Helios Fairfax Partners Corporation: Financial Results for the Year Ended December 31, 2020

05 Março 2021 - 7:22PM

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES

(Note:

All dollar amounts in this news release are expressed in

U.S. dollars except as otherwise noted. The financial results are

prepared using the recognition and measurement requirements of

International Financial Reporting Standards, except as otherwise

noted, and are unaudited.)

Helios Fairfax Partners Corporation (TSX:

HFPC.U) (formerly Fairfax Africa Holdings Corporation ("Fairfax

Africa")) announces fiscal year 2020 net loss of $206.6 million

($3.31 net loss per diluted share), compared to fiscal year 2019

net loss of $61.2 million ($1.01 net loss per diluted share),

reflecting increased net realized losses on investments,

transaction expenses and net foreign exchange losses in

2020.Completion of Strategic Transaction with Helios Holdings

Limited:

- On December 8,

2020, Fairfax Africa and Helios Holdings Limited ("HHL") announced

the completion of the strategic transaction signed on July 10, 2020

(the "Transaction"). Fairfax Africa has been renamed Helios Fairfax

Partners Corporation (“HFP”) and will continue to be listed on the

Toronto Stock Exchange under the symbol 'HFPC.U'.

- The Transaction creates a leading

pan-Africa focused listed investment holding company that has the

benefit of the asset management activities of Helios Investment

Partners LLP ("Helios"). This diversified investment platform

combines best-in-class third party investment management

capabilities with the strength of a permanent capital vehicle. HFP

and Helios collectively are among the largest Africa-focused

providers of debt and equity financing of African businesses,

through their private equity fund and balance sheet

investments.

- In connection with the Transaction,

HFP acquired limited partnership interests in HFA Topco, L.P.

("TopCo LP") for $275.3 million, in exchange for issuing 24,632,413

subordinate voting shares and 25,452,865 multiple voting shares of

HFP to HHL, representing 45.9% of the equity and voting interest in

HFP. HFP's limited partnership interests in TopCo LP provide HFP

with rights to certain carried interest proceeds and net management

fees generated by the Helios.

- As a result of the transaction,

Helios has been appointed sole investment adviser to HFP; and Tope

Lawani and Babatunde Soyoye, the co-founders and Managing Partners

of Helios, have been appointed as co-chief executive officers and

directors of HFP.

Highlights for 2020 (with comparisons to 2019

except as otherwise noted) included the following:

- Net loss of $206.6 million included

net realized losses on investments of $208.5 million, principally

from the sale of Atlas Mara common shares as part of the

Transaction ($141.3 million) and write-downs of the company's

investments in CIG common shares ($46.0 million), the PGR2 Loan

($22.4 million), Atlas Mara Warrants ($2.3 million) and Nova

Pioneer Warrants ($1.3 million); partially offset by a net change

in unrealized gains on investment of $30.6 million. Net change in

unrealized gains on investments principally reflected reversal of

prior period losses on the company's realized positions ($125.4

million), partially offset by decreases in the market price of the

company's investments in AGH (indirect) common shares ($43.8

million), Atlas Mara convertible bonds ($17.9 million), GroCapital

Holdings common shares ($13.8 million), Atlas Mara Facility ($12.1

million) and Philafrica common shares ($9.1 million).

- The company incurred $16.5 million

of expenses related to the Transaction, primarily related to legal,

financial advisory and other professional fees.

- The company incurred $9.5 million

of general and administration expenses in 2020 compared to $3.7

million in 2019, primarily reflecting share based compensation of

$5.8 million on the issuance of share option awards to various

employees and members of Helios and its affiliates upon closing of

the Transaction.

- On December 7, 2020, in connection

with the Transaction, HFP sold its 42.3% equity interest in Atlas

Mara to Fairfax Financial Holdings Limited ("Fairfax") for an

aggregate purchase price of $40.0 million, comprised of $20.0

million in cash and $20.0 million by way of an interest-free loan

due from Fairfax no later than three years from closing.

- In December 2020 HFP increased its

indirect equity interest in AGH through the purchase of Class A

shares of AGH for purchase consideration of $10,132.

- At December 31, 2020 common

shareholders' equity was $599.7 million, or book value per share of

$5.50 with 109,118,253 shares outstanding, compared to $518.8

million, or book value per share of $8.72 with 59,496,481 share

outstanding, at December 31, 2019, a decrease of 36.9%

primarily related to the net loss in the year ended of 2020.

Subsequent to December 31, 2020:

- On January 21, 2021 HFP agreed to

enter into a portfolio insurance arrangement with Fairfax. Under

the terms of the transaction, Fairfax will subscribe for $100.0

million of 3.0% unsecured debentures of HFP (the "Debentures"). The

Debentures will mature within three years of the date of issuance

(the "Closing Date") or, at the option of Fairfax, on either of the

first two anniversary dates of the Closing Date. The redemption

price for the Debentures will be $100.0 million, plus any accrued

and unpaid interest, less the amount, if any, by which the fair

value of HFP’s investments in AGH, Philafrica common shares,

Philafrica Facility, and the PGR2 Loan (collectively, the

"Reference Investments") is lower than $102.6 million (representing

the fair value of the Reference Investments as of June 30, 2020).

In addition, Fairfax will subscribe for 3 million warrants of HFP,

allowing Fairfax to purchase HFP subordinate voting shares ("SVS")

at an exercise price of $4.90. The warrants are exercisable at any

time prior to the fifth anniversary of the Closing Date. The

company expects the portfolio insurance arrangement to close in Q1

2021.

- Effective March 4, 2021, Ken Costa

has been appointed to the HFP board as a director and Chairman. Mr.

Costa is a Partner and Co-Chairman at Alvarium Investments. Prior

to joining Alvarium, Mr. Costa served as Chairman of Lazard

International from 2007 until 2011 and previously served as

Chairman of UBS Investment Bank for Europe, the Middle East and

Africa. He also served as Vice Chairman of Investment Banking at

UBS. Mr. Costa studied Law and Philosophy at Witwatersrand

University in South Africa and holds a Masters of Law Degree and a

Certificate in Theology from Queens’ College, Cambridge. Prem

Watsa, in support of Mr. Costa's appointment, has resigned as a

director and Chairman in order to permit that appointment.

There were 72.1 million and 59.5 million

weighted average shares outstanding during the fourth quarters of

2020 and 2019 respectively. At December 31, 2020 there were

53,665,388 subordinate voting shares and 55,452,865 multiple voting

shares outstanding.

Consolidated balance sheets, earnings and

comprehensive income information follow and form part of this news

release. Fourth quarter earnings and comprehensive income

information that follow is unaudited.

In presenting the company’s results in this news

release, management has included book value per basic share. Book

value per basic share is calculated by the company as common

shareholders' equity divided by the number of common shares

outstanding.

Helios Fairfax Partners Corporation is an

investment holding company whose investment objective is to achieve

long term capital appreciation, while preserving capital, by

investing in public and private equity securities and debt

instruments in Africa and African businesses or other businesses

with customers, suppliers or business primarily conducted in, or

dependent on, Africa.

| For further

information, contact: |

Keir Hunt,

General Counsel & Corporate Secretary |

| |

(416) 646-4180 |

This press release may contain forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements may relate to the company's or an

African Investment's future outlook and anticipated events or

results and may include statements regarding the financial

position, business strategy, growth strategy, budgets, operations,

financial results, taxes, dividends, plans and objectives of the

company. Particularly, statements regarding future results,

performance, achievements, prospects or opportunities of the

company, an African Investment, or the African market are

forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate" or "believes", or

variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "might", "will" or "will

be taken", "occur" or "be achieved".

Forward-looking statements are based on our

opinions and estimates as of the date of this press release and

they are subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to the following factors:

taxation of the company, its shareholders and subsidiaries; the

COVID-19 pandemic; substantial loss of capital; geographic

concentration of investments; financial market fluctuations;

control or significant influence position risk; minority

investments; risks upon dispositions of investments; bridge

financings; reliance on key personnel and risks associated with the

Investment Advisory Agreement; effect of fees; operating and

financial risks of investments; valuation methodologies involve

subjective judgments; lawsuits; foreign currency fluctuation;

unknown merits and risks of future investments; illiquidity of

investments; competitive market for investment opportunities; use

of leverage; significant ownership by certain shareholders may

adversely affect the market price of the subordinate voting shares;

trading price of subordinate voting shares relative to book value

per share; emerging markets; volatility of African securities

markets; political, economic, social and other factors; natural

disaster risks; sovereign debt risk; economic risk; and weather

risk. Additional risks and uncertainties are described in the

company’s annual information form dated March 5, 2021 which is

available on SEDAR at www.sedar.com and on the company’s

website at www.heliosfairfax.com. These factors and assumptions are

not intended to represent a complete list of the factors and

assumptions that could affect the company. These factors and

assumptions, however, should be considered carefully.

Although the company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The company does not

undertake to update any forward-looking statements contained

herein, except as required by applicable securities laws.

Information on CONSOLIDATED BALANCE

SHEETSas at December 31, 2020 and December 31,

2019 (US$ thousands)

| |

December 31, 2020 |

|

December 31, 2019 |

|

Assets |

|

|

|

|

Cash and cash equivalents |

66,052 |

|

|

44,334 |

|

|

Restricted cash deposits |

7,525 |

|

|

7,500 |

|

|

Term deposits |

12,392 |

|

|

— |

|

|

Short term investments |

— |

|

|

104,008 |

|

|

Loans |

76,175 |

|

|

41,984 |

|

|

Bonds |

58,829 |

|

|

78,820 |

|

|

Common stocks |

89,510 |

|

|

232,212 |

|

|

Derivatives and guarantees |

13,252 |

|

|

1,541 |

|

|

Limited partnership investments |

275,299 |

|

|

— |

|

|

Total cash and investments |

599,034 |

|

|

510,399 |

|

|

|

|

|

|

|

Interest receivable |

8,961 |

|

|

5,835 |

|

|

Deferred income taxes |

835 |

|

|

1,665 |

|

|

Income tax refundable |

— |

|

|

380 |

|

|

Other assets |

1,946 |

|

|

2,388 |

|

|

Total assets |

610,776 |

|

|

520,667 |

|

| |

|

|

|

|

Liabilities |

|

|

|

|

Accounts payable and accrued liabilities |

6,982 |

|

|

297 |

|

|

Payable to related parties |

3,660 |

|

|

1,555 |

|

|

Income taxes payable |

399 |

|

|

— |

|

|

Total liabilities |

11,041 |

|

|

1,852 |

|

| |

|

|

|

|

Equity |

|

|

|

|

Common shareholders' equity |

599,735 |

|

|

518,815 |

|

| |

610,776 |

|

|

520,667 |

|

| |

|

|

|

| |

|

|

|

|

Book value per basic share |

$ |

5.50 |

|

|

$ |

8.72 |

|

| |

|

|

|

|

Information on CONSOLIDATED STATEMENTS OF

EARNINGS (LOSS) AND COMPREHENSIVE INCOME (LOSS)for the

three and twelve months ended December 31, 2020 and 2019 (US$

thousands except per share amounts)

| |

(Unaudited) |

|

|

|

|

|

| |

Fourth quarter |

|

Year ended December 31, |

| |

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

Income |

|

|

|

|

|

|

|

|

|

Interest |

2,988 |

|

|

|

5,765 |

|

|

|

|

18,727 |

|

|

|

22,606 |

|

|

|

Dividends |

— |

|

|

|

2,381 |

|

|

|

|

15 |

|

|

|

2,381 |

|

|

|

Net realized losses on investments |

(208,462 |

) |

|

|

— |

|

|

|

|

(208,462 |

) |

|

|

(4,838 |

) |

|

|

Net change in unrealized gains (losses) on investments |

166,377 |

|

|

|

(16,920 |

) |

|

|

|

30,643 |

|

|

|

(73,223 |

) |

|

|

Net foreign exchange gains (losses) |

24,756 |

|

|

|

20,105 |

|

|

|

|

(13,956 |

) |

|

|

6,832 |

|

|

| |

(14,341 |

) |

|

|

11,331 |

|

|

|

|

(173,033 |

) |

|

|

(46,242 |

) |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Investment and advisory fees |

857 |

|

|

|

1,524 |

|

|

|

|

4,128 |

|

|

|

6,572 |

|

|

|

General and administration expenses |

6,970 |

|

|

|

1,197 |

|

|

|

|

9,528 |

|

|

|

3,677 |

|

|

|

Helios Transaction expenses |

2,150 |

|

|

|

— |

|

|

|

|

16,507 |

|

|

|

— |

|

|

|

Interest expense |

174 |

|

|

|

26 |

|

|

|

|

773 |

|

|

|

977 |

|

|

| |

10,151 |

|

|

|

2,747 |

|

|

|

|

30,936 |

|

|

|

11,226 |

|

|

|

Earnings (loss) before income taxes |

(24,492 |

) |

|

|

8,584 |

|

|

|

|

(203,969 |

) |

|

|

(57,468 |

) |

|

|

Provision for (recovery of) income taxes |

(2,209 |

) |

|

|

(182 |

) |

|

|

|

2,677 |

|

|

|

3,731 |

|

|

|

Net earnings (loss) and comprehensive income

(loss) |

(22,283 |

) |

|

|

8,766 |

|

|

|

|

(206,646 |

) |

|

|

(61,199 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Net earnings (loss) per share (basic and

diluted) |

$ |

(0.31 |

) |

|

|

$ |

0.15 |

|

|

|

|

$ |

(3.31 |

) |

|

|

$ |

(1.01 |

) |

|

|

Shares outstanding (weighted average) |

72,098,700 |

|

|

|

59,511,481 |

|

|

|

|

62,406,662 |

|

|

|

60,688,854 |

|

|

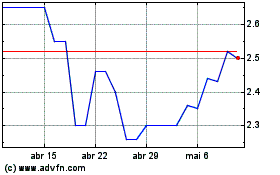

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024