Eldorado Gold Announces Launch of US$500 Million Senior Notes Offering

09 Agosto 2021 - 5:04PM

Eldorado Gold Corporation (“Eldorado”, the

“Company” or “We”) is pleased to announce that the Company intends

to offer up to US$500 million aggregate principal amount of senior

notes due 2029 (the “Notes”), subject to market and other

conditions. The interest rate and other terms of the Notes will be

determined based on prevailing market conditions.

Eldorado intends to use the net proceeds from

the sale of the Notes to redeem its outstanding US$234 million

9.500% Senior Secured Second Lien Notes due June 2024, to repay all

amounts outstanding under its existing term loan facility, to repay

all amounts outstanding under its existing revolving credit

facility, to pay fees and expenses in connection with the

foregoing, and for general corporate purposes. Eldorado has

obtained the requisite consent of its lenders for the sale of the

Notes under the Third Amended and Restated Credit Agreement dated

as of May 13, 2019 among the Company, as borrower, and HSBC Bank

Canada, as administrative agent, among others.

The Notes have not been registered under the

United States Securities Act of 1933, as amended (the “Securities

Act”), or the securities laws of any state and may not be offered

or sold absent registration under the Securities Act or an

applicable exemption from the registration requirements thereof.

The Notes will be offered and sold only to persons reasonably

believed to be qualified institutional buyers in accordance with

Rule 144A under the Securities Act and to certain “non-U.S.

persons” outside the United States in reliance on Regulation S

under the Securities Act and in each case pursuant to available

prospectus exemptions from securities laws of British Columbia. The

Notes will be offered and sold outside of the United States

(including in Canada) on a private placement basis pursuant to

certain exemptions from applicable securities laws.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction

or an exemption therefrom. This press release is being issued

pursuant to and in accordance with Rule 135c under the

Securities Act.

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkey, Canada,

Greece, Romania, and Brazil. The Company has a highly skilled and

dedicated workforce, safe and responsible operations, a portfolio

of high-quality assets, and long-term partnerships with local

communities. Eldorado’s common shares trade on the Toronto

Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contacts

Investor Relations

Lisa Wilkinson, VP, Investor Relations604.757.2237 or

1.888.353.8166lisa.wilkinson@eldoradogold.com

Cautionary Note about Forward-Looking Statements and

Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as “anticipates”, “believes”, “continue”, “expects”, “is

expected” or “intends” or the negatives thereof or variations of

such words and phrases or statements that certain actions, events

or results “may”, “could”, “would”, “might” or “will” be taken,

occur or be achieved. Forward-looking statements or information

contained in this release include, but are not limited to,

statements or information with respect to: the launch of the Notes,

the terms of the Notes, the completion of the transactions in

connection with the offering of the Notes and the use of the net

proceeds from the sale of the Notes.

Forward-looking statements and forward-looking

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information. We have made certain

assumptions about the forward-looking statements and information,

including assumptions about: the closing of, and net proceeds from,

the sale of the Notes; how the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

COVID-19 pandemic; the geopolitical, economic and legal climate

that we operate in; the repayment of outstanding indebtedness; and

anticipated costs and expenses. In particular, except where

otherwise stated, we have assumed a continuation of existing

business operations on substantially the same basis as exists at

the time of this release. Even though our management believes that

the assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statements or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others,

the following: the need to negotiate and execute a purchase

agreement and related documents; the need for continued cooperation

of the initial purchasers; the need to successfully market the

offering; global outbreaks of infectious diseases, including

COVID-19; geopolitical and economic climate (global and local)

risks; financing risks; as well as those risk factors discussed in

the sections titled “Forward-looking information and risks” and

“Risk factors in our business” in the Company’s most recent Annual

Information Form & Form 40-F. The reader is directed to

carefully review the detailed risk discussion in our most recent

Annual Information Form filed on SEDAR and EDGAR under our Company

name, which discussion is incorporated by reference in this

release, for a fuller understanding of the risks and uncertainties

that affect the Company’s business and operations.

Forward-looking statements and information are

designed to help you understand management’s current views of our

near and longer term prospects, and it may not be appropriate for

other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company’s business contained in the Company’s reports filed

with the securities regulatory authorities in Canada and the

U.S.

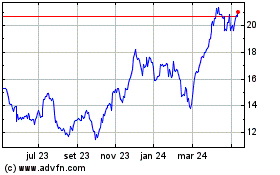

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

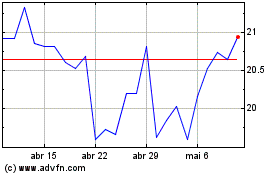

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025