained at the site for

reference purposes. Sample intervals are generally 1 meter in

length.

All samples are transported by road to Bureau

Veritas (BV) in Abidjan (Côte d'Ivoire). Each laboratory sample is

secured in poly-woven bags ensuring that there is a clear record of

the chain of custody. On arrival samples are weighed and crushed to

2mm (70% passing), pulverize entire sample to 75 micrometers (85%

passing). Samples are analyzed for gold using standard fire assay

technique with a 50-gram charge and an Atomic Absorption (AA)

finish. Blanks, field duplicates and certified reference material

(CRM's) are inserted by LMCI geologists in the sample sequence for

quality control and to ensure there are a suite of QC samples in

each fire assay batch.

The sampling and assaying at Lafigué is

monitored through the implementation of a quality assurance -

quality control (QA-QC) program. This QA-QC program was audited by

International mining consultant in 2017 and consequently designed

to follow industry best practices.

CONTACT INFORMATION

|

Martino De Ciccio VP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

Brunswick Group LLP in London Carole Cable, Partner +44 7974

982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.

Endeavour operates 5 mines across Côte d'Ivoire

(Agbaou and Ity), Burkina Faso (Houndé, Karma), and Mali (Tabakoto)

which are expected to produce 670-720koz in 2018 at an AISC of

$840-890/oz. Endeavour's high-quality development projects

(recently commissioned Houndé, Ity CIL and Kalana) have the

combined potential to deliver an additional 600koz per year at an

AISC well below $700/oz between 2018 and 2020. In addition, its

exploration program aims to discover 10-15Moz of gold between 2017

and 2021 which represents more than twice the reserve depletion

during the period.

For more information, please

visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on management's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

View appendix

- Figure 5: Gold in soil geochemistry.jpg

- Figure 4: Lafigué North Cross-Section.png

- Figure 1: Simplified map of the Fetekro property showing

Lafigué.jpg

- Appendix.pdf

- View News Release in PDF.pdf

- Figure 2: Lafigué discovery and selected intercepts per

area.jpg

- Figure 3: Lafigué Center Cross-Section.png

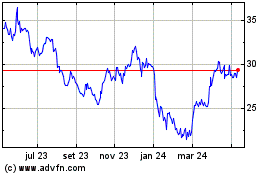

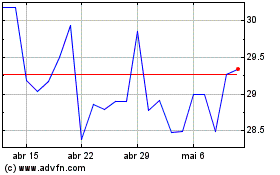

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025