AGI Announces Closing of $75 Million Public Offering of Senior Subordinated Unsecured Debentures and Redemption of Convertib...

19 Novembro 2019 - 11:17AM

Ag Growth International Inc. (TSX: AFN) ("

AGI" or

the "

Company") is pleased to announce that it has

closed its previously announced public offering of $75 million

aggregate principal amount of senior subordinated unsecured

debentures (the "

Debentures") at a price of $1,000

per Debenture. A syndicate book run by CIBC Capital Markets,

National Bank Financial Inc., RBC Capital Markets and Scotia

Capital Inc., and including TD Securities Inc., Raymond James Ltd.,

Cormark Securities Inc., Desjardins Securities Inc. and Laurentian

Bank Securities Inc. (collectively, the

"

Underwriters") acted as underwriters for the

offering.

The Debentures have an interest rate of 5.25%

per annum, have a maturity date of December 31, 2024, and are

listed for trading on the Toronto Stock Exchange under the symbol

"AFN.DB.G". AGI has granted the Underwriters an over-allotment

option, exercisable in whole or in part for a period of 30 days

following closing, to purchase up to an additional $11,250,000

aggregate principal amount of Debentures.

AGI will initially use the net proceeds of the

offering to repay outstanding indebtedness under its revolving

credit facilities, which facilities will then be redrawn to fund

the redemption of the Company's 5.00% convertible unsecured

subordinated debentures due December 31, 2020 (the

"Convertible Debentures"). The Convertible

Debentures are listed on the Toronto Stock Exchange under the

symbol "AFN.DB.C" and the redemption will be effective January 3,

2020 (the "Redemption Date"). The aggregate

principal amount of the Convertible Debentures outstanding is $75

million. On the Redemption Date, AGI will pay holders of the

Convertible Debentures a redemption price equal to $1,000 for each

$1,000 principal amount of Convertible Debentures held, plus

accrued and unpaid interest thereon up to but excluding the

Redemption Date, less any taxes required to be deducted or

withheld. Formal notice of redemption will be delivered to

the registered holders of Convertible Debentures through the

debenture trustee, Computershare Trust Company of Canada, in

accordance with the trust indenture governing the Convertible

Debentures. Beneficial holders of the Convertible Debentures

are encouraged to contact their investment dealer if they have any

questions about the redemption.

This press release is not an offer of Debentures

for sale in the United States. The Debentures may not be offered or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended, or an exemption from such

registration. The Company has not registered and will not register

the Debentures under the U.S. Securities Act of 1933, as amended.

The Company does not intend to engage in a public offering of

Debentures in the United States. This press release shall not

constitute an offer to nor shall there be any sale of the

Debentures in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Company Profile

AGI is a leading provider of equipment solutions

for agriculture bulk commodities including seed, fertilizer, grain

and feed systems with a growing platform in providing equipment and

solutions for food processing facilities. AGI has manufacturing

facilities in Canada, the United States, the United Kingdom,

Brazil, France, Italy and India and distributes its product

globally.

Further information can be found in the

disclosure documents filed by AGI with the securities regulatory

authorities, available at www.sedar.com and on AGI's website,

www.aggrowth.com.

Forward-Looking Information

This press release contains certain

forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking information is often, but

not always, identified by the use of words such as "anticipate",

"believe", "plan", "intend", "objective", "continuous", "ongoing",

"estimate", "expect", "may", "will", "project", "should" or similar

words suggesting future outcomes. In particular, this press release

includes forward-looking information relating to the anticipated

use of the net proceeds of the offering. This information is based

on current expectations that involve a number of risks and

uncertainties which could cause actual results to differ from those

anticipated. These risks include, but are not limited to, the

potential reallocation by AGI of all or a portion of the net

proceeds for business reasons, including, among others, due to

results of operations or as a result of other business

opportunities that may become available. Additional information on

these and other factors that could affect AGI's operations,

financial results or dividend payments are included in AGI's annual

information form and other reports on file with Canadian securities

regulatory authorities, which can be accessed through the SEDAR

website at www.sedar.com. AGI assumes no obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or any other reason, other than as

required by applicable securities laws. In the event AGI does

update any forward- looking information, no inference should be

made that it will make additional updates with respect to that

information, related matters, or any other forward-looking

information.

For More Information Contact:

Investor RelationsSteve

Sommerfeld204-489-1855steve@aggrowth.com

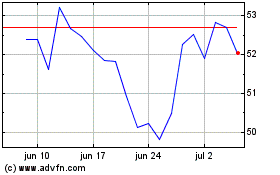

Ag Growth (TSX:AFN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

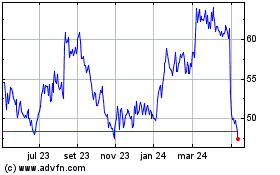

Ag Growth (TSX:AFN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025