Helix BioPharma Corp. (TSX: “HBP”), a an immuno-oncology company

developing drug candidates for the prevention and treatment of

cancer, today announced its financial results for the fiscal second

quarter ended January 31, 2020.

OVERVIEW

The Company reported a consolidated net loss and

total comprehensive loss, including non-controlling interest of

$2,255,000 ($0.02 loss per common share) and $4,466,000 ($0.04 loss

per common share), respectively for the three and six-month period

ended January 31, 2020. For the three and six-month periods

ended January 31, 2019, consolidated net loss and total

comprehensive loss including non-controlling interest totalled

$1,908,000 ($0.02 loss per common share) and $3,287,000 ($0.03 loss

per common share), respectively.

To-date in fiscal 2020, the Company has raised

gross proceeds totaling approximately $16,000,000 and as a result,

no longer faces a working capital deficiency. In addition,

the Company during the fiscal year, to-date has divested a 49%

percent stake in its Polish subsidiary and is working on divesting

the remaining 51% before the end of the Company’s fiscal 2020

year-end while retaining licensing agreements for future royalties

and milestones payments.

The Company has also been in discussions with

various capital market firms, both in the U.S. and Canada, with the

goal of raising additional capital to further advance the Company’s

clinical development programs and to qualify for a NASDAQ

listing.

Patient enrollment and screening commenced on

the LDOS006 Phase Ib/II clinical study in the U.S. for the

treatment of patients with previously treated advanced pancreatic

cancer. Two patients have been enrolled to-date. The

Phase Ib portion of the study involves three dose escalating

cohorts enrolling a total of nine (9) patients. The Phase II

portion of the study will enroll an additional eleven (11) patients

depending on meeting safety and efficacy criteria. The

Company’s other clinical studies for non-small cell lung cancer are

in the following stages of development. LDOS001 clinical

study has completed enrollment and the Company is working on

finalizing data for reporting while LDOS003 is in the last cohort

of the study’s dose escalation phase.

Research and development

Research and development costs for the three and

six-month periods ended January 31, 2020 totalled $1,588,000 and

$3,099,000, respectively ($1,330,000 and $2,344,000 respectively

for the three and six-month periods ended January 31, 2019).

The following table outlines research and

development expenditures for the Company’s significant research and

development projects:

|

|

For the three-month |

For the six-month |

| periods ended January

31 |

periods ended January

31 |

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| L-DOS47 |

$ |

1,332,000 |

$ |

788,000 |

$ |

2,453,000 |

$ |

1,649,000 |

| V-DOS47 |

|

69,000 |

|

102,000 |

|

180,000 |

|

232,000 |

| CAR-T |

|

– |

|

333,000 |

|

– |

|

333,000 |

| Corporate

research and development expenses |

|

160,000 |

|

125,000 |

|

260,000 |

|

225,000 |

| Trademark

and patent related expenses |

|

85,000 |

|

43,000 |

|

238,000 |

|

68,000 |

| Depreciation

expense |

|

34,000 |

|

26,000 |

|

48,000 |

|

59,000 |

| Stock-based

compensation expense |

|

40,000 |

|

– |

|

79,000 |

|

– |

|

Polish government grant subsidy (V-DOS47) |

|

(132,000 |

) |

(87,000 |

) |

(159,000 |

) |

(222,000) |

|

|

$ |

1,588,000 |

$ |

1,330,000 |

$ |

3,099,000 |

$ |

2,344,000 |

L-DOS47 research and development expenses for

the three and six-month periods ended January 31, 2020 totalled

$1,332,000 and $2,453,000, respectively (January 31, 2019 -

$788,000 and $1,649,000, respectively). L-DOS47 research and

development expenditures relate primarily to the Company’s LDOS001

Phase I clinical study in the U.S., the LDOS003 Phase II clinical

study in Poland and the Ukraine and the Company’s newly approved

LDOS006 Phase Ib/II clinical study in the U.S. The increase

in L-DOS47 expenditures in Q2 fiscal 2020 when compared to Q2

fiscal 2019 reflects an increase of approximately $350,000 in

L-DOS47 manufacturing activity to produce additional drug substance

in addition to increased spend of approximately $295,000 in the

Company’s newly launched pancreatic clinical study in the U.S. The

Company commenced enrollment in the new pancreatic clinical study

in December 2019. For the six-month period ending Q2 2020 when

compared to the six-moth period ended Q2 2019 the increase in

spending mainly reflects the increase in cost associated with the

commencement of the new pancreatic clinical trial in the U.S.

Preclinical V-DOS47 research and development

expenses for the three and six-month periods ended January 31, 2020

and 201 totalled $69,000 and $180,000, respectively (January 31,

2019 - $102,000 and $232,000, respectively). The Company’s

wholly owned subsidiary in Poland has a grant funding agreement

with the Polish National Centre for Research and Development

(“PNCRD”) for research and development expenditures associated with

V-DOS47. In the three and six-month period ended January 31,

2020, the Company’s Polish subsidiary received grant funding of

$132,000 and $159,000, respectively (January 31, 2019 - $87,000 and

$222,000, respectively), from the PNCRD.

CAR-T research and development expenses for both

the three and six-month periods ended January 31, 2020 totalled

$nil, respectively (January 31, 2019 - $333,000,

respectively). The Company’s collaboration with ProMab

Biotechnologies Inc. has been impacted by the Coronavirus pandemic

and as such certain planned activities have been deferred.

Trademark and patent related expenses for the

three and six-month periods ended January 31, 2020 totalled $85,000

and $238,000, respectively (January 31, 2019 - $43,000 and $68,000,

respectively). The Company continues to ensure it adequately

protects its intellectual property.

Stock based compensation expense for the three

and six-month periods ended January 31, 2020 totalled $40,000 and

$79,000, respectively (January 31, 2019 - $nil and $nil,

respectively). The amount represents the expense associated

with the vesting of stock options that were granted in May 2019,

over their vesting period.

Operating, general and

administration

Operating, general and administration expenses

for the three and six-month periods ended January 31, 2020 totalled

$654,000 and $1,363,000, respectively ($533,000 and $906,000

respectively for the three and six-month periods ended January 31,

2019). The increase is mainly the result of higher expenses

associated with various third-party advisor services such as

investor and media relations, legal, business development

activities and investment banking services. The Company has been in

discussion with various advisory groups as it pursues a listing on

a recognized U.S. stock exchange, like the Nasdaq.

The following table outlines operating, general

and administration costs expensed for the following periods:

|

|

For the three-month |

For the six-month |

| periods ended January

31 |

periods ended January

31 |

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Wages and

benefits |

$ |

145,000 |

$ |

179,000 |

$ |

319,000 |

$ |

334,000 |

| Director

fees |

|

39,000 |

|

41,000 |

|

81,000 |

|

80,000 |

|

Third-party advisors |

|

320,000 |

|

210,000 |

|

685,000 |

|

314,000 |

| Other

general and administrative |

|

114,000 |

|

100,000 |

|

206,000 |

|

172,000 |

|

Depreciation expense |

|

3,000 |

|

– |

|

6,000 |

|

1,000 |

|

Stock-based compensation expense |

|

33,000 |

|

3,000 |

|

66,000 |

|

5,000 |

|

|

$ |

654,000 |

$ |

533,000 |

$ |

1,363,000 |

$ |

906,000 |

LIQUIDITY AND CAPITAL

RESOURCES

The Company reported a consolidated net loss and

total comprehensive loss including non-controlling interest of

$2,255,000 for the three-month period ended January 31, 2020

(January 31, 2019 - $1,908,000) and $4,466,000 for the six-month

period ended January 31, 2020 (January 31, 2019 -

$3,287,000). As at January 31, 2020 the Company had working

capital of $873,000, shareholders’ equity of $1,088,000 and a

deficit of $175,938,000. As at July 31, 2019 the Company had

a working capital deficiency of $3,534,000, shareholders’

deficiency of $3,281,000 and a deficit of $171,531,000.

The Company experienced a working capital

deficiency for several fiscal quarters, until August 21, 2019 when

the Company closed a private placement financing for gross proceeds

of $7,000,005 which included a disposition of a 25% stake in the

Company’s Polish subsidiary. Subsequent to the August 21,

2019 private placement and as of March 12, 2020, the Company raised

an additional $9.000,000. To-date in fiscal 2020 the Company

has raised a total of $16,000,000.

As previously disclosed, the Company intends to

fully divest its remaining 51.0% interest in its Polish subsidiary

to raise additional capital to further fund the Company’s clinical

development programs for future royalties and milestone

payments.

In addition, the Company has been in discussions

with various capital market firms, both in the U.S. and Canada,

with the goal of raising additional capital to qualify the Company

for a listing on a U.S. stock exchange such as NASDAQ in order to

further advance the Company’s clinical development programs.

The Company’s cash reserves of $2,094,000 as at

January 31, 2020 in addition to the subsequent private placement

the Company closed on March 12, 2020 are insufficient to meet

anticipated cash needs for working capital and capital expenditures

through the next twelve months, and nor are they sufficient to see

planned research and development initiatives through to

completion. Though the funds raised have materially assisted

the Company in dealing with its working capital deficiency,

additional funds are required to advance the Company’s clinical and

preclinical programs and deal with working capital

requirements To the extent that the Company does not believe

it has sufficient liquidity to meet its current obligations,

management considers securing additional funds, primarily through

the issuance of equity securities of the Company, to be critical

for its development needs.

The Company’s condensed unaudited interim

consolidated statement of net loss and comprehensive loss for the

three and six-month periods ending January 31, 2020 and 2019 and

the condensed unaudited interim consolidated statement of cash

flows for the six-month periods ending January 31, 2020 and 2019

are summarized below:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Net Loss and Comprehensive Loss |

|

|

|

Consolidated Statements of Cash Flows |

|

|

|

(thousand $, except for per share data) |

|

|

|

|

|

|

|

(thousand $) |

|

|

|

|

|

|

|

For the three-months ended January 31 |

|

For the six-months ended January 31 |

|

|

|

|

For the six-months ended January 31 |

|

|

|

|

|

2020 |

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

|

|

|

2020 |

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

Cash provided by (used in): |

|

|

|

|

|

Research and development |

|

|

1,588 |

|

|

1,330 |

|

|

|

3,099 |

|

|

2,344 |

|

|

|

Net loss and total comprehensive loss, |

|

|

|

Operating, general, administration |

|

|

654 |

|

|

533 |

|

|

|

1,363 |

|

|

906 |

|

|

|

including non-controlling interest |

|

(4,466 |

) |

(3,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Results from operating activities |

|

|

|

|

|

|

|

|

Adjustments, including non-controlling |

|

|

|

|

before finance items |

|

|

(2,242 |

) |

|

(1,863 |

) |

|

|

(4,462 |

) |

|

(3,250 |

) |

|

|

interest to net cash provided by operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance items |

|

|

(13 |

) |

|

(45 |

) |

|

|

(4 |

) |

|

(37 |

) |

|

|

Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

54 |

|

64 |

|

|

|

Net loss and total comprehensive loss, |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

146 |

|

2 |

|

|

|

including non-controlling interest |

|

|

(2,255 |

) |

|

(1,908 |

) |

|

|

(4,466 |

) |

|

(3,287 |

) |

|

|

Foreign exchange loss (gain) |

|

10 |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

210 |

|

79 |

|

|

|

Add: Net loss and total comprehensive loss, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

attributable to non-controlling interest |

|

|

24 |

|

|

- |

|

|

|

59 |

|

|

- |

|

|

|

Changes in non-cash working capital |

(2,519 |

) |

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss, |

|

|

|

|

|

|

|

|

Operating activities |

|

(6,775 |

) |

(3,171 |

) |

|

|

attributable to Helix BioPharma Corp. |

|

|

(2,231 |

) |

|

- |

|

|

|

(4,407 |

) |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

7,657 |

|

3,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share |

|

-$ |

0.02 |

|

-$ |

0.02 |

|

|

-$ |

0.04 |

|

-$ |

0.03 |

|

|

|

Investing activities |

|

1,016 |

|

(2 |

) |

|

|

* Figures are for both basic and fully diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange rate changes on cash |

|

(10 |

) |

(13 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Net increase (decrease) in cash |

|

1,888 |

|

(60 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Cash beginning of the period |

|

206 |

|

366 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Cash end of the period |

|

2,094 |

|

306 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company’s Consolidated Statement of Financial Position as at

January 31, 2020 and July 31, 2019 are summarized below.

| |

|

|

|

|

|

Consolidated Statement of Financial Position (thousand $) |

|

|

|

|

|

|

|

|

|

|

31-Jan-20 |

31-Jul-19 |

|

|

|

|

|

|

|

|

Non current assets |

|

215 |

253 |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

Prepaids |

|

258 |

191 |

|

|

|

Accounts receivable |

|

172 |

290 |

|

|

|

Cash |

|

2,094 |

206 |

|

|

|

|

|

2,524 |

687 |

|

|

|

|

|

|

|

|

|

Total assets |

|

2,739 |

940 |

|

|

|

|

|

|

|

|

|

Shareholders' equity / (deficiency) |

1,088 |

(3,281 |

) |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Deferred government grant |

84 |

124 |

|

|

|

Accrued liabilities |

|

473 |

1,057 |

|

|

|

Accounts payable |

|

1,094 |

3,040 |

|

|

|

|

|

1,651 |

4,221 |

|

|

|

Total liabilities & |

|

|

|

|

|

shareholders' equity / (deficiency) |

2,739 |

940 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

The Company’s condensed unaudited interim

consolidated financial statements and management’s discussion and

analysis will be filed under the Company’s profile on SEDAR at

www.sedar.com, as well as on the Company’s website.

About Helix BioPharma Corp.

Helix BioPharma Corp. is an immuno-oncology

company specializing in the field of cancer therapy. The company is

actively developing innovative products for the prevention and

treatment of cancer based on its proprietary technologies. Helix’s

product development initiatives include its novel L-DOS47 new drug

candidate. Helix is currently listed on the TSX under the symbol

“HBP”.

Investor Relations

Helix BioPharma Corp.9120 Leslie Street, Suite

205Richmond Hill, Ontario, L4B 3J9Tel: (905) 841-2300Email:

ir@helixbiopharma.com

Forward-Looking Statements and Risks and

Uncertainties

This news release contains forward-looking

statements and information (collectively, “forward-looking

statements”) within the meaning of applicable Canadian securities

laws. Forward-looking statements are statements and information

that are not historical facts but instead include financial

projections and estimates, statements regarding plans, goals,

objectives, intentions and expectations with respect to the

Company’s future business, operations, research and development,

including the Company’s activities relating to DOS47, and other

information in future periods.

Forward-looking statements include, without

limitation, statements concerning (i) the Company’s ability to

operate on a going concern being dependent mainly on obtaining

additional financing; (ii) the Company’s priority continuing to be

L-DOS47; (iii) the Company’s development programs for DOS47,

L-DOS47, V-DOS47 and CAR-T; (iv) future expenditures, the

insufficiency of the Company’s current cash resources and the need

for financing; and (v) future financing requirements and the

seeking of additional funding. Forward-looking statements can

further be identified by the use of forward-looking terminology

such as “ongoing”, “estimates”, “expects”, or the negative thereof

or any other variations thereon or comparable terminology referring

to future events or results, or that events or conditions “will”,

“may”, “could”, or “should” occur or be achieved, or comparable

terminology referring to future events or results.

Forward-looking statements are statements about

the future and are inherently uncertain, and are necessarily based

upon a number of estimates and assumptions that are also uncertain.

Although the Company believes that the expectations reflected in

such forward-looking statements are reasonable, such statements

involve risks and uncertainties, and undue reliance should not be

placed on such statements. Forward-looking statements, including

financial outlooks, are intended to provide information about

management’s current plans and expectations regarding future

operations, including without limitation, future financing

requirements, and may not be appropriate for other purposes.

Certain material factors, estimates or assumptions have been

applied in making forward-looking statements in this news release,

including, but not limited to, the safety and efficacy of L-DOS47;

that sufficient financing will be obtained in a timely manner to

allow the Company to continue operations and implement its clinical

trials in the manner and on the timelines anticipated; the timely

provision of services and supplies or other performance of

contracts by third parties; future costs; the absence of any

material changes in business strategy or plans; and the timely

receipt of required regulatory approvals and strategic partner

support.

The Company’s actual results could differ

materially from those anticipated in the forward-looking statements

contained in this news release as a result of numerous known and

unknown risks and uncertainties, including without limitation, the

risk that the Company’s assumptions may prove to be incorrect; the

risk that additional financing may not be obtainable in a timely

manner, or at all, and that clinical trials may not commence or

complete within anticipated timelines or the anticipated budget or

may fail; third party suppliers of necessary services or of drug

product and other materials may fail to perform or be unwilling or

unable to supply the Company, which could cause delay or

cancellation of the Company’s research and development activities;

necessary regulatory approvals may not be granted or may be

withdrawn; the Company may not be able to secure necessary

strategic partner support; general economic conditions,

intellectual property and insurance risks; changes in business

strategy or plans; and other risks and uncertainties referred to

elsewhere in this news release, any of which could cause actual

results to vary materially from current results or the Company’s

anticipated future results. Certain of these risks and

uncertainties, and others affecting the Company, are more fully

described in the Company’s annual management’s discussion and

analysis for the year ended July 31, 2019 under the heading “Risks

and Uncertainty” and Helix’s Annual Information Form, in particular

under the headings “Forward-looking Statements” and “Risk Factors”,

and other reports filed under the Company’s profile on SEDAR at

www.sedar.com from time to time. Forward-looking statements and

information are based on the beliefs, assumptions, opinions and

expectations of Helix’s management on the date of this new release,

and the Company does not assume any obligation to update any

forward-looking statement or information should those beliefs,

assumptions, opinions or expectations, or other circumstances

change, except as required by law.

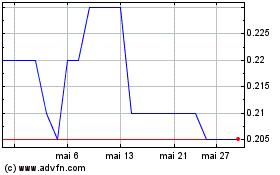

Helix BioPharma (TSX:HBP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Helix BioPharma (TSX:HBP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024