Suncor Energy announces pricing of US$1.0 billion notes offering

11 Maio 2020 - 7:15PM

Suncor announced today that it has priced an offering of US$450

million in aggregate principal amount of senior unsecured notes due

on May 15, 2023 (the “2023 Notes”) and US$550 million in aggregate

principal amount of senior unsecured notes due on May 15, 2025 (the

“2025 Notes” and, together with the “2023 Notes”, the “Notes”). The

2023 Notes will have a coupon of 2.800% and the 2025 Notes will

have a coupon of 3.100%. The offering is expected to close on May

13, 2020, subject to customary closing conditions.

Suncor intends to use the net proceeds from the sale of the

Notes to repay short-term indebtedness and for general corporate

purposes. Pending any such use of the net proceeds, Suncor will

invest the net proceeds in bank deposits and short-term marketable

securities. Suncor remains focused on maintaining the financial

health and resiliency of the company. With the issuance of the

Notes, Suncor maintains flexibility to allocate capital to debt

reduction over the next five years.

The offering is being made pursuant to an effective shelf

registration statement in the United States. RBC Capital

Markets and J.P. Morgan are acting as joint book-running managers

for the offering.

A copy of the prospectus supplement and the accompanying

prospectus for the offering may be obtained by contacting RBC

Capital Markets by telephone at 1-866-375-6829 (toll free); or J.P.

Morgan by telephone collect at 1-212-834-4533.

Under the terms of the offering, the underwriters have agreed

not to offer or sell any Notes in Canada or to any resident of

Canada.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be

any sale of these securities, in Canada, or in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Certain statements in this news release constitute

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation (collectively, “forward-looking

statements”). All forward-looking statements are based on Suncor’s

current expectations, estimates, projections, beliefs and

assumptions based on information available at the time the

statement was made and in light of Suncor’s experience and its

perception of historical trends.

Forward-looking statements in this news release include

references to the offering, which is expected to close on May 13,

2020, the financial health and resiliency of the company, the

company’s ability to allocate capital to debt reduction over the

next five years and the intended use of net proceeds of the

offering. Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to our company. Suncor’s actual results may differ

materially from those expressed or implied by our forward-looking

statements and you are cautioned not to place undue reliance on

them.

Suncor’s Earnings Release, Quarterly Report and

Management’s Discussion & Analysis for the first quarter

of 2020 and its most recently filed Annual Information Form/Form

40-F, Annual Report to Shareholders and other documents it files

from time to time with securities regulatory authorities describe

the risks, uncertainties, material assumptions and other factors

that could influence actual results and such factors are

incorporated herein by reference. Copies of these documents are

available without charge from Suncor at 150 6th Avenue S.W.,

Calgary, Alberta T2P 3E3, by calling 1-800-558-9071, or by email

request to invest@suncor.com or by referring to the company’s

profile on SEDAR at sedar.com or EDGAR at sec.gov. Except as

required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Suncor has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (the “SEC”)

for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration

statement, the related prospectus supplement and other documents

Suncor has filed with the SEC for more complete information about

Suncor and the offering. You may obtain these documents for free by

visiting www.sec.gov, or as indicated above.

Suncor Energy is Canada's leading integrated energy company.

Suncor's operations include oil sands development and upgrading,

onshore and offshore oil and gas production, petroleum refining,

and product marketing under the Petro-Canada brand. A member of Dow

Jones Sustainability indexes, FTSE4Good and CDP, Suncor is working

to responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index and the Corporate Knights’ Global 100.

Suncor's common shares (symbol: SU) are listed on the Toronto and

New York stock exchanges.

Investor inquiries:800-558-9071invest@suncor.com

Media inquiries:1-833-296-4570 media@suncor.com

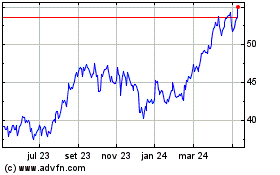

Suncor Energy (TSX:SU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

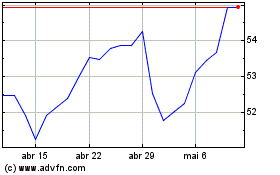

Suncor Energy (TSX:SU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025