Western Forest Products Inc. (TSX: WEF) (“Western” or the

“Company”) reported negative adjusted EBITDA of $17.4 million in

the first quarter of 2020. Results were impacted by strike action

that concluded in mid-February at the majority of its BC-based

operations, a graduated return to work through the second half of

the quarter, weak North American markets, and the novel Coronavirus

pandemic (“COVID-19”). The Company mitigated losses arising from

labour disruptions by selling available inventory and minimizing

certain expenditures.

Western curtailed production at its

manufacturing operations for one-week in March to implement

enhanced health and safety protocols and re-evaluate market

conditions arising from COVID-19. In accordance with directions

from provincial and federal authorities, the Company resumed

operations to continue to service customers and provide support for

thousands of industry jobs.

As a result of business uncertainty caused by

COVID-19, Western has suspended its quarterly dividend. The

Company’s Board of Directors will continue to review the dividend

quarterly.

First Quarter Summary

- Reached a 5-year collective bargaining agreement with United

Steelworkers Local 1-1937 (“USW”)

- Announced the sale of partial interests in certain Alberni

Valley operations for $36.2 million

- Closed with $113.5 million of available liquidity, exceeding

ongoing operating capital requirements

Net loss of $21.0 million ($0.06 net loss per

diluted share) was reported for the first quarter of 2020, as

compared to net income of $1.9 million ($nil per diluted share) for

the first quarter of 2019 and net loss of $29.2 million ($0.09 net

loss per diluted share) in the fourth quarter of 2019.

Western’s negative adjusted EBITDA of $17.4

million compared to adjusted EBITDA of $18.1 million in the first

quarter of 2019, and negative $18.1 million reported in the fourth

quarter of 2019. Operating loss prior to restructuring and other

items was $28.4 million, compared to $5.7 million in first quarter

of 2019, and $29.6 million loss reported in the fourth quarter of

2019.

| |

|

|

|

|

|

|

Q1 |

|

Q1 |

|

Q4 |

|

|

(millions of dollars except per share amounts and where otherwise

noted) |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2019 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

$ |

99.1 |

|

|

$ |

275.7 |

|

|

$ |

80.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Export tax expense |

|

|

|

|

|

|

4.0 |

|

|

|

9.2 |

|

|

|

3.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

(17.4 |

) |

|

|

18.1 |

|

|

|

(18.1 |

) |

|

|

Adjusted EBITDA margin |

|

|

|

|

|

|

-17.6 |

% |

|

|

6.6 |

% |

|

|

-22.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income prior to restructuring items and other income

(expense) |

|

|

|

$ |

(28.4 |

) |

|

$ |

5.7 |

|

|

$ |

(29.6 |

) |

|

|

Net income (loss) |

|

|

|

|

|

|

(21.0 |

) |

|

|

1.9 |

|

|

|

(29.2 |

) |

|

|

Basic and diluted earnings (loss) per share (in dollars) |

|

|

|

|

|

|

(0.06 |

) |

|

|

- |

|

|

|

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net debt, end of period |

|

|

|

|

|

|

137.0 |

|

|

|

72.4 |

|

|

|

111.3 |

|

|

|

Liquidity, end of period |

|

|

|

|

|

|

113.5 |

|

|

|

175.7 |

|

|

|

136.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“I’m proud of our employees and business

partners for safely returning to work and for their rapid

implementation of enhanced safety protocols to address the health

risk associated with COVID-19,” said Don Demens, President and

Chief Executive Officer. “Through their dedication and

collaboration, we continue to safely operate, service customers and

sustain jobs.”

Summary of First Quarter 2020

Results

First quarter results were significantly

impacted by strike action (the “Strike”) by the United Steelworkers

Local 1-1937 (“USW”), the gradual restart of certain

Strike-curtailed British Columbia (“BC”) operations, and the

negative impacts of the novel Coronavirus pandemic (“COVID-19”) on

markets and production. As a result, our BC operations operated on

a limited basis in the quarter.

We took steps during the Strike to mitigate the

impact on our customers, business and cash flows by actively

selling unencumbered inventories and drawing down working capital.

On February 15, 2020, USW members voted in support of a tentative

agreement to replace the collective agreement that expired on June

14, 2019, resulting in the end of the Strike.

Following the Strike, we performed the necessary

safety and maintenance procedures before commencing a gradual

restart of certain Strike-curtailed BC operations. Upon restart,

our manufacturing productivity was impacted by the consumption of

lower quality log inventory that degraded due to the duration of

the Strike. Operating efficiency improved through March as we

improved the mix of our log and lumber inventories.

We curtailed certain operations for one-week in

late March to implement enhanced health and safety protocols and to

re-evaluate market conditions arising from COVID-19. For more

details on these health and safety measures, refer to the

“COVID-19” section.

Adjusted EBITDA for the first quarter of 2020

was negative $17.4 million, as compared to positive EBITDA of $18.1

million from the same period last year. Operating loss prior to

restructuring and other items was $28.4 million, as compared to

operating income of $5.7 million in the same period last year.

Our near-term focus remains on ensuring the

health and safety of our employees, managing our balance sheet, and

servicing our customers.

Sales

Lumber and log sales volume and revenue were

impacted by the Strike and COVID-19. Lumber revenue in the first

quarter was $83.2 million, a decrease of 62.0% from the same period

last year. Lumber shipment volumes of 64 million board feet were

68.5% lower than the same period last year due to the Strike and

COVID-19. We continued to process logs at custom cut facilities and

execute on our wholesale lumber strategy, to service our customers

and to mitigate Strike impacts. We increased wholesale lumber

shipments as compared to the same period last year. Our United

States (“US”) based Columbia Vista division continued to perform in

line with our expectations and has been a positive addition to our

business and product mix.

Our average realized lumber pricing increased

20.6% from the same period last year, as the result of an improved

specialty product mix and a weaker Canadian dollar (“CAD”) to US

dollar (“USD”). Specialty lumber represented 73% of first quarter

shipments compared to 52% in the same period last year. Although

the average CAD-USD foreign exchange rate declined just 1% over the

comparative period, significant foreign exchange volatility in

March 2020 resulted in a 5% reduction in the closing exchange rate

period over period.

Log revenue was $12.9 million in the first

quarter of 2020, a decrease of 68.7% from the same period last

year, due to limited log production during the Strike and retaining

inventory to restock our supply chain through March 2020.

By-product revenue was $3.0 million, a decrease

of 80.8% as compared to the same period last year as most of our BC

coastal operations were curtailed for a majority of the first

quarter due to the Strike.

Operations

To support our selected customers during the

Strike, we continued to redirect available inventory to active

divisions. We operated on a sub-optimal basis during the Strike

resulting in higher transportation and operating costs.

An incremental $13.8 million in Strike-related

operating expense was recognized in the first quarter, including

curtailment costs during the Strike, production inefficiencies on

start-up and additional safety and maintenance procedures required

to resume operations. Operating expense was also negatively

impacted by $2.9 million of incremental timberlands provisions,

including for aged log inventory and silviculture expense. We also

incurred $1.1 million of COVID-19 related operating expenses in

March 2020.

Lumber production of 61 million board feet was

69.8% lower than the same period last year. Incremental production

from our US-based Columbia Vista division, acquired in February

2019, and volumes from our custom cut program were more than offset

by the curtailment of our BC operations due to the Strike.

We produced 167,000 cubic meters of logs from

our BC coastal operations in the first quarter of 2020 compared to

production of 922,000 cubic metres in the same quarter of last

year. First quarter log production in 2020 was impacted as all our

USW-certified timberlands operations were curtailed during the

Strike.

BC coastal saw log purchases were 141,000 cubic

metres, a 32.2% decrease from the same period last year. Reduced

saw log purchases resulted from extremely low BC coastal harvest

activity and volumes generated from our joint venture

arrangements.

Freight expense decreased by $16.8 million from

the same period last year due to lower shipment volumes.

First quarter adjusted EBITDA and operating

income included $4.0 million of countervailing duty (“CVD”) and

anti-dumping duty (“AD”), as compared to $9.2 million in the same

period last year. Duty expense declined as a result of reduced

US-destined lumber shipment volumes.

Selling and Administration Expense

First quarter selling and administration expense

was $6.4 million in 2020 as compared to $8.8 million in the first

quarter of 2019, due to lower share-based and performance

compensation expense and as a result of minimizing expenses during

the Strike.

Finance Costs

Finance costs were $2.2 million, compared to

$1.5 million in the same period last year, primarily due to a

comparatively higher average outstanding debt and a higher average

interest rate applicable in 2020.

Income Taxes

Lower operating earnings led to an income tax

recovery of $8.4 million being recognized in the first quarter of

2020, as compared to income tax expense of $0.8 million in the same

quarter of last year. The Company is exploring all opportunities to

accelerate receipt of its $16.7 million income tax receivable.

Net Income (Loss)

Net loss for the first quarter of 2020 was $21.0

million, as compared to net income of $1.9 million for the same

period last year. Results were significantly impacted by the

Strike, the restart of Strike-curtailed BC operations and

COVID-19.

Sale of Ownership Interests in Limited

Partnerships

On March 16, 2020, Western announced it had

reached an agreement whereby Huumiis Ventures Limited Partnership

(“HVLP”), a limited partnership beneficially owned by Huu-ay-aht

First Nations, will acquire a majority ownership interest in TFL 44

Limited Partnership (“TFL 44 LP") and an ownership interest in a

newly formed limited partnership that will own the Alberni Pacific

Division Sawmill (“APD Sawmill”) for total consideration of $36.2

million (the “Transaction”).

TFL 44 LP holds certain assets in Port Alberni,

British Columbia, including Tree Farm Licence 44 and other

associated assets and liabilities. HVLP will acquire an incremental

44% ownership interest in TFL 44 LP from Western for $35.2 million.

On completion of the Transaction, HVLP will own 51% of TFL 44 LP

and Western will own 49% of TFL 44 LP. Western may sell other area

First Nations, including HVLP, a further incremental ownership

interest of up to 26% in TFL 44 LP, under certain conditions.

Western and TFL 44 LP will enter into a long-term fibre agreement

to continue to supply Western’s British Columbia coastal

manufacturing operations, which have undergone significant capital

investment over the past several years.

Western will transfer its APD Sawmill into a

limited partnership (“APD LP”) along with certain other assets and

liabilities. HVLP will acquire a 7% ownership interest in APD LP

from Western for $1.0 million, and subject to further negotiations,

HVLP will have an option to purchase an incremental ownership

interest in APD LP, which may include a majority interest.

The completion of the Transaction is subject to

satisfaction of customary closing conditions, financing, and

certain third-party consents, including approval by the BC

Provincial Government and the Huu-ay-aht First Nations People’s

Assembly. The Transaction is anticipated to close in the third

quarter of 2020 as COVID-19 restrictions have delayed the

administration of certain closing conditions.

Dividend & Capital Allocation Update

Quarterly Dividend

In response to the global economic impacts of

COVID-19 on our business and sector, Western is suspending its

quarterly dividend until further notice. We believe that this is a

prudent decision in order to maintain financial flexibility and

liquidity due to the global uncertainty resulting from

COVID-19.

The Board of Directors will continue to review

the Company’s dividend on a quarterly basis. Any decision to

declare and pay dividends in the future will be made at the

discretion of our Board of Directors, after considering our

operating results, financial condition, cash requirements,

financing agreement restrictions and other factors our Board may

deem relevant.

Capital Expenditures

Due to COVID-19 and its impact on global markets

and operating conditions, we plan to incur only safety,

environmental, maintenance and committed capital expenditures in

the near-term. Strategic and discretionary capital projects will

remain on hold until there is greater operational certainty. We

will continue to evaluate opportunities to invest strategic capital

in jurisdictions that create the opportunity to grow long-term

shareholder value, but in the near-term will be prioritizing

liquidity and financial flexibility.

Normal Course Issuer Bid

On August 2, 2019, we renewed our Normal Course

Issuer Bid (“NCIB”) permitting the purchase and cancellation of up

to 18,763,888 of the Company’s common shares or approximately 5% of

the common shares issued and outstanding as of August 1, 2019. The

Company also entered into an automatic share purchase plan with its

designated broker to facilitate purchases of its common shares

under the NCIB at times when the Company would ordinarily not be

permitted to purchase its common shares due to regulatory

restrictions or self-imposed blackout periods.

In the three months ended March 31, 2020, the

Company did not repurchase any common shares. As at May 6, 2020,

18,763,888 common shares remain available to be purchased under the

current NCIB. The NCIB expires on August 7, 2020.

COVID-19

Western is committed to the health and safety of

our employees, contractors and the communities where we operate. To

help mitigate the spread of COVID-19, we have implemented strict

health and safety protocols across our business that are based on

guidance from health officials and experts, and in compliance with

regulatory orders and standards.

Health and safety protocols currently being

enforced include travel restrictions; self-isolation instructions

for those who have travelled, are ill, exhibiting symptoms of

COVID-19 or have come in direct contact with someone with COVID-19;

implementing physical distancing measures; restricting site access

to essential personnel and activities; increasing cleaning and

sanitization in workplaces; and where possible, providing those who

can work from home the ability to exercise that option. We continue

to monitor and review the latest guidance from health officials and

experts to ensure our protocols meet the current required

standards.

In response to the impacts of the COVID-19

pandemic, the Company also curtailed its BC manufacturing

facilities for up to a one-week period effective March 23,

2020.

State of Emergency declarations and other

restrictions relating to travel, business operations and isolation

have been made by governing bodies in the regions that Western

operates and sells its products. Western’s business activities have

been designated an essential service in Canada and the US, and we

will continue to monitor and adjust our operations as required to

ensure the health and safety of our employees, contractors and the

communities where we operate and to address changes in customer

demand. In addition, governments in Canada and the US have

announced various financial relief programs for businesses. We

continue to analyze whether Western can apply for any of the

programs to help mitigate the financial impacts of COVID-19.

With the potential negative impacts to the

global economy from COVID-19 and with dynamic global economic

conditions, our near-term focus remains on maintaining financial

flexibility to manage our business during this uncertain time while

protecting the health and safety of our employees and contractors

and servicing our customers.

Operations Curtailments

On March 22, 2020, the Company announced it was

temporarily curtailing its manufacturing facilities operating in BC

for up to a one-week period effective March 23, 2020. After

implementing enhanced health and safety protocols and re-evaluating

operating conditions, the Company resumed all operations in late

March, except at our Ladysmith, Cowichan Bay and Somass

sawmills.

On May 4, 2020, we restarted production at our

Cowichan Bay sawmill, which had remained curtailed after the end of

the Strike due to limited log supply. The continued operation of

our Cowichan Bay sawmill is dependent on log supply and market

conditions.

Our Ladysmith sawmill, which remained curtailed

after the end of the Strike, is expected to continue to remain

curtailed due to insufficient log supply.

Our Somass sawmill remains indefinitely

curtailed as a result of a fibre supply deficit arising from years

of tenure takebacks and government land use decisions, and rising

costs associated with the US Softwood Lumber dispute.

As of May 6, 2020, our other manufacturing and

timberlands are actively operating based on market demand.

Labour Relations Update

On February 6, 2020, the BC Minster of Labour

appointed Special Mediators to work with the Company and the USW

for a period of 10 days to determine if a negotiated settlement

could be reached.

On February 10, 2020, the Company announced that

terms of a tentative collective agreement had been reached, subject

to a ratification vote by USW membership.

On February 15, 2020, Western announced that USW

members voted in support of the tentative agreement to replace the

collective agreement that expired on June 14, 2019. The new 5-year

collective agreement is effective from June 15, 2019 and expires on

June 14, 2024.

The new agreement provides for general wage

increases of 3%, 2%, 2%, 3% and 2.5%, respectively, in each of the

five years of the agreement. The new agreement also provides for

improvements to health and welfare benefits and clarifies the

application of Western’s Alcohol and Drug Policy to USW members.

Western has maintained its management rights to operate alternate

shifts while agreeing to an enhanced shift review process. The

agreement also provides the Company with additional operational

flexibility in its Timberlands operations through the ability to

introduce additional USW contractors to ensure it is meeting its

Annual Allowable Cut requirements.

BC Government Forest Policies Update

During 2019, the BC Provincial Government (the

“Province”) introduced various policy initiatives that will impact

the BC forest sector regulatory framework as part of their Coastal

Revitalization Initiative.

On January 21, 2020, the Province announced

changes to the Manufactured Forest Products Regulation

(“Regulation”) effective July 1, 2020. The amendments to the

Regulation require lumber that is made from Western Red Cedar

(“WRC”) or cypress (yellow cedar) to be fully manufactured to be

eligible for export. Fully manufactured is defined as lumber that

will not be kiln-dried, planed or re-sawn at a facility outside of

BC and is subject to certain exemptions. The Province is working

with industry stakeholders to develop exemptions to meet its stated

objective and has formed a working group with key industry

representatives to help develop the exemption process. We continue

to collaboratively engage with the Province to ensure that the

desired outcome is met without unintended consequences to our

global customers. The impact that the amendments to this Regulation

may have on our operations cannot be determined at this time.

Strategy and Outlook

Western’s long-term business objective is to

create superior value for shareholders by building a margin-focused

specialty log and lumber business of scale to compete successfully

in global softwood markets. We believe this will be achieved by

maximizing the sustainable utilization of our forest tenures,

operating safe, efficient, low-cost manufacturing facilities and

augmenting our sales of targeted high-value specialty products for

selected global customers with a lumber wholesale program. We seek

to manage our business with a focus on operating cash flow and

maximizing value through the production and sales cycle. We

routinely evaluate our performance using the measure of Return on

Capital Employed.

Sales & Marketing Strategy Update

We continue to progress with the execution of

our sales and marketing strategy that focuses on the production and

sale of targeted, high-margin products of scale to selected

customers. We supplement our key product offerings with purchased

lumber to deliver the suite of products our customers require.

During the first quarter of 2020, we reached

marketing and vendor purchase agreements with certain customers

that will increase our access to the North American Home Centre and

Pro-Dealer sales channels. We expect this strategy to provide

Western with greater access to the growing repair and remodel

lumber segment.

Our Columbia Vista division continues to perform

in line with our expectations and has been a positive addition to

our business and product mix. We continued to develop and evaluate

growth opportunities for our wholesale lumber business.

Market Outlook

The onset of the COVID-19 pandemic brought to a

standstill what was a promising start to the 2020 North American

building season. Government actions to limit the spread of the

virus, including the complete shutdown of construction in some

jurisdictions, caused significant demand disruptions. In addition,

country-wide shutdowns have significantly restricted access to many

of our high-value offshore markets. In contrast to the challenges

faced in North America and Europe, lumber and log demand has

improved in China as the country emerged from its COVID-19

lockdown.

Strong market sentiment for WRC products at the

beginning of the year has faded and demand has slowed due to

COVID-19 containment measures. WRC lumber consumption from the Home

Centre channel has been impacted less than other distribution

channels.

In Japan, demand for Douglas fir and BC coastal

Hemlock products has remained steady due in part to reduced lumber

supply from Europe. Price realizations have been supported by a

weaker CAD relative to the USD.

Demand for industrial Niche products and

products targeted to the treating segment have remained strong. We

expect pricing and demand to remain steady, provided there are no

additional COVID-19 related disruptions.

Export logistics have been challenged due to the

limited number of in-bound shipping containers arriving in North

America. To mitigate export logistics risks we are utilizing both

container and break-bulk shipping modes to ensure continued supply

to our customers.

We expect domestic log and by-product prices to

remain steady due to limited supply. Log supply on the BC coast is

expected to remain constrained due to a combination of high harvest

costs and uncertain markets relating to COVID-19.

As we look forward, the COVID-19 outbreak has

led to near term market volatility and reduced long-term business

visibility. We plan to mitigate the increased volatility by

leveraging our diversified market and product offerings and

flexible operating platform. Our price realizations should be

supported by the relatively weak CAD-USD exchange rate. We will

continue to align our production volumes to match market

demand.

Softwood Lumber Dispute and US Market Update

The US application of duties on Canadian lumber

imports continues a long-standing pattern of US protectionist

action against Canadian lumber producers. We disagree with the

inclusion of specialty lumber products, particularly WRC and Yellow

Cedar products in this commodity lumber focused dispute. As duties

paid are determined on the value of lumber exported, and as our

shipments to the US market are predominantly high-value, appearance

grade lumber, we are disproportionately impacted by these

duties.

Western expensed $4.0 million of export duties

in the first quarter of 2020, comprised of CVD and AD at a combined

rate of 20.23% on all lumber it sold into the US. On February 3,

2020, the US Department of Commerce (“DoC”) issued preliminary

revised rates in the CVD and AD first administrative review of

shipments for the years ended December 31, 2017 and 2018. The

combined preliminary revised rates were 8.37% for 2017 and 8.21%

for 2018. The DoC may revise these rates between preliminary and

final determination. On April 24, 2020, the DoC announced a

COVID-19 administrative review extension that is expected to delay

the final rate determination until late September 2020. Cash

deposits continue at the current rate of 20.23% until the final

determinations are published, at which time the 2018 rate will

apply to US-destined lumber sales.

The Canadian government’s appeal of the US

International Trade Commission determination that softwood lumber

products from Canada materially injured US producers has been

delayed due to COVID-19.

At March 31, 2020, Western had US$72.6 million

of cash on deposit with the US Department of Treasury in respect of

these softwood lumber duties.

Including wholesale lumber shipments, our sales

to the US market represented approximately 27% of our total revenue

in 2019. Our distribution and processing centre in Arlington,

Washington and our Columbia Vista division in Vancouver, Washington

are expected to partially mitigate the damaging effects of duties

on our products destined for the US market. We intend to leverage

our flexible operating platform to continue to partially mitigate

any challenges that arise from this trade dispute.

Forward Looking Statements and

Information

This press release contains statements that may

constitute forward-looking statements under the applicable

securities laws. Readers are cautioned against placing undue

reliance on forward-looking statements. All statements herein,

other than statements of historical fact, may be forward-looking

statements and can be identified by the use of words such as

“will”, “estimate”, “expect”, “anticipate”, “plan”, “intend”,

“believe”, “seek”, “should”, “may”, “likely”, “continue” and

similar references to future periods. Forward-looking statements in

this press release include, but are not limited to, statements

relating to our current intent, belief or expectations with respect

to: domestic and international market conditions, demands and

growth; economic conditions; our growth, marketing, product,

wholesale, operational and capital allocation plans and strategies,

including but not limited to, payment of a dividend; fibre

availability and regulatory developments; the impact of the

Coronavirus pandemic; the timing or anticipated closing of the

Transaction; and the selling of additional incremental ownership

interest in TFL 44 LP and APD LP in the future.. Although such

statements reflect management’s current reasonable beliefs,

expectations and assumptions as to, amongst other things, the

future supply and demand of forest products, global and regional

economic activity and the consistency of the regulatory framework

within which the Company currently operates, there can be no

assurance that forward-looking statements are accurate, and actual

results and performance may materially vary. Many factors could

cause our actual results or performance to be materially different

including: economic and financial conditions, international demand

for forest products, competition and selling prices, international

trade disputes, changes in foreign currency exchange rates, labour

disputes and disruptions, natural disasters, relations with First

Nations groups, the availability of fibre and allowable annual cut,

development and changes in laws and regulations affecting the

forest industry, changes in the price of key materials for our

products, changes in opportunities, future developments in the

Coronavirus pandemic and other factors referenced under the “Risks

and Uncertainties” section of our MD&A in our 2019 Annual

Report dated February 11, 2020. The foregoing list is not

exhaustive, as other factors could adversely affect our actual

results and performance. Forward-looking statements are based only

on information currently available to us and refer only as of the

date hereof. Except as required by law, we undertake no obligation

to update forward-looking statements.

Reference is made in this press release to

adjusted EBITDA which is defined as operating income prior to

operating restructuring items and other income, plus amortization

of property, plant, equipment, and intangible assets, impairment

adjustments, and changes in fair value of biological assets.

Adjusted EBITDA margin is EBITDA presented as a proportion of

revenue. Western uses adjusted EBITDA and adjusted EBITDA margin as

benchmark measurements of our own operating results and as

benchmarks relative to our competitors. We consider adjusted EBITDA

to be a meaningful supplement to operating income as a performance

measure primarily because amortization expense, impairment

adjustments and changes in the fair value of biological assets are

non-cash costs, and vary widely from company to company in a manner

that we consider largely independent of the underlying cost

efficiency of their operating facilities. Further, the inclusion of

operating restructuring items which are unpredictable in nature and

timing may make comparisons of our operating results between

periods more difficult. We also believe adjusted EBITDA and

adjusted EBITDA margin are commonly used by securities analysts,

investors and other interested parties to evaluate our financial

performance.

Adjusted EBITDA does not represent cash

generated from operations as defined by International Financial

Reporting Standards (“IFRS”) and it is not necessarily indicative

of cash available to fund cash needs. Furthermore, adjusted EBITDA

does not reflect the impact of a number of items that affect our

net income. Adjusted EBITDA and adjusted EBITDA margin are not

measures of financial performance under IFRS, and should not be

considered as alternatives to measure performance under IFRS.

Moreover, because all companies do not calculate adjusted EBITDA

and adjusted EBITDA margin in the same manner, these measures as

calculated by Western may differ from similar measures as

calculated by other companies. A reconciliation between the

Company’s net income as reported in accordance with IFRS and

adjusted EBITDA is included in the Company’s Management’s

Discussion & Analysis for the year ended December 31, 2019,

which is available under the Company’s profile on SEDAR at

www.sedar.com.

Also in this press release management uses key

performance indicators such as net debt, net debt to capitalization

and current assets to current liabilities. Net debt is defined as

long-term debt less cash and cash equivalents. Net debt to

capitalization is a ratio defined as net debt divided by

capitalization, with capitalization being the sum of net debt and

equity. Current assets to current liabilities is defined as total

current assets divided by total current liabilities. These key

performance indicators are non-GAAP financial measures that do not

have a standardized meaning and may not be comparable to similar

measures used by other issuers. They are not recognized by IFRS,

however, they are meaningful in that they indicate the Company’s

ability to meet their obligations on an ongoing basis, and indicate

whether the Company is more or less leveraged than the prior

year.

Western is an integrated forest products company

building a margin-focused log and lumber business to compete

successfully in global softwood markets. With operations and

employees located primarily on the coast of British Columbia and

Washington State, Western is a premier supplier of high-value,

specialty forest products to worldwide markets. Western has a

lumber capacity in excess of 1.1 billion board feet from eight

sawmills and four remanufacturing facilities. The Company sources

timber from its private lands, long-term licenses, First Nations

arrangements, and market purchases. Western supplements its

production through a wholesale program providing customers with a

comprehensive range of specialty products.

TELECONFERENCE CALL NOTIFICATION:

Thursday, May 7, 2020 at 9:00 a.m. PDT (12:00 p.m.

EDT)

On Thursday, May 7, 2020, Western Forest

Products Inc. will host a teleconference call at 9:00 a.m. PDT

(12:00 p.m. EDT). To participate in the teleconference please dial

416-406-0743 or 1-800-806-5484 (passcode: 7246579#). This call will

be taped, available one hour after the teleconference, and on

replay until June 5, 2020 at 8:59 p.m. PDT (11:59 p.m. EDT). To

hear a complete replay, please call 905-694-9451 / 1-800-408-3053

(passcode: 2922033#).

Contacts:For further

information, please contact:

Stephen WilliamsExecutive Vice President &

Chief Financial Officer(604) 648-4500

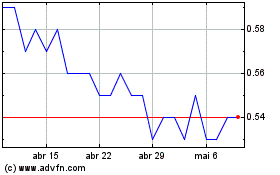

Western Forest Products (TSX:WEF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

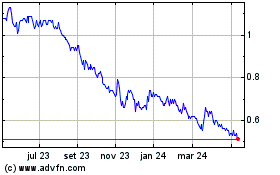

Western Forest Products (TSX:WEF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025