Helios Fairfax Partners Announces Portfolio Insurance Arrangement With Fairfax Financial Holdings Limited

21 Janeiro 2021 - 9:50AM

Helios Fairfax Partners Corporation (TSX: HFPC.U) (“HFP”) announces

that it has agreed to enter into a portfolio insurance arrangement

with Fairfax Financial Holdings Corporation (“Fairfax”) pursuant to

the terms of a binding term sheet. The portfolio insurance

arrangement will provide HFP with stability regarding any price

fluctuations regarding the Reference Investments (as defined below)

and with $100 million of investment proceeds which can be used by

HFP for additional investments in Africa.

Under the terms of the transaction, Fairfax will

subscribe for 3.0% unsecured debentures of HFP (the “Debentures”)

on a private placement basis for an aggregate subscription price of

US$100 million (the “Principal Amount”). The Debentures will mature

within three years of the date of issuance (the “Closing Date”) or,

at the option of Fairfax, on either of the first two anniversary

dates of the Closing Date. The “Redemption Price” for the

Debentures will be equal to the Principal Amount, plus any accrued

and unpaid interest, less the amount, if any, by which the fair

value of HFP’s investments in AGH, Philafrica and the PGR2 Loan

(collectively, the “Reference Investments”) is

lower than $102.6 million (representing the fair value of the

Reference Investments as of June 30, 2020).

In addition, Fairfax will subscribe for 3

million warrants of HFP, allowing Fairfax to purchase HFP

subordinate voting shares (“SVS”) at an exercise

price of US$4.90. The warrants are exercisable at any time prior to

the fifth anniversary of the Closing Date. The Warrants

will include customary anti-dilution provisions. If all of the

Warrants are exercised, the aggregate SVS issued would represent

approximately 5.6% of the SVS currently outstanding and 2.7% of all

HFP shares currently outstanding (multiple voting shares and

SVS).

The transaction, which constitutes a “related

party transaction” as defined in Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”), was unanimously approved by the board of directors

of HFP, including a specific approval by the independent directors,

with Fairfax affiliated directors abstaining. The transaction will

be exempt from the minority approval and valuation requirements of

MI 61-101.

Closing of the transaction is subject to the

finalization of definitive documentation and customary conditions,

including the receipt of the approval of the Toronto Stock

Exchange. The transaction will close as soon as all conditions

precedent have been satisfied, which is expected to occur in Q1

2021.

Helios Fairfax Partners Corporation is an

investment holding company whose investment objective is to achieve

long-term capital appreciation, while preserving capital, by

investing in public and private equity securities and debt

instruments in Africa and African businesses or other businesses

with customers, suppliers or business primarily conducted in, or

dependent on, Africa.

For further information, contact:

Helios Fairfax Partners Corporation Keir

HuntGeneral Counsel and Corporate Secretary+1-416-646-4180

Disclaimer

Certain statements included in this press

release constitute forward-looking statements within the meaning of

applicable securities laws, including, but not limited to, those

identified by the expressions “expect”, “will”, “believe” and

similar expressions. Some of the specific forward-looking

statements in this press release include, but are not limited to,

statements with respect to: the investment by Fairfax and the terms

thereof, the expected date of completion of such investment and the

anticipated benefits to shareholders. There can be no assurance

that the proposed transaction will be completed or that it will be

completed on the terms and conditions contemplated in this press

release. The proposed transaction could be modified or terminated

in accordance with its terms.

Forward-looking statements are based on a number

of key expectations and assumptions made by HFP including, without

limitation: the transaction will be completed on the terms

currently contemplated; the transaction will be completed in

accordance with the timing currently expected; all conditions to

the completion to the transaction will be satisfied or waived and

the term sheet will not be terminated prior to the completion of

the transaction. Although the forward-looking statements contained

in this press release are based on what HFP’s management believes

to be reasonable assumptions, HFP cannot assure investors that

actual results will be consistent with such information.

Forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results as actual results may differ

materially from those expressed or implied in such forward-looking

information. Those risks and uncertainties include, among other

things: the transaction may not be completed on the terms, or in

accordance with the timing, currently contemplated, or at all; and

HFP and Fairfax may not be successful in satisfying the conditions

to the transaction. Additional information about risks and

uncertainties related to HFP are contained in HFP’s annual

information form for the year ended December 31, 2019 and in HFP’s

management’s discussion and analysis of financial results dated

September 30, 2020, both of which are available on SEDAR at

www.sedar.com.

The forward-looking statements contained herein

represents HFP’s expectations as of the date of this press release,

and are subject to change after this date. HFP assumes no

obligation to update or revise any forward-looking information

whether as a result of new information, future events or otherwise,

except as required by applicable law.

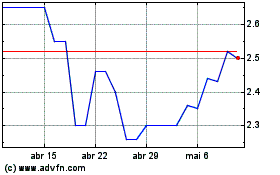

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025