Helix BioPharma Corp. Closes $7.0 Million Private Placement

21 Agosto 2019 - 6:05PM

Helix BioPharma Corp. (TSX: “HBP”) (“Helix” or the “Company”), an

immuno-oncology company developing innovative drug candidates for

the prevention and treatment of cancer, today announced it has

closed a private placement financing of 13,725,000 units of the

Company and the disposition of a 25% stake of its wholly-owned

Polish subsidiary for aggregate gross proceeds of CAD $7,000,005.

The terms of the placement are for the purchase

of units at $0.455 per unit. Each unit is comprised of one common

share and one common share purchase warrant. Each common share

purchase warrant will entitle the holder to purchase one common

share at an exercise price of $0.72 and have an expiry of five

years from the date of issuance. In addition, the terms of the

private placement also include the disposition by the Company of

shares of its Polish subsidiary, Helix Immuno-Oncology S.A.

(“HIO”), representing 25% of the outstanding shares of HIO.

Mr. Jerzy Wilczewski (“Mr. Wilczewski”),

acquired 13,725,500 units of Helix in the private placement.

Following closing, Mr. Wilczewski’s holdings, including previously

held common shares and common share purchase warrants of the

Company (“Warrants”), represent approximately 15.70% of the issued

and outstanding common shares of the Company on a non-diluted basis

and 26.14% on a partially diluted basis, assuming the full exercise

of all Warrants that Mr. Wilczewski beneficially owns or exercises

control or direction over.

“My family wants to contribute to cancer

research development,” said Mr. Wilczewski. “I decided to make this

sizeable investment in Helix because I believe in the social

objective and the uniqueness of the Company’s technology. An

additional motivation for me is the ongoing research and

development work that the Company is carrying on in Poland.”

“On behalf of Helix, I thank Mr. Wilczewski for

his confidence and contribution,” said Dr. Heman Chao, Helix’s

Chief Executive Officer.

The issuance of the units under the private

placement would ordinarily require shareholder approval under the

requirements of the Toronto Stock Exchange (the “TSX”), since the

aggregate number of common shares issuable (including through the

exercise of Warrants) in successive private placements within the

last three months exceeds 25% of the issued and outstanding common

shares of the Company prior to the first such placement and since

Mr. Wilczewski would potentially become a “control person” of the

Company on exercise of the Warrants. However, Mr. Wilczewski has

undertaken not to exercise any Warrants where the exercise would

result in him owning 20% or more of Helix’s outstanding common

shares unless disinterested shareholder approval, or the approval

of the TSX, has been obtained. The Company intends to seek

shareholder approval for the creation of Mr. Wilczewski as a

control person at its annual general meeting to be held later this

year.

The Company intends to use the net proceeds of

the private placement for working capital and research and

development activities.

ACM Alpha Consulting Management AG provided

financial advisory services to Helix in connection with the private

placement.

About Helix BioPharma Corp.

Helix BioPharma Corp. is an immuno-oncology

company specializing in the field of cancer therapy. The company is

actively developing innovative products for the prevention and

treatment of cancer based on its proprietary technologies. Helix’s

product development initiatives include its novel L-DOS47 new drug

candidate and Chimeric Antigen Receptor (“CAR”) based cell

therapies. Helix is currently listed on the TSX under the symbol

“HBP”.

Investor RelationsHelix

BioPharma Corp.9120 Leslie Street, Suite 205Richmond Hill, Ontario,

L4B 3J9Tel: 905-841-2300Email: ir@helixbiopharma.com

Cautionary Statements

This news release may contain forward-looking

statements with respect to Helix, its operations, strategy,

financial performance and condition, including its activities

relating to its drug development program, any anticipated timelines

for the commencement or completion of certain activities such as

raising sufficient capital, merger and acquisition activity,

listing on a U.S. exchange and other information in future periods.

These statements generally can be identified by use of

forward-looking words such as “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. The actual results and performance

of discussed herein could differ materially from those expressed or

implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including: (i) Helix’s ability to operate as a going

concern being dependent mainly on securing sufficient additional

financing in order to fund its ongoing research and development and

other operating activities; (ii) the generally inherent uncertainty

involved in scientific research and drug development and those

specific to Helix’s pre-clinical and clinical development programs

(DOS47, L-DOS47, V-DOS47 and CAR-T); (iii) that any transactions

contemplated herein are completed; and (iv) those risks and

uncertainties affecting Helix as more fully described in Helix’s

most recent Annual Information Form, which is available at

www.sedar.com (together, the “Helix Risk Factors”). Certain

material factors and assumptions are applied in making the

forward-looking statements, including, without limitation, that

sufficient financing will be obtained in a timely manner to allow

Helix to continue operations and implement its clinical trials in

the manner and on the timelines anticipated and that the Helix Risk

Factors will not cause Helix’s actual results or events to differ

materially from the forward-looking statements. These cautionary

statements qualify all such forward-looking statements.

Forward-looking statements and information are

based on the beliefs, assumptions, opinions, plans and expectations

of Helix’s management on the date of this news release, and the

Company does not assume any obligation to update any

forward-looking statement or information should those beliefs,

assumptions, opinions, plans or expectations, or other

circumstances change, except as required by law.

The securities offered have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended (the “U.S. Securities Act”), or any state securities

laws, and may not be offered or sold within the United States or

to, or for the account or benefit of, any U.S. persons (as defined

in Regulation S under the U.S. Securities Act) unless pursuant to

an exemption from those registration requirements. This press

release does not constitute an offer to sell or a solicitation of

an offer to buy any such securities of Helix BioPharma Corp. in the

United States or any other jurisdiction.

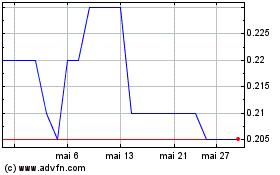

Helix BioPharma (TSX:HBP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Helix BioPharma (TSX:HBP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024