Cargojet Announces C$350 Million Bought Deal Equity Offering

12 Janeiro 2021 - 5:35PM

Cargojet Inc. (“Cargojet” or the “Company”) (TSX: CJT) is pleased

to announce that it has entered into an agreement with Scotiabank,

CIBC Capital Markets, RBC Capital Markets, J.P. Morgan Securities

Canada Inc., Morgan Stanley Canada Limited and BMO Capital Markets

acting as co-leads and joint bookrunners, on behalf of a syndicate

of underwriters (collectively, the “Underwriters”), pursuant to

which the Underwriters have agreed to purchase, on a bought deal

basis, 1,642,000 common voting shares (“Common Voting Shares”)

and/or variable voting shares (“Variable Voting Shares” and,

together with the Common Voting Shares, the “Shares”) of Cargojet

at a price of C$213.25 per Share (the “Offering Price”) for

aggregate gross proceeds to Cargojet of C$350,156,500 (the

“Offering”).

Cargojet has also granted the Underwriters an

over-allotment option to purchase up to an additional 246,300

Shares at the Offering Price, on the same terms and conditions,

exercisable, in whole or in part, at any time for a period of 30

days following the closing of the Offering. If this option is

exercised in full, an additional C$52,523,475 in gross proceeds

will be raised pursuant to the Offering and the aggregate gross

proceeds of the Offering will be C$402,679,975.

In line with previously stated strategic

priorities to invest in growth opportunities and continue to pay

down debt, the net proceeds from the Offering will be used to fund

the following:

- Expand Domestic Capacity

and Facilities. The COVID-19 pandemic has generally

increased demand for Cargojet’s domestic air cargo services due to

the dramatic increase in e-commerce activity. The Company intends

to use a portion of the net proceeds of the Offering to fund growth

capital expenditures including the acquisition of five B-767

freighter aircraft for delivery in 2021/2022, as well as

investments in a new hanger and additional land-based facility

infrastructure in Canada. The infrastructure investments will

support additional e-commerce volumes, driven by the ongoing

pandemic, that are expected to establish a new higher baseline

going forward.

- Pursue U.S. and

International Growth Strategy. The COVID-19 pandemic has

significantly increased demand for Cargojet’s international air

cargo services. Air cargo capacity has been severely constrained

due to the reduction of passenger aircraft operating on

international routes and it is uncertain when such capacity will

return to pre-pandemic levels. Furthermore, U.S. and international

air cargo growth opportunities have emerged as a result of rapidly

evolving global supply chains and a lack of air cargo capacity in

key markets. The Company intends to use a portion of the net

proceeds of the Offering to capitalize on potential strategic

investments in the U.S. and the acquisition of two long-range B-777

freighter aircraft for international routes for delivery in

2023.

- Repay

Indebtedness. The Company plans to use a portion of the

net proceeds of the Offering to discharge finance leases, including

associated balloon payments, on six aircraft maturing in fiscal

2021 and fully pay down outstanding revolver balances. The Company

remains committed to maintaining a strong balance sheet to support

its long-term growth strategy and capitalize on new domestic and

international growth opportunities.

The Company completed the year experiencing

record volumes during the peak season, consistent with previously

disclosed expectations, and delivered approximately 99% on time

performance to its customers. Cargojet plans to announce fourth

quarter and 2020 year-end results in early March 2021.

The Shares will be offered by way of a

preliminary short form prospectus in all provinces and territories

of Canada. The Shares may also be offered by private placement in

the United States to qualified institutional buyers pursuant to

Rule 144A under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”). Purchasers who are Canadians

as defined in the Canada Transportation Act (“Qualified Canadians”)

will receive Common Voting Shares and purchasers who are not

Qualified Canadians will receive Variable Voting Shares.

The Offering is expected to close on or about

February 1, 2021 and is subject to customary regulatory approvals,

including the approval of the Toronto Stock Exchange and the

securities regulatory authorities.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities to be offered have not been, and will not

be registered under the U.S. Securities Act or under any U.S. state

securities laws, and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons,

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

About Cargojet

Cargojet is Canada’s leading provider of time

sensitive premium air cargo services to all major cities across

North America, providing Dedicated ACMI and International Charter

services and carries over 25,000,000 pounds of cargo weekly.

Cargojet operates its network with its own fleet of 27 Cargo

aircraft. For further information, please contact:

Pauline DhillonChief Corporate Officer Tel: (905) 501

7373pdhillon@cargojet.com

Notice on Forward-Looking Statements:

Certain statements contained herein, including

statements related to the completion of the Offering and use of net

proceeds of the Offering, constitute “forward-looking statements”.

Forward-looking statements look into the future and provide an

opinion as to the effect of certain events and trends on the

business. Forward-looking statements may include words such as

“plans”, “intends”, “anticipates”, “should”, “estimates”,

“expects”, “believes”, “indicates”, “targeting”, “suggests” and

similar expressions. These forward-looking statements are based on

current expectations and entail various risks and uncertainties.

Reference should be made to the issuer’s public filings available

at www.sedar.com and at www.cargojet.com, including its most recent

Annual Information Form filed with the Canadian securities

regulators, its most recent Consolidated Financial Statements and

Notes thereto and related Management’s Discussion and Analysis

(MD&A), and the short form prospectus to be filed in connection

with the Offering, for a summary of material risks. These risks are

not intended to represent a complete list of the risks that could

affect the issuer; however, these risks should be considered

carefully. Actual results may materially differ from expectations,

if known and unknown risks or uncertainties affect our business, or

if our estimates or assumptions prove inaccurate. The

forward-looking statements contained herein describe the issuer’s

expectations at the date of this news release and, accordingly, are

subject to change after such date. The issuer assumes no obligation

to update or revise any forward-looking statement, whether as a

result of new information, future events or any other reason, other

than as required by applicable securities laws. In the event the

issuer does update any forward-looking statement, no inference

should be made that the issuer will make additional updates with

respect to that statement, related matters, or any other

forward-looking statement. Readers are cautioned not to place undue

reliance on these forward-looking statements.

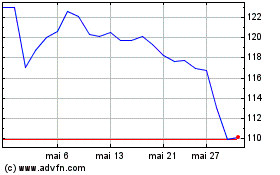

Cargojet (TSX:CJT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Cargojet (TSX:CJT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025