Western Potash Corp. Signs C$85,000,000 Financing Transaction With Appian Capital and Announces Investment Review Clearance of C$80,000,000 Equity Investment by Vantage Chance Limited

28 Abril 2022 - 11:19PM

Western Resources Corp. (the “Company”) (TSX: WRX) is pleased to

announce today that its wholly owned subsidiary, Western Potash

Corp. (“Western”), has entered into a C$85,000,000 term loan

facility financing transaction (the "Loan Transaction") with Appian

Capital Advisory LLP (“Appian”). The Loan Transaction has been

negotiated at arm's length and will not materially affect control

of the Company. Proceeds of the Loan Transaction will enable

Western to continue and complete the remaining construction and

development of the Milestone Phase I Project (the “Project”), pay

out existing creditors and for general and administrative expenses

of the Project.

The Loan Transaction includes:

- a six-year

term loan facility of up to USD equivalent of C$85,000,000, at an

interest rate of 12.5% per annum.

- the grant of a

1.5% royalty based on the gross revenue of the Project to Appian;

and

- the issuance

to Appian by the Company of 20,774,030 warrants ("Warrants") as

part of the consideration for the Facility, which will allow

Appian, after exercise, to acquire up to 20,774,030 common shares

of Company, which currently represents 11.1% of the Company's

issued and outstanding common shares, and will represent up to 9.9%

of the Company’s issued and outstanding common shares on a

post-transaction basis. The main terms of the Warrants are as

follows:

|

a) |

|

The Warrants

can be exercised by cash or without cash consideration (cashless

exercise pursuant to the formula set out in the TSX Company

Manual). |

| b) |

|

The exercise price of the warrants is $0.2834, representing a

25% discount to the 5-day VWAP on April 28, 2022, the execution

date of the Facility Agreement. |

| c) |

|

The term of the Warrants are 6 years from the closing of the

Loan Transaction. |

|

d) |

|

If the

Company share price reaches at least C$0.50/share above exercise

price for 5 consecutive trading days (to be adjusted for customary

anti-dilution provisions), Appian will be required to exercise (via

cash or cashless exercise) within 5 business days, subject to

Appian being legally permitted to exercise. |

| e) |

|

The form of Warrants certificate contains customary

anti-dilution provisions. |

The exercise price of the Warrants is less than

the market price of the common shares at the date of the Facility

Agreement and as such requires shareholders' approval pursuant to

Section 607(i) of the TSX Company Manual.

The Company is relying on an exemption from

holding a meeting of shareholders as its majority shareholder

Tairui Mining Inc. ("Tairui"), which holds 56.55% of the total

issued and outstanding common shares of the Company as of the date

hereof, will provide a written consent, pursuant to Section 604(d)

of the TSX Company Manual. Tairui is familiar with the terms of the

Transaction and is in favour of it.

The Facility Agreement and other material

documents of the Loan Transaction will be filed and available under

the Company’s profile on SEDAR at www.sedar.com.

The Company is also pleased to announce that

further to its previously announced equity investment of

C$80,000,000 (the “Equity Transaction”) by Vantage Chance Limited

(“Vantage”) in Western Potash Holdings Corp. (“WPHC”), a wholly

owned subsidiary of the Company, Vantage has confirmed its receipt

from Industry Canada that no national security notice has been sent

and no notice will be forthcoming under Investment Canada Act. The

Company expects the Equity Transaction will close in May 2022.

Western Resources Corp. Chairman and

CEO, Mr. Bill Xue said, “I am proud of the breakthrough

that the Western team has made in signing the Loan Transaction with

Appian. This funding, together with the C$80 million equity

investment, will provide a huge capital injection for Western and a

solid foundation for the completion of the Project. I am grateful

to the dedicated team members for their hard work and look forward

to witnessing the revolutionary changes the Project will bring to

potash mining in the Province of Saskatchewan.”

Michael W. Scherb, Appian Founder and

CEO, commented: “I am delighted to be supporting Western

Resources in the development of the Project. This transaction

demonstrates the continued success of Appian’s dedicated credit and

royalties offering, highlighting our ability to invest through the

capital structure and provide non-dilutive financing for mining

companies. The value that our market-leading technical team brings

is also a key differentiator, with our expertise helping project

owners to maximize potential and returns.”

About Appian Capital Advisory

LLP

Appian is a London-based leading investment

advisor to long-term value-focused private equity funds that invest

solely in mining and mining-related companies, with global

experience across South America, North America, Australia and

Africa and a successful track record of supporting companies to

achieve their development targets. Appian has a global operating

portfolio and a team of 54 experienced professionals with presences

in London, Toronto, Vancouver, Lima, Belo Horizonte, Montreal and

Sydney overseeing nearly 5,000 employees in the projects and the

companies it invested.

About Western Resources

Corp.Western Resources Corp. and the Company’s wholly

owned subsidiary Western Potash Corp. are constructing one of

Canada’s newest and most innovative, environmentally friendly and

capital-efficient potash mines. It is expected to be the first

potash mine internationally to leave no salt tailings at the

surface, thereby reducing the water consumption by approximately

half as well as significantly improving energy efficiency.

Successful completion of the Project will form the basis for

further expansion.

ON BEHALF OF THE BOARD OF DIRECTORS

Bill XueChairman and CEO

Cautions Regarding Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking information within the meaning

of applicable Canadian securities laws. Forward-looking statements

are statements that are not historical facts and are generally, but

not always, identified by words such as "anticipate", "continue",

"estimate", "expect", "expected", "intend", "may", "will",

"project", "plan", "should", "believe" and similar expressions

(including negative variations), or that events or conditions

"will", "would", "may", "could" or "should" occur. Forward-looking

statements are based on the opinions and estimates of management as

of the date such statements are made and they are subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results of the Company to be materially different from

those expressed or implied by such forward-looking statements or

forward-looking information. Although management of the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information that

is set out herein, except in accordance with applicable securities

laws.

For more information on the contents of this

release please contact Simon Guo, Corporate Secretary, at

306-924-9378.

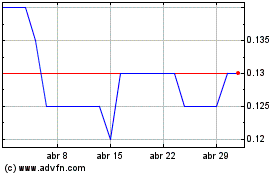

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024