JDE Peet’s successfully prices inaugural EUR 2 billion multi-tranche bond issue

09 Junho 2021 - 2:36PM

JDE Peet’s successfully prices inaugural EUR 2 billion

multi-tranche bond issue

PRESS RELEASE

Amsterdam, 9 June 2021

Key highlights

- Debut bond offering represents another milestone in the

evolution of JDE Peet’s, providing access to debt capital

markets

- EUR 2 billion priced across three tranches in the

investment grade bond market with a weighted average coupon of

0.469% and a weighted average tenure of 7.6 years

- Bond issuance will be used to refinance existing debt

facilities at attractive interest rates and further balances the

maturity profile

JDE Peet’s (EURONEXT: JDEP), the world’s largest

pure-play coffee and tea group by revenue, today announced that it

has priced EUR 2 billion aggregate principal of bonds (the

“Notes”).

The Notes will be issued on 16 June 2021 and

comprise the following series:

- 4.6-year EUR 750 million 0.000% Notes due 2026

- 7.6-year EUR 750 million 0.500% Notes due 2029

- 12-year EUR 500 million 1.125% Notes due 2033

The financing package has a weighted average coupon

of 0.469% and weighted average maturity of 7.6 years. The proceeds

of the Notes will be used to refinance existing debt facilities and

for general corporate purposes. The transaction generated over EUR

7.5 billion of demand.

“Our successful inaugural bond issuance is another

major milestone in the continuous improvement of our capital

structure and the evolution of JDE Peet’s. This transaction will

reduce the overall cost of debt while further improving our

maturity profile and diversifying JDE Peet’s financing sources,”

said Scott Gray, CFO of JDE Peet’s. “A few months after the

successful re-financing of our debt with our core banking partners,

I am very pleased to now see the endorsement from the fixed income

investor community, which is another testament to our strong credit

profile.”

The Notes will be senior unsecured obligations with

investment grade terms, issued by JDE Peet’s N.V. under its newly

established EUR 5 billion Guaranteed Debt Issuance Programme and

guaranteed by JACOBS DOUWE EGBERTS International B.V. and Peet’s

Coffee, Inc. It is expected that the Notes will be listed on the

EuroMTF market of the Luxembourg Stock Exchange.

The offer of Notes referred to in this

communication was limited in the EEA and the United Kingdom to

qualified investors only. The Notes have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”), or with any securities regulatory authority

of any state or other jurisdiction in the United States of

America.

The Notes may not be offered or sold in the United

States of America without either registration of the securities or

an exemption from registration under the U.S. Securities Act being

applicable. Accordingly, this communication is not for release,

distribution or publication, whether directly or indirectly and

whether in whole or in part, into or in the United States or any

(other) jurisdiction where any of such activities would constitute

a violation of the relevant laws of such jurisdiction.

# # #

Enquiries

MediaMichael Orr+31 20 55

81600Media@JDEPeets.com

Investors & AnalystsRobin Jansen+31 20 55

81212IR@JDEPeets.com

About JDE Peet’s

JDE Peet’s is the world's largest pure-play coffee

and tea company by revenue and served approximately 4,500 cups of

coffee or tea every second in 2020. JDE Peet's unleashes the

possibilities of coffee and tea in more than 100 developed and

emerging markets, through a portfolio of over 50 brands that

collectively cover the entire category landscape led by leading

household names such as L’OR, Peet’s, Jacobs, Senseo, Tassimo,

Douwe Egberts, OldTown, Super, Pickwick and Moccona. In 2020, JDE

Peet’s generated total sales of EUR 6.7 billion and employed a

global workforce of more than 19,000 employees. Read more about our

journey towards a coffee and tea for every cup at

www.JDEPeets.com.

- JDE Peet's successfully prices inaugural EUR 2 bn multi-tranche

bond issue

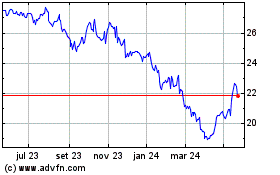

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

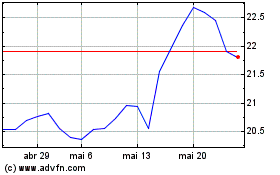

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024