Anaergia Inc. Announces $60 Million Bought Deal Offering of Subordinate Voting Shares

30 Março 2022 - 5:55PM

Anaergia Inc. (“

Anaergia” or the

“

Company”) (TSX: ANRG) today announced that it has

entered into an agreement to sell, on a bought deal

basis, 4,800,000 subordinate voting shares (the

“

Shares”) at a price of $12.50 per Share (the

“

Issue Price”) to a syndicate of underwriters led

by TD Securities Inc. (the “

Underwriters”) for

gross proceeds of approximately $60 million (the

“

Offering”).

In addition, the Company has granted the

Underwriters an over-allotment option (the “Over-Allotment

Option”) to purchase up to an additional 720,000

Shares at the Issue Price, exercisable, in whole or in part, for a

period of 30 days following closing of the Offering. If the

Over-Allotment Option is exercised in full, the gross proceeds to

the Company will be approximately $69 million.

As part of the Offering and pursuant to his

pre-emptive rights, Dr. Andrew Benedek, the Chair and Chief

Executive Officer of the Company, has agreed to purchase

approximately $5 million of the Shares, being 400,000 Shares, at

the Issue Price as part of the Offering. Dr. Benedek currently

holds an approximate 54.8% economic interest and 82.9% voting

interest in the Company through ownership of multiple voting shares

of the Company. Upon closing of the Offering, Dr. Benedek will hold

an approximate 51.0% economic interest and 80.7% voting interest in

the Company (or 50.4% economic interest and 80.3% voting interest

assuming the exercise in full of the Over-Allotment Option).

The Company intends to use the net proceeds of

the Offering to fund the Company's growth strategy, including the

development of build-own-operate (“BOO”) assets in

the Company's development pipeline and for general corporate

purposes. Since the Company's initial public offering, Anaergia has

grown its revenue backlog from BOO projects by $1.9 billion, with

new projects including the Tonder BOO project in Denmark and

additional BOO projects in Italy and in the United States. Anaergia

continues to see significant opportunities to invest more capital

in renewable natural gas (“RNG”) BOO projects

globally and in Europe in particular, as European countries are

looking to increase RNG infrastructure and have instituted

lucrative financial incentives to support this initiative against a

backdrop where the wholesale price of gas has increased

dramatically.

Dr. Benedek noted, “Since Anaergia’s initial

public offering (“IPO”) last summer, the Company

has identified and invested in more growth opportunities than

expected at the time of IPO. Furthermore, developments in Europe

over the past few weeks have ensured that energy security will

become a dominant force for years to come, and that this new

reality will have a dramatic impact on renewable fuel demand and

the profitability of Anaergia’s projects. With this new issue of

shares, we are confident that we will be able to deploy this growth

capital in financially attractive renewable energy projects to

continue our rapid expansion and build more of the necessary

renewable infrastructure for the good of the environment.”

On or before April 4, 2022 the Company will file

with the securities commissions or other similar regulatory

authorities in each of the provinces and territories of Canada, a

preliminary short form prospectus relating to the issuance of the

Shares. The Offering is expected to close on or about April 19,

2022, subject to customary conditions, including approval of the

Toronto Stock Exchange.

The Shares issued pursuant to the Offering will

also be offered in the United States by way of private placement to

“qualified institutional buyers” in reliance upon the exemption

from registration provided by Rule 144A under the U.S. Securities

Act of 1933 (the “U.S. Securities Act”) and

internationally as permitted by law.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Shares have not been, and will not be, registered under the U.S.

Securities Act, or any state securities laws. Accordingly, the

Shares may not be offered or sold within the United States unless

registered under the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions from the registration

requirements of the U.S. Securities Act and applicable state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the Shares in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Anaergia Anaergia was

created to eliminate a major source of greenhouse gases by cost

effectively turning organic waste into RNG, fertilizer and water,

using proprietary technologies. With a proven track record from

delivering world-leading projects on four continents, Anaergia is

uniquely positioned to provide end-to-end solutions for extracting

organics from waste, implementing high efficiency anaerobic

digestion, upgrading biogas, producing fertilizer and cleaning

water. Our customers are in the municipal solid waste, municipal

wastewater, agriculture, and food processing industries. In each of

these markets Anaergia has built many successful plants including

some of the largest in the world. Anaergia owns and operates some

of the plants it builds, and it also operates plants that are owned

by its customers.

Forward-Looking InformationThis

news release may contain forward-looking information within the

meaning of applicable securities legislation, including the

anticipated closing and use of proceeds from the Offering, which

reflects the Company’s current expectations regarding future

events. Forward-looking information is based on a number of

assumptions and is subject to a number of risks and uncertainties,

many of which are beyond the Company’s control, which could cause

actual results to differ materially from those that are disclosed

in or implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, the factors

discussed under “Risk Factors” in the Company’s management’s

discussion and analysis of financial condition and results of

operations and annual information form for the year ended December

31, 2021, which are available on SEDAR at www.sedar.com. Anaergia

does not undertake any obligation to update such forward-looking

information, whether as a result of new information, future events

or otherwise, except as expressly required under applicable

securities laws. All forward-looking information in this news

release speaks only as of the date of this news release.

For more information please see:

www.anaergia.com

For media relations please contact: Melissa

Bailey, Director, Marketing & Corporate Communications,

Melissa.Bailey@Anaergia.com

For investor relations please

contact: IR@Anaergia.com

SOURCE: Anaergia Inc.

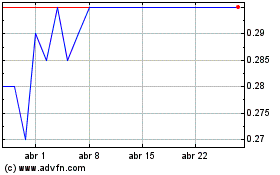

Anaergia (TSX:ANRG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Anaergia (TSX:ANRG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024