Mondelēz International, Inc. (Nasdaq: MDLZ) (“Mondelēz

International” or the “Guarantor”) announces today that its

fully-owned subsidiary Mondelez International Holdings Netherlands

B.V. (the “Issuer”) has priced an offering (the “Offering”) of EUR

300 million of senior unsecured bonds (the “Bonds”), fully and

unconditionally guaranteed (the “Guarantee” and together with the

Bonds, the “Securities”) by the Guarantor, exchangeable into

existing ordinary shares in the capital of JDE Peet’s N.V.

(Euronext Amsterdam: JDEP) a public limited liability company

(naamloze vennootschap) incorporated under the law of the

Netherlands, registered with the Dutch trade register under number

73160377 (“JDE Peet’s” or the “Company”).

The Bonds will have a maturity of three years

(except in case of an early redemption), will not bear interest and

will be issued at an issue price of 102.0% of their principal

amount, corresponding to an annual yield-to-maturity

of -0.66%. Upon exchange, the Bonds may be settled through the

delivery of JDEP ordinary shares currently owned by the Issuer,

with an initial exchange price of EUR 35.40, representing an

exchange premium of 30% to the reference price, being the

volume-weighted average price of a JDEP share on Euronext Amsterdam

between launch and pricing of the Bonds, or settled in cash. The

Bonds will be redeemed at their principal amount at maturity,

subject to the Issuer’s option to alternatively satisfy such

obligation by delivering the exchange property and, as the case may

be, an additional amount in cash.

The Issuer will have the option to redeem all,

but not only some, of the Bonds, at any time on or after September

20, 2023 at their principal amount, provided that the value of the

exchange property per Bond attributable to EUR 200,000 in principal

amount of Bonds shall have exceeded EUR 260,000 on each of not less

than 20 trading days in any period of 30 consecutive trading

days.

The underlying exchange property will be subject

to adjustments upon the occurrence of certain corporate events

pursuant to the terms and conditions of the Bonds.

The proceeds of the Offering will be used for

general corporate purposes, including the Chipita acquisition.

Following the offering of the Securities and

assuming exchange in full of the Bonds (with settlement exclusively

in JDE Peet’s shares), based on its current ownership interest the

Issuer would directly or indirectly retain a stake of approximately

21% in the Company’s share capital and remain a significant

shareholder of JDE Peet’s.

The Securities have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

“Securities Act”) and may not be offered or sold in the United

States, or to or for the account or benefit of a U.S. person absent

registration or an applicable exemption from such registration

requirements. Terms used in this paragraph without definition shall

have the meaning given to them in Regulation S under the Securities

Act.

The Securities were offered as part of a private

placement to qualified investors outside Australia, Canada, Japan

or South Africa. The Bonds may not be offered or sold to retail

investors. No Key Information Document (within the meaning of the

EU PRIIPS Regulation or the UK PRIIPS Regulation) has been or will

be prepared.

Settlement of the Bonds is expected to occur on

September 20, 2021 (the “Issue Date”).

Application will be made for the Bonds to be

admitted to trading on the Global Exchange Market which is the

exchange regulated market of Euronext Dublin or the Open Market

segment (Freiverkehr) of the Frankfurt Stock Exchange (or another

internationally recognised, regularly operating, regulated or

non-regulated stock exchange or securities market) no later than 60

days after the Issue Date.

This press release is neither an offer to sell

nor the solicitation of an offer to buy the Bonds or any other

securities and shall not constitute an offer, solicitation or sale

in any jurisdiction in which, or to any persons to whom, such an

offer, solicitation or sale is unlawful.

About Mondelēz

International

Mondelēz International, Inc. (Nasdaq: MDLZ)

empowers people to snack right in over 150 countries around the

world. With 2020 net revenues of approximately $27 billion, MDLZ is

leading the future of snacking with iconic global and local brands

such as OREO, belVita and LU biscuits; Cadbury Dairy Milk, Milka

and Toblerone chocolate; Sour Patch Kids candy and Trident gum.

Mondelēz International is a proud member of the Standard and Poor’s

500, Nasdaq 100 and Dow Jones Sustainability Index. Visit

www.mondelezinternational.com or follow the company on Twitter at

www.twitter.com/MDLZ.

Forward-Looking Statements

This press release contains forward-looking

statements. Words, and variations of words, such as “will,” “may,”

“expect,” “plan” and similar expressions are intended to identify

these forward-looking statements, including, but not limited to,

statements about the Offering and the Bonds. These forward looking

statements are subject to a number of risks and uncertainties, many

of which are beyond Mondelēz International’s control, which could

cause Mondelēz International’s actual results to differ materially

from those indicated in these forward-looking statements. Please

also see Mondelēz International’s risk factors, as they may be

amended from time to time, set forth in its filings with the U.S.

Securities and Exchange Commission, including its most recently

filed Annual Report on Form 10-K. Mondelēz International disclaims

and does not undertake any obligation to update or revise any

forward-looking statement in this press release, except as required

by applicable law or regulation.

REPRESENTATIONS BY

INVESTORS

NO ACTION HAS BEEN TAKEN BY THE

ISSUER, THE COMPANY OR ANY OF THEIR REPRESENTATIVES, OR ANY OF

THEIR RESPECTIVE AFFILIATES, THAT WOULD PERMIT AN OFFERING OF THE

BONDS, THE GUARANTEE OR THE SHARES TO BE TRANSFERRED AND DELIVERED

UPON EXCHANGE OF THE BONDS AND NOTIONALLY UNDERLYING THE BONDS

(SEPARATELY, A “SECURITY” AND TOGETHER, THE “SECURITIES”) OR

POSSESSION OR DISTRIBUTION OF THIS PRESS RELEASE OR ANY OFFERING OR

PUBLICITY MATERIAL RELATING TO THE OFFERING OR ANY OF THE

SECURITIES (TOGETHER, “OFFER MATERIALS”) IN ANY JURISDICTION WHERE

ACTION FOR THAT PURPOSE IS REQUIRED. PERSONS INTO WHOSE POSSESSION

THIS PRESS RELEASE OR ANY OTHER OFFER MATERIALS COMES ARE REQUIRED

BY THE ISSUER AND THE COMPANY TO INFORM THEMSELVES ABOUT, AND TO

OBSERVE, ANY SUCH RESTRICTIONS.

AN INVESTMENT IN THE BONDS

INCLUDES A SIGNIFICANT DEGREE OF RISK. IN MAKING ANY DECISION TO

PURCHASE THE BONDS, AN INVESTOR WILL BE DEEMED (A) TO HAVE SUCH

BUSINESS AND FINANCIAL EXPERIENCE AS IS REQUIRED TO GIVE IT THE

CAPACITY TO PROTECT ITS OWN INTERESTS IN CONNECTION WITH THE

PURCHASE OF THE BONDS, (B) NOT TO HAVE RELIED ON (I) ANY

INVESTIGATION THAT ANY THIRD PARTY, MAY HAVE CONDUCTED WITH RESPECT

TO THE ISSUER, THE GUARANTOR, THE COMPANY, OR THE SECURITIES, OR

(II) ANY DISCUSSIONS, NEGOTIATIONS OR OTHER COMMUNICATIONS ENTERED

INTO WITH, OR ANY OTHER WRITTEN OR ORAL INFORMATION MADE AVAILABLE

BY ANY THIRD PARTY, (C) TO HAVE MADE ITS OWN INVESTMENT DECISION

REGARDING THE SECURITIES BASED ON ITS OWN KNOWLEDGE, INVESTIGATION

AND ASSESSMENT OF THE ISSUER, THE GUARANTOR, THE COMPANY, THEIR

RESPECTIVE SUBSIDIARIES, THE SECURITIES, THE TERMS OF THE BONDS AND

THE TERMS OF THE PLACEMENT OF THE BONDS, AND BASED ON SUCH OTHER

PUBLICLY AVAILABLE INFORMATION IT DEEMS NECESSARY, APPROPRIATE AND

SUFFICIENT (AND WHICH IT CONFIRMS IT HAS BEEN ABLE TO ACCESS, READ

AND UNDERSTAND) AND (D) TO HAVE CONSULTED ITS OWN INDEPENDENT

ADVISERS OR TO OTHERWISE HAVE SATISFIED ITSELF CONCERNING, WITHOUT

LIMITATION, ACCOUNTING, REGULATORY, TAX OR OTHER CONSEQUENCES IN

THE LIGHT OF ITS PARTICULAR SITUATION UNDER THE LAWS OF ALL

RELEVANT JURISDICTIONS.

IMPORTANT NOTICES

THIS ANNOUNCEMENT DOES NOT COMPRISE A PROSPECTUS

FOR THE PURPOSES OF THE PROSPECTUS REGULATION (AS DEFINED ABOVE)

AND/OR PART VI OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 OF

THE UNITED KINGDOM OR OTHERWISE.

IN CONNECTION WITH THE OFFERING OF THE BONDS, A

PROSPECTUS IS NOT REQUIRED TO BE PUBLISHED PURSUANT TO THE

PROSPECTUS REGULATION OR THE UK PROSPECTUS REGULATION.

NO ACTION HAS BEEN TAKEN BY THE ISSUER, THE

GUARANTOR, THEIR REPRESENTATIVES OR ANY OF THEIR RESPECTIVE

AFFILIATES THAT WOULD PERMIT AN OFFERING OF THE BONDS OR POSSESSION

OR DISTRIBUTION OF THIS ANNOUNCEMENT OR ANY OFFERING OR PUBLICITY

MATERIAL RELATING TO THE BONDS IN ANY JURISDICTION WHERE ACTION FOR

THAT PURPOSE IS REQUIRED. PERSONS INTO WHOSE POSSESSION THIS

ANNOUNCEMENT COMES ARE REQUIRED BY THE ISSUER AND THE GUARANTOR TO

INFORM THEMSELVES ABOUT, AND TO OBSERVE, ANY SUCH RESTRICTIONS.

THIS ANNOUNCEMENT IS DIRECTED EXCLUSIVELY AT

MARKET PROFESSIONALS AND INSTITUTIONAL INVESTORS, BEING “QUALIFIED

INVESTORS” WITHIN THE MEANING OF THE PROSPECTUS REGULATION (IN THE

CASE OF PERSONS IN THE EEA) OR IN THE UK PROSPECTUS REGULATION (IN

THE CASE OF PERSONS IN THE UK). IT IS FOR INFORMATION PURPOSES ONLY

AND IS NOT TO BE RELIED UPON IN SUBSTITUTION FOR THE EXERCISE OF

INDEPENDENT JUDGEMENT. IT IS NOT INTENDED AS INVESTMENT ADVICE AND

UNDER NO CIRCUMSTANCES IS IT TO BE USED OR CONSIDERED AS AN OFFER

TO SELL, OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY NOR IS

IT A RECOMMENDATION TO BUY OR SELL ANY SECURITY.

ANY DECISION TO PURCHASE ANY OF THE BONDS SHOULD

ONLY BE MADE ON THE BASIS OF AN INDEPENDENT REVIEW BY A PROSPECTIVE

INVESTOR OF THE ISSUER’S, THE GUARANTOR’S AND THE COMPANY’S

PUBLICLY AVAILABLE INFORMATION. THE INFORMATION CONTAINED IN THIS

PRESS RELEASE IS SUBJECT TO CHANGE IN ITS ENTIRETY WITHOUT NOTICE

UP TO THE ISSUE DATE.

EACH PERSON RECEIVING THIS DOCUMENT SHOULD

CONSULT HIS/HER PROFESSIONAL ADVISERS TO ASCERTAIN THE SUITABILITY

OF THE SECURITIES AS AN INVESTMENT. FOR THE AVOIDANCE OF DOUBT,

NEITHER OF THE ISSUER NOR THE GUARANTOR MAKE ANY REPRESENTATION OR

WARRANTY THAT THEY INTEND TO ACCEPT OR BE BOUND BY ANY OF THE TERMS

HEREIN NOR SHALL THE ISSUER OR THE GUARANTOR BE OBLIGED TO ENTER

INTO ANY FURTHER DISCUSSIONS OR NEGOTIATIONS PURSUANT HERETO, BUT

THEY SHALL BE ENTITLED IN THEIR ABSOLUTE DISCRETION TO ACT IN ANY

WAY THAT THEY SEE FIT IN CONNECTION WITH THE PROPOSED TRANSACTION.

THIS DOCUMENT IS NOT AN OFFER TO SELL, NOR A SOLICITATION OF AN

OFFER TO BUY ANY SECURITIES AND ANY DISCUSSIONS, NEGOTIATIONS OR

OTHER COMMUNICATIONS THAT MAY BE ENTERED INTO, WHETHER IN

CONNECTION WITH THE TRANSACTION DESCRIBED HEREIN OR OTHERWISE,

SHALL BE CONDUCTED SUBJECT TO CONTRACT. NO REPRESENTATION OR

WARRANTY, EXPRESS OR IMPLIED, IS OR WILL BE MADE AS TO, OR IN

RELATION TO, THE ACCURACY OR COMPLETENESS OF THIS DOCUMENT, OR ANY

OTHER WRITTEN OR ORAL INFORMATION MADE AVAILABLE TO ANY INTERESTED

PARTY OR ITS ADVISERS AND, EXCEPT AS PROHIBITED BY APPLICABLE LAW,

ANY LIABILITY THEREFOR IS HEREBY EXPRESSLY DISCLAIMED.

POTENTIAL INVESTORS WHO ARE IN ANY DOUBT ABOUT

THE CONTENTS OF THIS PRESS RELEASE OR ANY OTHER OFFER MATERIALS

SHOULD CONSULT THEIR STOCKBROKER, BANK MANAGER, SOLICITOR,

ACCOUNTANT OR OTHER FINANCIAL ADVISER. IT SHOULD BE REMEMBERED THAT

THE PRICE OF SECURITIES AND THE INCOME FROM THEM CAN GO DOWN AS

WELL AS UP.

EACH PROSPECTIVE INVESTOR SHOULD PROCEED ON THE

ASSUMPTION THAT IT MUST BEAR THE ECONOMIC RISK OF AN INVESTMENT IN

THE SECURITIES. NEITHER OF THE ISSUER NOR THE GUARANTOR MAKE ANY

REPRESENTATION AS TO (I) THE SUITABILITY OF THE SECURITIES FOR ANY

PARTICULAR INVESTOR, (II) THE APPROPRIATE ACCOUNTING TREATMENT AND

POTENTIAL TAX CONSEQUENCES OF INVESTING IN THE SECURITIES OR (III)

THE FUTURE PERFORMANCE OF THE SECURITIES EITHER IN ABSOLUTE TERMS

OR RELATIVE TO COMPETING INVESTMENTS.

ANY ALLOCATION OF THE BONDS DESCRIBED IN THIS

DOCUMENT IS MADE EXPRESSLY SUBJECT TO THE CONDITION THAT ANY

OFFERING OF THE BONDS COMPLETES AND THAT THE BONDS ARE ISSUED. IN

PARTICULAR, IT SHOULD BE NOTED THAT ANY SUCH OFFERING AND FORMAL

DOCUMENTATION RELATING THERETO WILL BE SUBJECT TO CONDITIONS

PRECEDENT AND TERMINATION EVENTS, INCLUDING THOSE WHICH ARE

CUSTOMARY FOR SUCH AN OFFERING. ANY SUCH OFFERING WILL NOT COMPLETE

UNLESS SUCH CONDITIONS PRECEDENT ARE FULFILLED AND ANY SUCH

TERMINATION EVENTS HAVE NOT TAKEN PLACE OR THE FAILURE TO FULFIL

SUCH A CONDITION PRECEDENT OR THE OCCURRENCE OF A TERMINATION EVENT

HAS BEEN WAIVED, IF APPLICABLE.

GENERAL SELLING RESTRICTION

THIS DOCUMENT IS NOT AN OFFER TO SELL SECURITIES

OR THE SOLICITATION OF ANY OFFER TO BUY SECURITIES, NOR SHALL THERE

BE ANY OFFER OF SECURITIES IN ANY JURISDICTION IN WHICH SUCH OFFER

OR SALE WOULD BE UNLAWFUL. THERE WILL BE NO PUBLIC OFFER OF THE

SECURITIES IN ANY JURISDICTION.

COPIES OF THIS DOCUMENT ARE NOT BEING, AND MUST

NOT BE, MAILED, OR OTHERWISE FORWARDED, DISTRIBUTED OR SENT IN,

INTO OR FROM ANY JURISDICTION IN WHICH SUCH MAILING WOULD BE

ILLEGAL, OR TO PUBLICATIONS WITH A GENERAL CIRCULATION IN THOSE

JURISDICTIONS, AND PERSONS RECEIVING THIS DOCUMENT (INCLUDING

CUSTODIANS, NOMINEES AND TRUSTEES) MUST NOT MAIL OR OTHERWISE

FORWARD, DISTRIBUTE OR SEND IT IN, INTO OR FROM ANY JURISDICTION IN

WHICH SUCH MAILING WOULD BE ILLEGAL OR TO PUBLICATIONS WITH A

GENERAL CIRCULATION IN THOSE JURISDICTIONS.

UNITED STATES RESTRICTIONS

THE BONDS AND THE GUARANTEE (EACH AS DEFINED

BELOW AND, TOGETHER, THE “SECURITIES”) AND THE SHARES (AS DEFINED

BELOW) DELIVERABLE UPON EXCHANGE OF THE BONDS REFERRED TO HEREIN

HAVE NOT BEEN, AND WILL NOT BE, REGISTERED IN THE UNITED STATES

UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES

ACT"), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES,

AND THE SECURITIES MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES

OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, US PERSONS. CONSEQUENTLY,

THE SECURITIES AND THE SHARES DELIVERABLE UPON EXCHANGE OF THE

BONDS REFERRED TO HEREIN ARE BEING OFFERED AND SOLD ONLY OUTSIDE

THE UNITED STATES TO NON-US PERSONS IN OFFSHORE TRANSACTIONS IN

RELIANCE ON THE EXEMPTION PROVIDED BY REGULATION S UNDER THE

SECURITIES ACT (“REGULATION S”).

HOLDERS WHO WISH TO EXCHANGE THE BONDS HELD BY

THEM FOR THE SHARES, AS REFERRED TO HEREIN, MUST COMPLY WITH THE

TERMS AND CONDITIONS OF THE BONDS RELATED THERETO, INCLUDING

DELIVERING A CERTIFICATION CONTAINING REPRESENTATIONS THAT, AMONG

OTHER THINGS, SUCH HOLDER IS A NON-US PERSON OUTSIDE THE UNITED

STATES ACQUIRING THE SHARES DELIVERABLE UPON EXCHANGE OF THE BONDS

IN OFFSHORE TRANSACTIONS EXEMPT FROM REGISTRATION UNDER THE

SECURITIES ACT PURSUANT TO THE EXEMPTION PROVIDED BY REGULATION

S.

EEA AND UK SELLING RESTRICTIONS AND

DEEMED INVESTOR REPRESENTATIONS

THIS DOCUMENT AND THE OFFERING WHEN MADE ARE

ONLY ADDRESSED TO, AND DIRECTED IN, MEMBER STATES OF THE EUROPEAN

ECONOMIC AREA (THE “EEA”) OR IN THE UNITED KINGDOM (THE “UK”)

(EACH, A “RELEVANT STATE”), AT PERSONS WHO ARE “QUALIFIED

INVESTORS” WITHIN THE MEANING OF ARTICLE 2(1)(E) OF THE PROSPECTUS

REGULATION (IN THE CASE OF PERSONS IN THE EEA) OR IN THE UK

PROSPECTUS REGULATION (AS DEFINED ABOVE) (IN THE CASE OF PERSONS IN

THE UK) (IN EACH CASE, “QUALIFIED INVESTORS”). EACH PERSON IN A

RELEVANT STATE WHO INITIALLY ACQUIRES ANY BONDS OR TO WHOM ANY

OFFER OF BONDS MAY BE MADE AND, TO THE EXTENT APPLICABLE, ANY FUNDS

ON BEHALF OF WHICH SUCH PERSON IS ACQUIRING THE BONDS THAT ARE

LOCATED IN A RELEVANT STATE WILL BE DEEMED TO HAVE REPRESENTED,

ACKNOWLEDGED AND AGREED THAT IT IS A QUALIFIED INVESTOR.

PRODUCT GOVERNANCE / PROFESSIONAL

INVESTORS AND ECPS TARGET MARKET

MIFID II PROFESSIONALS/ECPS-ONLY

SOLELY FOR THE PURPOSES OF THE PRODUCT

GOVERNANCE REQUIREMENTS CONTAINED WITHIN: (A) EU DIRECTIVE

2014/65/EU ON MARKETS IN FINANCIAL INSTRUMENTS, AS AMENDED (“MIFID

II”); (B) ARTICLES 9 AND 10 OF COMMISSION DELEGATED DIRECTIVE (EU)

2017/593 SUPPLEMENTING MIFID II; AND (C) LOCAL IMPLEMENTING

MEASURES (TOGETHER, THE “MIFID II PRODUCT GOVERNANCE

REQUIREMENTS”), AND DISCLAIMING ALL AND ANY LIABILITY, WHETHER

ARISING IN TORT, CONTRACT OR OTHERWISE, WHICH ANY “MANUFACTURER”

(FOR THE PURPOSES OF THE MIFID II PRODUCT GOVERNANCE REQUIREMENTS)

MAY OTHERWISE HAVE WITH RESPECT THERETO, THE BONDS HAVE BEEN

SUBJECT TO A PRODUCT APPROVAL PROCESS, WHICH HAS DETERMINED THAT:

(I) THE TARGET MARKET FOR THE BONDS IS ELIGIBLE COUNTERPARTIES AND

PROFESSIONAL CLIENTS ONLY, EACH AS DEFINED IN MIFID II; AND (II)

ALL CHANNELS FOR DISTRIBUTION OF THE BONDS TO ELIGIBLE

COUNTERPARTIES AND PROFESSIONAL CLIENTS ARE APPROPRIATE. ANY PERSON

SUBSEQUENTLY OFFERING, SELLING OR RECOMMENDING THE BONDS (A

"DISTRIBUTOR") SHOULD TAKE INTO CONSIDERATION THE MANUFACTURERS’

TARGET MARKET ASSESSMENT; HOWEVER, A DISTRIBUTOR SUBJECT TO MIFID

II IS RESPONSIBLE FOR UNDERTAKING ITS OWN TARGET MARKET ASSESSMENT

IN RESPECT OF THE BONDS (BY EITHER ADOPTING OR REFINING THE

MANUFACTURERS’ TARGET MARKET ASSESSMENT) AND DETERMINING

APPROPRIATE DISTRIBUTION CHANNELS.

UK MIFIR PROFESSIONAL/ECPS-ONLY

SOLELY FOR THE PURPOSES OF EACH MANUFACTURER’S

PRODUCT APPROVAL PROCESS, THE TARGET MARKET ASSESSMENT IN RESPECT

OF THE BONDS HAS LED TO THE CONCLUSION THAT: (I) THE TARGET MARKET

FOR THE BONDS IS ONLY ELIGIBLE COUNTERPARTIES, AS DEFINED IN THE

FCA HANDBOOK CONDUCT OF BUSINESS SOURCEBOOK (“COBS”), AND

PROFESSIONAL CLIENTS, AS DEFINED IN REGULATION (EU) NO 600/2014 AS

IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (“UK MIFIR”); AND (II) ALL CHANNELS FOR

DISTRIBUTION OF THE BONDS TO ELIGIBLE COUNTERPARTIES AND

PROFESSIONAL CLIENTS ARE APPROPRIATE. ANY PERSON SUBSEQUENTLY

OFFERING, SELLING OR RECOMMENDING THE BONDS (A “DISTRIBUTOR”)

SHOULD TAKE INTO CONSIDERATION THE MANUFACTURERS’ TARGET MARKET

ASSESSMENT; HOWEVER, A DISTRIBUTOR SUBJECT TO THE FCA HANDBOOK

PRODUCT INTERVENTION AND PRODUCT GOVERNANCE SOURCEBOOK (THE “UK

MIFIR PRODUCT GOVERNANCE RULES”) IS RESPONSIBLE FOR UNDERTAKING ITS

OWN TARGET MARKET ASSESSMENT IN RESPECT OF THE BONDS (BY EITHER

ADOPTING OR REFINING THE MANUFACTURERS’ TARGET MARKET ASSESSMENT)

AND DETERMINING APPROPRIATE DISTRIBUTION CHANNELS.

THE TARGET MARKET ASSESSMENT IS WITHOUT

PREJUDICE TO THE REQUIREMENTS OF ANY CONTRACTUAL OR LEGAL SELLING

RESTRICTIONS IN RELATION TO ANY OFFERING OF THE BONDS.

FOR THE AVOIDANCE OF DOUBT, THE TARGET MARKET

ASSESSMENT DOES NOT CONSTITUTE: (A) AN ASSESSMENT OF SUITABILITY OR

APPROPRIATENESS FOR THE PURPOSES OF MIFID II OR UK MIFIR; OR (B) A

RECOMMENDATION TO ANY INVESTOR OR GROUP OF INVESTORS TO INVEST IN,

OR PURCHASE, OR TAKE ANY OTHER ACTION WHATSOEVER WITH RESPECT TO

THE BONDS.

THE BONDS ARE NOT INTENDED TO BE OFFERED, SOLD

OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR

OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA. FOR

THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR

MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE

4(1) OF MIFID II; OR (II) A CUSTOMER WITHIN THE MEANING OF

DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A

PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF

MIFID II. CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY

REGULATION (EU) NO 1286/2014, AS AMENDED (THE "PRIIPS REGULATION")

FOR OFFERING OR SELLING THE BONDS OR OTHERWISE MAKING THEM

AVAILABLE TO RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND

THEREFORE OFFERING OR SELLING THE BONDS OR OTHERWISE MAKING THEM

AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER

THE PRIIPS REGULATION.

THE BONDS ARE NOT INTENDED TO BE OFFERED, SOLD

OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR

OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR IN THE UK. FOR

THESE PURPOSES, A “RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR

MORE) OF: (I) A RETAIL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2

OF REGULATION (EU) NO 2017/565 AS IT FORMS PART OF DOMESTIC LAW BY

VIRTUE OF THE EUWA; OR (II) A CUSTOMER WITHIN THE MEANING OF THE

PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS

AMENDED (“FSMA”) OF THE UNITED KINGDOM AND ANY RULES OR REGULATIONS

MADE UNDER THE FSMA TO IMPLEMENT DIRECTIVE (EU) 2016/97, WHERE THAT

CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN

POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT

FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUWA. CONSEQUENTLY NO

KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014

AS IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUWA (THE “UK

PRIIPS REGULATION”) FOR OFFERING OR SELLING THE BONDS OR OTHERWISE

MAKING THEM AVAILABLE TO RETAIL INVESTORS IN THE UK HAS BEEN

PREPARED AND THEREFORE OFFERING OR SELLING THE BONDS OR OTHERWISE

MAKING THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE UK MAY BE

UNLAWFUL UNDER THE UK PRIIPS REGULATION.

IN ADDITION, IN THE UNITED KINGDOM THIS PRESS

RELEASE IS BEING DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT,

QUALIFIED INVESTORS (I) WHO HAVE PROFESSIONAL EXPERIENCE IN MATTERS

RELATING TO INVESTMENTS FALLING WITHIN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005, AS AMENDED (THE “ORDER”) AND QUALIFIED INVESTORS FALLING

WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER, AND (II) TO WHOM IT

MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER

BEING REFERRED TO AS “RELEVANT PERSONS”). THIS PRESS RELEASE MUST

NOT BE ACTED ON OR RELIED ON (I) IN THE UNITED KINGDOM, BY PERSONS

WHO ARE NOT RELEVANT PERSONS, AND (II) IN ANY MEMBER STATE OF THE

EEA, BY PERSONS WHO ARE NOT QUALIFIED INVESTORS. ANY INVESTMENT OR

INVESTMENT ACTIVITY TO WHICH THIS PRESS RELEASE RELATES IS

AVAILABLE ONLY TO (A) RELEVANT PERSONS IN THE UNITED KINGDOM AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS IN THE UNITED KINGDOM

AND (B) QUALIFIED INVESTORS IN MEMBER STATES OF THE EEA.

NETHERLANDS SELLING

RESTRICTIONS

THE ISSUER, THE GUARANTOR AND OTHERS WILL RELY

UPON THE TRUTH AND ACCURACY OF THE FOREGOING REPRESENTATIONS,

ACKNOWLEDGEMENTS AND AGREEMENTS.

THIS RELEASE HAS NOT BEEN FILED WITH, OR

REVIEWED BY, ANY NATIONAL OR LOCAL SECURITIES COMMISSION OR

REGULATORY AUTHORITY OF THE UNITED STATES, THE UNITED KINGDOM, THE

NETHERLANDS OR ANY OTHER JURISDICTION, NOR HAS ANY SUCH COMMISSION

OR AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PRESS

RELEASE. ANY REPRESENTATION TO THE CONTRARY MAY BE UNLAWFUL AND MAY

BE A CRIMINAL OFFENCE.

NOTICE TO PROSPECTIVE INVESTORS IN

CANADA

THE BONDS MAY ONLY BE DISTRIBUTED TO INVESTORS

IN CANADA PURSUANT TO AN EXEMPTION FROM THE PROSPECTUS REQUIREMENTS

OF CANADIAN SECURITIES LAWS. ONLY PROSPECTIVE INVESTORS IN ONTARIO,

QUÉBEC, BRITISH COLUMBIA, ALBERTA AND MANITOBA THAT QUALIFY AS

“ACCREDITED INVESTORS” AND ADDITIONALLY ALSO QUALIFY AS “PERMITTED

CLIENTS” WITHIN THE MEANING OF APPLICABLE CANADIAN SECURITIES LAWS

WILL BE ELIGIBLE TO PURCHASE THE BONDS. EACH PROSPECTIVE INVESTOR

IN CANADA WILL BE REQUIRED TO ACCEPT A REPRESENTATION LETTER

CONFIRMING ITS ELIGIBILITY AND PROVIDING CERTAIN ADDITIONAL

ACKNOWLEDGEMENTS, REPRESENTATIONS AND WARRANTIES.

THE ISSUER, THE GUARANTOR AND OTHERS WILL RELY

UPON THE TRUTH AND ACCURACY OF THE FOREGOING REPRESENTATIONS,

ACKNOWLEDGEMENTS AND AGREEMENTS SET OUT HEREIN.

|

Contacts: |

Jessica Vogl (Media) |

Shep Dunlap (Investors) |

| |

+1 847 943 5678 |

+1 847 943 5454 |

| |

news@mdlz.com |

ir@mdlz.com |

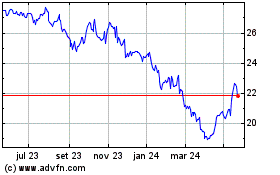

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

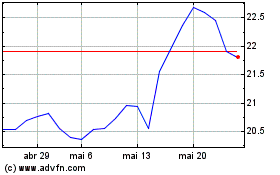

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025