AP Alternative Assets Releases Financial Results for the Three and Nine Months Ended September 30, 2020

28 Outubro 2020 - 10:28PM

AP Alternative Assets Releases Financial Results for the Three and

Nine Months Ended September 30, 2020

AP Alternative Assets, L.P. (“AAA”, Euronext Amsterdam: AAA)

today released its financial results for three and nine months

ended September 30, 2020. AAA invests its capital through, and is

the sole limited partner of, AAA Investments, L.P., which is

referred to as the “Investment Partnership.”

Highlights

- Net asset value at

September 30, 2020 was $10.3 million, or $0.13 per unit, reflecting

a net increase in net assets of approximately $1.0 million, or

$0.01 per common unit during the three months ended September 30,

2020.

- The increase in net asset value during

the three months ended September 30, 2020 was driven by an increase

in net assets from operations due to a realized gain on sale of

605,554 Athene shares by the Investment Partnership of $12.0,

offset by the reversal of previously recognized unrealized gains of

$(9.3) million.

Net Asset Value for AAA

At September 30, 2020, AAA had net assets of $10.3 million,

including its share of the net assets of the Investment

Partnership, as follows:

|

(in $ millions, except per unit amounts) |

Net Asset Value as of September 30, 2020 |

|

Gross Asset Value: |

|

| Cash |

$ |

9.6 |

|

| Other |

0.7 |

| Net Asset

Value(1) |

$ |

10.3 |

|

| Net Asset

Value per Unit(1) |

$ |

0.13 |

|

| Net Common

Units Outstanding |

76,328,950 |

____________________________

(1) The remaining cash will be used be used to

settle outstanding liabilities and expenses (including expenses

relating to ultimately winding up AAA). After payment of these

expenses the remaining cash of AAA (if any) will be distributed to

AAA unitholders (unless the cash, on a per unit basis, is de

minimis, in which case it is expected to be given to charity). This

distribution which, based on information now available to AAA is

currently estimated to be between USD 7 cents and 9 cents per AAA

unit. A further announcement in this regard will be made at the

relevant time. The net asset value also includes $0.8 million of

prepaid management fees that will continue to be amortized over the

life of the service period through December 31, 2020. If a decision

is made to wind up AAA prior to the end of the service period, AAA

will accelerate the amortization of the prepaid management fee.

Financial Report

AAA's interim report, which includes its

unaudited financial statements and the unaudited consolidated

financial statements of the Investment Partnership is available and

can be downloaded free of charge at its website at:

www.apolloalternativeassets.com.

Contact

Ann Dai (New

York) +1 (212) 822

0678

Additional Information

A presentation will be available on the company’s website at

http://www.apolloalternativeassets.com/ReportsAndFilings/AdditionalDocuments.aspx

in connection with this press release.

About AAA

AAA was established by Apollo Global Management,

Inc. and its subsidiaries (“Apollo”) and is a closed- end limited

partnership established under the laws of Guernsey. Apollo is a

leading global alternative investment manager with 30 years of

experience investing across the capital structure of leveraged

companies. AAA is managed by Apollo Alternative Assets, L.P. For

more information about AAA, please visit

www.apolloalternativeassets.com.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements involve risks and

uncertainties because they relate to future events and

circumstances. Such statements are based on currently available

operating, financial and competitive information and are subject to

various risks and uncertainties that could cause actual results and

developments to differ materially from the historical experience

and expressed or implied expectations of AAA. Undue reliance should

not be placed on such forward-looking statements. Forward-looking

statements speak only as of the date on which they are made and AAA

does not undertake to update its forward-looking statements unless

required by law.

Financial Schedules Follow

Financial Schedule I

|

AP ALTERNATIVE ASSETS, L.P.STATEMENT OF

OPERATIONS (unaudited) (in

thousands) |

|

|

For the Three Months Ended September

30, |

|

For the Nine Months Ended September 30, |

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INVESTMENT LOSS (ALLOCATED FROM AAA

INVESTMENTS, L.P.) |

|

|

|

|

|

|

|

|

Investment expenses |

$ |

(1,150 |

) |

|

$ |

(1,097) |

|

|

$ |

(3,212) |

|

|

$ |

(3,359) |

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

General and administrative expenses |

(309) |

|

|

(253) |

|

|

(710 |

) |

|

(840 |

) |

|

|

|

|

|

|

|

|

|

|

NET INVESTMENT LOSS |

(1,459 |

) |

|

(1,350 |

) |

|

(3,922 |

) |

|

(4,199 |

) |

|

|

|

|

|

|

|

|

|

|

UNREALIZED GAINS (LOSSES) FROM INVESTMENTS

(ALLOCATED FROM AAA INVESTMENTS,

L.P.) |

|

|

|

|

|

|

|

|

Net increase (decrease) in unrealized (depreciation)

appreciation of investment |

2,483 |

|

|

(549) |

|

|

(6,237 |

) |

|

1,229 |

|

|

|

|

|

|

|

|

|

|

|

NET GAIN (LOSS) FROM INVESTMENTS |

2,483 |

|

|

(549) |

|

|

(6,237 |

) |

|

1,229 |

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS

RESULTING FROM OPERATIONS |

$ |

1,024 |

|

|

$ |

(1,899 |

) |

|

$ |

(10,159 |

) |

|

$ |

(2,970 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Schedule II

|

AP ALTERNATIVE ASSETS, L.P.STATEMENT OF

ASSETS AND LIABILITIES (in thousands, except per

unit amounts) |

|

|

As of September

30, 2020

(unaudited) |

|

As of December 31, 2019 |

|

ASSETS |

|

|

|

|

Investment in AAA Investments, L.P. |

$ |

16,632 |

|

|

$ |

26,080 |

|

|

Other assets |

298 |

|

|

170 |

|

TOTAL ASSETS |

16,930 |

|

26,250 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

Accounts payable and accrued liabilities |

463 |

|

546 |

|

Due to affiliates |

6,190 |

|

|

5,268 |

|

|

TOTAL LIABILITIES |

6,653 |

|

5,814 |

|

|

|

|

|

|

|

NET ASSETS |

$ |

10,277 |

|

|

$ |

20,436 |

|

|

|

|

|

|

|

NET ASSETS CONSIST OF: |

|

|

|

|

Partners’ capital contribution (76,328,950 common units

outstanding at September 30, 2020 and December 31,

2019) |

$ |

1,621,541 |

|

|

$ |

1,621,541 |

|

|

Partners’ capital distributions |

(3,967,667 |

) |

|

(3,967,667 |

) |

|

Accumulated increase in net assets resulting from

operations |

2,356,403 |

|

2,366,562 |

|

|

|

|

|

|

|

NET ASSETS |

$ |

10,277 |

|

|

$ |

20,436 |

|

|

|

|

|

|

|

Net asset value per common unit |

$ |

0.13 |

|

|

$ |

0.27 |

|

|

|

|

|

|

|

Market price per common unit |

$ |

0.07 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Schedule III

|

AAA INVESTMENTS, L.P.CONSOLIDATED

STATEMENT OF OPERATIONS (unaudited) (in

thousands) |

|

|

|

For the Three Months Ended September 30, |

|

For the Six Months Ended September 30, |

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

EXPENSES: |

|

|

|

|

|

|

|

|

|

Management fees |

|

$ |

(842 |

) |

|

$ |

(842 |

) |

|

$ |

(2,527 |

) |

|

$ |

(2,527 |

) |

|

General and administrative expenses |

|

(309 |

) |

|

(256 |

) |

|

(687 |

) |

|

(836 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET INVESTMENT LOSS |

|

(1,151 |

) |

|

(1,098 |

) |

|

(3,214 |

) |

|

(3,363 |

) |

|

|

|

|

|

|

|

|

|

|

|

UNREALIZED GAIN (LOSS) FROM

INVESTMENTS: |

|

|

|

|

|

|

|

|

|

Net realized gains from sales/dispositions on

investments |

|

12,049 |

|

— |

|

12,049 |

|

— |

|

Net (decrease) increase in unrealized appreciation on

investments |

|

(9,317) |

|

|

(604) |

|

|

(18,911 |

) |

|

1,350 |

|

|

NET GAIN (LOSS) FROM INVESTMENTS |

|

2,732 |

|

|

(604) |

|

|

(6,862 |

) |

|

1,350 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS

RESULTING FROM OPERATIONS |

|

$ |

1,581 |

|

|

$ |

(1,702) |

|

|

$ |

(10,076 |

) |

|

$ |

(2,013 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Schedule IV

|

AAA INVESTMENTS, L.P.CONSOLIDATED

STATEMENT OF ASSETS AND LIABILITIES (in

thousands) |

|

|

As of September 30, 2020 (unaudited) |

|

As of December 31,2019 |

|

ASSETS |

|

|

|

|

Investments: |

|

|

|

|

Investment in Opportunistic Investment at fair value (cost

of $0 and $9,570 at September 30, 2020 and December 31, 2019,

respectively) |

$ |

— |

|

|

$ |

28,480 |

|

|

Cash and cash equivalents |

9,626 |

|

|

14 |

|

|

Other assets |

1,141 |

|

|

3,541 |

|

|

Due from affiliates |

6,190 |

|

|

5,268 |

|

|

TOTAL ASSETS |

16,957 |

|

|

37,303 |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

Accounts payable and accrued liabilities |

321 |

|

|

482 |

|

|

Line of Credit due to affiliates |

0 |

|

|

8,725 |

|

|

TOTAL LIABILITIES |

321 |

|

|

9,207 |

|

|

|

|

|

|

|

NET ASSETS |

$ |

16,636 |

|

|

$ |

28,096 |

|

|

|

|

|

|

|

NET ASSETS CONSIST OF: |

|

|

|

|

Partners' capital |

$ |

(2,682,361 |

) |

|

$ |

(2,680,977 |

) |

|

Accumulated increase in net assets resulting from

operations |

2,698,997 |

|

|

2,709,073 |

|

|

|

|

|

|

|

NET ASSETS |

$ |

16,636 |

|

|

$ |

28,096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attachment

- AAAEarningsReleaseQ320.pdf

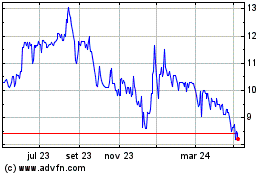

Alan Allman Associates (EU:AAA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

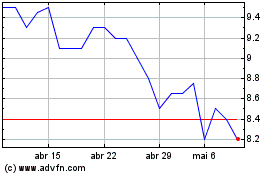

Alan Allman Associates (EU:AAA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025