Western Resources Corp. (TSX: WRX) (“Western” or “the

Company”) is pleased to announce that Western Potash Corp.

(“WPC”), the company’s wholly-owned subsidiary, has received key

findings from its upcoming NI 43-101 report (“Report”) for its

Milestone Phase I Project (“The Phase I Project”) in southern

Saskatchewan. The Report is based on the expansion of the mine life

from 12 years to 40 years and the update of the mining plan.

The technical Report is being prepared by March

Consulting Associates Inc. (“March”). March is an engineering and

project management provider with extensive experience in delivering

mining projects across Saskatchewan.

The Phase I Project is the first stage of

Canada’s newest and most innovative, environmentally friendly and

capital-efficient potash mines. Currently, the total Phase I

Project is approximately 78% complete (including engineering,

procurement, infrastructure and construction) and awaiting final

financing to finish. The initial startup and commissioning of the

solution mining is complete and was operated for approximately 18

months, accumulating potash in the crystallization pond.

Data and other information obtained from these

operations in conjunction with several leading solution mining

experts has enabled Western to optimise the Phase I Project

solution mining plan to enhance the reliability to meet the target

production of 146,000 tonnes per annum (tpa) of granular potash.

The mining plan will extract both the Belle Plaine and Patience

Lake members from a series of horizontal caverns which have been

planned within the unitized area.

The reserves within the expanded unitization

area are:

-

A proven reserve of 11.7 million tonnes (Mt) at an average grade of

32.4% KCl;

-

A probable reserve of 19.5 Mt at a grade of 33.5% KCl.

Cavern losses (10%) and processing recoveries of

95% have been applied to the reserves. The proven and probable

reserves within the unitized area are sufficient for a mine life of

over 200 years at the target production rate. The project economics

are based on an operation period of 40 years at target production.

Excess reserves would be available to extend mine life or increase

production in the future.

The resource estimate (effective the date of

this release) within Saskatchewan Subsurface Mineral Lease KLSA 008

is as follows:

-

A Measured Resource of 418.5 million tonnes (Mt) at a grade of

20.8% K2O

-

An Indicated Resource of 2,304.2 Mt, grading 21.0% K2O

-

An Inferred Resource of 2,575.2 Mt, grading 21.4% K2O

The Resource numbers were adjusted with

deductions for unseen anomalies (5% Measured, 9% Indicated and 25%

Inferred). A cut-off grade of 15% K2O was applied. No thickness or

carnallite grade cut-offs were applied. Extraction ratio’s and/or

cavern losses were not applied to the resource tonnages. Reserves

are included in the Resource numbers.

The actual CAPEX allocated to the Phase I

Project to date is $116.24M and a further $33.21M is needed to

complete the Project and bring the plant into production, resulting

in a total Phase I Project CAPEX of $149.45M (including a 12.5%

contingency on the remaining CAPEX). This estimate adopts the AACE

(Association for the Advancement of Cost Engineering) International

Class 3 standard.

The total annual OPEX for the Phase I Project,

based on operational data from the pilot phase, is estimated at

$CAD13.25M per year (excluding G&A, logistics and royalties) or

$CAD90.60/t MOP for 146,000 tpa. Sustaining CAPEX consists mainly

of expanding the mine field (drilling, piping and infrastructure)

and planned equipment maintenance. Sustaining CAPEX includes

approximately $36M every six years to expand the wellfield for

ongoing production.

Assuming a nominal discount rate of 8%, the

economic analysis yields an after-tax project Net Present Value

(NPV) of $CAD225.8M, with an Internal Rate of Return (IRR) of

20.4%, based on the assumption of 100% equity investment and potash

price of $US524/t ($CAD665/t) FOB mine gate. This price is obtained

from the Argus report from November 2021 for granular MOP to the

USA Corn Belt and forecasted freight costs from the mine. Costs are

given in Canadian dollars ($CAD) and prices are given in United

States dollars ($US), with an assumed exchange rate of $US 1 = $CAD

1.27. Inflation has not been applied to the potash price or future

costs with the noted potash price assumed to apply from 2025 to the

end of project life.

March has undertaken a review of the project and

determined mine life could be increased from 12 to 40 years with

the implementation of an asset maintenance and replacement

strategy. The full costs of this plan have been included in the

OPEX and sustaining CAPEX results above.

The management continues to have confidence in

the success of the Phase I Project, and has a plan to engage March

to complete studies for the purpose of increasing the total

capacity of the site to around 300,000 tonnes per annum. This would

aim to duplicate the existing surface facilities on the adjacent

quarter section to maximize the use of existing infrastructure and

utilities already on site.

This news release was reviewed by Kyle

Krushelniski, P.Eng. of March Consulting Associates Inc., who is a

Qualified Person under NI 43-101 and is the lead author of the

updated NI 43-101 Technical Report on which this news release is

based.

About Western Resources Corp.Western Resources

Corp. (TSX: WRX) (“Western” or “the Company”) and the company’s

wholly-owned subsidiary Western Potash Corp. are constructing

Canada’s newest and most innovative, environmentally friendly and

capital-efficient potash mine. This will be the first potash mine

in the world that will leave no salt tailings at the surface,

thereby reducing the water consumption by half as well as

significantly improved energy efficiency.

About March Consulting Associates Inc.March

Consulting Associates Inc. (March) is a Saskatchewan based employee

and First Nations’ owned organization, operating in Saskatchewan

for over 22 years with offices in Saskatoon, and Regina. March

provides engineering, procurement, project, and construction

management to a variety of resource‐based industrial and commercial

enterprises. March utilizes the latest digital, analytical, and

intelligent 3D modelling capabilities in the mining, process,

mechanical, electrical, instrumentation and controls, civil,

structural, and Finite Element Analysis (FEA) disciplines.

ON BEHALF OF THE BOARD OF DIRECTORS

“Bill Xue”

Bill XueChairman

Cautions Regarding Forward-Looking

Statements

Except for statements of historical fact

relating to the Company, certain information contained herein

constitutes “forward-looking information” under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, statements with respect to the filing and results of

the Technical Report. Forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made and they are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results

of the Company to be materially different from those expressed or

implied by such forward-looking statements or forward-looking

information. Although management of the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information that is set out

herein, except in accordance with applicable securities laws.

For more information on the contents of this

release please contact Jerry Zhang, Corporate Secretary, at

604-689-9378.

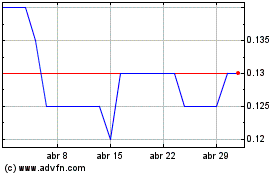

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

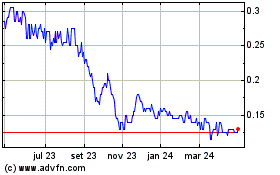

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024