Lundin Gold Inc. ("Lundin Gold" or the "Company")

(TSX: LUG, Nasdaq Stockholm: LUG) has announced today that it has

entered into an agreement with BMO Capital Markets (“BMO”), under

which BMO has agreed to buy on a bought deal basis 4,150,000

common shares (the “Common Shares”), at a price of C$12.05 per

Common Share for gross proceeds of approximately C$50 million (the

“Offering”). The Company has granted BMO an option, exercisable at

the offering price for a period of 30 days following the closing of

the Offering, to purchase up to an additional 15% of the Offering

to cover over-allotments, if any. The offering is expected to close

on or about June 11, 2020 and is subject to Lundin Gold receiving

all necessary regulatory approvals.

Newcrest Mining Limited, which currently holds

approximately 32% of the Company’s issued and outstanding shares

through a wholly-owned subsidiary, has exercised its pre-emptive

participation rights in the Offering, along with Orion Mine

Finance, which currently holds approximately 11% of the Company’s

issued and outstanding shares. The Company expects that Zebra

Holdings and Investments S.à.r.l, Lorito Holdings S.à.r.l and/or

Nemesia S.à.r.l (the “Lundin Family Trusts”), which collectively

hold approximately 27% of the Company’s issued and outstanding

shares, will participate in the financing at their collective

pro-rata shareholdings.

The net proceeds of the offering will be used to

study increased throughput, future resource expansion, potential

COVID-19 related costs and for general working capital

purposes.

The Common Shares will be offered by way of a

short form prospectus in all of the provinces and territories of

Canada other than Quebec and may also be offered by way of private

placement in the United States pursuant to exemptions from the

registration requirements of the U.S. Securities Act of 1933, as

amended, and applicable U.S. state securities laws.

The securities offered have not been

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About Lundin Gold

Lundin Gold, headquartered

in Vancouver, Canada, owns the Fruta del Norte gold mine

in southeast Ecuador. Fruta del Norte is among the largest and

highest-grade gold deposits in the world.

The Company's board and management team have

extensive expertise in mine operations and are dedicated to

operating Fruta del Norte responsibly. The Company operates with

transparency and in accordance with international best practices.

Lundin Gold is committed to delivering value to its

shareholders, while simultaneously providing economic and social

benefits to impacted communities, fostering a healthy and safe

workplace and minimizing the environmental impact. The Company

believes that the value created through the operation of Fruta del

Norte will benefit its shareholders, the Government and the

citizens of Ecuador.

Additional Information

The information in this release is subject to

the disclosure requirements of Lundin Gold under the EU Market

Abuse Regulation. This information was publicly communicated on May

26, 2020 at 4:25 a.m. Pacific Time through the contact persons set

out below.

For more information, please

contact

Lundin Gold Inc.Ron F. HochsteinPresident and

CEO+593 2-299-6400+1-604-806-3589

Lundin Gold Inc. Sabina Srubiski Manager,

Investor Relations

+1-604-806-3089info@lundingold.comwww.lundingold.com

Follow Lundin Gold on Twitter

Caution Regarding Forward-Looking

Information and Statements

Certain of the information and statements in

this press release are considered "forward-looking information" or

"forward-looking statements" as those terms are defined under

Canadian securities laws (collectively referred to as

"forward-looking statements"). Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions or future

events or performance (often, but not always, identified by words

or phrases such as "believes", "anticipates", "expects", "is

expected", "scheduled", "estimates", "pending", "intends", "plans",

"forecasts", "targets", or "hopes", or variations of such words and

phrases or statements that certain actions, events or results

"may", "could", "would", "will", "should", "might", "will be

taken", or "occur" and similar expressions) are not statements of

historical fact and may be forward-looking statements.

By their nature, forward-looking statements and

information involve assumptions, inherent risks and uncertainties,

many of which are difficult to predict, and are usually beyond the

control of management, that could cause actual results to be

materially different from those expressed by these forward-looking

statements and information. Lundin Gold believes that the

expectations reflected in this forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be correct. Forward-looking information should not be

unduly relied upon. This information speaks only as of the

date of this press release, and the Company will not necessarily

update this information, unless required to do so by securities

laws.

This press release contains forward-looking

information in a number of places, such as in statements relating

to use of proceeds from the Offering, closing of the Offering, and

the ability to obtain the necessary regulatory authority and

approvals.. There can be no assurance that such statements

will prove to be accurate, as Lundin Gold's actual results and

future events could differ materially from those anticipated in

this forward-looking information as a result of the factors

discussed in the "Risk Factors" section in Lundin Gold's Annual

Information Form dated March 24, 2020, which is available at

www.lundingold.com or on SEDAR.

Lundin Gold's actual results could differ

materially from those anticipated. Factors that could cause actual

results to differ materially from any forward-looking statement or

that could have a material impact on the Company or the trading

price of its shares include: risks relating to the impacts of a

pandemic virus outbreak; risks associated with the Company's

community relationships; risks related to financing requirements;

failure by the Company to maintain its obligations under its credit

facilities; operating risks; risks associated with the ramp up of

mining operations; risks related to political and economic

instability in Ecuador; risks related to production estimates;

risks related to Lundin Gold’s compliance with environmental laws

and liability for environmental contamination; volatility in the

price of gold; shortages of critical supplies; lack of availability

of infrastructure; deficient or vulnerable title to mining

concessions; easements and surface rights; risks related to the

Company’s workforce and its labour relations; inherent safety

hazards and risk to the health and safety of the Company’s

employees and contractors; risks related to the Company’s ability

to obtain, maintain or renew regulatory approvals, permits and

licenses; the imprecision of mineral reserve and resource

estimates; key talent recruitment and retention of key personnel;

volatility in the market price of the Company’s shares; the

potential influence of the Company's largest shareholders;

uncertainty with the tax regime in Ecuador; measures to protect

endangered species and critical habitats; the cost of

non-compliance and compliance costs; exploration and development

risks; the Company's reliance on one project; risks related to

illegal mining; the reliance of the Company on its information

systems and the risk of cyber-attacks on those systems; the

adequacy of the Company’s insurance; uncertainty as to reclamation

and decommissioning; the ability of Lundin Gold to ensure

compliance with anti-bribery and anti-corruption laws; the

uncertainty regarding risks posed by climate change; the potential

for litigation; limits of disclosure and internal controls;

security risks to the Company; its assets and its personnel;

conflicts of interest; the risk that the Company will not declare

dividends; and social media and the Company’s reputation.

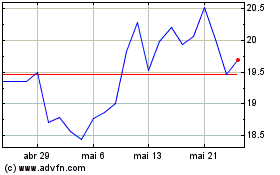

Lundin Gold (TSX:LUG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

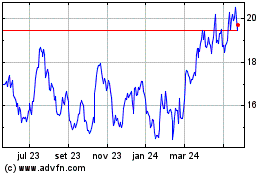

Lundin Gold (TSX:LUG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024