Canadian Utilities Limited (TSX: CU, CU.X)

Canadian Utilities announced adjusted earnings in 2018 of $607

million, or $2.24 per share, compared to $602 million, or $2.23 per

share, in 2017. Canadian Utilities had fourth quarter 2018 adjusted

earnings of $187 million, or $0.69 per share, compared to $169

million, or $0.63 per share, in the fourth quarter of 2017.

Higher fourth quarter 2018 earnings compared to the same period

in 2017 were due to strong results in all business segments.

Strong 2018 earnings were driven by our non-regulated businesses

mainly due to improved results in electricity generation and

Alberta PowerLine. Continued capital investment and operational

cost improvements in our regulated businesses helped partially

offset the adverse earnings impact of rate re-basing in several of

our Alberta utilities.

Canadian Utilities invested $2 billion in capital growth

projects in 2018, of which $1.1 billion was invested in Regulated

Utilities and more than $800 million was invested in long-term

contracted assets, including Alberta PowerLine and a hydroelectric

power station acquisition in Mexico.

In the period 2019 to 2021, Canadian Utilities plans to invest

$3.6 billion in Regulated Utility and long-term contracted assets

in Canada, Australia, and Latin America, which will continue to

strengthen our high-quality earnings base.

RECENT DEVELOPMENTS

- On January 10, 2019, Canadian Utilities declared a first

quarter dividend for 2019 of 42.27 cents per Class A non-voting and

Class B common share. Canadian Utilities has increased its dividend

per share for 47 consecutive years, the longest track record of

annual dividend increases of any publicly traded Canadian

company.

- In the fourth quarter of 2018, construction continued on the

Alberta PowerLine Project. The project is ahead of schedule and the

expected energization date has been advanced to March 2019 from the

original target date of June 2019.

- In December, Canadian Utilities sold its 100 per cent ownership

interest in Barking Power assets in the U.K. The total proceeds

received on the sale of the Barking Power assets were $219 million.

This transaction is consistent with Canadian Utilities' strategy of

selling mature assets and recycling the proceeds into growing areas

of the Company.

- In November, Canadian Utilities subsidiary CU Inc. issued $385

million of 3.95 per cent 30-year debentures. Proceeds from this

issuance were used to fund capital investments, to repay existing

indebtedness, and for other general corporate

purposes.

FINANCIAL SUMMARY AND RECONCILIATION OF ADJUSTED

EARNINGS

A financial summary and reconciliation of adjusted earnings to

earnings attributable to equity owners of the company is provided

below:

|

|

For the Three Months Ended December 31 |

For the Year Ended December 31 |

| ($ millions except

share data) |

2018 |

2017 (10) |

2018 |

2017 (10) |

| Adjusted earnings (1) |

187 |

169 |

607 |

602 |

| Gain on sale of operation (2) (8) |

— |

— |

— |

30 |

| Proceeds from termination of PPA (3) (8) |

— |

— |

36 |

— |

| Restructuring and other costs (4) (8) |

— |

— |

(60) |

— |

| Derecognition of customer contributions (5)

(8) |

— |

31 |

— |

31 |

| Impairment (6) (8) |

— |

(7) |

— |

(7) |

| Sale of Barking Power assets (7) (8) |

87 |

— |

87 |

— |

| Unrealized gains (losses) on mark-to-market

forward commodity contracts (8) |

2 |

(53) |

31 |

(90) |

| Rate-regulated activities (8) |

(37) |

(52) |

(133) |

(119) |

| Dividends on equity preferred shares |

17 |

17 |

67 |

67 |

| Other (8) (9) |

— |

(3) |

(1) |

— |

| Earnings attributable to

equity owners of the Company |

256 |

102 |

634 |

514 |

| Weighted average shares outstanding (millions of

shares) |

272.2 |

270.3 |

271.5 |

269.4 |

| (1) |

Adjusted earnings are defined as

earnings attributable to equity owners of the Company after

adjusting for the timing of revenues and expenses associated with

rate-regulated activities, dividends on equity preferred shares of

the Company, and unrealized gains or losses on mark-to-market

forward commodity contracts. Adjusted earnings also exclude

one-time gains and losses, significant impairments, and items that

are not in the normal course of business or a result of day-to-day

operations. Adjusted earnings present earnings on the same basis as

was used prior to adopting International Financial Reporting

Standards (IFRS) - that basis being the U.S. accounting principles

for rate-regulated entities - and they are a key measure used to

assess segment performance, to reflect the economics of rate

regulation and to facilitate comparability of Canadian Utilities’

earnings with other Canadian rate-regulated companies. |

| (2) |

In January 2017, Canadian Utilities

sold its 100 per cent investment in ATCO Real Estate Holdings Ltd.

to ATCO Ltd. which resulted in a gain of $30 million. |

| (3) |

In the third quarter of 2018, the

Battle River unit 5 Power Purchase Arrangement was terminated by

the Balancing Pool and dispatch control was returned to Canadian

Utilities. Canadian Utilities received a payment from the Balancing

Pool and recorded additional coal-related costs and Asset

Retirement Obligations associated with the Battle River generating

facility. This one-time receipt and costs in the net amount of $36

million were excluded from adjusted earnings. |

| (4) |

In the second quarter of 2018,

restructuring and other costs not in the normal course of business

of $60 million were recorded. These costs mainly relate to staff

reductions and associated severance costs, as well as costs related

to decisions to discontinue certain projects that no longer

represent long-term strategic value to the Company. |

| (5) |

In December 2017, Canadian

Utilities signed a contract amendment that triggered a reassessment

of the accounting treatment of the Muskeg River generating plant.

Due to the nature of the contract amendment, the Company recorded

$31 million on derecognition of customer contributions related to a

sale of electricity generation assets on transition to finance

lease. |

| (6) |

In the fourth quarter of 2017,

Structures & Logistics recognized an impairment relating to

workforce housing assets in Canada and space rental assets in the

U.S. Canadian Utilities' 24.5 per cent share of the impairment

decreased earnings by $7 million in the Corporate & Other

segment. |

| (7) |

In the fourth quarter of 2018,

Canadian Utilities sold its 100 per cent ownership interest in the

Barking Power assets. A gain in the amount of $87 million was

excluded from adjusted earnings. |

| (8) |

Refer to Note 4 of the 2018

Consolidated Financial Statements for detailed descriptions of the

adjustments. |

| (9) |

The Company adjusted the deferred

tax asset which was recognized as a result of the Tula Pipeline

Project impairment. The adjustment is due to a difference between

the tax base currency, which is the Mexican peso, and the U.S.

dollar functional currency. |

| (10) |

These numbers have been restated to

account for the impact of IFRS 15. Additional detail on IFRS 15 is

discussed in Note 3 of the 2018 Consolidated Financial

Statements. |

TELECONFERENCE AND WEBCAST

Canadian Utilities will hold a live teleconference and webcast

to discuss our year-end financial results. Dennis DeChamplain,

Senior Vice President and Chief Financial Officer, will discuss

year-end financial results and recent developments at 8:00 am

Mountain Time (10:00 am Eastern Time) on Thursday, February 28,

2019 at 1-800-319-4610. No pass code is required. Opening remarks

will be followed by a question and answer period with investment

analysts. Participants are asked to please dial-in 10 minutes prior

to the start and request to join the Canadian Utilities

teleconference.

Management invites interested parties to listen via live webcast

at:http://www.canadianutilities.com/Investors/Events-and-Presentations/

A replay of the teleconference will be available approximately

two hours after the conclusion of the call until March 28, 2019.

Please call 1-800-319-6413 and enter pass code 2938. An archive of

the webcast will be available on February 28, 2019 and a transcript

of the call will be posted on

http://www.canadianutilities.com/Investors/Events-and-Presentations/ within

a few business days.

This news release should be used as a preparation for reading

the full disclosure documents. Canadian Utilities’ consolidated

financial statements and management’s discussion and analysis for

the quarter ended December 31, 2018 will be available on the

Canadian Utilities website (www.canadianutilities.com), via SEDAR

(www.sedar.com) or can be requested from the Company.

With approximately 5,000 employees and assets of $22

billion, Canadian Utilities Limited is an ATCO company. Canadian

Utilities is a diversified global energy infrastructure corporation

delivering service excellence and innovative business solutions in

Electricity (electricity generation, transmission, and

distribution); Pipelines & Liquids (natural gas transmission,

distribution and infrastructure development, energy storage, and

industrial water solutions); and Retail Energy (electricity and

natural gas retail sales). More information can be found at

www.canadianutilities.com.

Investor Inquiries:

D.A. (Dennis) DeChamplainSenior Vice President &Chief

Financial Officer403-292-7502

Media Inquiries:

Donna PincottDirector, Corporate Communications587-224-7684

Forward-Looking Information:Certain statements

contained in this news release may constitute forward-looking

information. Forward-looking information is often, but not always,

identified by the use of words such as “anticipate”, “plan”,

“estimate”, “expect”, “may”, “will”, “intend”, “should”, and

similar expressions.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information.

The Company’s actual results could differ materially from those

anticipated in this forward-looking information as a result of

regulatory decisions, competitive factors in the industries in

which the Company operates, prevailing economic conditions, and

other factors, many of which are beyond the control of the

Company.

The Company believes that the expectations reflected in the

forward-looking information are reasonable, but no assurance can be

given that these expectations will prove to be correct and such

forward-looking information should not be unduly relied upon.

Any forward-looking information contained in this news release

represents the Company’s expectations as of the date hereof and is

subject to change after such date. The Company disclaims any

intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by applicable securities

legislation.

PDF

available: http://resource.globenewswire.com/Resource/Download/8061c6bc-2666-4f0e-9d9e-55524f1ec4b8

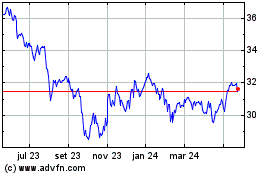

Canadian Utilities (TSX:CU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

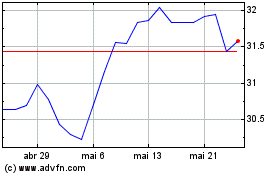

Canadian Utilities (TSX:CU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025