Helios Fairfax Partners Announces Closing of Portfolio Insurance Arrangement With Fairfax Financial Holdings Limited

01 Abril 2021 - 8:55AM

Helios Fairfax Partners Corporation (TSX: HFPC.U)

(“

HFP”) announces the closing of its

previously-announced portfolio insurance arrangement with Fairfax

Financial Holdings Limited (“

Fairfax”).

Under the terms of the transaction, certain of

Fairfax’s affiliates have subscribed for 3.0% unsecured debentures

of HFP (the “Debentures”) on a private placement

basis for an aggregate subscription price of US$100 million (the

“Principal Amount”). The Debentures will mature

three years from March 31, 2021 (the “Closing

Date”) or, at the option of Fairfax, on either of the

first two anniversary dates of the Closing Date. The “Redemption

Price” for the Debentures is equal to the Principal Amount, plus

any accrued and unpaid interest, less the amount, if any, by which

the fair value of HFP’s investments in AGH, Philafrica and the PGR2

Loan (collectively, the “Reference Investments”)

is lower than US$102.6 million (representing the fair value of the

Reference Investments as of June 30, 2020).

In addition, certain of Fairfax’s affiliates

have subscribed for 3 million warrants of HFP

(“Warrants”), allowing Fairfax to purchase HFP

subordinate voting shares (“SVS”) at an exercise

price of US$4.90. The Warrants are exercisable at any time prior to

the fifth anniversary of the Closing Date. The Warrants include

customary anti-dilution provisions. If all of the Warrants are

exercised, the aggregate SVS issued would represent approximately

5.3% of the SVS then outstanding and 2.7% of all HFP shares then

outstanding (HFP multiple voting shares (“MVS”)

and SVS).

Immediately prior to the Closing Date, Fairfax

beneficially owned, and exercised control or direction over (i)

7,629,308 SVS, representing 14.2% of the total SVS outstanding; and

(ii) 30,000,000 MVS, representing 54.1% of the total MVS

outstanding. Fairfax’s aggregate ownership, control and direction

of the SVS and MVS prior to the Closing Date represented an

approximate 34.5% equity interest and an approximate 53.3% voting

interest in HFP. As of the Closing Date, Fairfax

beneficially owned, and exercised control or direction over (i)

assuming the exercise of all of the Warrants, 10,629,308 SVS,

representing 18.8% of the total SVS outstanding; and (ii)

30,000,000 MVS, representing 54.1% of the total MVS outstanding.

Fairfax’s aggregate ownership, control and direction of the SVS and

MVS as of the Closing Date represented an approximate 36.2% equity

interest and an approximate 53.4% voting interest in HFP.

Fairfax acquired the Debentures and Warrants for

investment purposes and, in the future, it may discuss with

management and/or the board of directors of HFP any of the

transactions listed in clauses (a) to (k) of item 5 of Form F1 of

National Instrument 62-103 – The Early Warning System and Related

Take-over Bid and Insider Reporting Issues and, subject to the

provisions of the securityholders agreement of HFP, it may further

purchase, hold, vote, trade, dispose or otherwise deal in the

securities of HFP, in such manner as it deems advisable to benefit

from changes in market prices of HFP’s securities, publicly

disclosed changes in the operations of HFP, its business strategy

or prospects or from a material transaction of HFP. An early

warning report will be filed by Fairfax in accordance with

applicable securities laws and will be available on SEDAR at

www.sedar.com or may be obtained directly from Fairfax upon request

at 416-367-4941 (Attention: John Varnell) or at Fairfax Financial

Holdings Limited, 95 Wellington Street West, Suite 800, Toronto,

Ontario M5J 2N7.

Helios Fairfax Partners Corporation is an

investment holding company whose investment objective is to achieve

long-term capital appreciation, while preserving capital, by

investing in public and private equity securities and debt

instruments in Africa and African businesses or other businesses

with customers, suppliers or business primarily conducted in, or

dependent on, Africa.

For further information, contact:

Helios Fairfax Partners Corporation Keir

HuntGeneral Counsel and Corporate Secretary+1-416-646-4180

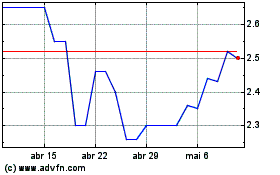

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024