Forward Reports Fiscal 2022 First Quarter Results

10 Fevereiro 2022 - 6:15PM

Forward Industries, Inc. (NASDAQ:FORD), a single source

solution provider for the full spectrum of hardware and software

product design and engineering services as well as a designer and

distributor of carry and protective solutions, today announced

financial results for its first quarter ended December 31, 2021.

First Quarter Fiscal 2022 Financial

Highlights

- Revenues were $11.6 million, an

increase of 19.6% from $9.7 million for the three months ended

December 31, 2020.

- Gross margin declined to 22.5%

compared to 23.3% for the three months ended December 31,

2020.

- Operating income increased by $0.4

million, to $0.2 million, compared to a loss from operations of

$0.2 million for the three months ended December 31, 2020.

- Net income was $0.2 million

compared to $1.2 million for the three months ended December 31,

2020 (which, for 2020, included a $1.4 million gain as a result of

the forgiveness of a PPP loan).

- Basic and diluted earnings per

share was $0.02 compared to $0.12 for the three months ended

December 31, 2020.

- Cash balance of $2.4 million at

December 31, 2021 as compared to $1.4 million at September 30,

2021.

Terry Wise, Chief Executive Officer of Forward

Industries, stated, “We began our 2022 fiscal year profitably. The

resilient performance of the business, despite ongoing challenging

market conditions, reflects the successful execution of our

strategy. The design division continues to show solid growth and is

underpinned by a strong pipeline of projects. Sales

within our retail division are steadily growing at a relatively

competitive gross margin in a sector significantly impacted by

exorbitant freight and shipping costs. Finally, within the OEM

distribution sector, we are actively pursuing opportunities

outside the declining diabetic sector. Based on this promising

first quarter performance, I remain cautiously optimistic of a

strong fiscal year.”

The tables below are derived from the Company’s

consolidated financial statements included in its Form 10-Q filed

on February 10, 2022 with the Securities and Exchange Commission.

Please refer to the Form 10-Q for complete financial statements and

further information regarding the Company’s results of operations

and financial condition relating to the fiscal quarters ended

December 31, 2021 and 2020. Please also refer to the Company’s Form

10-K for a discussion of risk factors applicable to the Company and

its business.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 including statements regarding our pipeline of

work and projects, growth in sales for our retail business, and

growth in our design division. Forward has tried to identify these

forward-looking statements by using words such as “may”, “should,”

“expect,” “hope,” “anticipate,” “believe,” “intend,” “plan,”

“estimate” and similar expressions. These forward-looking

statements are based on information currently available to the

Company and are subject to a number of risks, uncertainties and

other factors that could cause its actual results, performance,

prospects or opportunities to differ materially from those

expressed in, or implied by, these forward-looking statements.

These risks include the inability to expand our customer base,

pricing pressures, lack of success of our sales people, failure to

develop products at a profit, failure to commercialize products

that we develop, continued supply chain issues, inability of our

design division’s customers to pay for our services, unanticipated

issues with our affiliated sourcing agent, issues at Chinese

factories that we source our products as a result of the pandemic

or otherwise, and failure to obtain acceptance of our products by

big box retail stores. No assurance can be given that the actual

results will be consistent with the forward-looking statements.

Investors should read carefully the factors described in the “Risk

Factors” section of the Company’s filings with the SEC, including

the Company’s Form 10-K for the year ended September 30, 2021 for

information regarding risk factors that could affect the Company’s

results. Except as otherwise required by Federal securities laws,

Forward undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, changed circumstances or any other reason.

About Forward Industries

Forward is a fully integrated design,

development and manufacturing solution provider to top tier medical

and technology customers worldwide. Through its acquisitions of

Intelligent Product Solutions, Inc. and Kablooe Design, Inc., the

Company has expanded its ability to design and develop solutions

for its existing multinational client base and expand beyond the

diabetic product line into a variety of industries with a full

spectrum of hardware and software product design and engineering

services. In addition to our existing design and distribution

of carry and protective solutions, primarily for handheld

electronic devices, we are now a one-stop shop for design

development and manufacturing solutions serving a wide range of

clients in the industrial, commercial, medical and consumer

industries.

For more information,

contact:

Anthony Camarda, CFO, Forward Industries,

Inc. (631)

547-3041, acamarda@forwardindustries.com

| FORWARD

INDUSTRIES, INC. AND SUBSIDIARIES |

|

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

December

31, |

|

September

30, |

| |

|

|

|

|

2021 |

|

|

|

2021 |

|

|

|

Assets |

|

(Unaudited) |

|

|

|

| |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

| |

Cash |

|

$ |

2,432,225 |

|

|

$ |

1,410,365 |

|

|

| |

Accounts receivable, net |

|

8,788,041 |

|

|

|

8,760,715 |

|

|

| |

Inventories, net |

|

2,972,134 |

|

|

|

2,062,557 |

|

|

| |

Prepaid expenses and other current assets |

|

630,649 |

|

|

|

561,072 |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Total

current assets |

|

14,823,049 |

|

|

|

12,794,709 |

|

|

| |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

213,826 |

|

|

|

167,997 |

|

|

|

Intangible assets, net |

|

1,265,469 |

|

|

|

1,318,658 |

|

|

|

Goodwill |

|

1,758,682 |

|

|

|

1,758,682 |

|

|

|

Operating lease right of use assets, net |

|

3,844,425 |

|

|

|

3,743,242 |

|

|

|

Other assets |

|

72,251 |

|

|

|

72,251 |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Total

assets |

$ |

21,977,702 |

|

|

$ |

19,855,539 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Note payable to Forward China |

$ |

1,550,000 |

|

|

$ |

- |

|

|

| |

Accounts payable |

|

307,508 |

|

|

|

391,992 |

|

|

| |

Due to Forward China |

|

6,961,599 |

|

|

|

5,733,708 |

|

|

| |

Deferred income |

|

752,878 |

|

|

|

187,695 |

|

|

| |

Current portion of earnout consideration |

|

25,000 |

|

|

|

25,000 |

|

|

| |

Current portion of operating lease liability |

|

334,126 |

|

|

|

340,151 |

|

|

| |

Accrued expenses and other current liabilities |

|

662,519 |

|

|

|

529,497 |

|

|

| |

|

|

Total

current liabilities |

|

10,593,630 |

|

|

|

7,208,043 |

|

|

| |

|

|

|

|

|

|

|

|

Other liabilities: |

|

|

|

|

| |

Note payable to Forward China |

|

- |

|

|

|

1,600,000 |

|

|

| |

Operating lease liability, less current portion |

|

3,676,805 |

|

|

|

3,559,053 |

|

|

| |

Earnout consideration, less current portion |

|

45,000 |

|

|

|

45,000 |

|

|

| |

|

Total other liabilities |

|

3,721,805 |

|

|

|

5,204,053 |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Total

liabilities |

|

14,315,435 |

|

|

|

12,412,096 |

|

|

| |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

| |

Common stock, par value $0.01 per share; 40,000,000 shares

authorized; |

|

|

|

|

| |

|

10,061,185 shares issued and outstanding at December 31, 2021 |

|

|

|

|

| |

|

and September 30, 2021 |

|

100,612 |

|

|

|

100,612 |

|

|

| |

Additional paid-in capital |

|

19,953,276 |

|

|

|

19,914,476 |

|

|

| |

Accumulated deficit |

|

(12,391,621 |

) |

|

|

(12,571,645 |

) |

|

| |

|

|

|

|

|

|

|

| |

|

|

Total

shareholders' equity |

|

7,662,267 |

|

|

|

7,443,443 |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Total

liabilities and shareholders' equity |

$ |

21,977,702 |

|

|

$ |

19,855,539 |

|

|

| |

|

|

|

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

| FORWARD

INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(UNAUDITED) |

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Revenues,

net |

$ |

11,613,741 |

|

$ |

9,717,603 |

|

|

| Cost of

sales |

|

8,994,973 |

|

|

7,454,717 |

|

|

|

Gross profit |

|

2,618,768 |

|

|

2,262,886 |

|

|

| |

|

|

|

|

| Sales and

marketing expenses |

|

737,677 |

|

|

602,961 |

|

|

| General and

administrative expenses |

|

1,666,877 |

|

|

1,827,418 |

|

|

| |

|

|

|

|

|

Income/(loss) from operations |

|

214,214 |

|

|

(167,493 |

) |

|

| |

|

|

|

|

| Gain on

forgiveness of note payable |

|

- |

|

|

(1,356,570 |

) |

|

| Fair value

adjustment of earn-out consideration |

|

- |

|

|

(30,000 |

) |

|

| Interest

income |

|

- |

|

|

(22,747 |

) |

|

| Interest

expense |

|

32,828 |

|

|

46,392 |

|

|

| Other

expense/(income), net |

|

1,362 |

|

|

(3,604 |

) |

|

|

Income before income taxes |

|

180,024 |

|

|

1,199,036 |

|

|

| |

|

|

|

|

| Provision

for income taxes |

|

- |

|

|

- |

|

|

| |

|

|

|

|

|

Net income |

$ |

180,024 |

|

$ |

1,199,036 |

|

|

| |

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

Basic |

$ |

0.02 |

|

$ |

0.12 |

|

|

|

Diluted |

$ |

0.02 |

|

$ |

0.12 |

|

|

| |

|

|

|

|

| Weighted

average common shares outstanding: |

|

|

|

|

|

Basic |

|

10,061,185 |

|

|

9,885,563 |

|

|

|

Diluted |

|

10,337,113 |

|

|

10,039,799 |

|

|

|

|

|

|

|

|

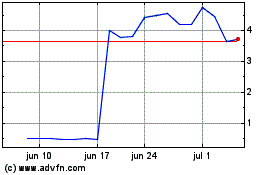

Forward Industries (NASDAQ:FORD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

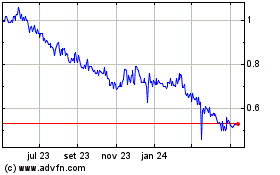

Forward Industries (NASDAQ:FORD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024