Wajax Corporation (“Wajax” or the “Corporation”) (TSX: WJX)

announced today that it has entered into an agreement with a

syndicate of underwriters led by BMO Capital Markets, RBC Capital

Markets, and Scotiabank under which the underwriters have agreed to

purchase, on a "bought deal" basis, $50 million principal amount of

listed senior unsecured debentures, at a price of $1,000 per

debenture, with an interest rate of 6.00% per annum, payable

semi-annually on January 15th and July 15th commencing on July 15,

2020 (the "Debentures"). The Debentures will mature on January 15,

2025.

The Corporation has also granted the

underwriters the option to purchase up to $7.5 million principal

amount of additional Debentures at the same price, to cover

over-allotments, if any, and for market stabilization purposes,

exercisable in whole or in part anytime up to 30 days following

closing of the offering.

The Debentures will not be redeemable before

January 15, 2023 (the “First Call Date”), except upon the

occurrence of a change of control of the Corporation in accordance

with the terms of the indenture (the "Indenture") governing the

Debentures. On and after the First Call Date and prior to January

15, 2024, the Debentures will be redeemable in whole or in part

from time to time at the Corporation’s option at a redemption price

equal to 103.00% of the principal amount of the Debentures redeemed

plus accrued and unpaid interest, if any, up to but excluding the

date set for redemption. On and after January 15, 2024 and prior to

the Maturity Date, the Debentures will be redeemable, in whole or

in part, from time to time at the Corporation’s option at par plus

accrued and unpaid interest, if any, up to but excluding the date

set for redemption. The Corporation shall provide not more than 60

nor less than 30 days’ prior notice of redemption of the

Debentures.

The Corporation will have the option to satisfy

its obligation to repay the principal amount of the Debentures due

at redemption or maturity by issuing and delivering that number of

freely tradeable common shares determined in accordance with the

terms of the Indenture.

The Debentures will not be convertible into

common shares at the option of the holders at any time.

The Corporation intends to use the net proceeds

of the offering for the repayment of outstanding indebtedness under

existing credit facilities.

The Debentures will be direct, senior unsecured

obligations of the Corporation and will rank: (i) subordinate to

all indebtedness of the Corporation under its existing Second

Amended and Restated Credit Agreement, dated as of September 20,

2017, as amended through November 19, 2019 (as amended or restated

from time to time, the “Senior Secured Credit Facilities”),

including related hedges, derivative instruments and cash

management arrangements under the Senior Secured Credit Facilities,

(ii) effectively subordinate to all existing and future secured

indebtedness of the Corporation (other than its Senior Secured

Credit Facilities), but only to the extent of the value of the

assets securing such secured indebtedness; (iii) pari passu with

one another and equally in right of payment from the Corporation

with all other unsubordinated unsecured indebtedness of the

Corporation except as prescribed by law; and (iv) senior to any

other existing and future subordinated unsecured indebtedness

(including any convertible subordinated unsecured debentures) of

the Corporation. The Debentures will not be obligations of, or

guaranteed by, any of the Corporation’s subsidiaries, and will be

effectively subordinated to the indebtedness of the Corporation

subsidiaries (including trade payables). The Indenture will not

restrict the Corporation or its subsidiaries from incurring

additional indebtedness or from mortgaging, pledging or charging

its properties to secure any indebtedness or liabilities.

The offering is subject to normal regulatory

approvals, including approval of the Toronto Stock Exchange, and is

expected to close on or about December 4, 2019.

The Debentures will be offered by way of a

prospectus supplement to the base shelf prospectus dated November

21, 2019 in all of the provinces of Canada.

The securities offered have not been and will

not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

Wajax Corporation

Founded in 1858, Wajax (TSX: WJX) is one of

Canada’s longest-standing and most diversified industrial products

and services providers. The Corporation operates an integrated

distribution system providing sales, parts and services to a broad

range of customers in diverse sectors of the Canadian economy,

including: construction, forestry, mining, industrial and

commercial, oil sands, transportation, metal processing, government

and utilities, and oil and gas.

The Corporation’s goal is to be Canada’s leading

industrial products and services provider, distinguished through

its three core capabilities: sales force excellence, the breadth

and efficiency of repair and maintenance operations, and the

ability to work closely with existing and new vendor partners to

constantly expand its product offering to customers. The

Corporation believes that achieving excellence in these three areas

will position it to create value for its customers, employees,

vendors and shareholders.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains certain

forward-looking statements and forward-looking information, as

defined in applicable securities laws (collectively,

“forward-looking statements”). These forward-looking statements

relate to future events or the Corporation’s future performance.

All statements other than statements of historical fact are

forward-looking statements. Often, but not always, forward looking

statements can be identified by the use of words such as “plans”,

“anticipates”, “intends”, “predicts”, “expects”, “is expected”,

“scheduled”, “believes”, “estimates”, “projects” or “forecasts”, or

variations of, or the negatives of, such words and phrases or state

that certain actions, events or results “may”, “could”, “would”,

“should”, “might” or “will” be taken, occur or be achieved. Forward

looking statements involve known and unknown risks, uncertainties

and other factors beyond the Corporation’s ability to predict or

control which may cause actual results, performance and

achievements to differ materially from those anticipated or implied

in such forward-looking statements. There can be no assurance that

any forward-looking statement will materialize. Accordingly,

readers should not place undue reliance on forward looking

statements. The forward-looking statements in this news release are

made as of the date of this news release, reflect management’s

current beliefs and are based on information currently available to

management. Although management believes that the expectations

represented in such forward-looking statements are reasonable,

there is no assurance that such expectations will prove to be

correct. Specifically, this news release includes forward looking

statements regarding, among other things, the proposed timing of

completion of the offering and the likelihood that the offering

will be completed on the terms provided herein or at all; the

receipt of all necessary approvals of the Toronto Stock Exchange;

the anticipated use of the net proceeds of the offering; our goal

of becoming Canada’s leading industrial products and services

provider, distinguished through our core capabilities; and our

belief that achieving excellence in our areas of core capability

will position Wajax to create value for its customers, employees,

vendors and shareholders. These statements are based on a number of

assumptions which may prove to be incorrect, including, but not

limited to, the ability of the Corporation to receive, in a timely

manner and on satisfactory terms, the necessary approval of the

Toronto Stock Exchange; general business and economic conditions;

the supply and demand for, and the level and volatility of prices

for, oil, natural gas and other commodities; financial market

conditions, including interest rates; our ability to execute our

updated Strategic Plan, including our ability to develop our core

capabilities, execute on our organic growth priorities, complete

and effectively integrate acquisitions, such as Groupe Delom Inc.,

and to successfully implement new information technology platforms,

systems and software; the future financial performance of the

Corporation; our costs; market competition; our ability to attract

and retain skilled staff; our ability to procure quality products

and inventory; and our ongoing relations with suppliers, employees

and customers. The foregoing list of assumptions is not exhaustive.

Factors that may cause actual results to vary materially include,

but are not limited to, the failure or delay in satisfying any of

the conditions to the completion of the offering. Additional

factors include, but are not limited to, a deterioration in general

business and economic conditions; volatility in the supply and

demand for, and the level of prices for, oil, natural gas and other

commodities; a continued or prolonged decrease in the price of oil

or natural gas; fluctuations in financial market conditions,

including interest rates; the level of demand for, and prices of,

the products and services we offer; levels of customer confidence

and spending; market acceptance of the products we offer;

termination of distribution or original equipment manufacturer

agreements; unanticipated operational difficulties (including

failure of plant, equipment or processes to operate in accordance

with specifications or expectations, cost escalation, our inability

to reduce costs in response to slow-downs in market activity,

unavailability of quality products or inventory, supply

disruptions, job action and unanticipated events related to health,

safety and environmental matters); our ability to attract and

retain skilled staff and our ability to maintain our relationships

with suppliers, employees and customers. The foregoing list of

factors is not exhaustive. Further information concerning the risks

and uncertainties associated with these forward-looking statements

and the Corporation’s business may be found in our Annual

Information Form for the year ended December 31, 2018, filed on

SEDAR. The forward-looking statements contained in this news

release are expressly qualified in their entirety by this

cautionary statement. The Corporation does not undertake any

obligation to publicly update such forward-looking statements to

reflect new information, subsequent events or otherwise unless so

required by applicable securities laws.

Additional information, including Wajax’s Annual

Report, is available on SEDAR at www.sedar.com.

For further information, please

contact:

Mark Foote, President and Chief Executive Officer

Email: mfoote@wajax.com

Stuart Auld, Chief Financial Officer Email:

sauld@wajax.com

Trevor Carson, Vice President, Financial Planning

and Risk Management Email: tcarson@wajax.com

Telephone #: (905) 212-3300

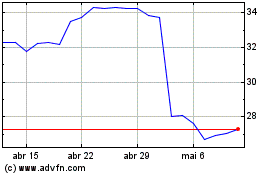

Wajax (TSX:WJX)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Wajax (TSX:WJX)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025