Canadian Natural Resources Limited Prices US$1.1 Billion in 5 and 10 Year Notes

22 Junho 2020 - 9:49PM

Canadian Natural Resources Limited ("Canadian Natural" or the

“Company”) announces that on June 22, 2020, the Company priced the

following US$ unsecured notes:

|

Note / Coupon |

Principal |

Maturity |

Price per Note |

Yield to Maturity |

|

5 year / 2.05% |

US$600,000,000 |

July 15, 2025 |

US$99.832 |

2.085% |

|

10 year / 2.95% |

US$500,000,000 |

July 15, 2030 |

US$99.955 |

2.955% |

The offering is targeted to close on June 24,

2020, subject to customary closing conditions. Net proceeds from

the sale of the notes will be used primarily to refinance the

Company’s outstanding short-term indebtedness and for general

corporate purposes. The net proceeds that are not utilized

immediately may be invested in short-term marketable

securities.

J.P. Morgan Securities LLC, BofA Securities,

Inc. and MUFG Securities Americas Inc. acted as joint book-running

managers for the offering. BMO Capital Markets Corp., Citigroup

Global Markets Inc., RBC Capital Markets, LLC, Scotia Capital (USA)

Inc., TD Securities (USA) LLC, Mizuho Securities USA LLC, SMBC

Nikko Securities America, Inc., CIBC World Markets Corp., Wells

Fargo Securities, LLC, Barclays Capital Inc., Desjardins Securities

Inc. and National Bank of Canada Financial Inc. acted as

co-managers.

The sale of the notes will be the first issuance

under the US base shelf prospectus dated July 24, 2019 that allows

for the issuance of debt securities in an aggregate principal

amount of up to US $3.0 billion.

|

|

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or other

jurisdiction. Canadian Natural has filed a registration statement

(including a prospectus) with the U.S. Securities and Exchange

Commission (“SEC”) for the offering of notes to which this

communication relates. Before you invest in any such offering, you

should read the prospectus in that registration statement and other

documents Canadian Natural has filed with the SEC for more complete

information about Canadian Natural and the offering of notes. You

may get these documents for free by visiting EDGAR on the SEC Web

Site at www.sec.gov. Alternatively, Canadian Natural, any

underwriter or any dealer participating in the offering of notes

will arrange to send you the prospectus if you request it by

contacting J.P. Morgan Securities LLC collect at 1-212-834-4533,

BofA Securities, Inc. toll-free at 1-800-294-1322 or

dg.prospectus_requests@bofa.com or MUFG Securities Americas Inc.

toll-free at 1-877-649-6848. |

|

Under the terms of the offering, the

underwriters have agreed not to offer or sell any notes in Canada

or to any resident of Canada.

Canadian Natural is a senior oil and natural gas

production company, with continuing operations in its core areas

located in Western Canada, the U.K. sector of the North Sea and

Offshore Africa.

|

CANADIAN NATURAL RESOURCES LIMITED |

| 2100, 855

- 2nd Street S.W. Calgary, Alberta, T2P4J8 Phone:

403-514-7777 Email: ir@cnrl.com |

|

|

|

TIM S. MCKAY President MARK A.

STAINTHORPEChief Financial Officer and Senior

Vice-President, Finance JASON M. POPKOManager,

Investor Relations Trading Symbol - CNQToronto Stock ExchangeNew

York Stock Exchange |

Certain information regarding the Company contained herein may

constitute forward-looking statements under applicable securities

laws. Such statements are subject to known or unknown risks

and uncertainties that may cause actual results to differ

materially from those anticipated or implied in the forward-looking

statements. Refer to our website for complete forward-looking

statements www.cnrl.com

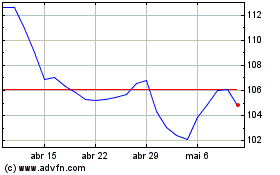

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024