JDE Peet’s reports half-year results 2022

Successfully navigating the macro backdrop, with another

strong set of quality results

PRESS RELEASEAmsterdam, 3 August 2022

Key items1

- Organic sales up +15.7% (+19.7%

reported), driven by +15.9% price and stable volume/mix of

-0.2%

- Organic gross profit up +1.4%,

coupled with increasing investments for growth (organic SG&A

+4.2%)

- Organic adjusted EBIT down -2.1% to

EUR 631 million

- Free cash flow increased to EUR 696

million; leverage at 2.78x incl. EUR 500 million share buyback

- Underlying EPS up +18.3% to EUR

1.05

- Amplifying progress on

sustainability commitments, with step-change in responsible

sourcing

- FY 22 outlook

confirmed

A message from Fabien Simon, CEO of JDE

Peet’s

“Half-way through 2022, we delivered very well on our

commitments, despite unprecedented economic and geopolitical

disruptions, exacerbated by the tragic war in Ukraine. Our strong

set of results is a testament to the resilient growth profile of

JDE Peet’s, supported by powerful brands, leading market positions

and talented teams around the world.

We are successfully navigating through supply chain disruptions,

pandemic effects and mounting inflation, while keeping course of

our value creation agenda, centred around quality and inclusive

revenue growth. E-commerce sales kept growing organically at a

double-digit rate, as did revenue in the U.S. and in China in-home,

while we are accelerating the store expansion there.

Confronted with an exceptional level of cost inflation, we

stepped-up efficiencies, and leveraged portfolio and revenue

management. We implemented affordable price increases of less than

1 euro-cent per cup, on average. As a result, the absolute gross

profit held up well year-over-year.

Not only did we lead on pricing, delivered double-digit earnings

growth per share and further increased our investments for growth,

but we also amplified our sustainability agenda, with the ambition

to elevate the industry standard, targeting 80% responsibly sourced

coffee by the end of 2022.

Based on the progress made in the first half of 2022, we remain

confident to reach our full-year outlook, while we continue to

navigate, with humility and agility, the unpredictable inflationary

environment, geo-political unrest and ongoing effects of the

pandemic."Advancing on Sustainability

Through its Common Grounds sustainability

programme, JDE Peet's has embarked on a journey built on

authenticity, to support inclusive and regenerative behaviours from

farm to cup and to embrace circular practices across the entire

value chain. The sustainability programme consists of three

pillars: Responsible Sourcing, fostering thriving

agricultural supply chains; Minimised Footprint,

to reduce the company's environmental impact; and Connected

People, to engage the company's employees and its

communities.

Through its responsible sourcing and supplier engagement

programme, JDE Peet's is committed to a sustainable supply of

coffee & tea from various origins that supports farming

communities’ vision of prosperity and contributes to healthy

ecosystems. Under this programme, JDE Peet's has significantly

accelerated its journey towards responsibly sourcing 100% of its

coffee by 2025 as the company substantially increased its

responsibly sourced coffee target from 30% to 80% by the end of

2022.

JDE Peet's also made good progress in reducing its carbon

footprint. In the first half of 2022, for instance, the company

increased the use of renewable electricity in manufacturing to more

than 40%. In addition, the company further improved the gender

diversity of the Board through the appointments of three female

Board members during the 2022 AGM.

Outlook 2022

JDE Peet's expects the business environment to remain volatile

for the remainder of 2022 as input cost inflation, geo-political

unrest and certain effects of the pandemic persist. Within this

context, the company continues to expect to deliver double-digit

organic sales growth, with disciplined pricing for inflation, while

aiming for a stable level of gross profit compared to last year.

The company will continue to invest in its people and strategic

growth opportunities, while keeping a tight focus on other cost

items, and expects to deliver free cash flow of at least EUR 1

billion.

FINANCIAL REVIEW HALF-YEAR 2022

in EUR m (unless otherwise stated)

|

|

6M 2022 |

6M 2021 |

Organic change |

Reported change |

|

Sales |

3,896 |

3,254 |

15.7 % |

19.7 % |

|

Adjusted EBIT |

631 |

636 |

-2.1 % |

-0.8 % |

|

Underlying profit for the period |

523 |

446 |

- |

17.3% |

|

Underlying EPS (EUR)1, 2 |

1.05 |

0.89 |

- |

18.3% |

|

Reported basic EPS (EUR)2 |

1.02 |

0.76 |

- |

33.9% |

| 1

Underlying earnings (per share) exclude all adjusting items (net of

tax) |

|

|

| 2

Based on weighted average number of shares outstanding |

Total reported sales increased by 19.7% to EUR 3,896 million.

Excluding a positive effect of 3.7% related to foreign exchange and

0.3% related to scope and other changes, total sales increased by

15.7% on an organic basis. Organic sales growth was driven by 15.9%

in price and stable volume/mix of -0.2%. In-Home sales increased by

12.0% and sales in Away-from-Home increased by 33.7%, on an organic

basis.

Total adjusted EBIT decreased by 0.8% to EUR 631 million on a

reported basis. Excluding the effects of foreign exchange and scope

and other changes, the Adjusted EBIT decreased organically by 2.1%,

as slightly higher gross profit was offset by increased investments

in advertising, digital and emerging markets capabilities, which,

in turn, was partially offset by lower promotions. The organic

increase in gross profit was driven by ongoing cost discipline,

simplification, revenue management and pricing to offset

inflation.

Underlying profit - excluding all adjusting items net of tax -

increased by 17.3% to EUR 523 million, supported by lower interest

expenses as a result of deleveraging and lower average cost of

debt, following the company's refinancing in 2021, as well as by a

reduction of other finance expenses, a favourable impact from

derivatives, and an increase in financial income.

Net leverage increased slightly from 2.7x at the end of FY 21 to

2.8x net debt to adjusted EBITDA at the end of H1 22, as the

company allocated EUR 500 million to buy back shares from its

shareholder Mondelez International Holdings Netherlands B.V.

JDE Peet's liquidity position remains strong, with total

liquidity of EUR 2.2 billion consisting of a cash position of EUR

0.7 billion (excluding restricted cash) and available committed RCF

facilities of EUR 1.5 billion.

For the full and original version of the press release click

here

CONFERENCE CALL & AUDIO WEBCAST

Fabien Simon (CEO) and Scott Gray (CFO) will host a conference

call for analysts and institutional investors at 10:00 AM CET today

to discuss the half-year 2022 results. A live and on-demand audio

webcast of the conference call will be available via JDE Peet’s’

Investor Relations website. This press release contains certain

non-IFRS financial measures and ratios, which are not recognised

measures of financial performance or liquidity under IFRS. For a

reconciliation of these non-IFRS financial measures to the most

directly comparable IFRS financial measures, see page 7 of this

press release.

ENQUIRIES

Media

Khaled RabbaniMedia@jdepeets.com+31 20 558 1753Investors

& Analysts

Robin JansenIR@jdepeets.com+31 6 159 44 569About JDE

Peet’sJDE Peet’s is the world's leading pure-play coffee

and tea company, serving approximately 4,500 cups of coffee or tea

per second. JDE Peet's unleashes the possibilities of coffee and

tea in more than 100 markets with a portfolio of over 50 brands

including L’OR, Peet’s, Jacobs, Senseo, Tassimo, Douwe Egberts,

OldTown, Super, Pickwick and Moccona. In 2021, JDE Peet’s generated

total sales of EUR 7 billion and employed a global workforce of

more than 19,000 employees. Read more about our journey towards a

coffee and tea for every cup at www.jdepeets.com.

IMPORTANT INFORMATION

Market Abuse Regulation

This press release contains information within the meaning of

Article 7(1) of the EU Market Abuse Regulation.

Presentation

The condensed consolidated unaudited financial statements of JDE

Peet’s N.V. (the "Company") and its consolidated subsidiaries (the

"Group") are prepared in accordance with International Financial

Reporting Standards as adopted by the European Union ("IFRS"). In

preparing the financial information in these materials, except as

otherwise described, the same accounting principles are applied as

in the consolidated special purpose financial statements of the

Group as of, and for, the year ended 31 December 2021 and the

related notes thereto. All figures in these materials are

unaudited. In preparing the financial information included in these

materials, most numerical figures are presented in millions of

euro. Certain figures in these materials, including financial data,

have been rounded. In tables, negative amounts are shown in

parentheses. Otherwise, negative amounts are shown by "-" or

"negative" before the amount.

Forward-looking Statements

These materials contain forward-looking statements as defined in

the United States Private Securities Litigation Reform Act of 1995

concerning the financial condition, results of operations and

businesses of the Group. These forward-looking statements and other

statements contained in these materials regarding matters that are

not historical facts and involve predictions. No assurance can be

given that such future results will be achieved. Actual events or

results may differ materially as a result of risks and

uncertainties facing the Group. Such risks and uncertainties could

cause actual results to vary materially from the future results

indicated, expressed or implied in such forward-looking statements.

There are a number of factors that could affect the Group’s future

operations and could cause those results to differ materially from

those expressed in the forward-looking statements including

(without limitation): (a) competitive pressures and changes in

consumer trends and preferences as well as consumer perceptions of

its brands; (b) fluctuations in the cost of green coffee, including

premium Arabica coffee beans, tea or other commodities, and its

ability to secure an adequate supply of quality or sustainable

coffee and tea; (c) global and regional economic and financial

conditions, as well as political and business conditions or other

developments; (d) interruption in the Group's manufacturing and

distribution facilities; (e) its ability to successfully innovate,

develop and launch new products and product extensions and on

effectively marketing its existing products; (f) actual or alleged

non-compliance with applicable laws or regulations and any legal

claims or government investigations in respect of the Group's

businesses; (g) difficulties associated with successfully

completing acquisitions and integrating acquired businesses; (h)

the loss of senior management and other key personnel; and (i)

changes in applicable environmental laws or regulations. The

forward-looking statements contained in these materials speak only

as of the date of these materials. The Group is not under any

obligation to (and expressly disclaim any such obligation to)

revise or update any forward-looking statements to reflect events

or circumstances after the date of these materials or to reflect

the occurrence of unanticipated events. The Group cannot give any

assurance that forward-looking statements will prove correct and

investors are cautioned not to place undue reliance on any

forward-looking statements. Further details of potential risks and

uncertainties affecting the Group are described in the Company’s

public filings with the Netherlands Authority for the Financial

Markets (Stichting Autoriteit Financiële Markten) and other

disclosures.

Market and Industry Data

All references to industry forecasts, industry statistics,

market data and market share in these materials comprise estimates

compiled by analysts, competitors, industry professionals and

organisations, of publicly available information or of the Group's

own assessment of its markets and sales. Rankings are based on

revenue, unless otherwise stated.

- jde-peets-half-year-results-2022-report

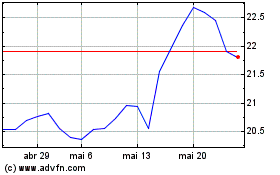

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

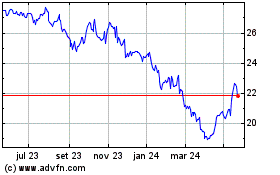

JDE Peets NV (EU:JDEP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024