Eldorado Gold Corporation (“Eldorado” or “the Company”) today

reports the Company’s financial and operational results for the

third quarter of 2021.

- Quarterly production

exceeds expectations; increasing full year 2021 annual

guidance: Gold production totalled 125,459 ounces in Q3

2021, a decrease of 8% from Q3 2020 production of 136,922 ounces

driven by a planned shift to lower-grade ore at Kisladag. Gold

production in the quarter increased 8% over Q2 2021. As a result of

strong production in the first nine months of 2021, primarily due

to operational improvements at Kisladag, Eldorado is increasing its

2021 annual production guidance by approximately 6% to

460,000-480,000 ounces of gold.

- Free cash

flow(4): Free cash flow from continuing

operations of $29.7 million in Q3 2021 decreased from free cash

flow from continuing operations of $114.7 million in Q3 2020(2,3)

primarily as a result of planned lower production, lower gold

prices and planned increased growth and sustaining capital

spending. An increase from negative free cash flow of $23.7 million

in Q2 2021(2,3) was primarily due to free cash flow being

negatively impacted in the second quarter by the timing of tax and

annual royalty payments. We expect free cash flow generation to

continue in Q4 2021.

- All-in sustaining

costs(4): Q3 2021 all-in sustaining costs

of $1,133 per ounce of gold sold in the quarter increased from Q3

2020 ($918 per ounce sold) as a result of planned lower production

in the quarter, higher cash operating costs per ounce and increased

sustaining capital expenditure. All-in sustaining costs per ounce

of gold sold increased in the quarter from Q2 2021 ($1,074 per

ounce sold) as a result of increased sustaining capital

expenditure. We are maintaining our 2021 annual guidance with

all-in-sustaining costs of $920 - $1,150 per ounce sold.

- Net earnings and adjusted

net earnings attributable to

shareholders(4): Net earnings from

continuing operations attributable to shareholders of the Company

in Q3 2021 were $8.5 million, or $0.05 per share (Q3 2020: net

earnings of $46.0 million or $0.26 per share, Q2 2021: net earnings

of $31.0 million or $0.17 per share)(1,3). Adjusted net earnings

attributable to shareholders of the Company from continuing

operations in Q3 2021 were $39.9 million, or $0.22 per share (Q3

2020: adjusted net earnings of $63.6 million or $0.37 earnings per

share, Q2 2021: adjusted net earnings of $29.1 million or $0.16 per

share)(1,3). Material adjustments in Q3 2021 included $31.1 million

of finance costs relating to the Company's debt refinancing in the

quarter.

- EBITDA: Q3 2021

EBITDA from continuing operations was $106.6 million (Q3 2020:

$161.0 million, Q2 2021:$106.9 million)(3) and Q3 2021 adjusted

EBITDA from continuing operations(4) was $108.1 million (Q3 2020:

$164.5 million, Q2 2021: $101.7 million)(3).

- Capital spending:

Capital expenditures totalled $64.4 million in Q3 2021 (Q3 2020:

$50.4 million, Q2 2021: $71.6 million)(3), reflecting a planned

increase and following reduced spending in the prior year due to

the novel coronavirus ("COVID-19") pandemic. Capital allocation is

following a rigorous process to ensure discipline and control at

all operations.

- At Kisladag, $17.7 million

investment in the quarter related to waste stripping, construction

of the north leach pad to support the mine life extension and

installation of a high-pressure grinding roll ("HPGR") circuit,

which is expected to improve heap leach recovery with commissioning

now in progress and expected to complete in November 2021.

- At Lamaque, $10.1 million

investment in the quarter related primarily to the decline

connecting the Triangle underground mine with the Sigma mill, which

is expected to reduce operating costs, reduce greenhouse gas

emissions, and provide access for underground drill platforms for

Ormaque, Plug 4, and other exploration targets in the prospective

corridor. Investment in the quarter also included raising the

embankment at the Sigma tailing storage facility.

- Financial

position: As at September 30, 2021, the Company had

$439.3 million of cash and cash equivalents and $250 million

undrawn and available under its revolving credit facility.

- Refinancing

completed: In August 2021, the Company

completed its offering of $500 million aggregate principal amount

of 6.25% senior unsecured notes due 2029 (the "senior notes") and

on October 15, 2021 entered into a $250 million amended and

restated senior secured credit facility ("Fourth ARCA"). Eldorado

used, in part, the net proceeds from the offering of the senior

notes to redeem the outstanding $234 million 9.5% senior secured

second lien notes due June 2024, and to repay all amounts

outstanding under its prior term loan and revolving credit

facility. The issuance of the senior notes and entering into of the

Fourth ARCA provides Eldorado greater financial flexibility to

pursue a broader range of financing alternatives for the

development of the Kassandra assets in Greece.

- Sale of Tocantinzinho

Project: On October 27, 2021, the Company completed a sale

of the Tocantinzinho Project, a non-core gold asset. Eldorado

received $20 million in cash consideration and 46,926,372 common

shares of G Mining Ventures Corp ('GMIN'). Deferred cash

consideration of $60 million is payable on the first anniversary of

commercial production of the Project, with an option to defer 50%

of the consideration at a cost of $5 million. The project has been

presented as a discontinued operation following the sale and a net

loss of $60.8 million reflects a reduction of fair value to the

amount of upfront cash and share consideration, less estimated

costs of disposal.

- Suspension of Mining at

Stratoni: On October 15, 2021, we announced that

operations at Stratoni will be suspended in Q4 2021. The mine will

be placed on care and maintenance while exploration drilling

continues with the goal of expanding reserves and resources. We

will evaluate resuming operations subject to exploration success

and positive results of further technical and economic review.

- Measures remain in place to

manage the impact of the COVID-19 pandemic: The Company's

mines remain fully operational and isolated cases of COVID-19 have

been successfully managed. Preventing the spread of COVID-19,

ensuring safe working environments across Eldorado's global sites,

and preparedness should an outbreak occur, remain priorities.

|

(1) |

2020 and YTD 2021 amounts have been recast to correct an immaterial

error related to an understatement of the net book value of certain

of our property, plant and equipment as a result of errors in the

amounts recorded for depreciation. See Note 2(c) of our Unaudited

Condensed Consolidated Interim Financial Statements. |

|

(2) |

2020 and YTD 2021 amounts have been restated for a voluntary change

in accounting policy to classify cash paid for interest on the

statement of cash flows as a financing, rather than an operating

activity. See Note 3(c) of our Unaudited Condensed Consolidated

Interim Financial Statements. |

|

(3) |

From Q3 2021, the Brazil Segment is presented as a discontinued

operation. See Note 5 of our Unaudited Condensed Consolidated

Interim Financial Statements. Amounts presented are from continuing

operations only. |

|

(4) |

These financial measures or ratios are non-IFRS financial measures

or ratios. See the section 'Non-IFRS Measures' for explanations and

discussion of these non-IFRS financial measures or ratios in the

September 30, 2021 MD&A. |

“In the third quarter of 2021, the Company

recorded strong, safe operational performance led by higher

production at Kisladag, resulting in a solid quarter of cash flow

generation,” said George Burns, President and CEO. “To reflect the

strong production in the first nine months of the year, we

increased our 2021 production guidance by approximately 6% to

460,000 to 480,000 ounces. Our organic growth projects at existing

operations remain on track with the Kisladag HPGR and Lamaque

decline projects expected to be completed in the fourth quarter,

allowing us to realize the benefits of these projects early next

year."

"We continue to move forward with de-risking the

Skouries project. We refinanced our senior notes at 6.25% and

executed a $250 million amended and restated senior secured credit

facility. We have structured both the senior notes and the credit

facility to provide Eldorado greater financial flexibility to

pursue a broader range of funding alternatives for the development

of the Kassandra assets in Greece."

"With operational results outperforming our

expectation in the first three quarters of 2021, our financing

position remaining solid, and numerous upcoming catalysts expected

in the fourth quarter, Eldorado remains well-positioned to provide

additional growth and value creation in the future."

Consolidated Financial and Operational

Highlights

|

|

3 months ended September 30, |

|

9 months ended September 30, |

|

Continuing operations(7),

except where noted |

|

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

Revenue |

$ |

238.4 |

|

$ |

287.6 |

|

|

$ |

696.3 |

|

$ |

748.2 |

|

|

Gold revenue |

$ |

221.5 |

|

$ |

264.3 |

|

|

$ |

626.6 |

|

$ |

684.7 |

|

|

Gold produced (oz) |

|

125,459 |

|

|

136,922 |

|

|

|

353,268 |

|

|

390,654 |

|

|

Gold sold (oz) |

|

125,189 |

|

|

137,704 |

|

|

|

352,923 |

|

|

388,883 |

|

|

Average realized gold price ($/oz sold) (1) |

$ |

1,769 |

|

$ |

1,919 |

|

|

$ |

1,775 |

|

$ |

1,761 |

|

|

Cash operating costs ($/oz sold) (1,2) |

|

646 |

|

|

537 |

|

|

|

644 |

|

|

568 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

743 |

|

|

664 |

|

|

|

726 |

|

|

651 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

1,133 |

|

|

918 |

|

|

|

1,066 |

|

|

908 |

|

|

Net (loss) earnings for the period (3,5) |

|

8.5 |

|

|

46.0 |

|

|

|

53.9 |

|

|

101.2 |

|

|

Net (loss) earnings per share – basic ($/share) (3,5) |

|

0.05 |

|

|

0.26 |

|

|

|

0.30 |

|

|

0.60 |

|

|

Adjusted net earnings (loss) (1,3,4,5) |

|

39.9 |

|

|

63.6 |

|

|

|

94.2 |

|

|

127.9 |

|

|

Adjusted net earnings (loss) per share ($/share) (1,3,4,5) |

|

0.22 |

|

|

0.37 |

|

|

|

0.52 |

|

|

0.75 |

|

|

Cash flow from operating activities before changes in working

capital (1,6) |

|

101.0 |

|

|

135.1 |

|

|

|

258.1 |

|

|

326.3 |

|

|

Free cash flow (1,6) |

|

29.7 |

|

|

114.7 |

|

|

|

39.3 |

|

|

205.4 |

|

|

Cash, cash equivalents and term deposits |

$ |

439.3 |

|

$ |

504.4 |

|

|

$ |

439.3 |

|

$ |

504.4 |

|

|

(1) |

These financial measures or ratios are non-IFRS financial measures

or ratios. See the section 'Non-IFRS Measures' for explanations and

discussion of these non-IFRS financial measures or ratios in the

September 30, 2021 MD&A. |

|

(2) |

By-product revenues are off-set against cash operating costs. |

|

(3) |

Attributable to shareholders of the Company. |

|

(4) |

See reconciliation of net earnings (loss) to adjusted net earnings

(loss), a non-IFRS financial measure, in the section 'Non-IFRS

Measures' in the September 30, 2021 MD&A. |

|

(5) |

2020 and YTD 2021 amounts have been recast to correct an immaterial

error related to an understatement of the net book value of certain

of our property, plant and equipment as a result of errors in the

amounts recorded for depreciation. See Note 2(c) of our Unaudited

Condensed Consolidated Interim Financial Statements. |

|

(6) |

2020 and YTD 2021 amounts have been restated for a voluntary change

in accounting policy to classify cash paid for interest on the

statement of cash flows as a financing, rather than an operating

activity. See Note 3(c) of our Unaudited Condensed Consolidated

Interim Financial Statements. |

|

(7) |

From Q3 2021, the Brazil Segment is presented as a discontinued

operation. See Note 5 of our Unaudited Condensed Consolidated

Interim Financial Statements. Amounts presented are from continuing

operations only. |

Gold production of 125,459 ounces decreased 8%

from last year’s third quarter production of 136,922 ounces. Gold

sales in Q3 2021 totalled 125,189 ounces, a decrease of 9% from

137,704 ounces sold in Q3 2020 and an increase from Q2 2021 of

114,140 ounces. The lower sales volume compared with the prior year

primarily reflects decreases in production at Kisladag and

Olympias.

Total revenue was $238.4 million in Q3 2021, a

decrease of 17% from $287.6 million in Q3 2020 and a slight

increase from Q2 2021 of $233.2 million. Total revenue was $696.3

million in the nine months ended September 30, 2021, a

decrease of 7% from total revenue of $748.2 million in the nine

months ended September 30, 2020. The decreases in both three

and nine-month periods were primarily due to lower sales

volumes.

Cash operating costs in Q3 2021 averaged $646

per ounce sold, an increase from $537 per ounce in Q3 2020, and

cash operating costs per ounce sold averaged $644 in the nine

months ended September 30, 2021, an increase from $568 per

ounce in the nine months ended September 30, 2020. Increases

in both the three and nine-month periods were primarily due to

lower-grade ore mined and processed at Kisladag and Lamaque,

resulting in fewer ounces produced and sold. The increase in cash

operating costs per ounce sold in Q3 2021 was also due to increased

refining costs associated with sales of gold slag in the quarter.

These increases were partially offset by a reduction in cash

operating costs per ounce sold at Olympias, and to a lesser extent

Efemcukuru. The improvement in cash operating costs per ounce sold

at Olympias in Q3 2021 was primarily a result of higher grades,

combined with higher silver and base metal sales, which reduce cash

operating costs as by-product credits.

We reported net earnings attributable to

shareholders from continuing operations of $8.5 million ($0.05 per

share) in Q3 2021, compared to net earnings of $46.0 million ($0.26

per share) in Q3 2020 and net earnings of $53.9 million ($0.30 per

share) in the nine months ended September 30, 2021 compared to

net earnings of $101.2 million ($0.60 earnings per share) in the

nine months ended September 30, 2020. The decreases in both

periods reflect lower production and sales volumes and higher

finance costs related to the debt refinancing in the quarter. These

decreases were partially offset by lower income tax expense.

Adjusted net earnings from continuing operations

were $39.9 million ($0.22 per share) in Q3 2021 compared to

adjusted net earnings of $63.6 million ($0.37 per share) in Q3

2020. Adjusted net earnings in Q3 2021 removes, among other things,

$31.1 million of finance costs relating to the debt

refinancing in the quarter including a $21.4 million redemption

premium and $9.7 million of unamortized costs related to the debt

redeemed that were expensed in the quarter.

Gold Operations

|

|

3 months ended September 30, |

9 months ended September 30, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Total |

|

|

|

|

|

Ounces produced |

|

125,459 |

|

|

136,922 |

|

|

353,268 |

|

|

390,654 |

|

|

Ounces sold |

|

125,189 |

|

|

137,704 |

|

|

352,923 |

|

|

388,883 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

646 |

|

$ |

537 |

|

$ |

644 |

|

$ |

568 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,133 |

|

$ |

918 |

|

$ |

1,066 |

|

$ |

908 |

|

|

Sustaining capital expenditures (2) |

$ |

34.7 |

|

$ |

22.1 |

|

$ |

79.3 |

|

$ |

63.4 |

|

|

Kisladag |

|

|

|

|

|

Ounces produced |

|

51,040 |

|

|

59,593 |

|

|

141,229 |

|

|

169,659 |

|

|

Ounces sold |

|

51,038 |

|

|

59,571 |

|

|

142,593 |

|

|

171,088 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

612 |

|

$ |

440 |

|

$ |

546 |

|

$ |

452 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

916 |

|

$ |

708 |

|

$ |

755 |

|

$ |

641 |

|

|

Sustaining capital expenditures (2) |

$ |

8.2 |

|

$ |

5.3 |

|

$ |

14.7 |

|

$ |

13.7 |

|

|

Lamaque |

|

|

|

|

|

Ounces produced |

|

37,369 |

|

|

39,525 |

|

|

101,847 |

|

|

99,973 |

|

|

Ounces sold |

|

37,381 |

|

|

38,587 |

|

|

101,136 |

|

|

97,279 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

646 |

|

$ |

494 |

|

$ |

683 |

|

$ |

530 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,130 |

|

$ |

747 |

|

$ |

1,117 |

|

$ |

844 |

|

|

Sustaining capital expenditures (2) |

$ |

13.7 |

|

$ |

6.8 |

|

$ |

34.0 |

|

$ |

23.1 |

|

|

Efemcukuru |

|

|

|

|

|

Ounces produced |

|

23,305 |

|

|

23,892 |

|

|

70,076 |

|

|

74,007 |

|

|

Ounces sold |

|

23,825 |

|

|

24,471 |

|

|

70,961 |

|

|

73,384 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

552 |

|

$ |

561 |

|

$ |

534 |

|

$ |

577 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

911 |

|

$ |

1,012 |

|

$ |

839 |

|

$ |

894 |

|

|

Sustaining capital expenditures (2) |

$ |

5.3 |

|

$ |

5.1 |

|

$ |

11.7 |

|

$ |

11.8 |

|

|

Olympias |

|

|

|

|

|

Ounces produced |

|

13,745 |

|

|

13,912 |

|

|

40,116 |

|

|

47,015 |

|

|

Ounces sold |

|

12,945 |

|

|

15,075 |

|

|

38,233 |

|

|

47,132 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

952 |

|

$ |

992 |

|

$ |

1,110 |

|

$ |

1,056 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,728 |

|

$ |

1,450 |

|

$ |

1,806 |

|

$ |

1,484 |

|

|

Sustaining capital expenditures (2) |

$ |

7.5 |

|

$ |

4.9 |

|

$ |

19.0 |

|

$ |

14.8 |

|

|

(1) |

By-product revenues are off-set against cash operating costs. |

|

(2) |

These financial measures or ratios are non-IFRS financial measures

or ratios. See the September 30, 2021 MD&A for

explanations and discussion of these non-IFRS financial measures or

ratios. |

Kisladag

Kisladag produced 51,040 ounces of gold in Q3

2021, a 14% decrease from 59,593 ounces in Q3 2020. The decrease

was the result of a planned shift to lower-grade ore through 2021

as compared to 2020. However, gold production was higher than

expected in the quarter with several operational improvements

implemented in the mine, crushing circuit and leach pad in the

first half of 2021, resulting in increased throughput. Gold

production is expected to reduce primarily in Q1 2022 as a result

of the commissioning of the HPGR circuit, which will increase

recoveries once in operation.

Cash operating costs per ounce sold increased to

$612 in Q3 2021 from $440 in Q3 2020. The increase was primarily

due to lower production and sales as a result of the decrease in

average grade of ore placed on the leach pad throughout 2021

combined with increased refining costs associated with sales of

gold slag in the quarter.

AISC per ounce sold increased to $916 in Q3 2021

from $708 in Q3 2020. The increase was primarily due to higher cash

operating costs per ounce sold and higher sustaining capital

expenditure in the quarter. Sustaining capital expenditure of $8.2

million in Q3 2021 primarily included process infrastructure

upgrades and mine equipment overhauls.

Growth capital expenditures were $17.7 million

in Q3 2021 and $70.9 million in the nine months ended

September 30, 2021. Growth capital included continued

installation works of an HPGR circuit expected to improve heap

leach recovery. Commissioning of the HPGR is progressing well and

is expected to be completed in November. Growth capital also

included waste stripping and construction of the North leach pad,

both to support the mine life extension.

Lamaque

Lamaque produced 37,369 ounces of gold in Q3

2021, a 5% decrease from 39,525 ounces in Q3 2020 and reflecting a

planned shift to lower-grade ore stopes in the quarter. Average

grade was 5.99 grams per tonne in Q3 2021, an increase from 5.58

grams per tonne in the first half of 2021 but lower than 7.25 grams

per tonne in Q3 2020. Tonnes processed in the quarter increased 15%

from Q3 2020 as a result of increased underground development and

the ability to process higher volumes resulting from ongoing

successful debottlenecking of the mill.

Cash operating costs per ounce sold increased to

$646 in Q3 2021 from $494 in Q3 2020, primarily reflecting the

planned shift to lower-grade ore.

AISC per ounce sold increased to $1,130 in Q3

2021 from $747 in Q3 2020 as a result of higher cash operating

costs per ounce sold and higher sustaining capital. Sustaining

capital expenditure totalled $13.7 million in Q3 2021 and related

primarily to underground development and maintenance.

Growth capital expenditure totalled $10.1

million in Q3 2021 and $26.0 million in the nine months ended

September 30, 2021, and primarily included continued

development of the underground decline from the Sigma mill to the

Triangle mine which commenced in Q3 2020 and remains on schedule

for completion in Q4 2021. Following completion, the decline is

expected to reduce operating costs, reduce greenhouse gas

emissions, and provide access for underground drill platforms for

Ormaque, Plug 4, and other exploration targets in the prospective

corridor between the Triangle underground mine and the Sigma

mill.

Efemcukuru

Efemcukuru produced 23,305 ounces of gold in Q3

2021, a slight decrease from 23,892 ounces in Q3 2020 and reflect

continued strong production. The flotation columns installed in

late 2020 continue to operate well and have resulted in an increase

in quality of gold concentrate through 2021. Production in 2021 has

been adjusted to reflect a reduced effective rate for payable

ounces, following a change in the structure of concentrate sales

contracts. The reduced effective rate for payable ounces under the

new contracts are offset by a decrease in production costs due to

the elimination of treatment charges and other deductions now

blended in the reduced effective rate.

Cash operating costs per ounce sold improved to

$552 in Q3 2021 from $561 in Q3 2020. Cash operating costs in Q3

2021 benefited from lower selling costs due to the change in

pricing structure of concentrate sales contracts and lower costs

resulting from the weakening of the Turkish Lira.

AISC per ounce sold improved to $911 in Q3 2021

from $1,012 in Q3 2020. The decrease is primarily due to higher

royalty expense in Q3 2020 as a result of a gold royalty rate

increase announced in September 2020, for which $1.2 million of

additional royalty expense was recorded in Q3 2020 associated with

gold sales during the first six months of 2020. In early 2021, the

retroactive portion of the gold royalty rate increase was amended

to be effective from the announcement date only and no longer

retroactive to January 1, 2020. Sustaining capital expenditure of

$5.3 million in Q3 2021 primarily included underground development,

equipment rebuilds, and process upgrades.

Olympias

Olympias produced 13,745 ounces of gold in Q3

2021, a slight decrease from 13,912 ounces in Q3 2020. Lower

processing volumes in the quarter were partially offset by higher

average gold grade. Lead and silver production was also lower in Q3

2021 as compared to Q3 2020, primarily a result of lower processing

volumes. An increase in zinc feed grade to 4.55% in Q3 2021 from

3.53% in Q3 2020 resulted in higher zinc production in the quarter,

despite lower processing volumes. Operations at Olympias continued

to be negatively affected in Q3 2021 by low productivity as the

Company progresses through the implementation of transformation

efforts at its Kassandra mines. Discussions with stakeholders are

ongoing and are expected to lead to a sustainable continuous

improvement program as the year progresses. Further improvement is

underway to long range mine design and planning based on updated

geotechnical guidance.

Cash operating costs per ounce sold improved to

$952 in Q3 2021 from $992 in Q3 2020, primarily a result of

processing higher-grade ore, combined with higher silver and base

metal sales, which reduce cash operating costs as by-product

credits.

AISC per ounce sold increased to $1,728 in Q3

2021 from $1,450 in Q3 2020 due to an increase in royalties

following ratification of the Amended Investment Agreement in March

2021. AISC was also negatively impacted by an increase in

sustaining capital expenditure to $7.5 million in Q3 2021 from $4.9

million in Q3 2020. Sustaining capital expenditure of $7.5 million

in Q3 2021 primarily included underground development, diamond

drilling and tailings facility construction.

Conference Call

A conference call to discuss the details of the

Company’s Q3 2021 results will be held by senior management on

Friday, October 29, 2021 at 11:30 AM ET (8:30 AM PT). The call will

be webcast and can be accessed at Eldorado Gold’s website:

www.eldoradogold.com and via this link:

http://services.choruscall.ca/links/eldoradogold20211029.html

| Conference

Call Details |

|

Replay

(available until Dec. 3, 2021) |

| Date: |

October 29, 2021 |

|

Vancouver: |

+1 604 638 9010 |

| Time: |

11:30 am ET (8:30 am PT) |

|

Toll Free: |

1 800 319 6413 |

| Dial in: |

+1 604 638 5340 |

|

Pass code: |

7602 |

| Toll free: |

1 800 319 4610 |

|

|

|

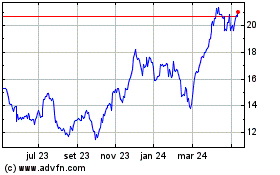

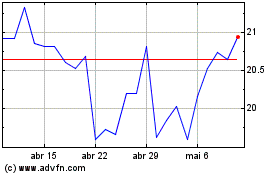

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkey, Canada,

Greece and Romania. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lisa Wilkinson, VP Investor

Relations604.757.2237 or 1.888.353.8166

lisa.wilkinson@eldoraogold.com

Media

Louise McMahon, Director Communications &

Public Affairs604.757.5573 or 1.888.363.8166

louise.mcmahon@eldoradogold.com

Non-IFRS Measures

Certain non-IFRS measures, including cash

operating costs, total cash costs,, all-in sustaining cost

("AISC"), adjusted net earnings/(loss) attributable to

shareholders, earnings before interest, taxes, depreciation and

amortization ("EBITDA"), adjusted earnings before interest, taxes,

depreciation and amortization ("Adjusted EBITDA"), sustaining and

growth capital, free cash flow, working capital and cash flow from

operations before changes in working capital, non-IFRS ratios,

including cash operating cost per ounce sold, total cash costs per

ounce sold, AISC per ounce sold, average realized gold price per

ounce sold, adjusted net earnings/(loss) per share attributable to

shareholders, are included in this press release. Please see the

September 30, 2021 MD&A for explanations and discussion of

these non-IFRS measures. The Company believes that these measures,

in addition to conventional measures prepared in accordance with

International Financial Reporting Standards (“IFRS”), provide

investors an improved ability to evaluate the underlying

performance of the Company. The non-IFRS measures are intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. These measures do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to other issuers.

Cautionary Note about Forward-looking Statements and

Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", “continue”,

“projected”, "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "believes" or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved.

Forward-looking statements or information

contained in this release include, but are not limited to,

statements or information with respect to: the Company’s 2021

annual guidance, including at our individual mine production;

construction of the decline connecting Sigma mill with the Triangle

underground mine, including the timing of completion; continued

drilling at the Ormaque gold resource, completion of the HPGR

circuit, including the timing of completion; the optimization of

Greek operations, including the benefits and risks thereof; our

expectation as to our future financial and operating performance,

including expectations around generating free cash flow; working

capital requirements; debt repayment obligations; use of proceeds

from financing activities; expected metallurgical recoveries and

improved concentrate grade and quality; gold price outlook and the

global concentrate market; risk factors affecting our business; our

strategy, plans and goals, including our proposed exploration,

development, construction, permitting and operating plans and

priorities and related timelines; and schedules and results of

litigation and arbitration proceedings. Forward-looking statements

and forward-looking information by their nature are based on

assumptions and involve known and unknown risks, market

uncertainties and other factors, which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: our 2021 annual guidance, timing of construction of the

decline between Sigma mill and the Triangle underground mine;

results from drilling at Ormaque; benefits of the improvements at

Kisladag; how the world-wide economic and social impact of COVID-19

is managed and the duration and extent of the COVID-19 pandemic;

timing and cost of construction and exploration; the geopolitical,

economic, permitting and legal climate that we operate in; the

future price of gold and other commodities; the global concentrate

market; exchange rates; anticipated costs, expenses and working

capital requirements; production, mineral reserves and resources

and metallurgical recoveries; the impact of acquisitions,

dispositions, suspensions or delays on our business; and the

ability to achieve our goals. In particular, except where otherwise

stated, we have assumed a continuation of existing business

operations on substantially the same basis as exists at the time of

this release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others:

inability to meet production guidance, inability to complete

construction of the decline between Triangle mill and the Triangle

underground mine on time or to meet expected timing thereof, poor

results from drilling at Ormaque; inability to complete

improvements at Kisladag or to meeting expected timing thereof, or

to achieve the benefits thereof; inability to assess taxes in

Turkey or depreciation expenses; global outbreaks of infectious

diseases, including COVID-19; timing and cost of construction, and

the associated benefits; recoveries of gold and other metals;

geopolitical and economic climate (global and local), risks related

to mineral tenure and permits; gold and other commodity price

volatility; information technology systems risks; continued

softening of the global concentrate market; risks regarding

potential and pending litigation and arbitration proceedings

relating to our business, properties and operations; expected

impact on reserves and the carrying value; the updating of the

reserve and resource models and life of mine plans; mining

operational and development risk; financing risks; foreign country

operational risks; risks of sovereign investment; regulatory risks

and liabilities including environmental regulatory restrictions and

liability; discrepancies between actual and estimated production;

mineral reserves and resources and metallurgical testing and

recoveries; additional funding requirements; currency fluctuations;

community and non-governmental organization actions; speculative

nature of gold exploration; dilution; share price volatility and

the price of our common shares; competition; loss of key employees;

and defective title to mineral claims or properties, as well as

those risk factors discussed in the sections titled

“Forward-Looking Statements” and "Risk factors in our business" in

the Company's most recent Annual Information Form & Form 40-F.

The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Information Form filed on

SEDAR and EDGAR under our Company name, which discussion is

incorporated by reference in this release, for a fuller

understanding of the risks and uncertainties that affect the

Company’s business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change.

Financial Information and condensed statements

contained herein or attached hereto may not be suitable for readers

that are unfamiliar with the Company and is not a substitute for

reading the Company’s financial statements and related MD&A

available on our website and on SEDAR and EDGAR under our Company

name. The reader is directed to carefully review such document for

a full understanding of the financial information summarized

herein.

Except as otherwise noted, scientific and

technical information contained in this press release was reviewed

and approved by Simon Hille, FAusIMM and VP Technical Services for

the Company, and a "qualified person" under NI 43-101.

Eldorado Gold CorporationCondensed

Consolidated Interim Statements of Financial PositionAs at

September 30, 2021 and December 31, 2020(Unaudited – in thousands

of U.S. dollars)

| As at |

Note |

|

September 30, 2021 |

|

December 31, 2020 |

| ASSETS |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

439,316 |

|

|

|

$ |

451,962 |

|

|

|

Term deposits |

|

|

— |

|

|

|

59,034 |

|

|

|

Marketable securities |

|

|

21,882 |

|

|

|

194 |

|

|

|

Accounts receivable and other |

7 |

|

97,783 |

|

|

|

73,022 |

|

|

|

Inventories |

2(c),8 |

|

170,687 |

|

|

|

164,135 |

|

|

|

Current portion of employee benefit plan assets |

15 |

|

— |

|

|

|

5,749 |

|

|

|

Assets held for sale |

5 |

|

48,386 |

|

|

|

— |

|

|

|

|

|

|

778,054 |

|

|

|

754,096 |

|

|

|

Restricted cash |

|

|

2,633 |

|

|

|

2,097 |

|

|

|

Other assets |

|

|

28,883 |

|

|

|

39,562 |

|

|

|

Property, plant and equipment |

2(c) |

|

3,970,909 |

|

|

|

4,042,199 |

|

|

|

Goodwill |

|

|

92,591 |

|

|

|

92,591 |

|

|

| |

|

|

$ |

4,873,070 |

|

|

|

$ |

4,930,545 |

|

|

| LIABILITIES &

EQUITY |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

$ |

167,784 |

|

|

|

$ |

179,372 |

|

|

|

Current portion of lease liabilities |

|

|

8,994 |

|

|

|

11,297 |

|

|

|

Current portion of debt |

9 |

|

— |

|

|

|

66,667 |

|

|

|

Current portion of asset retirement obligations |

|

|

4,701 |

|

|

|

4,701 |

|

|

|

Liabilities associated with assets held for sale |

5 |

|

386 |

|

|

|

— |

|

|

| |

|

|

181,865 |

|

|

|

262,037 |

|

|

| Debt |

9 |

|

493,621 |

|

|

|

434,465 |

|

|

| Lease liabilities |

|

|

15,581 |

|

|

|

14,659 |

|

|

| Employee benefit plan

obligations |

|

|

21,893 |

|

|

|

21,974 |

|

|

| Asset retirement

obligations |

|

|

109,416 |

|

|

|

106,677 |

|

|

| Deferred income tax

liabilities |

2(c) |

|

379,775 |

|

|

|

412,162 |

|

|

| |

|

|

1,202,151 |

|

|

|

1,251,974 |

|

|

| Equity |

|

|

|

|

|

| Share capital |

13 |

|

3,225,173 |

|

|

|

3,144,644 |

|

|

| Treasury stock |

|

|

(10,289 |

) |

|

|

(11,452 |

) |

|

| Contributed surplus |

|

|

2,641,587 |

|

|

|

2,638,008 |

|

|

| Accumulated other

comprehensive loss |

|

|

(27,526 |

) |

|

|

(30,297 |

) |

|

| Deficit |

2(c) |

|

(2,199,224 |

) |

|

|

(2,103,205 |

) |

|

| Total equity

attributable to shareholders of the Company |

|

|

3,629,721 |

|

|

|

3,637,698 |

|

|

| Attributable to

non-controlling interests |

|

|

41,198 |

|

|

|

40,873 |

|

|

| |

|

|

3,670,919 |

|

|

|

3,678,571 |

|

|

| |

|

|

$ |

4,873,070 |

|

|

|

$ |

4,930,545 |

|

|

Approved on behalf of the Board of

Directors

(signed)

John Webster Director

(signed) George

Burns

Director

Date of approval: October 28, 2021

Eldorado Gold CorporationCondensed

Consolidated Interim Statements of Comprehensive Income

(Loss)For the three and nine months ended September 30,

2021 and 2020(Unaudited – in thousands of U.S. dollars)

| |

|

|

Three months ended |

|

Nine months ended |

| |

|

|

September 30, |

|

September 30, |

| |

Note |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

| Metal sales |

10 |

|

$ |

238,441 |

|

|

|

$ |

287,595 |

|

|

|

$ |

696,283 |

|

|

|

$ |

748,167 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cost of

sales |

|

|

|

|

|

|

|

|

|

| Production costs |

|

|

110,180 |

|

|

|

117,386 |

|

|

|

331,540 |

|

|

|

328,225 |

|

|

|

| Depreciation and

amortization |

2(c) |

|

50,720 |

|

|

|

57,012 |

|

|

|

154,229 |

|

|

|

159,490 |

|

|

|

| |

|

|

160,900 |

|

|

|

174,398 |

|

|

|

485,769 |

|

|

|

487,715 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Earnings from mine

operations |

|

|

77,541 |

|

|

|

113,197 |

|

|

|

210,514 |

|

|

|

260,452 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Exploration and evaluation

expenses |

|

|

4,663 |

|

|

|

4,035 |

|

|

|

16,552 |

|

|

|

9,488 |

|

|

|

| Mine standby costs |

11 |

|

9,139 |

|

|

|

2,497 |

|

|

|

12,842 |

|

|

|

10,382 |

|

|

|

| General and administrative

expenses |

|

|

7,676 |

|

|

|

6,632 |

|

|

|

27,543 |

|

|

|

21,054 |

|

|

|

| Employee benefit plan

expense |

|

|

839 |

|

|

|

496 |

|

|

|

2,204 |

|

|

|

1,953 |

|

|

|

| Share-based payments

expense |

14 |

|

1,716 |

|

|

|

2,586 |

|

|

|

5,419 |

|

|

|

7,244 |

|

|

|

| Write-down (recovery) of

assets |

|

|

38 |

|

|

|

29 |

|

|

|

(392 |

) |

|

|

(63 |

) |

|

|

| Foreign exchange gain |

|

|

(605 |

) |

|

|

(4,317 |

) |

|

|

(6,827 |

) |

|

|

(7,436 |

) |

|

|

| Earnings from

operations |

|

|

54,075 |

|

|

|

101,239 |

|

|

|

153,173 |

|

|

|

217,830 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Other income |

12 |

|

1,732 |

|

|

|

2,658 |

|

|

|

12,666 |

|

|

|

2,833 |

|

|

|

| Finance costs |

12 |

|

(41,019 |

) |

|

|

(19,873 |

) |

|

|

(66,851 |

) |

|

|

(42,516 |

) |

|

|

| Earnings from

continuing operations before income tax |

|

|

14,788 |

|

|

|

84,024 |

|

|

|

98,988 |

|

|

|

178,147 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Income tax expense |

2(c) |

|

5,627 |

|

|

|

40,730 |

|

|

|

45,170 |

|

|

|

82,195 |

|

|

|

| Net earnings from

continuing operations |

|

|

$ |

9,161 |

|

|

|

$ |

43,294 |

|

|

|

$ |

53,818 |

|

|

|

$ |

95,952 |

|

|

|

| Net (loss) earnings

from discontinued operations, net of tax |

5 |

|

(60,761 |

) |

|

|

1,089 |

|

|

|

(149,920 |

) |

|

|

(7,895 |

) |

|

|

| Net (loss) earnings

for the period |

|

|

$ |

(51,600 |

) |

|

|

$ |

44,383 |

|

|

|

$ |

(96,102 |

) |

|

|

$ |

88,057 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

|

|

| Shareholders of the

Company |

2(c) |

|

(52,220 |

) |

|

|

47,088 |

|

|

|

(96,018 |

) |

|

|

93,271 |

|

|

|

| Non-controlling interests |

|

|

620 |

|

|

|

(2,705 |

) |

|

|

(84 |

) |

|

|

(5,214 |

) |

|

|

| Net (loss) earnings

for the period |

|

|

$ |

(51,600 |

) |

|

|

$ |

44,383 |

|

|

|

$ |

(96,102 |

) |

|

|

$ |

88,057 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Earnings (loss)

attributable to shareholders of the Company: |

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

|

8,541 |

|

|

|

45,999 |

|

|

|

53,902 |

|

|

|

101,166 |

|

|

|

| Discontinued operations |

5 |

|

(60,761 |

) |

|

|

1,089 |

|

|

|

(149,920 |

) |

|

|

(7,895 |

) |

|

|

| |

|

|

$ |

(52,220 |

) |

|

|

$ |

47,088 |

|

|

|

$ |

(96,018 |

) |

|

|

$ |

93,271 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average number of

shares outstanding (thousands) |

|

|

|

|

|

|

|

|

|

| Basic |

|

|

182,447 |

|

|

|

173,822 |

|

|

|

179,556 |

|

|

|

169,676 |

|

|

|

| Diluted |

|

|

183,948 |

|

|

|

178,131 |

|

|

|

181,674 |

|

|

|

173,732 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net (loss) earnings

per share attributable to shareholders of the

Company: |

|

|

|

|

|

|

|

|

|

| Basic (loss) earnings per

share |

2(c) |

|

$ |

(0.29 |

) |

|

|

$ |

0.27 |

|

|

|

$ |

(0.53 |

) |

|

|

$ |

0.55 |

|

|

|

| Diluted (loss) earnings per

share |

2(c) |

|

$ |

(0.29 |

) |

|

|

$ |

0.26 |

|

|

|

$ |

(0.53 |

) |

|

|

$ |

0.54 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net earnings per share

attributable to shareholders of the Company - continuing

operations: |

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

2(c) |

|

$ |

0.05 |

|

|

|

$ |

0.26 |

|

|

|

$ |

0.30 |

|

|

|

$ |

0.60 |

|

|

|

| Diluted earnings per

share |

2(c) |

|

$ |

0.05 |

|

|

|

$ |

0.26 |

|

|

|

$ |

0.30 |

|

|

|

$ |

0.58 |

|

|

|

Eldorado Gold CorporationCondensed

Consolidated Interim Statements of Comprehensive Income

(Loss)For the three and nine months ended September 30,

2021 and 2020(Unaudited – in thousands of U.S. dollars)

| |

|

|

Three months ended |

|

Nine months ended |

| |

|

|

September 30, |

|

September 30, |

| |

Note |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net (loss) earnings for the period |

2(c) |

|

$ |

(51,600 |

) |

|

|

$ |

44,383 |

|

|

|

$ |

(96,102 |

) |

|

|

$ |

88,057 |

|

|

| Other comprehensive

(loss) income: |

|

|

|

|

|

|

|

|

|

| Items that will not be

reclassified to earnings or loss: |

|

|

|

|

|

|

|

|

|

|

Change in fair value of investments in marketable securities, net

of tax |

|

|

3,048 |

|

|

|

669 |

|

|

|

3,018 |

|

|

|

1,567 |

|

|

|

Actuarial losses on employee benefit plans, net of tax |

|

|

(277 |

) |

|

|

(227 |

) |

|

|

(247 |

) |

|

|

(425 |

) |

|

| Total other

comprehensive income for the period |

|

|

2,771 |

|

|

|

442 |

|

|

|

2,771 |

|

|

|

1,142 |

|

|

| Total comprehensive

(loss) income for the period |

|

|

$ |

(48,829 |

) |

|

|

$ |

44,825 |

|

|

|

$ |

(93,331 |

) |

|

|

$ |

89,199 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

|

|

| Shareholders of the

Company |

2(c) |

|

(49,449 |

) |

|

|

47,530 |

|

|

|

(93,247 |

) |

|

|

94,413 |

|

|

| Non-controlling interests |

|

|

620 |

|

|

|

(2,705 |

) |

|

|

(84 |

) |

|

|

(5,214 |

) |

|

| |

|

|

$ |

(48,829 |

) |

|

|

$ |

44,825 |

|

|

|

$ |

(93,331 |

) |

|

|

$ |

89,199 |

|

|

Eldorado Gold CorporationCondensed

Consolidated Interim Statements of Cash FlowsFor the three

and nine months ended September 30, 2021 and 2020(Unaudited – in

thousands of U.S. dollars)

| |

|

|

Three months ended |

|

Nine months ended |

| |

|

|

September 30, |

|

September 30, |

| Cash flows generated from

(used in): |

Note |

|

2021 |

|

|

|

20201 |

|

2021 |

|

|

|

20201 |

| Operating

activities |

|

|

|

|

|

|

|

|

|

|

Net earnings for the period from continuing operations |

2(c) |

|

$ |

9,161 |

|

|

|

$ |

43,294 |

|

|

|

$ |

53,818 |

|

|

|

$ |

95,952 |

|

|

| Items not affecting cash: |

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

2(c) |

|

51,178 |

|

|

|

57,552 |

|

|

|

155,714 |

|

|

|

161,149 |

|

|

| Finance costs |

|

|

41,019 |

|

|

|

19,873 |

|

|

|

66,851 |

|

|

|

42,516 |

|

|

| Interest income |

|

|

(413 |

) |

|

|

(429 |

) |

|

|

(1,888 |

) |

|

|

(1,712 |

) |

|

| Unrealized foreign exchange

gain |

|

|

(945 |

) |

|

|

(4,582 |

) |

|

|

(2,634 |

) |

|

|

(7,632 |

) |

|

| Income tax expense |

2(c) |

|

5,627 |

|

|

|

40,730 |

|

|

|

45,170 |

|

|

|

82,195 |

|

|

| (Gain) loss on disposal of

assets |

|

|

(180 |

) |

|

|

(89 |

) |

|

|

46 |

|

|

|

2,322 |

|

|

| Gain on disposal of mining

licenses |

12 |

|

— |

|

|

|

— |

|

|

|

(7,046 |

) |

|

|

— |

|

|

| Write-down (recovery) of

assets |

|

|

38 |

|

|

|

29 |

|

|

|

(392 |

) |

|

|

(63 |

) |

|

| Share-based payments

expense |

14 |

|

1,716 |

|

|

|

2,586 |

|

|

|

5,419 |

|

|

|

7,244 |

|

|

| Employee benefit plan

expense |

|

|

839 |

|

|

|

496 |

|

|

|

2,204 |

|

|

|

1,953 |

|

|

| |

|

|

108,040 |

|

|

|

159,460 |

|

|

|

317,262 |

|

|

|

383,924 |

|

|

| Property reclamation

payments |

|

|

(515 |

) |

|

|

(618 |

) |

|

|

(1,622 |

) |

|

|

(1,618 |

) |

|

| Employee benefit plan receipt

(payments) |

|

|

5,639 |

|

|

|

(1,284 |

) |

|

|

5,118 |

|

|

|

(1,955 |

) |

|

| Income taxes paid |

|

|

(12,561 |

) |

|

|

(22,899 |

) |

|

|

(64,574 |

) |

|

|

(55,746 |

) |

|

| Interest received |

|

|

413 |

|

|

|

429 |

|

|

|

1,888 |

|

|

|

1,712 |

|

|

| Changes in non-cash working

capital |

16 |

|

4,094 |

|

|

|

42,658 |

|

|

|

(4,819 |

) |

|

|

23,720 |

|

|

| Net cash generated

from operating activities of continuing operations |

|

|

105,110 |

|

|

|

177,746 |

|

|

|

253,253 |

|

|

|

350,037 |

|

|

| Net cash generated

from (used in) operating activities of discontinued

operations |

|

|

692 |

|

|

|

(2,975 |

) |

|

|

(4,048 |

) |

|

|

(2,012 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

|

| Purchase of property, plant

and equipment |

|

|

(64,441 |

) |

|

|

(50,438 |

) |

|

|

(200,035 |

) |

|

|

(127,152 |

) |

|

| Acquisition of subsidiary, net

of $4,311 cash received |

4 |

|

— |

|

|

|

— |

|

|

|

(19,336 |

) |

|

|

— |

|

|

| Proceeds from the sale of

property, plant and equipment |

|

|

966 |

|

|

|

147 |

|

|

|

2,277 |

|

|

|

773 |

|

|

| Value added taxes related to

mineral property expenditures, net |

|

|

(11,971 |

) |

|

|

(12,801 |

) |

|

|

(16,170 |

) |

|

|

(18,283 |

) |

|

| Proceeds from the sale of

mining licenses |

12 |

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

| Purchase of marketable

securities and investment in debt securities |

|

|

(27,060 |

) |

|

|

— |

|

|

|

(27,060 |

) |

|

|

— |

|

|

| Proceeds from the sale of

marketable securities |

|

|

— |

|

|

|

5,237 |

|

|

|

— |

|

|

|

5,237 |

|

|

| Decrease (increase) in term

deposits |

|

|

1,000 |

|

|

|

(48,528 |

) |

|

|

59,034 |

|

|

|

(50,089 |

) |

|

| (Increase) decrease in

restricted cash |

|

|

(432 |

) |

|

|

(21 |

) |

|

|

(536 |

) |

|

|

1,077 |

|

|

| Net cash used in

investing activities of continuing operations |

|

|

(101,938 |

) |

|

|

(106,404 |

) |

|

|

(196,826 |

) |

|

|

(188,437 |

) |

|

| Net cash generated

from (used in) investing activities of discontinued

operations |

|

|

(911 |

) |

|

|

9,683 |

|

|

|

(2,348 |

) |

|

|

8,867 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

|

| Issuance of common shares, net

of issuance costs |

|

|

240 |

|

|

|

7,820 |

|

|

|

14,374 |

|

|

|

94,899 |

|

|

| Acquisition of non-controlling

interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,500 |

) |

|

| Contributions from

non-controlling interests |

|

|

— |

|

|

|

— |

|

|

|

409 |

|

|

|

301 |

|

|

| Proceeds from borrowings |

9 |

|

500,000 |

|

|

|

— |

|

|

|

500,000 |

|

|

|

150,000 |

|

|

| Repayment of borrowings |

9 |

|

(433,953 |

) |

|

|

(58,574 |

) |

|

|

(517,286 |

) |

|

|

(91,907 |

) |

|

| Debt redemption premium

paid |

9(c) |

|

(21,400 |

) |

|

|

— |

|

|

|

(21,400 |

) |

|

|

— |

|

|

| Loan financing costs |

|

|

(7,535 |

) |

|

|

— |

|

|

|

(7,535 |

) |

|

|

— |

|

|

| Interest paid |

|

|

(7,634 |

) |

|

|

(9,370 |

) |

|

|

(23,117 |

) |

|

|

(29,728 |

) |

|

| Principal portion of lease

liabilities |

|

|

(2,802 |

) |

|

|

(2,531 |

) |

|

|

(7,813 |

) |

|

|

(7,524 |

) |

|

| Purchase of treasury

stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,679 |

) |

|

| Net cash generated

from (used in) financing activities of continuing

operations |

|

|

26,916 |

|

|

|

(62,655 |

) |

|

|

(62,368 |

) |

|

|

104,862 |

|

|

| Net cash used in

financing activities of discontinued operations |

|

|

(12 |

) |

|

|

(20 |

) |

|

|

(36 |

) |

|

|

(60 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash and cash equivalents |

|

|

29,857 |

|

|

|

15,375 |

|

|

|

(12,373 |

) |

|

|

273,257 |

|

|

| Cash and cash

equivalents - beginning of period |

|

|

409,732 |

|

|

|

435,624 |

|

|

|

451,962 |

|

|

|

177,742 |

|

|

| Cash in disposal group held

for sale |

|

|

(273 |

) |

|

|

— |

|

|

|

(273 |

) |

|

|

— |

|

|

| Cash and cash

equivalents - end of period |

|

|

$ |

439,316 |

|

|

|

$ |

450,999 |

|

|

|

$ |

439,316 |

|

|

|

$ |

450,999 |

|

|

Restated, see Note 3(c).

Eldorado Gold CorporationCondensed

Consolidated Interim Statements of Changes in EquityFor

the three and nine months ended September 30, 2021 and

2020(Unaudited – in thousands of U.S. dollars)

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

| |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

| Share

capital |

|

|

|

|

|

|

|

|

| Balance beginning of

period |

|

$ |

3,224,830 |

|

|

|

$ |

3,135,955 |

|

|

|

$ |

3,144,644 |

|

|

|

$ |

3,054,563 |

|

|

|

Shares issued upon exercise of share options, for cash |

|

219 |

|

|

|

185 |

|

|

|

1,617 |

|

|

|

2,001 |

|

|

|

Shares issued upon exercise of performance share units |

|

30 |

|

|

|

— |

|

|

|

1,202 |

|

|

|

— |

|

|

|

Transfer of contributed surplus on exercise of options |

|

87 |

|

|

|

71 |

|

|

|

635 |

|

|

|

801 |

|

|

| Shares issued upon acquisition

of subsidiary (Note 4) |

|

— |

|

|

|

— |

|

|

|

65,647 |

|

|

|

— |

|

|

|

Shares issued to the public, net of share issuance costs |

|

7 |

|

|

|

6,396 |

|

|

|

11,428 |

|

|

|

85,242 |

|

|

| Balance end of period |

|

$ |

3,225,173 |

|

|

|

$ |

3,142,607 |

|

|

|

$ |

3,225,173 |

|

|

|

$ |

3,142,607 |

|

|

| |

|

|

|

|

|

|

|

|

| Treasury

stock |

|

|

|

|

|

|

|

|

| Balance beginning of

period |

|

$ |

(10,295 |

) |

|

|

$ |

(11,587 |

) |

|

|

$ |

(11,452 |

) |

|

|

$ |

(8,662 |

) |

|

|

Purchase of treasury stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,679 |

) |

|

|

Shares redeemed upon exercise of restricted share units |

|

6 |

|

|

|

6 |

|

|

|

1,163 |

|

|

|

760 |

|

|

| Balance end of period |

|

$ |

(10,289 |

) |

|

|

$ |

(11,581 |

) |

|

|

$ |

(10,289 |

) |

|

|

$ |

(11,581 |

) |

|

| |

|

|

|

|

|

|

|

|

| Contributed

surplus |

|

|

|

|

|

|

|

|

| Balance beginning of

period |

|

$ |

2,639,288 |

|

|

|

$ |

2,634,246 |

|

|

|

$ |

2,638,008 |

|

|

|

$ |

2,627,441 |

|

|

|

Share-based payment arrangements |

|

2,422 |

|

|

|

2,338 |

|

|

|

6,579 |

|

|

|

6,456 |

|

|

|

Acquisition of non-controlling interest, without change in

control |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,171 |

|

|

|

Shares redeemed upon exercise of restricted share units |

|

(6 |

) |

|

|

(6 |

) |

|

|

(1,163 |

) |

|

|

(760 |

) |

|

|

Shares redeemed upon exercise of performance share units |

|

(30 |

) |

|

|

— |

|

|

|

(1,202 |

) |

|

|

— |

|

|

|

Transfer to share capital on exercise of options |

|

(87 |

) |

|

|

(71 |

) |

|

|

(635 |

) |

|

|

(801 |

) |

|

| Balance end of period |

|

$ |

2,641,587 |

|

|

|

$ |

2,636,507 |

|

|

|

$ |

2,641,587 |

|

|

|

$ |

2,636,507 |

|

|

| |

|

|

|

|

|

|

|

|

| Accumulated other

comprehensive loss |

|

|

|

|

|

|

|

|

| Balance beginning of

period |

|

$ |

(30,297 |

) |

|

|

$ |

(28,266 |

) |

|

|

$ |

(30,297 |

) |

|

|

$ |

(28,966 |

) |

|

|

Other comprehensive income for the period |

|

2,771 |

|

|

|

442 |

|

|

|

2,771 |

|

|

|

1,142 |

|

|

| Balance end of period |

|

$ |

(27,526 |

) |

|

|

$ |

(27,824 |

) |

|

|

$ |

(27,526 |

) |

|

|

$ |

(27,824 |

) |

|

| |

|

|

|

|

|

|

|

|

| Deficit |

|

|

|

|

|

|

|

|