Innergex Renewable Energy Inc. (TSX: INE) (“Innergex” or the

“Corporation”) has entered into an agreement with TD Securities

Inc., CIBC Capital Markets, BMO Capital Markets and National Bank

Financial Inc. on behalf of a syndicate of underwriters, pursuant

to which the underwriters have agreed to purchase, on a bought deal

basis, convertible unsecured subordinated debentures of Innergex

(the “Debentures”) in an aggregate principal amount of $125 million

(the “Offering”). The Debentures will be offered at a price of

$1,000 per Debenture by way of short form prospectus in each of the

provinces of Canada, and may also be offered in the United States

under applicable registration statement exemptions.

The Debentures will bear interest at a rate of

4.65% per annum, payable semi-annually on October 31 and April 30

each year, commencing on April 30, 2020. The Debentures will be

convertible at the holder’s option into Innergex common shares at a

conversion price of $22.90 per share (the “Conversion Price”),

representing a conversion rate of 43.6681 common shares per

$1,000 principal amount of Debentures. The Debentures will mature

on October 31, 2026. They will not be redeemable before October 31,

2022. On and after October 31, 2022, and before October 31, 2024,

Innergex may redeem the Debentures at par plus accrued and unpaid

interest, in certain circumstances. On or after October 31, 2024,

Innergex may redeem the Debentures at par plus accrued and unpaid

interest.

Innergex has also granted an over-allotment

option to the underwriters of the Offering, entitling them to

purchase, for a period of 30 days from the closing of the Offering,

up to $18.75 million principal amount of additional Debentures at

the offering price of $1,000 per Debenture, to cover

over-allotments, if any.

Innergex also announces that it has issued a

notice of redemption to the holders of its currently outstanding

4.25% convertible unsecured subordinated debentures maturing on

August 31, 2020 (the “4.25% Convertible Debentures”). As set out in

the notice of redemption, Innergex intends to redeem all of the

4.25% Convertible Debentures issued and outstanding as of October

8, 2019 (the "Redemption Date"). The 4.25% Convertible Debentures

are redeemable at a redemption price equal to their principal

amount (the "Redemption Price"), plus accrued and unpaid interest

thereon to, but excluding, the Redemption Date. As of the close of

business on September 4, 2019, there was $100 million principal

amount of 4.25% Convertible Debentures issued and outstanding.

Pursuant to the terms of the 4.25% Convertible

Debentures, holders of the 4.25% Convertible Debentures have the

right, prior to the Redemption Date, to convert their 4.25%

Convertible Debentures into Innergex common shares at a conversion

price of $15.00 per common share. A full description of the

redemption process as well as of the right of holders of 4.25%

Convertible Debentures to convert their debentures into Innergex

common shares is set out in Innergex’s final short-form prospectus

dated July 31, 2015. Holders of 4.25% Convertible Debentures should

also refer to the Trust Indenture dated August 10, 2015 for

additional information. All of the foregoing documents are

available under Innergex’s profile on SEDAR at www.sedar.com.

The net proceeds of the Offering will be used to

initially prepay indebtedness under the Corporation’s revolving

term credit facility, which will then be available to be drawn, as

required, to finance the redemption of all outstanding 4.25%

Convertible Debentures, and to fund development projects and other

growth opportunities or for general corporate purposes.

In connection with the Offering, Innergex will

file a preliminary short form prospectus in all provinces of Canada

by September 11, 2019. The prospectus offering is subject to all

standard regulatory approvals, including that of the Toronto Stock

Exchange, and is expected to close on or about September 30,

2019.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities in

any jurisdiction. The Debentures being offered, and the Innergex

common shares issuable upon the conversion or redemption of the

Debentures, have not been and will not be registered under the U.S.

Securities Act of 1933 or state securities laws. Accordingly, the

Debentures may not be offered or sold in the United States except

pursuant to applicable exemptions from registration.

This press release is not an offer of

securities for sale in the United States. Securities may not be

sold in the United States absent registration or an exemption from

registration.

About Innergex Renewable Energy

Inc.The Corporation is an independent renewable power

producer which develops, acquires, owns and operates hydroelectric

facilities, wind farms and solar farms. As a global corporation,

Innergex conducts operations in Canada, the United States, France

and Chile. Innergex manages a large portfolio of assets currently

consisting of interests in 66 operating facilities with an

aggregate net installed capacity of 1,988 MW (gross 2,888 MW),

including 37 hydroelectric facilities, 25 wind farms and four solar

farms. Innergex also holds interests in eight projects under

development with a net installed capacity of 896 MW (gross 978 MW),

two of which are currently under construction and prospective

projects at different stages of development with an aggregate gross

capacity totalling 7,767 MW. Respecting the environment and

balancing the best interests of the host communities, its partners,

and its investors are at the heart of the Corporation's development

strategy. Its approach for building shareholder value is to

generate sustainable cash flows, provide an attractive

risk-adjusted return on invested capital and to distribute a stable

dividend. Innergex Renewable Energy Inc. is rated BBB- by

S&P.

Forward-Looking Information

Disclaimer To inform readers of Innergex's future

prospects, this press release contains forward-looking information

within the meaning of applicable securities laws including, but not

limited to, the use of proceeds of the Offering, the size of the

Offering, the anticipated closing of the Offering, the redemption

of the 4.25% Convertible Debentures, Innergex’s business strategy,

future development and growth prospects, business outlook,

objectives, plans and strategic priorities, and other statements

that are not historical facts (“Forward-Looking Information”).

Forward-Looking Information can generally be identified by the use

of words such as “approximately”, “may”, “will”, "could",

“believes", “expects", “intends”, "should", “plans”, “potential”,

"project", “anticipates”, “estimates”, “scheduled” or “forecasts”,

or other comparable terminology that states that certain events

will or will not occur. It represents the projections and

expectations of Innergex relating to future results and

developments as of the date of this press release. It includes

future-oriented financial information or financial outlook within

the meaning of securities laws, such as use of proceeds of the

Offering, to inform readers of the potential financial impact of

the Offering. Such information may not be appropriate for other

purposes.

The material risks and uncertainties that may

cause actual results and developments to be materially different

from current expressed Forward-Looking Information are referred to

in the Corporation’s Annual Information Form in the “Risk Factors”

section and include, without limitation: the ability of the

Corporation to execute its strategy for building shareholder value;

its ability to raise additional capital and the state of capital

markets; liquidity risks related to derivative financial

instruments; variability in hydrology, wind regimes and solar

irradiation; delays and cost overruns in the design and

construction of projects; uncertainty surrounding the development

of new facilities; variability of installation performance and

related penalties; and the ability to secure new power purchase

agreements or to renew existing ones.

Although the Corporation believes that the

expectations and assumptions on which Forward-Looking Information

is based are reasonable, readers of this press release are

cautioned not to rely unduly on this Forward-Looking Information

since no assurance can be given that they will prove to be correct.

The Corporation does not undertake any obligation to update or

revise any Forward-Looking Information, whether as a result of

events or circumstances occurring after the date of this press

release, unless so required by legislation.

For informationJean-François

NeaultChief Financial Officer450 928-2550, ext.

1207jfneault@innergex.cominnergex.com

Karine VachonDirector – Communications450

928-2550, ext. 1222kvachon@innergex.com

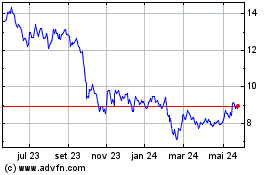

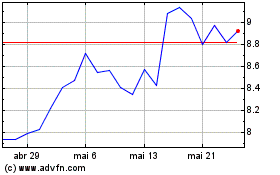

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024