JDE Peet’s reports half-year results 2021

Good progress and broad-based performance, delivered in

a quality way

PRESS RELEASE Amsterdam, 4 August 2021

Key items1

- Total organic sales grew 4.2%, supported by In-Home momentum

(+4.9%) and fuelled by Single Serve and Beans growing double-digit.

E-commerce grew by 30% In-Home

- Away-from-Home returned to profitability, despite largely

stable sales base on average for H1 (+0.7%) although with visible

positive reopening effects in Q2

- Organic adjusted EBIT grew 0.8% to EUR 636 million, with gross

profit margin expansion

- Free cash flow of EUR 553 million and net debt reduced to EUR

4,660 million

- Leverage reduced to 2.98x, from 3.23x at the end of FY 20

- Underlying EPS grew 12.9%, mainly supported by operational

improvements

- Positive market share performance across technologies and

continued progress on Sustainability

- Confident to reach FY 21 outlook

A message from Fabien Simon, CEO of JDE

Peet’s

“I would like to thank all our teams around the world for their

perseverance while successfully navigating our company through all

the ongoing challenges and complexity and for delivering this

strong set of results.

We are pleased with our first-half 2021 results, across all key

metrics, including top-line, profitability, cash generation and

in-market performance. Guided by our refreshed strategy, we

delivered 4.2% organic sales growth, in a quality way, with a gross

profit margin expansion of 26 basis points that enabled JDE Peet's

to reinvest behind its powerful portfolio of brands and future

growth opportunities.

In the first half of the year, we also continued to evolve our

business portfolio. We announced partnerships with J.M. Smucker in

the US and with Pret A Manger in the UK, the acquisition of Campos

in Australia and the divestment of two small businesses in the

Netherlands and France.

We also significantly optimised our financial position and

capital structure, reducing our leverage to below 3x, and our

average cost of debt to around 1.5%, from our successful

refinancing and inaugural bond issue.

Looking at our Sustainability agenda, I am very pleased that in

June, our European manufacturing footprint reached Zero Landfill

status.

Based on the progress made in the first half of 2021 and our

current expectations for the remainder of the year, we remain

confident to reach our outlook for the year, being intentional on

managing inflation and navigating the enduring uncertainty of the

pandemic."

Sustainability

We continued to make good progress on our Sustainability agenda

in the first half of 2021. In March, when we refinanced our bank

facilities, we connected EUR 2.5 bn of our investment grade

facilities to our sustainability ambitions. That same month, we

also committed to adopt a Science-Based Target and we are on track

to announce a science-based greenhouse gas reduction target through

SBTi in the second half of this year. In manufacturing, our

facility in Gavle, Sweden, was the first one to achieve the PAS2060

certification for carbon neutrality in March, and in June, all our

manufacturing facilities in Europe reached the Zero Landfill status

for the first time.

Outlook 2021

Although vaccination programmes around the world continue to

support the gradual lifting of lockdown measures, the COVID

situation remains highly volatile and uncertain as, unfortunately,

spikes in infection rates in a number of countries continue to lead

to new lockdowns. This continues to limit the visibility and

predictability regarding the timing and the pace of the recovery in

our Away-from-Home businesses.

Within this context, we continue to expect organic sales growth

of 3 to 5% in FY 21, assuming a gradual recovery in Away-from-Home.

We also continue to expect organic adjusted EBIT to grow in the low

single-digit range in FY 21, as we step up our investments for

growth, notably in marketing and innovation support.

Our commitment to reduce our leverage to below 3x net debt to

EBITDA was achieved by the end of June.

FINANCIAL REVIEW HALF-YEAR 2021

in EUR m (unless otherwise stated)

|

|

6M 2021 |

6M 2020 |

Organic change |

Reported change |

|

Sales |

3,254 |

3,236 |

4.2 % |

0.5 % |

|

Adjusted EBIT |

636 |

642 |

0.8 % |

-1.0 % |

|

Underlying profit for the period |

446 |

393 |

- |

13.5 |

% |

|

Underlying EPS (EUR) 1, 2 |

0.89 |

0.79 |

- |

12.9 |

% |

|

Reported basic EPS (EUR) |

0.76 |

0.44 |

- |

72.7 |

% |

| 1 Underlying earnings (per

share) exclude all adjusting items (net of tax) |

|

|

| 2 Based on 501,446,549

shares outstanding (H1 20: 498,719,501) on 30 June |

|

|

In H1 21, total sales increased by 4.2% on an organic basis. Our

In-Home businesses continued to deliver strong organic sales growth

of 4.9% while sales in Away-from-Home remained relatively stable

(+0.7%) as the positive effects of re-openings in a limited number

of countries in the course of H1 21 was largely offset by new

lockdowns in a number of other markets.

Total organic sales growth reflects a volume/mix effect of 3.7%

and 0.4% in price. Changes in scope and other changes decreased

sales by 0.2% while foreign exchange had a negative impact of 3.5%.

Total reported sales increased by 0.5% to EUR 3,254 million.

Adjusted EBIT increased organically by 0.8% to EUR 636 million

driven by increased gross profit which was partially re-invested in

marketing, innovations and growth capabilities. Adjusted SG&A

increased organically by EUR 61 million. Including the effects of

foreign exchange and scope changes, adjusted EBIT decreased by

1.0%.

Underlying profit - excluding all adjusting items net of tax -

increased by 13.5% to EUR 446 million supported by lower interest

expenses as a result of deleveraging and lower average cost of

debt, as well as a reduction of other finance expenses.

Net leverage improved to 2.98x net debt to adjusted EBITDA from

3.23x at the end of FY 20.

In the first half of 2021, both Moody's and Standard &

Poor's assigned investment grade ratings with a stable outlook to

JDE Peet's, underscoring our operating strength, strong financial

discipline, and continued progress on deleveraging.

Our liquidity position remains strong, with total liquidity of

EUR 2 billion consisting of a cash position of EUR 0.5 billion and

available committed RCF facilities of EUR 1.5 billion. For the

full and original version of the press release click here

CONFERENCE CALL & AUDIO WEBCAST

Fabien Simon (CEO) and Scott Gray (CFO) will host a conference

call for analysts and institutional investors at 10:00 AM CET today

to discuss the half-year 2021 results. A live and on-demand audio

webcast of the conference call will be available via JDE Peet’s’

Investor Relations website.1 This press release contains certain

non-IFRS financial measures and ratios, which are not recognised

measures of financial performance or liquidity under IFRS. For a

reconciliation of these non-IFRS financial measures to the most

directly comparable IFRS financial measures, see page 6 of the

press release.

ENQUIRIES

Media Michael Orr Media@JDEPeets.com +31 20 558

1600

Investors & Analysts Robin Jansen

IR@JDEPeets.com +31 6 159 44 569

About JDE Peet’sJDE Peet’s is the world's

leading pure-play coffee and tea company by revenue and served

approximately 4,500 cups of coffee or tea every second in 2020. JDE

Peet's unleashes the possibilities of coffee and tea in more than

100 developed and emerging markets through a portfolio of over 50

brands that collectively cover the entire category landscape led by

household names such as L’OR, Peet’s, Jacobs, Senseo, Tassimo,

Douwe Egberts, OldTown, Super, Pickwick and Moccona. In 2020, JDE

Peet’s generated total sales of EUR 6.7 billion and employed a

global workforce of more than 19,000 employees. Read more about our

journey towards a coffee and tea for every cup at

www.JDEPeets.com.

IMPORTANT INFORMATION

Market Abuse Regulation

This press release contains information within the meaning of

Article 7(1) of the EU Market Abuse Regulation.

Presentation

The condensed consolidated unaudited financial

statements of JDE Peet’s N.V. (the "Company") and its consolidated

subsidiaries (the "Group") are prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union ("IFRS"). In preparing the financial

information in these materials, except as otherwise described, the

same accounting principles are applied as in the consolidated

special purpose financial statements of the Group as of, and for,

the year ended 31 December 2020 and the related notes thereto. All

figures in these materials are unaudited. In preparing the

financial information included in these materials, most numerical

figures are presented in millions of euro. Certain figures in these

materials, including financial data, have been rounded. In tables,

negative amounts are shown in parentheses. Otherwise, negative

amounts are shown by "-" or "negative" before the amount.

Forward-looking Statements

These materials contain forward-looking statements

as defined in the United States Private Securities Litigation

Reform Act of 1995 concerning the financial condition, results of

operations and businesses of the Group. These forward-looking

statements and other statements contained in these materials

regarding matters that are not historical facts and involve

predictions. No assurance can be given that such future results

will be achieved. Actual events or results may differ materially as

a result of risks and uncertainties facing the Group. Such risks

and uncertainties could cause actual results to vary materially

from the future results indicated, expressed or implied in such

forward-looking statements. There are a number of factors that

could affect the Group’s future operations and could cause those

results to differ materially from those expressed in the

forward-looking statements including (without limitation): (a)

competitive pressures and changes in consumer trends and

preferences as well as consumer perceptions of its brands; (b)

fluctuations in the cost of green coffee, including premium Arabica

coffee beans, tea or other commodities, and its ability to secure

an adequate supply of quality or sustainable coffee and tea; (c)

global and regional economic and financial conditions, as well as

political and business conditions or other developments; (d)

interruption in the Group's manufacturing and distribution

facilities; (e) its ability to successfully innovate, develop and

launch new products and product extensions and on effectively

marketing its existing products; (f) actual or alleged

non-compliance with applicable laws or regulations and any legal

claims or government investigations in respect of the Group's

businesses; (g) difficulties associated with successfully

completing acquisitions and integrating acquired businesses; (h)

the loss of senior management and other key personnel; and (i)

changes in applicable environmental laws or regulations. The

forward-looking statements contained in these materials speak only

as of the date of these materials. The Group is not under any

obligation to (and expressly disclaim any such obligation to)

revise or update any forward-looking statements to reflect events

or circumstances after the date of these materials or to reflect

the occurrence of unanticipated events. The Group cannot give any

assurance that forward-looking statements will prove correct and

investors are cautioned not to place undue reliance on any

forward-looking statements. Further details of potential risks and

uncertainties affecting the Group are described in the Company’s

public filings with the Netherlands Authority for the Financial

Markets (Stichting Autoriteit Financiële Markten) and other

disclosures.

Market and Industry Data

All references to industry forecasts, industry

statistics, market data and market share in these materials

comprise estimates compiled by analysts, competitors, industry

professionals and organisations, of publicly available information

or of the Group's own assessment of its markets and sales. Rankings

are based on revenue, unless otherwise stated.

- jde-peets-half-year-results-2021-report

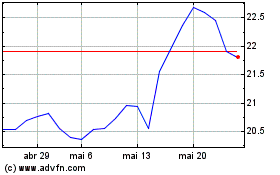

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

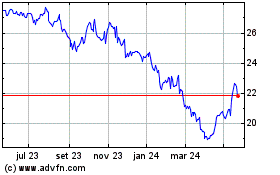

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024