INNSUITES HOSPITALITY TRUST (IHT) – IHT Continuing Operating Results Improve

14 Agosto 2020 - 7:45AM

InnSuites Hospitality Trust (NYSE American: IHT) InnSuites

Hospitality Trust (IHT) reported total revenues of $6.57 million

from continuing operations for the fiscal year ended January 31,

2020 (FY 2020) compared to total revenues from continuing

operations of $6.17 million for the fiscal year ended January 31,

2019 (FY2019), an increase of $0.4 million, or 6.5%.

Consolidated Net Loss for FY2020 was

approximately $2.0 million compared to Consolidated Net Income of

$11.1 million for FY2019. Fiscal year ended January 31, 2019

included net income from discontinued operations of $13.1 million

as a result of the profitable sales of our Yuma hotel property and

our IBC technology subsidiary. We did not sell any of our

properties during the fiscal year ended January 31, 2020.

FY 2020 consolidated net loss from continuing

operations, before non-cash depreciation of $0.9 million, before a

one-time reserve of $0.8 million on its Note Receivable from the

2018 sale of its IBC technology segment , and before the non-cash

impact of $0.2 million of adopting this year’s new lease accounting

standard was approximately break-even (loss of $0.05 million),

compared to a net loss from continuing operations, before non-cash

depreciation, of $0.8 million in FY2019, showing an improvement in

continuing operations on a year to year basis.

Net income per share basic and diluted for

FY2020 was ($0.21) compared to $1.20 for FY2019.

Preliminary results for the first fiscal quarter

ended April 30, 2020 show the negative impact of the COVID-19 virus

in the travel and hospitality industries. With significantly lower

occupancy and reduced room rates at all properties, we anticipate

declines in both revenues and earnings in the first fiscal quarter

(February–April). It is our expectation a modest improvement will

occur in the second fiscal quarter (May-July), with continuing

improvement during the remainder of the fiscal year ending January

31, 2021 as the travel and hospitality industries, and overall

economy rebound.

On July 31, 2019 IHT’s paid a one cent

semi-annual dividend on shares held of record a July 15, 2019. This

continues IHT’s recent practice of paying total annual dividends of

two cents per share, payable one cent each semi-annually on July 31

and January 31. This dividend continues 50 consecutive

uninterrupted fiscal years during which IHT has paid dividends,

since the formation of IHT and the initial listing of its shares on

the New York Stock Exchange in 1971.

Said James Wirth President, CEO, and Board

Chairman:

“The fiscal year just ended showed significant

improvement in continuing operations as IHT continues to execute

our strategic plan of selling existing hotel real estate at market

prices significantly above our carrying (book) values, and moving

away from concentration in the hotel industry toward

diversification, including IHT’s high potential investment in UPI’s

innovative efficient, clean-energy power generation, and/or reverse

merger diversification. Additional profitable hotel real estate

sales are anticipated to continue during the 24 months ahead.”

“Management recognizes the current low IHT stock

trading range, which we believe affords opportunity for long term

investors and continued stock buy-backs.”

For more information, visit

www.InnSuitesTrust.com.

Forward-Looking Statements

With the exception of historical information,

the matters discussed in this news release may include

“forward-looking statements” within the meaning of the federal

securities laws. All statements regarding IHT’s review and

exploration of potential strategic, operational and structural

alternatives and expected associated costs and benefits are

forward-looking. Actual developments and business decisions may

differ materially from those expressed or implied by such

forward-looking statements. Important factors, among others, that

could cause IHT’s actual results and future actions to differ

materially from those described in forward-looking statements

include the uncertain outcome, impact, effects and results of IHT’s

review of strategic, operational and structural alternatives, IHT’s

success in finding potential qualified purchasers for its

hospitality real estate, or a reverse merger partner, and other

risks discussed in IHT’s SEC filings. IHT expressly disclaims any

obligation to update any forward-looking statement contained in

this news release to reflect events or circumstances that may arise

after the date hereof, all of which are expressly qualified by the

foregoing, other than as required by applicable law.

FOR FURTHER INFORMATION:Marc Berg, Executive

Vice President602-944-1500email: mberg@innsuites.com

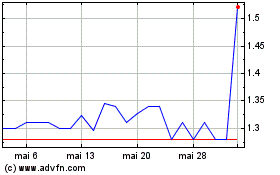

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025