Eldorado Gold Corporation (“Eldorado”, the

“Company” or “We”) announces the completion of a Feasibility Study

(“FS”) on the wholly-owned Skouries project, located in northern

Greece. As previously announced, the Company will host a conference

call, later today, on Wednesday, December 15, 2021, at 6:00 PM ET

(3:00 PM PT). The call details are at the end of this news release.

All financial figures are in U.S. dollars unless otherwise stated.

Feasibility Study

Highlights1

- Robust

Economics:

- 19% after-tax

Internal Rate of Return (“IRR”) and $1.3 billion after-tax Net

Present Value (“NPV”) (5%), based on long-term prices of $1,500 per

ounce (“oz”) gold and $3.85 per pound copper.

- IRR of 24% and

NPV (5%) of $1.8 billion using approximate spot prices of $1,800

per oz gold and $4.25 per pound copper.

- 2.9

million ounce Life of Mine (“LOM”) gold production

- Average annual

production of 140,000 oz of gold and 67 million pounds of copper

(approximately 312,000 oz gold equivalent) over a 20-year mine

life.

- Average annual

gold production of 182,000 oz in the first 5 years

of production.

-

Negative cash operating cost of $(368) per oz sold

over the LOM.

-

Negative All-In Sustaining Costs (“AISC”) of $(17) per

oz sold over the LOM.

- Initial

capital costs to complete the Skouries

project of $845 million, an increase of 23% over the March 2018

Pre-Feasibility Study1 (“PFS”), primarily related to increased

input prices, scope change related to water management and an

enhanced execution plan.

(1) PFS filed as a technical

report in March 2018 titled “Technical Report, Skouries Project,

Greece” with an effective date of January 1, 2018.“The completion

of the Skouries FS is an important milestone for the Company. The

results of the study reflect the robust economics of this

world-class asset that will support our growth strategy,” said

George Burns, Eldorado’s President and CEO. “Eldorado is looking

forward to expanding our production profile at the Kassandra Mines

and developing this region as a cornerstone for the Company.”

“The project has been significantly de-risked

through the infrastructure built to date, the Amended Investment

Agreement ratified by the Greek government in March 2021, and

today, the Feasibility Study which reflects a more resilient

project. Skouries remains a very attractive and executable project

that will have a lasting, positive impact, and create additional

economic and social value for our shareholders and all

stakeholders.”

“Completion of the Skouries Feasibility Study is a critical

milestone and will allow the company to advance financing

alternatives for the project. Subject to financing and Board

approval, target re-start of construction at Skouries is mid-2022.

With timely completion of construction in two and a half years,

Skouries would provide significant upside to our five-year

production profile.”

Summary of Skouries Feasibility

Study

|

Skouries Feasibility Summary |

|

Metrics |

Units |

Results |

|

|

Type of operation |

|

Open Pit & Underground |

|

|

Life of Mine |

years |

20 |

|

|

Total Ore Mined |

Mt |

147 |

|

|

Contained Gold Mined |

Moz |

3.6 |

|

|

Contained Copper Mined |

Blbs |

1.6 |

|

|

Strip Ratio |

w:o |

1.01 |

|

|

Throughput |

Mtpa |

8 |

|

|

Head Grade – gold |

g/t Au |

0.77 |

|

|

Head Grade – copper |

% |

0.50 |

|

|

Recoveries – gold |

% |

83 |

|

|

Recoveries – copper |

% |

90 |

|

|

Gold Production |

|

|

|

Total Production, LOM |

Moz |

2.9 |

|

|

Annual Production, LOM |

oz |

140,000 |

|

|

Annual Production, first 5 years |

oz |

182,000 |

|

|

Copper Production |

|

|

|

Total Production, LOM |

Mlbs |

1,411 |

|

|

Annual Production, LOM |

Mlbs |

67 |

|

|

Annual Production, first 5 years |

Mlbs |

76 |

|

|

Per Unit Costs, LOM |

|

|

|

Total Mining Costs |

$/t, processed |

13 |

|

|

Processing |

$/t, processed |

11 |

|

|

G&A |

$/t, processed |

3 |

|

|

Total Operating Costs |

$/t, processed |

27 |

|

|

Per Ounce Costs, LOM |

|

|

|

Cash Operating Costs |

$/oz |

(368 |

) |

|

AISC |

$/oz |

(17 |

) |

|

Capital Costs |

|

|

|

Initial Phase 1 Capital |

$M |

845 |

|

|

Phase 2 Underground Capital |

$M |

172 |

|

|

Sustaining Capital |

$M |

850 |

|

|

NPV5%,

after-tax |

$B |

1.3 |

|

|

After-tax IRR |

% |

19 |

|

|

Payback Period |

years |

<4 |

|

(1) These financial measures or ratios are

non-IFRS financial measures or ratios. See the section 'Non-IFRS

Measures” below. Note: Skouries 2021 Feasibility Study assumes a

gold price of $1,500/oz, copper price of $3.85/lb, $US/Euro

exchange rate of 1.13 for 2022, 1.15 for 2023, 1.18 for 2024, 1.2

thereafter

The technical report for the Skouries FS will be

filed on SEDAR and EDGAR in accordance with the requirements under

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (NI 43-101).

Skouries Project Overview

The Skouries project, is part of the Kassandra

Mines Complex, and located within the Halkidiki Peninsula of

Northern Greece. It is a gold-copper porphyry deposit designed to

be mined using a combination of conventional open pit and

underground mining techniques. The total life of mine is 20 years

consisting of two phases. Phase 1 is a combined open pit and

underground mine operating over approximately 9 years. Phase 2

consists of mining solely from the underground mine for a further

11 years. The mineral process facility will produce a gold-copper

concentrate.

The Skouries asset was acquired through the

acquisition of European Goldfields in 2012 when the project was in

feasibility stage and construction commenced in 2013. Construction

was halted and the project was placed on care and maintenance in

November 2017. Negotiations for the Amended Investment Agreement

between Eldorado and the Hellenic Republic commenced following a

change in the government. The Amended Investment Agreement was

signed on February 5, 2021, and ratified in March 2021.

Initial and Sustaining

Capital

The Phase 1 capital cost to complete the

Skouries project is estimated to be $845 million with the breakdown

provided in the table below.

|

Phase 1 Capital Cost Estimate |

|

Capital Cost Item |

$M |

|

Mine |

191 |

|

Process plant and infrastructure |

270 |

|

IWMF and Water Management |

119 |

|

Total Direct Capital Costs |

580 |

|

Indirect costs |

47 |

|

EPCM (or other) costs |

75 |

|

Owner’s costs |

62 |

|

Contingency |

81 |

|

Total Capital Cost - Phase 1 |

845 |

The Phase 1 capital cost estimate of $845

million is a 23% increase from the $689 million estimate in the

PFS. The four key areas that account for the increase are as

follows:

- Execution

Model: The project execution approach has been updated to reflect

an Engineering, Procurement and Construction Management (“EPCM”)

delivery model with a Tier 1 partner for timely delivery of the

project. An EPCM approach allows for a reduction in interfaces and

allows the Company to focus on operational readiness, training,

governance, and working with our stakeholders. It also includes an

additional factor to account for cost escalation during the

execution period. This increased capital cost by $53 million, or

approximately 8%.

- Input

Costs: The FS has been updated to reflect current commodity prices,

including steel, copper, cement and labour, increasing the capital

cost estimate by $51 million, or approximately 7%.

- Scope

Enhancement:

- Water

Management: To increase mine resiliency for changes in return

periods and intensity of precipitation events, Eldorado modified

the design of the water management infrastructure. This includes a

larger contact water management pond, an increase to the capacity

of the water treatment plant, an increase in the number of water

re-injection wells, and an updated spillway design. This will

better position Skouries to handle major weather events throughout

the mine life.

-

Underground deferral: A portion of the underground mine was

deferred to reduce risk in execution and operational readiness.

Execution risk is reduced by focusing on the critical areas to

achieve first gold. Operational readiness risk is reduced by

focusing efforts on commissioning and training to commence

operations. The underground activity is confined to a test stoping

program and core infrastructure. This will allow project delivery

to focus on the open pit and then transition to the underground,

significantly reducing parallel activities.

- These

scope enhancements, all of which have been incorporated, increased

the capital cost estimate by $33 million, or approximately 5%.

- Foreign

Exchange: In the four years since the PFS was published,

strengthening of the Euro to the US dollar has increased the

capital cost estimate increased by $19 million, or approximately

3%.

In addition to the Phase 1 capital costs of $845

million, future capital requirements, include $172 million relating

to Phase 2 underground material handling systems, to be spent

between years 4-10 of the operation. Additional sustaining capital

is estimated to be $850 million over the LOM, or $43 million on

average per year.

De-risking the Skouries

Project

The project has been de-risked several ways. In

addition to the execution and ratification of the Amended

Investment Agreement with the Greek state and the completion of the

Skouries FS, there is also prior completion of infrastructure and

construction at the project site. Prior to entering care &

maintenance in 2017, construction at the Skouries project was

approximately 50% complete. Completed works include a major mill

mechanical equipment set, stripping of the open pit, large amounts

of civil works and tagged items being managed with a

vendor-approved preservation plan. The project has also

successfully removed and relocated archeological

antiquities from ancient mining activities on the Skouries

site.

Skouries Project Cash Flows

A table providing the deterministic life of mine

average production and cash flow forecast is included at the end of

the news release.

Project Sensitivities

At base case prices and a 5% discount rate, the

after-tax NPV and IRR are most sensitive to metal prices and least

sensitive to capital costs. Changes to gold and copper prices have

a similar impact on the project’s financial outcomes.

|

Sensitivity Table – Gold and Copper Price |

|

Gold Price($/oz) |

Copper Price($/lb) |

After-Tax NPV($B) |

After-Tax IRR(%) |

|

$1,300 |

$3.25 |

0.7 |

13 |

|

$1,500 (base case) |

$3.85 |

1.3 |

19 |

|

$1,800 (spot) |

$4.25 |

1.8 |

24 |

Below is a table summarizing key value driver

sensitivities of capital expenditures (“Capex”) and operational

expenditures (“Opex”).

|

Sensitivity Table – Capex |

|

Capital Cost |

After-Tax NPV($B) |

After-Tax IRR(%) |

|

-15% |

1.4 |

23 |

|

$845M (base case) |

1.3 |

19 |

|

+15% |

1.1 |

16 |

|

Sensitivity Table – Opex |

|

Operating Cost $/t |

After-Tax NPV($B) |

After-Tax IRR(%) |

|

-15% |

1.5 |

21 |

|

27.0 (base case) |

1.3 |

19 |

|

+15% |

1.0 |

17 |

Reserves and Resources

Description

The Skouries project is a gold-copper porphyry

deposit with mineralization in stockwork veins, veinlets and

disseminated styles. The deposit has been drilled to a depth of 920

meters from surface and the ore body is open at depth. In addition

to the knowledge obtained from our existing operations in the

Kassandra complex, the extensive detailed drilling of the deposit

and associated testwork provides high confidence in the quality and

composition of the ore body.

|

Skouries Mineral Reserves and Resources, as of September

30, 2021 |

|

Category |

Resource(t x 1000) |

Grade Au(g/t) |

Grade Cu(g/t) |

Contained Au(oz x 1000) |

Contained Cu(t x 1000) |

|

Total Reserves |

|

Proven |

73,101 |

0.87 |

0.52 |

2,053 |

381 |

|

Probable |

74,015 |

0.66 |

0.48 |

1,576 |

359 |

|

Proven and Probable |

147,116 |

0.77 |

0.50 |

3,630 |

740 |

|

Total Resources |

|

Measured |

90,714 |

0.85 |

0.51 |

2,479 |

466 |

|

Indicated |

149,260 |

0.53 |

0.44 |

2,551 |

652 |

|

Measured and Indicated |

239,974 |

0.65 |

0.47 |

5,030 |

1,118 |

|

Inferred |

67,657 |

0.37 |

0.40 |

814 |

267 |

Notes on Mineral Resources and Reserves:

- Mineral resources and mineral

reserves are as of September 30, 2021

- The mineral resources and mineral

reserves were classified using logic consistent with the CIM

Definition Standards for Mineral Resources & Mineral Reserves

(2014) incorporated, by reference into NI 43-101.

- Mineral reserves are included in

the mineral resources.

- The mineral resources and mineral

reserves are disclosed on a total project basis.

- Mineral Resource Reporting and

demonstration of Reasonable Prospects for Eventual Economic

Extraction: The mineral resources used a long term look gold metal

price of $1,800/oz for the determination of resource cut-off grades

or values. This guided execution of the next step where

constraining surfaces or volumes were created to control resource

reporting. Underground resources were constrained by 3D volumes

whose design was guided by the reporting cut-off grade or value,

contiguous areas of mineralization and mineability. Only material

internal to these volumes were eligible for reporting. The Skouries

project, with both open pit and underground resources have the open

pit resources constrained by the permit and underground resources

constrained by a reporting shape.

- Long-term metal price assumptions:

Gold price: $1,300/oz, silver price: $17.00/oz, copper price:

$2.75/lb, lead price: $2,000/t, zinc price: $2,300/t.

- Reserve cut-off grades at Skouries:

$10.60/t NSR (open pit), $33.33/t NSR (underground). Resource

cut-off grades at Skouries: 0.30 g/t Au equivalent grade (open

pit), 0.70 g/t Au equivalent grade (underground).

- Qualified Persons: John Battista,

MAusIMM., of Mining Plus is responsible for Skouries (open pit)

mineral reserves; Colm Keogh, P.Eng., Manager, Operations Support

for the Company, is responsible for Skouries (underground) mineral

reserves; Sean McKinley, P.Geo., Manager, Mine Geology &

Reconciliation for the Company, is responsible for the Skouries

mineral resources.

Project Scope

The project scope comprises an open pit and

underground mining operation, a processing facility, utilities,

water management, and tailings facility.

Mining Operations: Open pit mining will be done

by conventional truck-shovel operation. The mining sequence will

consist of drilling, blasting, loading and hauling of ore and waste

materials for processing and waste disposal. Direct feed ore from

the open pit will be hauled to the Skouries processing plant by the

fleet of 90t trucks. During Phase 1, approximately 8 million tonnes

of low-grade ore will be hauled to the low-grade ore stockpile

where it is planned to be processed during Phase 2 of the

project.

Underground ore will be recovered by

conventional sublevel open stoping with paste tailings backfill.

Underground ore production during pit operations will attain 2.5

million tonnes per annum (Phase 1) and will subsequently be

expanded to 6.5 million tonnes per annum following pit depletion.

Phase 2 will introduce an automated material handling system to

include underground crushing and shaft hoisting necessary to

achieve the higher volume.

Processing: The Skouries process plant flowsheet

consists of a primary crusher, SAG mill, pebble crusher and ball

mill to achieve a primary grind size of 120 microns. The feed will

be run through a rougher and scavenger flotation circuit where the

flotation product will produce concentrate with a grade of

approximately 30 g/t gold and 26% copper. Overall recoveries are

expected to be 83% gold and 90% copper.

Tailings: Skouries will use dry stack tailings

impoundment, the most sustainable method used to store filtered

tailings. Dry stack tailings reduce the risk of a tailings dam

failure and requires a significantly reduced footprint. This method

enables maximum recovery of process water for reuse.

Water Management: The Skouries Water Management

Plan is compliant with Greek and EU legislation and is based on

current view environmental modeling, with higher storm intensity

and higher return event frequency than prior versions. The water

management system will include a large contact pond, a

high-capacity water treatment plant and enhanced water re-injection

well capacities.

Permitting: Approval was granted in April 2021

by the Greek Ministry of Energy and Environment for a modification

to the Kassandra Mines Environmental Impact Assessment (“EIA”) to

allow for the use of dry stack tailings disposal at the Skouries

project. A copy of the news release can be accessed at the

following link. The Company plans to submit a modification to the

Kassandra Mines EIA by the end of 2021 that will cover the

expansion of the Olympias processing facility and the Stratoni port

modernization. Approval of this modification is expected in

2022.

Emissions: The Skouries operating scope

considers underground mine electrification to the fullest extent

practical and full project deployment of technology to improve

efficiency and decrease energy intensity. Eldorado will continue

with energy and greenhouse gas studies to demonstrate alignment

with the Greek State and the European Union in their efforts to

continue to reduce the carbon intensity of the Greek electrical

grid.

Social Inclusion and Local

Empowerment

The Skouries project will have a significant

positive impact on the local economy. The operational readiness and

training plans included in the Skouries FS will ensure local hiring

preference. Over the life of the Kassandra Mines, $80 million will

be committed to Corporate Social Responsibility programs, including

community, cultural, social, environmental and charitable purposes.

In addition, Eldorado will provide re-skilling and upskilling

training for employees regularly through the development of an

innovative Technical Training Center.

Skouries Feasibility Study Conference

Call Details

Eldorado will host a conference call to discuss

the Skouries FS later today, on Wednesday, December 15, 2021, at

6:00 PM ET (3:00 PM PT).

The call will be webcast and can be accessed at Eldorado Gold's

website: www.eldoradogold.com, or via:

https://services.choruscall.ca/links/eldoradogold20211215.html

Conference Call Details

Date: December 15, 2021Time: 6:00 PM ET (3:00 PM PT)Dial in: +1

604 638 5340Toll free: 1 800 319

4610

Replay (available until January 19, 2022)

Vancouver: +1 604 638 9010Toll Free: 1 800 319 6413 Access

code: 8125

Skouries Project Cash Flows

|

|

|

LOM |

Year -3 |

Year -2 |

Year -1 |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

|

Ore Production |

tonnes x 1000 |

147,175 |

|

0 |

|

0 |

|

950 |

|

8,000 |

|

8,079 |

|

8,007 |

|

8,023 |

|

8,018 |

|

7,988 |

|

8,005 |

|

7,997 |

|

|

Gold |

Oz x 1000 |

2,949 |

|

0 |

|

0 |

|

8 |

|

177 |

|

185 |

|

213 |

|

199 |

|

137 |

|

128 |

|

121 |

|

184 |

|

|

Copper |

lbs x 106 |

1,411 |

|

0 |

|

0 |

|

2 |

|

64 |

|

80 |

|

86 |

|

82 |

|

66 |

|

66 |

|

61 |

|

83 |

|

|

Gold Price |

US$/oz |

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

|

Copper Priced |

US $/lbs |

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

|

Currency (1) |

EUR/USD |

1.20 |

|

1.13 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

|

Gold Revenue |

US$M |

4,412 |

|

0 |

|

0 |

|

0 |

|

265 |

|

277 |

|

319 |

|

299 |

|

206 |

|

192 |

|

181 |

|

275 |

|

|

Copper Revenue |

US$M |

5,426 |

|

0 |

|

0 |

|

0 |

|

246 |

|

307 |

|

333 |

|

317 |

|

252 |

|

255 |

|

237 |

|

318 |

|

|

TTRC + Royalties |

US$M |

(586 |

) |

0 |

|

0 |

|

0 |

|

(28 |

) |

(34 |

) |

(37 |

) |

(35 |

) |

(27 |

) |

(27 |

) |

(25 |

) |

(35 |

) |

|

Net Revenue |

US$M |

9,252 |

|

0 |

|

0 |

|

0 |

|

483 |

|

550 |

|

615 |

|

581 |

|

431 |

|

420 |

|

392 |

|

558 |

|

|

Opex |

US$M |

(3,940 |

) |

0 |

|

0 |

|

0 |

|

(136 |

) |

(185 |

) |

(208 |

) |

(206 |

) |

(204 |

) |

(189 |

) |

(183 |

) |

(186 |

) |

|

Proceeds from pre-commerical production |

US$M |

7 |

|

0 |

|

0 |

|

7 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Capital – growth Phase 1 |

US$M |

(845 |

) |

(168 |

) |

(452 |

) |

(225 |

) |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Capital – growth Phase 2 |

US$M |

(172 |

) |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

(23 |

) |

(22 |

) |

(47 |

) |

(41 |

) |

(34 |

) |

|

Capital - sustaining |

US$M |

(850 |

) |

0 |

|

0 |

|

0 |

|

(138 |

) |

(130 |

) |

(28 |

) |

(22 |

) |

(40 |

) |

(45 |

) |

(57 |

) |

(69 |

) |

|

Taxes |

US$M |

(669 |

) |

0 |

|

0 |

|

0 |

|

(52 |

) |

(54 |

) |

(61 |

) |

(54 |

) |

(20 |

) |

(20 |

) |

(14 |

) |

(48 |

) |

|

Unlevered free cash flow |

US$M |

2,783 |

|

(168 |

) |

(452 |

) |

(219 |

) |

157 |

|

181 |

|

318 |

|

276 |

|

144 |

|

119 |

|

97 |

|

221 |

|

|

EBITDA |

US$M |

5,313 |

|

0 |

|

0 |

|

0 |

|

347 |

|

365 |

|

407 |

|

375 |

|

228 |

|

231 |

|

209 |

|

372 |

|

|

EBITDA margin |

% |

55 |

% |

0 |

% |

0 |

% |

0 |

% |

72 |

% |

66 |

% |

66 |

% |

64 |

% |

53 |

% |

55 |

% |

53 |

% |

67 |

% |

|

|

|

Year 9 |

Year 10 |

Year 11 |

Year 12 |

Year 13 |

Year 14 |

Year 15 |

Year 16 |

Year 17 |

Year 18 |

Year 19 |

Year 20 |

|

Ore Production |

tonnes x 1000 |

8,000 |

|

8,000 |

|

8,000 |

|

8,000 |

|

8,000 |

|

7,099 |

|

6,491 |

|

6,503 |

|

6,496 |

|

6,496 |

|

5,909 |

|

3,115 |

|

|

Gold |

Oz x 1000 |

208 |

|

156 |

|

146 |

|

155 |

|

148 |

|

143 |

|

142 |

|

133 |

|

133 |

|

106 |

|

81 |

|

47 |

|

|

Copper |

lbs x 106 |

90 |

|

72 |

|

73 |

|

75 |

|

75 |

|

71 |

|

72 |

|

71 |

|

72 |

|

64 |

|

54 |

|

32 |

|

|

Gold Price |

US$/oz |

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

1,500 |

|

|

Copper Priced |

US $/lbs |

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

3.85 |

|

|

Currency (1) |

EUR/USD |

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

|

|

Gold Revenue |

US$M |

312 |

|

234 |

|

220 |

|

233 |

|

221 |

|

214 |

|

213 |

|

200 |

|

200 |

|

159 |

|

121 |

|

71 |

|

|

Copper Revenue |

US$M |

348 |

|

276 |

|

283 |

|

288 |

|

290 |

|

273 |

|

277 |

|

273 |

|

276 |

|

248 |

|

208 |

|

122 |

|

|

TTRC + Royalties |

US$M |

(38 |

) |

(30 |

) |

(30 |

) |

(31 |

) |

(31 |

) |

(29 |

) |

(30 |

) |

(29 |

) |

(29 |

) |

(26 |

) |

(21 |

) |

(12 |

) |

|

Net Revenue |

US$M |

621 |

|

480 |

|

472 |

|

490 |

|

480 |

|

458 |

|

461 |

|

444 |

|

447 |

|

381 |

|

308 |

|

180 |

|

|

Opex |

US$M |

(205 |

) |

(225 |

) |

(230 |

) |

(228 |

) |

(212 |

) |

(201 |

) |

(202 |

) |

(202 |

) |

(203 |

) |

(203 |

) |

(193 |

) |

(139 |

) |

|

Proceeds from pre-commerical production |

US$M |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Capital – growth Phase 1 |

US$M |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Capital – growth Phase 2 |

US$M |

(3 |

) |

(1 |

) |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Capital - sustaining |

US$M |

(73 |

) |

(34 |

) |

(31 |

) |

(23 |

) |

(21 |

) |

(34 |

) |

(29 |

) |

(21 |

) |

(15 |

) |

(13 |

) |

(9 |

) |

(17 |

) |

|

Taxes |

US$M |

(56 |

) |

(20 |

) |

(16 |

) |

(20 |

) |

(21 |

) |

(18 |

) |

(62 |

) |

(42 |

) |

(44 |

) |

(29 |

) |

(16 |

) |

(0 |

) |

|

Unlevered free cash flow |

US$M |

284 |

|

200 |

|

195 |

|

219 |

|

226 |

|

204 |

|

168 |

|

179 |

|

184 |

|

137 |

|

91 |

|

24 |

|

|

EBITDA |

US$M |

417 |

|

255 |

|

242 |

|

262 |

|

268 |

|

256 |

|

258 |

|

242 |

|

244 |

|

178 |

|

115 |

|

42 |

|

|

EBITDA margin |

% |

67 |

% |

53 |

% |

51 |

% |

53 |

% |

56 |

% |

56 |

% |

56 |

% |

54 |

% |

55 |

% |

47 |

% |

37 |

% |

23 |

% |

(1) EUR/USD exchange rate of 1.13 in 2022, 1.15 in 2023, 1.18 in

2024, and 1.20 thereafter.

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkey, Canada,

Greece and Romania. The Company has a highly skilled and

dedicated workforce, safe and responsible operations, a portfolio

of high-quality assets, and long-term partnerships with local

communities. Eldorado’s common shares trade on the Toronto

Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Qualified Person

Except as otherwise noted, scientific and

technical information contained in this press release was reviewed

and approved by Simon Hille, FAusIMM, Vice President, Technical

Services for Eldorado Gold Corporation, and a "qualified person"

under NI 43-101.

The relevant qualified persons have verified the

data disclosed including sampling, analytical and test data

underlying the information contained in this news release. This

included an appropriate Quality Control sampling program of

reference standards, blanks and duplicates to monitor the integrity

of all assay results.

Non-IFRS Measures

Certain non-IFRS measures, including cash costs,

all-in sustaining cost ("AISC"), and earnings before interest,

taxes, depreciation and amortization ("EBITDA"), sustaining

capital, non-IFRS ratios, including EBITDA margin, are included in

this press release. The Company believes that these measures, in

addition to conventional measures prepared in accordance with

International Financial Reporting Standards (“IFRS”), provide

investors an improved ability to evaluate the underlying

performance of the Company. Please see the September 30, 2021

MD&A for explanations and discussion of these non-IFRS

measures. The non-IFRS measures are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. These measures do not have any standardized meaning

prescribed under IFRS, and therefore may not be comparable to other

issuers.

Cash Costs

Cash operating costs and cash operating costs

per ounce sold are non-IFRS financial measures and ratios. In the

gold mining industry, these metrics are common performance measures

but do not have any standardized meaning under IFRS. We follow the

recommendations of the Gold Institute Production Cost Standard. The

Gold Institute, which ceased operations in 2002, was a

non-regulatory body and represented a global group of producers of

gold and gold products. The production cost standard developed by

the Gold Institute remains the generally accepted standard of

reporting cash operating costs of production by gold mining

companies. Cash operating costs include mine site operating costs

such as mining, processing and administration, but exclude royalty

expenses, depreciation and depletion, share based payment expenses

and reclamation costs. Revenue from sales of by-products including

silver, lead and zinc reduce cash operating costs. Cash operating

costs per ounce sold is based on ounces sold and is calculated by

dividing cash operating costs by volume of gold ounces sold. We

disclose cash operating costs and cash operating costs per ounce

sold as we believe the measures provide valuable assistance to

investors and analysts in evaluating the Company's operational

performance and ability to generate cash flow. The most directly

comparable measure prepared in accordance with IFRS is production

costs. Cash operating costs and cash operating costs per ounce of

gold sold should not be considered in isolation or as a substitute

for measures prepared in accordance with IFRS.

AISC

AISC and AISC per ounce sold are non-IFRS

financial measures and ratios. These financial measures and ratios

are intended to assist readers in evaluating the total costs of

producing gold from current operations. While there is no

standardized meaning across the industry for this measure, our

definition conforms to the definition of AISC set out by the World

Gold Council and the updated guidance note dated November 14, 2018.

We define AISC as the sum of total cash costs (as defined and

calculated above), sustaining capital expenditure relating to

current operations (including capitalized stripping and underground

mine development), sustaining leases (cash basis), sustaining

exploration and evaluation cost related to current operations

(including sustaining capitalized evaluation costs), reclamation

cost accretion and amortization related to current gold operations

and corporate and allocated general and administrative expenses.

Corporate and allocated general and administrative expenses include

general and administrative expenses, share-based payments and

defined benefit pension plan expense. Corporate and allocated

general and administrative expenses do not include non-cash

depreciation. As this measure seeks to reflect the full cost of

gold production from current operations, growth capital and

reclamation cost accretion not related to operating gold mines are

excluded. Certain other cash expenditures, including tax payments,

financing charges (including capitalized interest), except for

financing charges related to leasing arrangements, and costs

related to business combinations, asset acquisitions and asset

disposals are also excluded. AISC per ounce sold is based on ounces

sold and is calculated by dividing AISC by volume of gold ounces

sold.

EBITDA and EBITDA Margin

EBITDA from continuing operations and Adjusted

EBITDA from continuing operations are non-IFRS financial measures.

EBITDA from continuing operations represents net earnings before

interest, taxes, depreciation and amortization. Adjusted EBITDA

includes net pre-commercial production proceeds and removes the

impact of impairments or reversals of impairments, share based

payments, losses or gains on disposals of assets, executive

severance costs, mine standby costs relating to the COVID-19

pandemic and other non-cash or non-recurring expenses or

recoveries. In addition to conventional measures prepared in

accordance with IFRS, we and certain investors use EBITDA and

Adjusted EBITDA as an indicator of the Company's ability to

generate liquidity by producing operating cash flow to fund working

capital needs, service debt obligations and fund capital

expenditures.

EBITDA is also frequently used by investors and

analysts for valuation purposes based on an observed or inferred

relationship between EBITDA and market values to determine the

approximate total enterprise value of a company. EBITDA and

Adjusted EBITDA are intended to provide additional information to

investors and analysts and do not have any standardized definition

under IFRS, and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. EBITDA and Adjusted EBITDA exclude the impact of cash costs

of financing activities and taxes, and therefore are not

necessarily indicative of operating earnings or cash flow from

operations as determined under IFRS. Other companies may calculate

EBITDA and Adjusted EBITDA differently.

Sustaining Capital

Sustaining capital and growth capital are

non-IFRS financial measures. We define sustaining capital as

capital required to maintain current operations at existing levels.

Sustaining capital excludes non-cash sustaining lease additions,

unless otherwise noted, and does not include expenditure related to

capitalized evaluation, development projects, or other growth or

sustaining capital not related to operating gold mines. Sustaining

capital also excludes capitalized interest. Growth capital is

defined as capital expenditures for major growth projects or

enhancement capital for significant infrastructure improvements at

existing operations.

Contacts

Investor Relations

Lisa Wilkinson, VP, Investor Relations604.757

2237 or 1.888.353.8166 lisa.wilkinson@eldoradogold.com

Media

Louise McMahon, Director Communications &

Public Affairs604.616 2296 or 1.888.363.8166

louise.mcmahon@eldoradogold.com

Cautionary Note about Forward-looking Statements and

Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", “continue”,

“projected”, "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "believes" or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved.

Forward-looking statements or information

contained in this release include, but are not limited to,

statements or information with respect to: the Company's ability to

successfully advance the Skouries project and achieve the results

provided for in the FS; the results of the FS, including the

forecasts for the economics, life of mine, required capital, costs,

and cash flow at the Skouries project; expected production,

including grade; forecasted NPV, IRR, EBITDA, and AISC;

expectations regarding advancement and development of the Skouries

project, including the ability to meet expectations and the timing

thereof; expectations on mining operations; requirements for

permitting; expectations on emissions; the social impact and

benefits of the Skouries project, including in the local

communities; estimates of Mineral Resources and Reserves, including

all underlying assumptions, and the conversion of Mineral Resources

to Mineral Reserves; the filing of a technical report reflecting

the results of the FS; our expectation as to our future financial

and operating performance, including future cash flow, estimated

cash costs, expected metallurgical recoveries, gold price outlook;

and our strategy, plans and goals, including our proposed

exploration, development, construction, permitting and operating

plans and priorities, related timelines and schedules.

Forward-looking statements and forward-looking

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about our ability to execute our plans relating to the Skouries

project as set out in the FS, including the timing thereof; ability

to obtain all required approvals and permits; the assumptions

provided for in the FS will be accurate, including cost estimates;

no changes in input costs, exchange rates, development and gold;

the geopolitical, economic, permitting and legal climate that we

operate in, including at the Skouries project; the future price of

gold and other commodities; exchange rates; anticipated costs and

expenses; production, mineral reserves and resources and

metallurgical recoveries, the impact of acquisitions, dispositions,

suspensions or delays on our business and the ability to achieve

our goals.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others,

the following: ability to execute on plans relating to the Skouries

project, including the timing thereof, ability to achieve the

social impact and benefits contemplated; risk relating to

permitting and obtaining the required approvals, changes in

exchange rates, input costs, development costs and gold prices;

geopolitical and economic climate (global and local), risks related

to mineral tenure and permits; gold and other commodity price

volatility; recoveries of gold and other metals; results of test

work; risks regarding potential and pending litigation and

arbitration proceedings relating to the Company’s business,

properties and operations; expected impact on reserves and the

carrying value; the updating of the reserve and resource models and

life of mine plans; mining operational and development risk;

foreign country operational risks; risks of sovereign investment;

regulatory risks and liabilities including, regulatory environment

and restrictions, and environmental regulatory restrictions and

liability; discrepancies between actual and estimated production,

mineral reserves and resources and metallurgical testing and

recoveries; additional funding requirements; currency fluctuations;

community and non-governmental organization actions; speculative

nature of gold exploration; dilution; share price volatility;

competition; loss of key employees; and defective title to mineral

claims or properties, as well as those risk factors discussed in

the sections titled “Forward-Looking Statements” and "Risk factors

in our business" in the Company's most recent Annual Information

Form and Annual Report on Form 40-F. The reader is directed to

carefully review the detailed risk discussion in our most recent

Annual Information Form filed on SEDAR and EDGAR under our Company

name, which discussion is incorporated by reference in this

release, for a fuller understanding of the risks and uncertainties

that affect the Company’s business and operations.

Forward-looking statements and information is

designed to help you understand management’s current views of our

near and longer term prospects, and it may not be appropriate for

other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company's business contained in the Company's reports filed

with the securities regulatory authorities in Canada and the United

States.

Financial Information and condensed statements

contained herein or attached hereto may not be suitable for readers

that are unfamiliar with the Company and is not a substitute for

reading the Company’s financial statements and related MD&A

available on our website and on SEDAR under our Company name. The

reader is directed to carefully review such document for a full

understanding of the financial information summarized herein.

Mineral resources which are not mineral reserves do not have

demonstrated economic viability. With respect to “indicated mineral

resource” and “inferred mineral resource”, there is a great amount

of uncertainty as to their existence and a great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all

or any part of a “measured mineral resource”, “indicated mineral

resource” or “inferred mineral resource” will ever be upgraded to a

higher category.

Cautionary Note to US Investors

Concerning Estimates of Measured, Indicated and Inferred

Resources

Technical disclosure regarding the Company’s

properties included herein (the “Technical Disclosure”) has been

prepared in accordance with the requirements of the securities laws

in effect in Canada, which differ from the requirements of United

States securities laws. The terms “mineral reserve”, “proven

mineral reserve”, “probable mineral reserve”, “mineral resource”,

“measured mineral resource”, “indicated mineral resource” and

“inferred mineral resource” are Canadian mining terms as defined in

accordance with NI 43-10. NI 43-101 is a rule developed by the

Canadian Securities Administrators that establishes standards for

all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. These standards differ

from the requirements of the United States Securities Commission

(the “SEC”) applicable to domestic United States reporting

companies. Accordingly, information contained herein contain

descriptions of our mineral deposits that may not be comparable to

similar information made public by United States companies subject

to the SEC’s reporting and disclosure requirements.

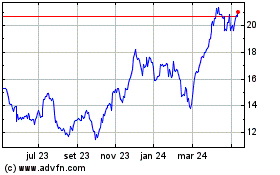

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

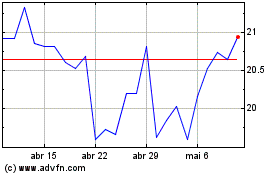

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024