Delta 9 Reports First Quarter 2022 Results

16 Maio 2022 - 9:00AM

DELTA 9 CANNABIS INC. (TSX: DN) (OTCQX: DLTNF) (“Delta 9” or the

“Company”), is pleased to announce financial and operating results

for the three-month period ending March 31, 2022.

Q1, 2022 Highlights:

-

The Company announced closing of transformative retail acquisition

acquiring 17 cannabis retail stores in Edmonton, Alberta from Uncle

Sam’s Cannabis Ltd. Delta 9 now has 35 operating retail stores and

is a leading retailer of cannabis products in Canada. The Company

expects the Uncle Sam’s Transaction to be accretive in 2022 and

2023 before synergies. The acquisition represents an attractive

revenue multiple of approximately 0.68x annualized revenue.

-

The Company completed a strategic financing of $10 million with

Sundial Growers Inc. (NASDAQ: SNDL) by way of a convertible

debenture that matures on March 30, 2025 and bears an interest rate

of 10% per annum. The Sundial Debenture is convertible into common

shares at a conversion price of $0.35 per common share.

-

The Company announced closing of a $32 million Credit Facility with

connect First Credit Union. The credit facility consists of a $23

million commercial mortgage, a $5 million M&A facility, and a

$4 million working capital line of credit. The term of the facility

is for 5 years and amortized over a 12-year period. The funds will

be used to pay down $11.2 million in existing debt and $11.8

million for the Company’s existing $11.8 million convertible

debenture due July 2022. To our knowledge, the new 4.55% fixed

interest rate we are paying is among the most competitive rates

established by any public cannabis company to date.

Financial Highlights for Q1, 2022:

-

Net revenue of $12.5 million versus $13.2 million for the

three-month period ending March 31, 2021.

-

Gross profit, before changes in the fair value of biological

assets, of $3.0 million versus $3.7 million for the three-month

period ending March 31, 2021.

-

Net income (loss) from operations of $(2.9) million versus $(3.2)

million for the three-month period ending March 31, 2021.

-

Adjusted EBITDA (loss) was $(1.7) million versus Adjusted EBITDA of

$6,199 for the three-month period ending March 31, 2021.

-

The Company reported earnings per share of ($0.04) for the

three-month period ending March 31, 2022.

- The Company

reported a strong financial position, with a cash position of $11.5

million, working capital of $15 million, and total assets of $106.9

million.

"Delta 9 recorded a transformative first quarter

of 2022, closing on our 17-store acquisition of Uncle Sam’s

Cannabis as well as a $42 million balance sheet re-structuring

through a $10 million strategic investment and $32 million credit

facility,” said John Arbuthnot, CEO of Delta 9. “In the first

quarter of 2022 we saw a degree of seasonality and industry

headwinds relating to supply chain issues and overall weakness in

the Canadian cannabis market affecting our business and impacting

sequential revenue growth; however, we remain bullish that the

remainder of 2022 looks to be a promising year for Delta 9.”

Summary of Quarterly Results:

|

Consolidated Statement ofNet Income (Loss) |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

|

Revenue |

$16,750,695 |

$15,192,268 |

$17,120,932 |

$12,479,577 |

|

Cost of Sales |

11,817,720 |

10,425,214 |

12,247,951 |

9,515,096 |

|

Gross Profit Before Unrealized Gain From Changes In Biological

Assets |

4,932,975 |

4,767,054 |

4,872,981 |

2,964,481 |

|

Unrealized gain from changes in fair value of biological assets

(Net) |

(42,861) |

1,690,676 |

(1,853,245) |

874,293 |

|

Gross Profit |

$4,890,114 |

$6,457,730 |

$3,019,736 |

$3,838,774 |

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

General and Administrative |

2,742,066 |

3,687,945 |

2,972,633 |

3,810,316 |

|

Sales and Marketing |

2,537,879 |

2,649,302 |

3,212,250 |

2,713,630 |

|

Share Based Compensation |

413,716 |

175,514 |

371,433 |

246,944 |

|

Total Operating Expenses |

$5,693,661 |

$6,512,761 |

$6,556,316 |

$6,770,890 |

|

|

|

|

|

|

|

Adjusted EBITDA (Loss)1 |

1,199,876 |

191,056 |

613,562 |

(1,694,529) |

|

Income (Loss) from Operations |

$(803,547) |

$(55,031) |

$(3,536,580) |

$(2,932,116) |

|

Other Income/ Expenses |

(736,367) |

(788,741) |

(1,622,996) |

(1,189,730) |

|

Net Income (Loss) |

$(1,138,899) |

$(843,772) |

$(5,159,576) |

$(4,121,846) |

|

Basic and Diluted Earnings (Loss) Per Share |

$(0.01) |

$(0.01) |

$(0.05) |

$(0.04) |

A comprehensive discussion of Delta 9’s financial position and

results of operations is provided in the Company’s Management

Discussion & Analysis for the first quarter ended March 31,

2022 filed on SEDAR and can be found

at www.sedar.com.Q1 Results 2022 Conference

Call

Delta 9 has scheduled a conference call to discuss the results

for its first quarter ended March 31, 2022. The conference call

will be hosted May 16, 2022 at 12:00 p.m. Eastern

Time by John Arbuthnot, Chief Executive Officer, and Jim

Lawson, Chief Financial Officer, followed by a question and answer

period.

| Date |

May 16,

2022 |

| Time |

12:00 p.m. ET |

| Dial in # |

1-888-886-7786 - Toll free North America |

| |

|

| Replay information: |

1-877-674-6060 |

| Replay Password |

033301# Available until

June 16, 2022 |

For more information contact:Investor

& Media Contact:Ian Chadsey VP Corporate

AffairsMobile: 204-898-7722E-mail: ian.chadsey@delta9.ca

About Delta 9 Cannabis Inc.

Delta 9 Cannabis Inc. is a vertically integrated

cannabis company focused on bringing the highest quality cannabis

products to market. The Company sells cannabis products through its

wholesale and retail sales channels and sells its cannabis grow

pods to other businesses. Delta 9's wholly-owned subsidiary, Delta

9 Bio-Tech Inc., is a licensed producer of medical and recreational

cannabis and operates an 80,000 square foot production facility

in Winnipeg, Manitoba, Canada. Delta 9 owns and operates a

chain of retail stores under the Delta 9 Cannabis Store brand.

Delta 9's shares trade on the Toronto Stock Exchange under the

symbol "DN" and on the OTCQX under the symbol “DLTNF”. For more

information, please visit www.invest.delta9.ca.

Disclaimer for Forward-Looking

Information

Certain statements in this release are

forward-looking statements, which reflect the expectations of

management regarding the Company’s future business plans and other

matters. Forward-looking statements consist of statements that are

not purely historical, including any statements regarding beliefs,

plans, expectations or intentions regarding the future. Forward

looking statements in this news release include statements relating

to Delta 9’s financial results for the quarter ended March 31,

2022. Such statements are subject to risks and uncertainties that

may cause actual results, performance or developments to differ

materially from those contained in the statements, including the

Company’s actual financial results being different from its

estimates as well as all risk factors set forth in the annual

information form of Delta 9 dated March 31, 2022 which

has been filed on SEDAR. No assurance can be given that any of the

events anticipated by the forward-looking statements will occur or,

if they do occur, what benefits the Company will obtain from them.

Readers are urged to consider these factors carefully in evaluating

the forward-looking statements contained in this news release and

are cautioned not to place undue reliance on such forward-looking

statements, which are qualified in their entirety by these

cautionary statements. These forward-looking statements are made as

of the date hereof and the Company disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, except as required by applicable securities

laws.

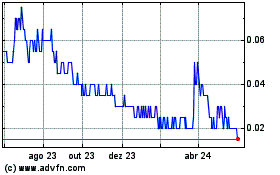

Delta 9 Cannabis (TSX:DN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

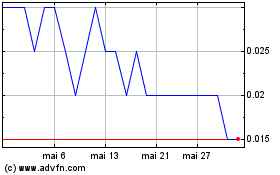

Delta 9 Cannabis (TSX:DN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025