MACI Revenue Increased 38% Over First

Quarter 2018

Vericel Corporation (NASDAQ:VCEL), a leader in advanced cell

therapies for the sports medicine and severe burn care markets,

today reported financial results for the first quarter ended March

31, 2019, and recent business highlights.

First Quarter 2019

Financial Highlights

- Total net product revenues increased 21% to $21.8 million

compared to $18.0 million in the first quarter of 2018;

- Gross margins of 60% compared to gross margins of 57% in the

first quarter of 2018;

- Net loss of $2.8 million, or $0.07 per share, compared to $7.7

million, or $0.21 per share, in the first quarter of 2018;

- Non-GAAP adjusted EBITDA loss of $0.4 million compared to a

loss of $2.6 million in the first quarter of 2018;

- As of March 31, 2019, the company had $84.1 million in cash and

short-term investments compared to $82.9 million as of December 31,

2018; and

- Full year 2019 revenue guidance for MACI® and Epicel® raised to

$110 to $114 million compared to previous full year revenue

guidance of $108 million to $112 million.

Recent Business HighlightsDuring and since the

first quarter of 2019, the company:

- Announced an exclusive license agreement with MediWound Ltd.

for North American rights to NexoBrid®, a biological orphan product

for debridement of thermal burns;

- Deployed the expanded MACI sales force, which increased from 40

to 48 territories; and

- Reported publication of outcomes data from 954 burn patients

treated with Epicel in the Journal of Burn Care and Research.

“We delivered another solid quarter of performance and the MACI

sales force continues to increase its productivity even as we add

new representatives, which speaks to the quality of our sales

representatives as well as the demand for MACI,” said Nick

Colangelo, president and CEO of Vericel. “Based on the strong

underlying indicators of growth for the rest of the year we have

raised our full year 2019 revenue guidance. Moreover, we

believe that the addition of NexoBrid significantly expands our

burn care target addressable market and will enable us to build a

second significant commercial franchise to go along with our

cartilage repair franchise, thereby enhancing the long-term growth

profile of the company.” First Quarter 2019

ResultsTotal net product revenues for the quarter ended

March 31, 2019 increased 21% to $21.8 million compared to $18.0

million in the first quarter of 2018. Total net product

revenues for the quarter included $16.6 million of MACI®

(autologous cultured chondrocytes on porcine collagen membrane) net

revenue and $5.2 million of Epicel® (cultured epidermal autografts)

net revenue, compared to $12.1 million of MACI net revenue and $6.0

million of Epicel net revenue, respectively, in the first quarter

of 2018. Gross profit for the quarter ended March 31, 2019

was $13.2 million, or 60% of net revenues, compared to $10.4

million, or 57% of net revenues, for the first quarter of 2018.

Total operating expenses for the quarter ended

March 31, 2019 were $16.5 million compared to $14.7 million for the

same period in 2018. The increase in operating expenses was

primarily due to a $1.2 million increase in stock-based

compensation, an incremental $0.6 million in MACI sales force

expenses as a result of the sales force expansion in the second

quarter of 2018, and a $0.6 million increase in selling expenses

and patient reimbursement support services.

Vericel’s net loss for the quarter ended March

31, 2019 was $2.8 million, or $0.07 per share, compared to $7.7

million, or $0.21 per share, for the first quarter of 2018.

Non-GAAP adjusted EBITDA loss was $0.4 million for the quarter

ended March 31, 2019 compared to a loss of $2.6 million in the

first quarter of 2018. See table reconciling non-GAAP

measures for more details.As of March 31, 2019, the company had

$84.1 million in cash and short-term investments compared to $82.9

million as of December 31, 2018. Full Year 2019 Financial

GuidanceThe company now expects total MACI and Epicel net

product revenues for the full year 2019 to be in the range of $110

to $114 million, compared to the previous full year revenue

guidance of $108 to $112 million. Conference Call

Information Today's conference call will be available live

at 8:00am Eastern time in the Investor Relations section of the

Vericel website at

http://investors.vcel.com/events-presentations. A

presentation supporting today’s conference call will be available

on the webcast and in the Investor Relations section of the Vericel

website. Please access the site at least 15 minutes prior to

the scheduled start time in order to download the required audio

software if necessary. To participate in the live call by

telephone, please call (877) 312-5881 and reference Vericel

Corporation's first-quarter 2019 investor conference call. If

calling from outside the U.S., please use the international phone

number (253) 237-1173.If you are unable to participate in the live

call, the webcast will be available at

http://investors.vcel.com/events-presentations until May 7,

2020. A replay of the call will also be available until

11:00am (EDT) on May 12, 2019 by calling (855) 859-2056, or from

outside the U.S. (404) 537-3406. The conference ID is 1775796.

About Vericel CorporationVericel is a leader in

advanced cell therapies for the sports medicine and severe burn

care markets. The company markets two cell therapy products

in the United States. MACI (autologous cultured chondrocytes

on porcine collagen membrane) is an autologous cellularized

scaffold product indicated for the repair of symptomatic, single or

multiple full-thickness cartilage defects of the knee with or

without bone involvement in adults. Epicel (cultured

epidermal autografts) is a permanent skin replacement for the

treatment of patients with deep dermal or full-thickness burns

greater than or equal to 30% of total body surface area. For

more information, please visit the company's website at

www.vcel.com.

GAAP v. Non‑GAAP Measures Vericel's reported

earnings are prepared in accordance with generally accepted

accounting principles in the United States, or GAAP, and represent

earnings as reported to the Securities and Exchange Commission.

Vericel has provided in this release financial information

that has not been prepared in accordance with GAAP. Vericel's

management believes that the non-GAAP adjusted EBITDA described in

the release, or non-GAAP EBITDA adjusted for specific items that

are generally not indicative of our core operations, provides

additional information that is useful to investors in understanding

Vericel's underlying performance, business and performance trends,

and helps facilitate period to period comparisons and comparisons

of its financial measures with other companies in Vericel's

industry. However, non-GAAP financial measures that Vericel

uses may differ from measures that other companies may use.

Non-GAAP financial measures are not required to be uniformly

applied, are not audited and should not be considered in isolation

or as substitutes for results prepared in accordance with

GAAP.Epicel® and MACI® are registered trademarks of Vericel

Corporation. © 2019 Vericel Corporation. All rights

reserved.NexoBrid® is a registered trademark of MediWound Ltd. and

is used under license to Vericel Corporation.This document contains

forward-looking statements, including, without limitation,

statements regarding full-year 2019 revenue and financial guidance,

statements concerning anticipated progress, objectives and

expectations regarding the commercial potential of our products and

growth in revenues, and objectives and expectations regarding our

company described herein, all of which involve certain risks and

uncertainties. These statements are often, but are not always, made

through the use of words or phrases such as "anticipates,"

"intends," "estimates," "plans," "expects," "we believe," "we

intend," “guidance,” ”outlook,” “future,” and similar words or

phrases, or future or conditional verbs such as "will," "would,"

"should," "potential," "could," "may," or similar expressions.

Actual results may differ significantly from the expectations

contained in the forward-looking statements. Among the factors that

may result in differences are the inherent uncertainties associated

with our expectations regarding 2019 revenues, growth in revenues,

profit and target addressable market, improvements in gross margins

and cash flow, our ability to achieve or sustain profitability, our

need to generate significant sales to become profitable, potential

fluctuations in sales volumes and our results of operations over

the course of the year, competitive developments, estimating the

commercial growth potential of our products and product candidates,

market demand for our products, our ability to secure consistent

reimbursement for our products, changes in third party coverage and

reimbursement, any disruption or delays in operations at our

facilities, our dependence on a limited number of third party

suppliers, our ability to maintain and expand our network of direct

sales employees, and our ability to supply or meet customer demand

for our products. These and other significant factors are discussed

in greater detail in Vericel's Annual Report on Form 10-K for the

year ended December 31, 2018, filed with the Securities and

Exchange Commission ("SEC") on February 26, 2019, Quarterly Reports

on Form 10-Q and other filings with the SEC. These forward-looking

statements reflect management's current views and Vericel does not

undertake to update any of these forward-looking statements to

reflect a change in its views or events or circumstances that occur

after the date of this release except as required by law.

Global Media Contacts:David SchullRusso

Partners LLCDavid.schull@russopartnersllc.com+1 212-845-4271

(office)+1 858-717-2310 (mobile)

Karen ChaseRusso Partners LLCKaren.chase@russopartnersllc.com+1

646-942-5627 (office)+1 917-547-0434 (mobile)

Investor Contacts: Chad RubinSolebury

Troutcrubin@troutgroup.com+1 (646) 378-2947

Lee SternSolebury Troutlstern@troutgroup.com+1 (646)

378-2922

VERICEL

CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(unaudited, amounts in

thousands)

| |

|

March 31, |

|

December 31, |

| |

|

2019 |

|

2018 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

35,084 |

|

|

$ |

18,286 |

|

| Short term

investments |

|

49,001 |

|

|

64,640 |

|

| Accounts

receivable (net of allowance for doubtful accounts of $669 and

$514, respectively) |

|

18,774 |

|

|

23,454 |

|

|

Inventory |

|

4,063 |

|

|

3,558 |

|

| Other

current assets |

|

2,679 |

|

|

2,847 |

|

| Total

current assets |

|

109,601 |

|

|

112,783 |

|

| Property and equipment,

net |

|

6,445 |

|

|

5,906 |

|

| Right-of-use

assets |

|

25,183 |

|

|

— |

|

|

Total assets |

|

$ |

141,229 |

|

|

$ |

118,689 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

6,201 |

|

|

7,108 |

|

| Accrued

expenses |

|

4,179 |

|

|

6,930 |

|

| Current

portion of operating lease liabilities |

|

2,385 |

|

|

— |

|

| Other

liabilities |

|

176 |

|

|

754 |

|

| Total

current liabilities |

|

12,941 |

|

|

14,792 |

|

| Operating lease

liabilities |

|

25,100 |

|

|

— |

|

| Other long-term

liabilities |

|

133 |

|

|

1,666 |

|

|

Total liabilities |

|

38,174 |

|

|

16,458 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

| Common

stock, no par value; shares authorized — 75,000; shares issued and

outstanding — 43,825 and 43,578, respectively |

|

474,806 |

|

|

471,180 |

|

| Other

comprehensive gain (loss) |

|

3 |

|

|

(39 |

) |

|

Warrants |

|

104 |

|

|

104 |

|

| Accumulated

deficit |

|

(371,858 |

) |

|

(369,014 |

) |

| Total

shareholders’ equity |

|

103,055 |

|

|

102,231 |

|

| Total

liabilities and shareholders’ equity |

|

$ |

141,229 |

|

|

$ |

118,689 |

|

VERICEL

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited, amounts in thousands except

per share amounts)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| Product

sales, net |

|

$ |

21,810 |

|

|

$ |

18,027 |

|

| Cost of

product sales |

|

8,640 |

|

|

7,666 |

|

| Gross

profit |

|

13,170 |

|

|

10,361 |

|

| Research and

development |

|

3,008 |

|

|

3,729 |

|

| Selling,

general and administrative |

|

13,520 |

|

|

10,954 |

|

| Total

operating expenses |

|

16,528 |

|

|

14,683 |

|

| Loss from

operations |

|

(3,358 |

) |

|

(4,322 |

) |

| Other income

(expense): |

|

|

|

|

| Increase in

fair value of warrants |

|

— |

|

|

(2,907 |

) |

| Interest

income |

|

480 |

|

|

— |

|

| Interest

expense |

|

(2 |

) |

|

(432 |

) |

| Other

income |

|

36 |

|

|

2 |

|

| Total other

income (expense) |

|

514 |

|

|

(3,337 |

) |

| Net loss |

|

$ |

(2,844 |

) |

|

$ |

(7,659 |

) |

| |

|

|

|

|

| Net loss per share (Basic

and Diluted) |

|

$ |

(0.07 |

) |

|

$ |

(0.21 |

) |

| Weighted average number of

common shares outstanding (Basic and Diluted) |

|

43,725 |

|

|

36,140 |

|

| RECONCILIATION OF REPORTED NET LOSS (GAAP) TO

ADJUSTED EBITDA (NON-GAAP MEASURE) - UNAUDITED |

| |

|

|

|

|

| |

|

Three Months Ended March 31, |

| (In

thousands) |

|

2019 |

|

2018 |

| Net loss (GAAP) |

|

$ |

(2,844 |

) |

|

$ |

(7,659 |

) |

| Change in

fair value of warrants |

|

— |

|

|

2,907 |

|

| Stock

compensation expense |

|

2,628 |

|

|

1,342 |

|

| Depreciation

and amortization |

|

324 |

|

|

427 |

|

| Net

interest (income) expense |

|

(478 |

) |

|

432 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

(370 |

) |

|

$ |

(2,551 |

) |

| |

|

|

|

|

|

|

|

|

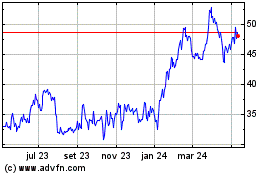

Vericel (NASDAQ:VCEL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

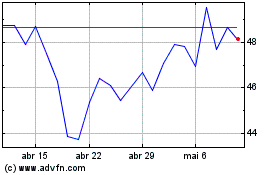

Vericel (NASDAQ:VCEL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024